Strong dollar? Hahahahahahahahahahahaha….

Strong dollar? Hahahahahahahahahahahaha….

That is was the answer to a question I had this summer when I met with an unnamed Treasury official whose name might rhyme with Jimothy. The unnamed official nearly fell off his chair laughing when I said "So, does the US still have a strong dollar policy?" It was meant as a joke. I was sitting at Treasury with Yves Smith, John Lounsbury and a couple of other writers on Aug 16th, with the dollar at 82.5, down from 88.7 in May. I mentioned in my Aug 17th post that, based on my meeting at Treasury: "we’re certainly not going to be expecting a "strong dollar" policy." At the time, I summed up the meeting for Members saying:

I would say that Geithner’s view of the economy is about the same as John Cleese’s view of the dead parrot: "This bird wouldn’t go "voom" if you put a million volts through it!" I agree, Krugman agrees, the Dallas Fed agrees, Bernanke agrees – this is a $15Tn, 300M person economy that is at a virtual standstill.

Unnamed Official makes the very good argument that we are like a business with debt but good cash flow and Global lenders are currently lining up to give us more cash (low TBill rates, low corporate borrowing cost, strong demand for bank capital raises). Why don’t we do what a normal business does and borrow money to expand?

Why indeed? And that is just what has been happening as the dollar has dropped another 7.8% in the 66 days since that meeting as we borrow our assets off while the Fed keeps things looking good buy sucking up whatever junk the Treasury decides to print. Kudos to Doug Kass for taking my "Inflation Nation" concept to the next level and coining the very apt phrase "Screwflation," which he explains:

Screwflation, like its first cousin stagflation, is an expression of a period of slow and uneven economic growth, but, its potential inflationary consequences have an outsized impact on a specific group. The emergence of screwflation hurts just the group that you want to protect — namely, the middle class, a segment of the population that has already spent a decade experiencing an erosion in disposable income and a painful period (at least over the past several years) of lower stock and home prices. Importantly, quantitative easing is designed to lower real interest rates and, at the same time, raise inflation. A lower interest rate policy hurts the savings classes — both the middle class and the elderly. And inflation in the costs of food, energy and everything else consumed (without a concomitant increase in salaries) will screw the average American who doesn’t benefit from QE 2.

I know, I promised last week I would get off this topic after a week of posts on the subject but, despite my best efforts, I had enough brain cells remaining after the weekend to notice that yesterday’s 1% move up in the market was coming against a 2% drop in the Dollar. That’s why, and I kid you not, the S&P, priced in Euros yesterday, shows a 0.6% LOSS, not a 1% gain. This morning, the futures are on fire because Timmy (I can name him now) said (and now I am the one falling off my chair laughing) "the major currencies, which are roughly in alignment now." Alignment? If by alignment you mean in a straight line going up with the dollar crushed at the bottom – bullseye Mr. Secretary! John Snow laughs at your BS…

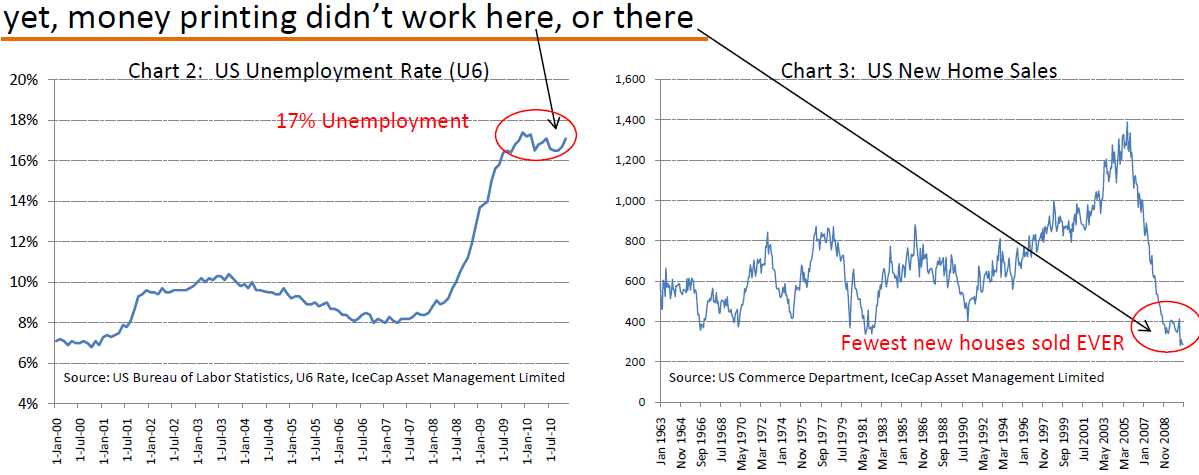

Despite the improvements in the Fed’s own Beige Book this week and, of course, despite all logic and all that is holy – please have mercy on us you friggin’ Bankster’s tool – Chairman Bernanke is determined to shove our nation right off the cliff by restating, over and over and over "There would appear — all else being equal — to be a case for further action." This is something that our friends at Zero Hedge are now calling "The Wrath of Bernanke" and Ice Cap Management notes what a disaster this policy has been and continues to be with charts like this one:

.jpg)

Arrrrrrrrrrrrrrrrgh! I am so frustrated by all this BS! How is this not obvious to people? How do we let them keep doing this. I’m going to say this one time, very slowly, so even the people in the hats with the tea bags stapled to the brim can understand it. If the Fed pumps $1.25Tn into a $15Tn economy, that INFLATES prices by about 10%. Why? Because more money is chasing the same amount of goods and services in Timmy’s "dead parrot" economy.

OK, now comes the part that the middle class conservatives simply do not get. When the Fed bails out the Banksters and pumps money into the economy from the top down, rather than, say, the evil government spending $1.25Tn to create jobs and push money through from the bottom up – then there is no demand for MORE goods (because no new people are employed) but there is more money at the top to outbid you for the same goods (I illustrated this last week too).

That, then, DECREASES the purchasing power of EVERY DOLLAR YOU HAVE by 10%. Not just the dollars in your wallet, not just the dollars you earn this year – EVERY DOLLAR you have worked your entire life to accumulate is being TAXED by Ben Bernanke to the tune of 10%. If you had 10 years worth of savings for retirement then the effective tax rate on you was 100% this year in order to support those Big Businesses you love so much.

The markets are NOT going up in value, corporations are NOT making more sales, you home is NOT holding it’s value and YOU got a 10% pay cut because your boss is paying you the same amount of dollars he paid you last year (and probably the same as 2005 for most people!) but those dollars now buy 10% less stuff. Yet the Chairman of the Federal Reserve, who supposedly functions under a dual mandate to maintain full employment and control inflation (oops, fell of my chair laughing again) IS GOING TO DO IT TO YOU AGAIN!

Harmlessly passing your time in the grassland away;

Only dimly aware of a certain unease in the air.

You’d better watch out!

There may be dogs about

I looked over Jordan, and I’ve seen

Things are not what they seem.

That’s what you get for pretending the danger’s not real.

Meek and obedient you follow the leader

Down well trodden corridors into the valley of steel."Sheep" – Pink Floyd

Anyway, believe what you will, we’re shorting this nonsense!