Wheeeee, this is fun!

Wheeeee, this is fun!

Industrial Production was DOWN 0.2% vs up 0.2% expected. This 200% miss was led by a 1.9% drop in utilities as consumers simply can't afford to keep the lights on anymore, even with very low natural gas prices keeping costs down. The only segment that was up was – you guessed it – MINING, as top 10% speculators hoarding shiny bits of metal in anticipation of the collapse of civilization drove production up 0.7%, marking 3 consecutive months of increasing activity.

Housing Starts dropped 10% in September and Permits for future starts dropped another 4% and this morning we got word that Mortgage Applications fell 10.5% last week as the price of a 30-year fixed mortgage went from 4.21% to an unaffordable (I guess) 4.34%. Imagine prospective buyers sitting at a table saying to the broker: "4.34%? Why that's outrageous, we won't pay it!" Inflation (real inflation) is 3.5% and you are paying 4.34% so that is a net effective 0.84% interest rate on a home AND STILL NO TAKERS! As we noted last week, 34% of Americans think their homes will go down in value next year.

That's just silly – home prices are ALREADY down in value by 12% this year. Your home is, unfortunately, priced in dollars so the "stable" prices this year are only stable when priced in a currency that's collapsing. To Japanese or European buyers, your home value is swirling down the toilet just as fast as it was during the first two years of the collapse.

It's kind of like when the coyote is standing on a rock that has broken off from the cliff and doesn't realize he's falling with the rock – these illusions work just fine until you both splatter into the ground…

What then, is the point of giving us the illusion of economic health by debasing our currency faster than the economy is falling? Clearly we are not fooling the consumers – consumer confidence is in the toilet because a vast majority of consumers live in the real World which is currently located between a rock and a hard place for 90% of Americans. Oh, by the way, don't forget that those polls where 60% of the people say the economy sucks include the top 10%, who think the economy is great – so great, in fact, that they are putting all their money into gold and shifting their money into foreign countries – just like the first class passengers getting off the Titanic.

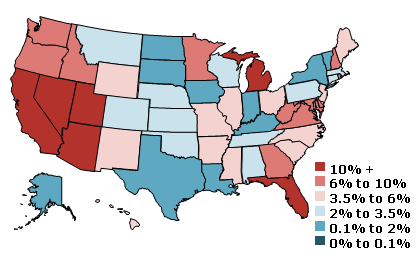

The point is, that without devaluing the dollar by 12% and keeping mortgage rates down under 4.5% then more than 10% of the $20Tn of currently outstanding home loans would be underwater. Even at 10%, that's $2Tn worth of loans that the banks will lose a great deal of money on (see chart). 10% of $2Tn is $200Bn. If the homes drop another 10%, not only do the bad loans escalate to $4Tn but the bottom half go 20% underwater or more and become much more likely to default and now we're looking at $600Bn in losses – AT LEAST.

The point is, that without devaluing the dollar by 12% and keeping mortgage rates down under 4.5% then more than 10% of the $20Tn of currently outstanding home loans would be underwater. Even at 10%, that's $2Tn worth of loans that the banks will lose a great deal of money on (see chart). 10% of $2Tn is $200Bn. If the homes drop another 10%, not only do the bad loans escalate to $4Tn but the bottom half go 20% underwater or more and become much more likely to default and now we're looking at $600Bn in losses – AT LEAST.

Oh, and by the way, NONE of this is reflected on the books of the banks as they continue to follow the "Mark to Fantasy" model that has been sweeping this massive issue under the rug for 2 years now. This is the "extend and pretend" policy we have committed to in the US – we HOPE that home price will recover at some point but that's just not going to happen without jobs and, since there are no jobs, the fallback plan by the Fed to protect the banks is to debase the currency so that it LOOKS like $20Tn of bank assets are holding their value (in declining dollar terms).

How long can we keep this up? That's the big question in the markets. I have said for a very long time that Quantitative Easing that is not accompanied by stimulus is madness. Well, we jumped down that rabbit hole and now the markets are falling up as we jump on the boulder that's falling down while embracing the illusion of a solid floor. "We're all mad here," said the Cheshire Cat. "How do you know I'm mad?" said Alice. "You must be, said the Cat, "or you wouldn't be investing in this market!" Or at least that's how I remember it….

Another very good bit of investing advice from the Cheshire Cat is:

"Would you tell me, please, which way I ought to go from here?"

"That depends a good deal on where you want to get to," said the Cat.

"I don’t much care where–" said Alice.

"Then it doesn’t matter which way you go," said the Cat.

"–so long as I get SOMEWHERE," Alice added as an explanation.

"Oh, you’re sure to do that," said the Cat, "if you only walk long enough."

What is our investing premise then? Which way do we want to go? In an environment like this one, the most important thing to do is PROTECT our assets. Sitting in cash doesn't work because inflation is eating its buying power away but we can't go putting everything in commodities either as they, ultimately, need to be bought by someone and if demand isn't there and the inflation story eases off, they can lose value quicker than anything.

Yes, we need to protect against inflation but don't confuse protecting yourself FROM inflation with betting ON inflation. As we learned from Japan, Quantitative Easing can only take you so far. While we are weary of hyperinflation coming down the pike, that will be very easy to take advantage of as we can leverage options plays to huge profits if everything is heading up and up. Right now, our goal is just to stay ahead of the declining dollar and to hopefully find a few good companies we can invest in for more than a few days.

Case in point, the BOE is now looking at their own QE and the EU "quasi-automatic" sanctions on members that overshoot their deficit targets is pretty much saying that there are no hard stops on EU deficits anymore. The BOJ is in money-printing mode as well so it's going to be very hard to destroy the value of our own currency if every other country is destroying the value of their currency at the same time. This, of course, is why people buy gold but, as I point out to our gold bugs, ABX has 140M ounces of gold reserves. At $1,400 an ounce that's $196Bn. A rise in gold to $2,500 an ounce transfers $154Bn of Global Wealth to ABX and similar gains for other miners adding up to a good Trillion dollars. Do you really think that is what Central Banks are trying to accomplish?

The top 1% and their pet bankers currently control 66% of the global wealth. It's not likely they are going to pursue a strategy that hands 10% of it over to miners, is it? As always, it's amateur speculators that get caught up in currency and commodity crazes while old money – REAL MONEY – continues to buy land. As we've been noting in Member Chat for quite some time now, Blackstone (BX) has been on a spree lately, buying almost anything that isn't nailed down. $3.9Bn for Extended Stay, $1Bn from ProLogis, $300M to Columbia Sussex (Sheraton)… Almost every week there is another deal where BX buys more real estate.

I like BX as a long-term investment, especially with our buy/write hedges that give us a 20% discount on the purchase. I also like companies like KO (more on my interview with CEO Muhtar Kent later today) who manage inflation for you with smart hedging strategies. You don't have to knock yourself out figuring out how to take advantage of inflation/deflation/commodities/real estate when there are perfectly good companies who already have the skill sets to do that for you. We'll be focusing on these companies this week and into the weekend when we'll have a list of "Stocks that can Weather the Storm" – suggestions will be welcome in Chat!

We had a near perfect test of our 7.5% lines yesterday, as expected and now we'll see what holds up as earnings season swings into full gear and we count down to those elections in less than two weeks. We're still fundamentally bearish (based on observed facts) but technically bullish (based on market manipulation keeping us over the lines). As we expected yesterday, oil may fail the $80 mark this morning, especially if inventory numbers show another build and speculators are forced to dump their barrels at any price before the November contracts close and force them to actually accept delivery of the oil they pretended to want.

That USO weekly $36 put I mentioned in the morning post, which we jumped on at .38 in Member Chat on Monday, opened at .72 yesterday and finished the day at $1.45 so a nice double, even if you were late to the party! We are done with those and flipped to the Nov $35 puts at .80 at 10:04 in Chat but those are already looking chasey at $1.45, up 80% in a day is a bit much – don't you think?

So, as I said, lots and lots of opportunities to make very good money in this crazy market without committing a ton of cash to commodities or tying up a lot of money in speculative stocks. I called for more cash last week as I thought the dollar was bottoming (and our UUP play is doing well) and I stand by that as it's an important time to stay flexible and take those BS long profits off the table before the market takes it for you!