Good Monday to all! I hope everyone enjoyed their weekend. We are ready to move into another week of earnings, and we are starting out this Monday in a few positions still. We are currently holding positions in Trina Solar (TSL) with an entry of 26.72. We are looking to exit at 27.50 or higher. We are also involved in GFI Group (GFIG) at 4.85, and we are looking to exit at 5. Finally, we are involved with Atlas Air Worldwide (AAWW) at 52.92, and we are looking to exit at around 54.48. The company reports earnings tomorrow, so we will want to exit at least some of the position today to lock in some gains.

Good Monday to all! I hope everyone enjoyed their weekend. We are ready to move into another week of earnings, and we are starting out this Monday in a few positions still. We are currently holding positions in Trina Solar (TSL) with an entry of 26.72. We are looking to exit at 27.50 or higher. We are also involved in GFI Group (GFIG) at 4.85, and we are looking to exit at 5. Finally, we are involved with Atlas Air Worldwide (AAWW) at 52.92, and we are looking to exit at around 54.48. The company reports earnings tomorrow, so we will want to exit at least some of the position today to lock in some gains.

The market is looking to open in the green and all of our positions look to be ready to pop up this morning. The market has done a lot of popping and dropping, however, the past few sessions, so we will have to wait and see if we can sustain gains.

We are going to start things out this week with a new Play of the Week that will hopefully earn us 3-6%…

Play of the Week: Skechers Inc. (SKX)

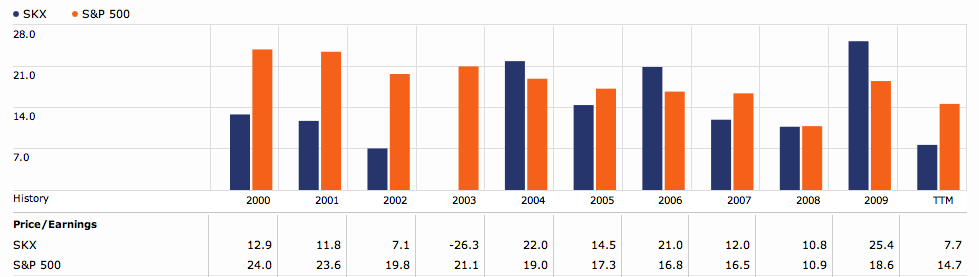

Analysis: We have quite a relationship with Skechers Inc. (SKX). It is rated as a Hold on our Longterm Ratings with a FV estimate in the upper 20s. The stock is a Buy below 24. This week, however, the stock is reporting its earnings on  Thursday morning. The company is poised to hit an EPS of 1.02 vs. one year ago 0.52 – a solid gain for SKX of almost 100% in profits per share. The stock has plenty of potential to move into earnings at least 3% or more.

Thursday morning. The company is poised to hit an EPS of 1.02 vs. one year ago 0.52 – a solid gain for SKX of almost 100% in profits per share. The stock has plenty of potential to move into earnings at least 3% or more.

One of the main reasons the company will move is that the stock is volatile and buzz oriented. The last four earnings for SKX have all produced 10%+ surprises. Last quarter, it was an 80% surprise, and one year ago, the surprise was over 40%. When a company, in the past, has had very positive results it tends to attract traders into the stock before earnings as well as investors. They are expecting the company will be able to produce another round of over-the-top results and don’t want to miss the wave. What ends up happening then is that the stock becomes overvalued and prices in earnings beforehand, and they usually disappoint to the homerun stature and fall.

That is why SKX appears to be a great Play of the Week over Overnight Trade? The stock has the legs and room to move. The company’s Shape-Ups continue to be a hit and are starting to push the company in the right direction. Another reason that I like SKX to make a move to the upside over the next few days is that the stock is undervalued. Many companies do not get huge moves before earnings because they are already overvalued or overbought. Skechers has just gotten out of 6%+ drop over the past week. The stock is under 50 on RSI, making it relatively undervalued. It is oversold on fast stochastics, but they are bottoming out and ready to move to the buy side. Earnings and the capabilities of Skechers’ earnings should give the.png) company the capability to create buyer interest.

company the capability to create buyer interest.

No one has reported much in the industry that Skechers is in with footwear. One company, Wolverine Worldwide (WWW) reported earnings with a positive surprise, but they are a vastly different type of company from Skechers. The company, though, should have enough of its own mojo moving into earnings that it will not need industry-like earnings or companies to help prop it up.

The drop has been due to a cloudy outlook for Skechers with its toning shoe markdown, but as Wedbush Morgan comments, the current valuation on the company has the toning shoe nearly eliminated from the SKX picture.

The firm comments, "We acknowledge that excess inventory of Shape-ups at retail will take some time to be worked down to match reduced levels of demand; however, we also believe toning will continue to be additive to top line next year, particularly as the international segment ramps up…while the news will look worse before it improves (i.e., the likelihood of sustained markdowns on Shape-ups through year end and Q3 inventory growth outpacing sales growth), current valuation is seemingly discounting toning almost in its entirety."

I am very toned up for the earnings on Skechers, and the stock should take a nice rise into earnings.

Entry: We are looking to get involved at 23.80 – 24.00.

Exit: We are looking to exit for a 3-5% gain.

Stop Loss: 4% on bottom.

Good Investing,

David Ristau