Foreclosure Fraud For Dummies, 1: The Chains and the Stakes

By Mike Konczal, courtesy of New Deal 2.0

All you need to know to follow the trail of wrongdoing.

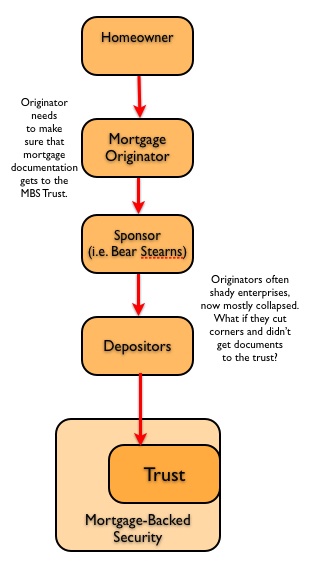

The current wave of foreclosure fraud and the consequences for the economy are difficult to follow. As such, I’m going to write a few posts to simplify what is going on so you can follow stories as they unfold. This is very 101 level, and will include a reading list of blog posts and articles at each stage to help provide depth. (Special thanks to Yves Smith for walking me through much of this.) Let’s make three charts of the chains involved in the process. The first is what is currently going on with foreclosure fraud (click through for a larger image):

As you can see, in judicial review states like Florida the courts require that servicers, or those who administer the bonds that are full of mortgages (securitization, residential mortgage backed securities, RMBS, are all phrases they use), say that they have everything necessary in order to have standing to bring a foreclosure. They need to have the note for a mortgage, which is supposed to be in the trust — part of the mortgage backed securities — that they administer.

What is breaking down here? In Florida, a judicial review state, it was found that one person was notarizing documents far faster than anyone reasonably could have. Someone found forged documents necessary for the foreclosure process, like the note. A separate court system was set up to resolve these foreclosures faster, at the expense of allowing serious challenges to the documents. Here’s Smith on how kangaroo these courts look up close. Here’s WaPo on one individual and the nightmare of trying to challenge an invalid foreclosure. Keep him in mind when you hear about deadbeats and whatnot: the current system is designed to make it difficult for anyone to challenge their case.

Meet the robo-signer who kicked it off here at this WaPo story. I almost feel bad for this patsy; the real battle here is between junior and senior tranche holders, and this doofus could end up in jail in order to keep John Paulson rich. After reading about this guy, I’m asking our elites to take better care of their goons. (Can we get a Financial Patsy Fordism social contract movement going? If you are going to be a patsy for GMAC, you should be paid enough to be able to buy GMAC’s services.)

Why would servicers do this? One story would be that the more foreclosures they process, the more fees they get, so there is an incentive to cut as many corners to speed through the process as possible. Hence the term foreclosure mills. You can read more about this from Andy Kroll’s excellent work for Mother Jones (start here).

There’s another problem though — what if servicers are behaving this way because the actual notes aren’t in the trust? Let’s go back to the creation of these instruments.

I take a mortgage out at Joe’s Lending, a mortgage originator. A mortgage consists of two parts. The first is the note, or the IOU, which is the borrower’s promise to pay. The second is the mortgage, which is the security, or the lien, or the actual interest.

Joe’s lending takes the mortgage note to a sponsor to turn these mortgages into a bond. The sponsor is often an investment bank like (now non-existent) Bear Sterns. Now that investment bank puts an intermediary in between itself and the trust. This intermediary is usually called a depositor, and sometimes there are several of them in the chain.

What’s the worry here? Well many of these mortgage originators were fly-by-night shops, shady enterprises that collapsed the moment they hit trouble. And many of them cut corners, and one of the corners they may have cut would have been to send the note to the trust. Specifically, there is worry that many mortgage originators never sent the notes to the depositors. Originators wanted volume to get fees and may not have done all the paperwork correctly. There are a lot of things that have to end up in the trust when I take out a mortgage, things like the note, title insurance, supporting documents. But the note is the most important.

Why is this important? Because the trustees usually sign several certificates saying that they have verified all the documentation in these trusts. Many of these trusts are under New York trust law, which is particularly clear and strict when it comes to these matters. With this in mind, tackle these three posts by Yves Smith (one two three).

So connect the two together, and you can see why we might have a systemic crisis on our hands:

There are roughly $2.6 trillion dollars in mortgage backed securities. The Wall Street Journal starts to explain how this will be a battle between holders of junior and senior tranches of debt. It also exposes the servicers, which include the four largest banks, to extensive legal liabilities by those who bought these securitizations that were signed off as being properly administered and created.

One result is that this has led homeowners to reasonably demand to see the proper documentation before they and their families are put out on the street. Read Ryan Grim and Shahien Nasiripour from June, Who Owns Your Mortgage? “Produce The Note” Movement Helps Stall Foreclosures.

Katie Porter is an expert who has done extensive research into this area and often blogs about it at credit slips. See the blog posts: How to Find the Owner of Your Mortgage and Produce the (Bogus?) Paper. In her research, Porter found that this situation was extensive — see Misbehavior and Mistake in Bankruptcy Mortgage Claims:

“A majority of mortgage claims are missing one or more of the required pieces of documentation for a bankruptcy claims. Fees and charges on claims often are poorly identified and do not appear to be reasonable. The bankruptcy data reinforce concerns about the overall reliability of the mortgage service industry to charge homeowners only the correct and legal amount of the debt and to comply with applicable consumer protection laws.”

By rushing the process, unreasonable and excessive foreclosure fees can get applied to homeowners when there may not even be the proper documentation to have the standing to bring foreclosure at all.

So keep these frameworks in mind when you see the debate unfold in the next weeks. It is a problem of systemic risk, and it is a problem for the currently cratered securitization market. It will need to be addressed, the sooner the better. But how?

Mike Konczal is a Fellow at the Roosevelt Institute.

[Sign up for weekly ND20 highlights, mind-blowing stats, event alerts, and reading/film/music recs.]