Industrial Production Unexpectedly Declines, First Drop in a Year; Where to From Here?

Courtesy of Mish

In yet another sign of a weakening economy, Production in U.S. Unexpectedly Dropped in September

Output at factories, mines and utilities fell 0.2 percent, the first decline since the recession ended in June 2009, figures from the Federal Reserve showed today. Factory production also decreased 0.2 percent, reflecting declines in consumer durable goods, like appliances and furniture.

The rebuilding of stockpiles, a component of the factory rebound last year, will probably cool following eight consecutive gains in inventories, a sign assembly lines will not accelerate much more. At the same time, improving demand from overseas and a pickup in business investment on new equipment may keep benefiting American manufacturers like Alcoa Inc., helping support the

Economists forecast production would increase 0.2 percent, according to the median of 63 projections in a Bloomberg News survey. Estimates ranged from a decrease of 0.3 percent to a gain of 0.4 percent. The drop followed an unrevised 0.2 percent gain in August.

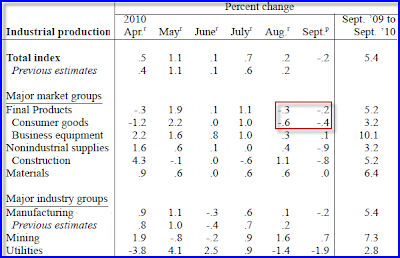

Industrial Production Release

Inquiring minds are interested in the Industrial Production Release details.

Final products and consumer goods were both down for the second consecutive month. With the collapse in housing and the stimulus money pretty much spent, I expect further weakening of all the major market group components.

The only positives in the report this month are mining and business equipment, with the latter weakening rapidly.

Industrial Production

In percentage terms the bounce in industrial production looks impressive. In actual terms it looks pretty feeble.

Note that industrial production collapsed to 1998 lows at the bottom of the recession, taking back an unprecedented 11 years worth of gains. In spite of the huge bounce from the bottom in percentage terms, Industrial production is barely above the level in 2000.

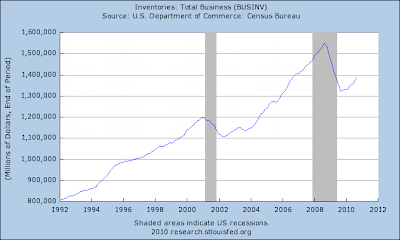

Business Inventories

Note the impressive drop in business inventories. In percentage terms the rebound looks good, but only in percentage terms, not real terms.

Moreover, the important point is that inventory replenishment is nearly over. Looking ahead, production will be more in line with actual final demand, and that demand looks both weak and weakening.

Look for 3rd quarter GDP to surprise to the downside.

Fed is Spooked

I believe this is what has the Fed spooked. Yet, spooked or not, the Demographic Pendulum is in Motion.

Demographic Pendulum in Motion

Few understand the deflationary impacts of the entire gamut of trends that is playing out, or the stress these trends place on families.

It is futile to fight changing social trends, but that has not stopped the Fed with reckless proposals on top of reckless proposals. Please see Inflation Targeting Proposal an Exercise in Blazing Stupidity; Fed Fools Itself for more details.

As I stated in June of 2008, we are now on the back side of peak consumption and Peak Credit. Regardless of what Bernanke of the Fed does, the demographic pendulum is in motion. There is no going back.

Once attitudes hit extreme then reverse, there is nothing the Fed or anyone else can do about it.