After seeing the market be able to battle through issues like the bank probing and questions of the Fed, I am much more confident in the ability for us to hit 11,500 before moving back to 10,500. Today, the market once again looks poised for  a great day. Retail sales came out higher than expected, which should have been expected after the sales we saw in September from all the stores that were better than expected. Additionally, Fed Chairman Ben Bernanke is injecting optimism into the market with his comments that the Fed will rejuvenate the economy by buying more Treasury Bills.

a great day. Retail sales came out higher than expected, which should have been expected after the sales we saw in September from all the stores that were better than expected. Additionally, Fed Chairman Ben Bernanke is injecting optimism into the market with his comments that the Fed will rejuvenate the economy by buying more Treasury Bills.

Additionally, our Overnight Trade in Webster Financial looks as though it should be a good one. The company reported earnings of 0.22 per share vs. the expected 0.17. The company had a very upbeat commentary, and they saw their bad loan provision drop 22%. The company saw its net interest margin increase nine basis points as well. The stock does not trade in pre-market, but I will be looking to sell at the open.

After yet another day of more positive earnings, putting the week’s total at 32/36 companies that met or beat expetations, I am fairly confident we can position ourselves into something a bit more long term with some growth potential.

Got to love this chart above…

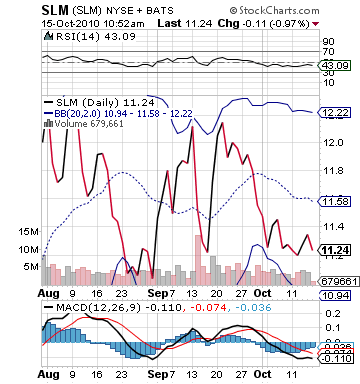

Midterm Trade of the Day: Sallie Mae Inc. (SLM)

Analysis: Perhaps I feel a bit inclined to this company because over the next few years I will be paying them thousands of dollars. Yet, of the Mae/Mac family, Sallie Mae has seemed to be the most successful at regaining its ability to turn loans into profits and remaining afloat. The company is set to release their Q3 2010 earnings on Tuesday night, and they are expecting an EPS of 0.27 vs. one year ago’s 0.26. Moving into earnings, however, the company appears quite undervalued and nearing a bottom.

Currently, Sallie Mae holds a P/E ratio of 5.96. This is an extremely low ratio that shows very little market confidence in the company. Yet, at the same time, the market does not hold the company to high standards on earnings. A small beat or even belief that even a 0.01 or 0.02 beat was possible would do wonders for the stock price. The industry average P/E ratio is 14.7, which puts SLM well below the average. The company is hurt by its parental figures now traded OTC, and the stigma around the government bailouts. Yet, Sallie Mae has actually reestablished itself quite well.

For many years, Sallie Mae would give money to any student that wanted it. Backed by the government, the risk was futile. Since the credit crisis, SLM has had to reshape its company, and it took a dip. In 2008, the company’s revenue dropped to under $1.8B. This year, the company is expecting a revenue without government injections of $2.8B. The company has returned to profitability and is bringing money back to its shareholders.

Now, the question is whether SLM can make a move of 3-5% before earnings. The last couple days of financial toil and trouble have hurt everything from banks to credit services to insurance companies. SLM has dipped up to 1.5% today, and it has put it in a great buying range. The stock has barely over 1% downside to its lower bollinger band, yet it has 10% upside to its bollinger band. What will drive the price higher?

Out of the past four quarters, three of those have returned positive surprise earnings of 35% twice and 550%. The 550% came one year ago in the Q3 of 2009. One catalyst for a run up into earnings is what has happened before whether it be a consistent major beat of earnings over a period of time or a recent or one year ago significant beat. After the beat one year ago, the stock jumped 22% the next day. Investors/traders will remember that trend. With most of them on the sidelines right now, in a current undervaluation, they will look to enter and buy up this stock moving into earnings.

now, in a current undervaluation, they will look to enter and buy up this stock moving into earnings.

The company, additionally, is coming out of a quarter that showed significant strength. The company bought up $28 billion in loans from Citigroup’s student loan division.

As Barron’s writer Tiernan Ray commented on the matter, "Sallie’s purchasing the assets for $1.2 billion. If the $28 billion in loans is worth $1.2 billion, then Sallie’s $148 billion of existing FFELP student loans it holds should by the same math be worth $6 billion. In his view, that means Sallie’s actually trading below its virtual portfolio at the current market cap of $5.5 billion, meaning most of the business is being had for free at the current price. ‘Essentially, this means the market is assigning $0 value to the company’s private loan virtual portfolio, origination platform, servicing operations, and debt collection operations.’"

The company may lose some business from the Department of Education, but this is a company that has literally no valuation whatsoever. Moving into earnings, the upside is very positive, while the downside is limited. This is a perfect value play, and one that we should take advantage of despite the stigma surrounding the company.

Entry: We are looking for entry at 11.15 – 11.25.

Exit: We are looking to exit for a 3-5% gain.

Stop Loss: 4% on bottom.

Good Investing,

David Ristau