Well, we need a recovery morning at least. We are going to exit FSI International (FSII) at the open, but it will be for a severe loss of nearly 13%. The company had great earnings and even a nice Q4 forecast. The company’s 2011 forecast though was horrendous and drove the stock downwards. Sallie Mae came out with earnings that were mixed. The company beat EPS estimates after one-time charges. It has not moved a wink from its close yesterday. I am going to hold this through the open and see what happens. We are also in Huntington Bank (HBAN) as our Play of the Week. We nearly got a 4% gain yesterday, but it just missed. We will see what we can get out of it today as the company reports tomorrow morning. Finally, we got into Trina Solar Inc. (TSL) yesterday afternoon as the company moved into a Buy area below $27.

Well, we need a recovery morning at least. We are going to exit FSI International (FSII) at the open, but it will be for a severe loss of nearly 13%. The company had great earnings and even a nice Q4 forecast. The company’s 2011 forecast though was horrendous and drove the stock downwards. Sallie Mae came out with earnings that were mixed. The company beat EPS estimates after one-time charges. It has not moved a wink from its close yesterday. I am going to hold this through the open and see what happens. We are also in Huntington Bank (HBAN) as our Play of the Week. We nearly got a 4% gain yesterday, but it just missed. We will see what we can get out of it today as the company reports tomorrow morning. Finally, we got into Trina Solar Inc. (TSL) yesterday afternoon as the company moved into a Buy area below $27.

We are a bit maxed out in way of positions right now on the Buy side, and with the market looking to bounce back from yesterday, it looks like a nice time to look at a new Longterm Rating this morning on Ford Inc (F). This afternoon, we can take a look at some Midterm Trades after the dust settles on some of these positions.

Longterm Rating: Ford Inc. (F)

Thesis

We’ve all heard the E! True Hollywood Story about the star that rose to glory, nearly lost it all, only to make it all back again. Its the all-American turnaround story. In the business world, though, many times companies do not get the chance after near failure to turn things around. One company, though, is making the most of their chance and is developing some of the nicest

The company has been able to build themselves, first, by offering a better product. The company is building cars that people actually want to drive and creating demand for them. In addition to better products, the company has focused on downsizing/simplification of their brand. The company has reduced their costs of doing business as well.

The most important part of any automobile company is their cars. For years, Ford automobiles took a backseat to the likes of Toyota, Nissan, and other European cars. The company attempted to battle this trend by buying up Mazda, Jaguar, Volvo, and Land Rover. Yet, they continued to lack a focus on their own line, and the company floundered when a recession struck hard. The company, therefore, began its turnaround starting with The One Ford Vision, which combined a vision of stripping away everything that did not say Ford on it and putting all their attention into their own line.

The company started this attention with their launch of the Ford Fiesta. A microcosm of the redefinition the company is seeking. The car has strong reviews, a “green” focus, and is line with what today’s consumer wants. The Fiesta is a car that people will want to buy over other competitor brands, which is something Ford has struggled to create in its sedans for some time. The Fiesta is ranked #1 out of 31 new affordable cars on USNews newest 2011 rankings.

In 2009, the company only comprised 8% of the small car market share, while holding a 15% overall share of cars sold. The new Fiesta along with an improved Ford Focus that is based on the European model and features a new engine that provides 40 mpg should significantly boost the small car market share and increase the company’s total share.

The Fiesta and Focus are not the only cars gaining positive reviews and consumer attention. J.D. Power’s latest rankings show a number of the Ford cars making great strides. The company got four out of five stars on initial quality for its 2011 line from J.D. Power, tying or beating out BMW, Honda, Hyundai, Infiniti, Jaguar, Mazda, Nissan, Toyota, VW, and Volvo.

Another of the new gems for Ford is the Ford Fusion, a sleeker and more upscale version of the Taurus. The car was named North America’s Car of the Year for 2011 by Kelley Blue Book. Consumer Reports rated the Fusion its top rated sedan for 2010. The sleek, new car is the silver star of Ford. It had record sales throughout the 2010 automotive year. Additionally, the new Ford Flex made Consumer Reports Top 10 Family Cars of 2011. The Kelley Blue Book’s important Top Ten Most Comfortable Cars contained a Ford with the Ford Taurus.

Ford is building great products. It has been many years since Ford had such positive reviews of their lineup, and they have more of the same in their pipeline. The company is planning on releasing an electric version of the Ford Focus by 2012, building off of the reception and mistakes of the Leaf and Volt. Additionally, the company has plans for an all-electric transit .png) van.

van.

Another of the parts of The One Ford Vision is that it means that the company must remove all parts that were not Ford.The company has sold off Land Rover, Volvo, Mazda (except for 3%), and Jaguar. While it lost out and undersold a number of its companies, the company’s fire-sale is going to bring a renewed freshness and quality approach to Ford. Additionally, the sale of these brands has allowed Ford to address a sizable debt load that the company has had for some time.

What will also help Ford moving forward is the concessions it was able to receive from its labor force. In 2009, the company lowered its hourly wages to levels with Toyota and other foreign companies. The company’s cuts should help them reduce their costs by $500 million every year, and therefore, increase operating and gross margins.

One cannot ignore that all of this would not be possible without the failure of its rival, foremost Toyota. The recall and recent perception of Toyota has tarnished the company’s image and allowed Ford to make an even stronger case for competition. Toyota’s market share has dropped from 17% to 15% over the past two years. Ford’s share has risen 2%.

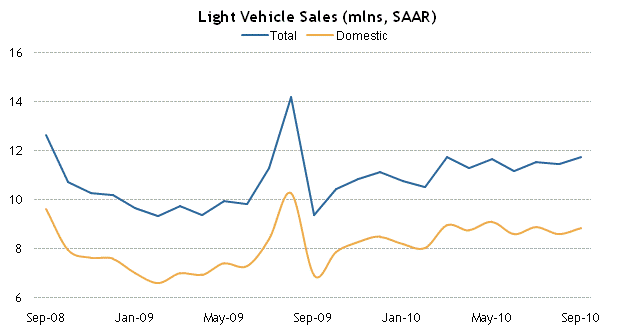

The bullish case does not stop there. Industry-wide, the auto industry still has a lot of pent-up demand that has not been unleashed yet. Auto sales are below scrappage levels. In the past year neatly 13 million units have been removed from the rode, while only 11 million units have been sold. With nearly 2 million new drivers each year, the numbers do not add up. There are still a lot consumers not taking the big-ticket item, but that trend is not sustainable. As more buyers come to the table, it will significantly benefit the entire sector and Ford.

Finally, Ford is doing a lot to help increase its international exposure and become a more global vehicle. For one, the company is making strides in China. The company was late to the game in China, but they have been able to improve significantly there over the past two years with the release of the Focus and Fiesta. These cars appeal globally. In the first nine months of 2010, the company saw sales increase in Asia and Africa by 40% in sales over one year ago. The One Ford Vision has taken Ford globally, and this should continue to be another place of great growth for the company.

While the story sounds too good to be true, there are a number of caveats and risks that come with the territory. For one, Ford has been able to make strides because, frankly, no other company was over the past two years in the North American scene. GM and Chrysler spent the past two years focusing on not losing their companies, and we all know the Toyota story. That is all now behind us, and these companies are stepping up their games as well. Ford has done a great job of reinventing their lines and creating a new image of their brand, but they have to continue to improve their pipeline in order to compete.

GM’s upcoming IPO will most likely take actual financial market share away from Ford, which is one of two American car companies publicly traded (Tesla being the other). Investing in Ford, currently, is sometimes thought of as investing in the entire American industry. Good news for GM or Chrysler tends to bode well for Ford stock. That may not be the case after a GM IPO scheduled for mid-November.

Financially, the company is continuing to improve. For many years, Ford had a significant amount of debt that was unable to be unloaded. The company recently was able to sell $1 billion of its debt on the open market as the company moves closer to investment grade. The company has improved its financial health since 2008. Its current ratio was a measly and dangerous 1.34 in 2008 and has moved to 2.35 in the TTM. The company still has more liabilities in total than total assets, which is very concerning, but this trend seems to be moving in the right direction in the past three quarters.

Return on equity is moving in the right direction as well. The company is moving closer to having an equal amount of total assets to total liabilities and improving its net income. It has not been positive since 2005, and it could be positive as soon as next year. The company’s ROIC is moving towards positive as well, which has not been positive since 2005.

Efficiency is also improving with Ford. Days sales outstanding has improved from 275 in 2009 to 225 in the TTM. Days in inventory has reduced to its lowest levels since 2004 for the TTM, which is a very small 21 days. Inventory turnover has improved from 13 to 17 in the past year, and the cash conversion cycle has dropped below 200 days for the first time since 2007.

Financially, the company is in now means healthy, but it appears that the sales and the rebuilding is not just on the outside. The company is improving itself at its core on the balance sheet and financial statement.

Ford’s longterm potential depends on the company’s ability to continue to do what it is doing today and not be satisfied ever  with what they have accomplished. American automakers tended to lose sight of quality and their consumer. Yet, this is just bad business. The best product is always the best way to do business, and Ford has gone back to the simple truth of business. They will only succeed further if they can continue on that path.

with what they have accomplished. American automakers tended to lose sight of quality and their consumer. Yet, this is just bad business. The best product is always the best way to do business, and Ford has gone back to the simple truth of business. They will only succeed further if they can continue on that path.

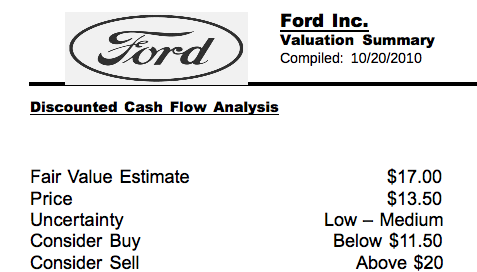

Valuation

My fair value estimate for Ford is $17 per share based on discounted cash-flow analysis. The company is on the cusp of what could be years of cyclical profitability. They are seeing 20%+ quarterly sales growth every month, and their quarterly earnings are starting to show the same results. The economy is definitely risky, but the company has the current lineup that is attractive and can remain that way for years.

The stock is a Buy below $11.50, and it a Short above $20.

Good Investing,

David Ristau