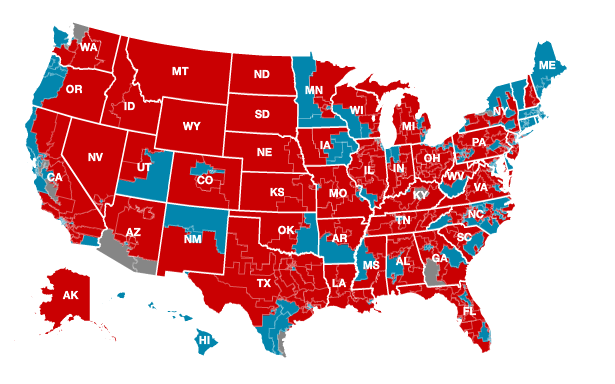

Welcome to Wednesday all. Today is a new day in politics with a new face and direction for the country…yeah right. The market is trading up slightly on news that the Republicans seized the House and anticipation of the Federal Reserve meeting to decide interest rates. We are currently in two positions that are looking good. We are getting out of our Overnight Trade in Aetna (AET) at 30.75 for a 2% gain. I missed the big upswing, but the stock was good for as much as 5% in gains. We are also in Cloud Peak Energy (CLD) for a 1/2 position. We got out of 1/2 of CLD for a 4% gain yesterday at 18.38, and we are still holding onto the rest.

Welcome to Wednesday all. Today is a new day in politics with a new face and direction for the country…yeah right. The market is trading up slightly on news that the Republicans seized the House and anticipation of the Federal Reserve meeting to decide interest rates. We are currently in two positions that are looking good. We are getting out of our Overnight Trade in Aetna (AET) at 30.75 for a 2% gain. I missed the big upswing, but the stock was good for as much as 5% in gains. We are also in Cloud Peak Energy (CLD) for a 1/2 position. We got out of 1/2 of CLD for a 4% gain yesterday at 18.38, and we are still holding onto the rest.

Additionally, I have posted the latest results from the month of October. We are up 109% on the year in our Buy Virtual Portfolio, and we are up close to 40% on our Short Sale Virtual Portfolio. Check it all out here!

We have had a lot of success with the Midterm Trades as of late, and I want to continue our successes with them…

Midterm Trade of the Day: Solarfun Power Holdings, Inc. (SOLF)

Analysis: Solar stocks have been quite good to us in the longer trading spectrum when the opportunities are right. Today, we have another very positive opportunity in Solarfun Power (SOLF). Solarfun used to be my favorite stock because I made 60% on it in two days back in 2008. The company, however, has not become one of the stock leaders like I had hoped. Companies like Trina Solar, SunPower, and Yingli Green have become the leaders in silicon PV cells, but that does not mean that in its own windows SOLF cannot represent a solid trade.

Next Monday, SOLF is slated to report its earnings at 0.49 EPS vs. one year ago at 0.37. The company has beat earnings three out of four of the last quarters by more than 80%. These blowouts are typical for this company, .png) and it was one of the first items that attracted me to it. When a company has such considerable beats consistently, it tends to make investors flood the stock prior to earnings. SOLF is in a great position to do that with its current valuations below fair valued and earnings on the horizon.

and it was one of the first items that attracted me to it. When a company has such considerable beats consistently, it tends to make investors flood the stock prior to earnings. SOLF is in a great position to do that with its current valuations below fair valued and earnings on the horizon.

In addition to its own success, the solar industry is looking good this quarter. First Solar recorded a quarterly beat and JinkoSolar beat EPS estimates by over 70%. The next company is slated for Friday morning, and that is ReneSola (SOL). The company is slated to report EPS at 0.52 with a swing to profit from the year prior when they recorded an EPS of -0.14. In addition to SOLF, LDK Solar (LDK), GT Solar (SOLR), and JA Solar (JASO) are all reporting on Monday evening or Tuesday morning next week. Between SOL and the four reports next week, solar may start to see a heightened demand and this will push up prices.

The push is even more attractive for SOLF over the others. The company has an RSI near 40, which is well below fair valued at 50. The stock is oversold and near its lower bollinger band. SOLF now has about 6% downside to its lower band while 25% upside to its upper band. The stock has pretty wide bands, so I would expect them to narrow, and that can only occur if SOLF goes back up.

Solar has taken a slight beating to start this week and end last week. This is a great opportunity to buy right before we get into the heart of the reporting season for solar.

Entry: We are looking to get involved at 9.88 – 9.98.

Exit: We are looking to exit for a 3-5% gain.

Stop Loss: 4% on bottom.

Good Investing,

David Ristau