Now, like many Americans, the Democrats know what it's like to lose their House.

Back in the mid-1800's, the nation had another kind of Tea Party as the Whigs became a successful 3rd party, even going so far as to put two men in the White House – William Henry Harrison and Zachary Taylor plus Millard Fillmore, who succeeded "Old Rough and Ready" who died just after a year in office but that was a long term compared to Harrison, who caught pneumonia making a long inauguration speech in the freezing rain and died of it a month later despite attempts to cure him with opium, castor oil and leeches – treatments we are likely to see again as the Republicans vow to repeal Health Care legislation.

I don't have to talk about what happened last night, Barry Ritholtz did a great job of it in "The Tragedy of the Obama Administration" so let's just focus on the repercussions of the changeover and, of course, today's upcoming Fed decision. The Board of Governors were meeting all day yesterday and will meet again this morning to discuss their policy decision and one would think they can't be so deaf as to see that our citizens are not interested in additional deficit spending, which is exactly what QE2 is when the Fed writes checks to paper over the Treasury's profligate spending.

Look for new and improved ways of not taxing corporations. Like GM, which will not have to pay taxes on its next $45.4Bn of earnings despite the fact that the Government paid for their losses already and allowed the company to bust union contracts and trash benefits for the millions of retired and fired workers as they shut down and sold brands – permanently shipping US manufacturing jobs overseas.

Look for new and improved ways of not taxing corporations. Like GM, which will not have to pay taxes on its next $45.4Bn of earnings despite the fact that the Government paid for their losses already and allowed the company to bust union contracts and trash benefits for the millions of retired and fired workers as they shut down and sold brands – permanently shipping US manufacturing jobs overseas.

Of course, this tax break isn't about GM. GM just sets a good precedent for similar treatment of Banksters and others who received relief under TARP and, of course, whatever they decide to call the next emergency bailout of Big Business. If the market breaks our tops, we are going to be loving the XLF which already owns most of the people who got elected last night. With FAS at $22.44, we can sell the April $19 puts for $2.75 and buy the Jan $17/21.67 bull call spread for $3.10 and that's net .35 on the $4.67 spread that's starting out 100% in the money and makes 1,334% if FAS simply holds $21.67.

See, that's why we don't fear the upside. If the market is going to have a mindless rally, we can find dozens of trade ideas that can keep us ahead of inflation like that. This is why we can PATIENTLY wait for the market to PROVE it can move forward – our job is to preserve cash so we can participate in these mindless opportunities to make ridiculous returns while the life savings and futures of the bottom 95% is ground into dust.

Do I feel bad about that? Not anymore, they are going to get the economy they just voted for and that's survival of the financially fittest and we'd better get serious about it because no prisoners will be taken in the next round of "Survivor, America." Already the commodities are flying in celebration of the return of control of the House to Republicans. There will be no legislation, there will be no investigation, there will be no restrictions at all and oil already jammed up to $85 in pre-market trading along with gold back over $1,360 and copper back at $3.85. Isn't that great? $5 more per barrel costs US consumers $100M a day and there's NOTHING they can do about it. They must spend it and that's more credit card transactions and more retail spending on gas, which we'll use as data to pretend the economy is improving – BRILLIANT!

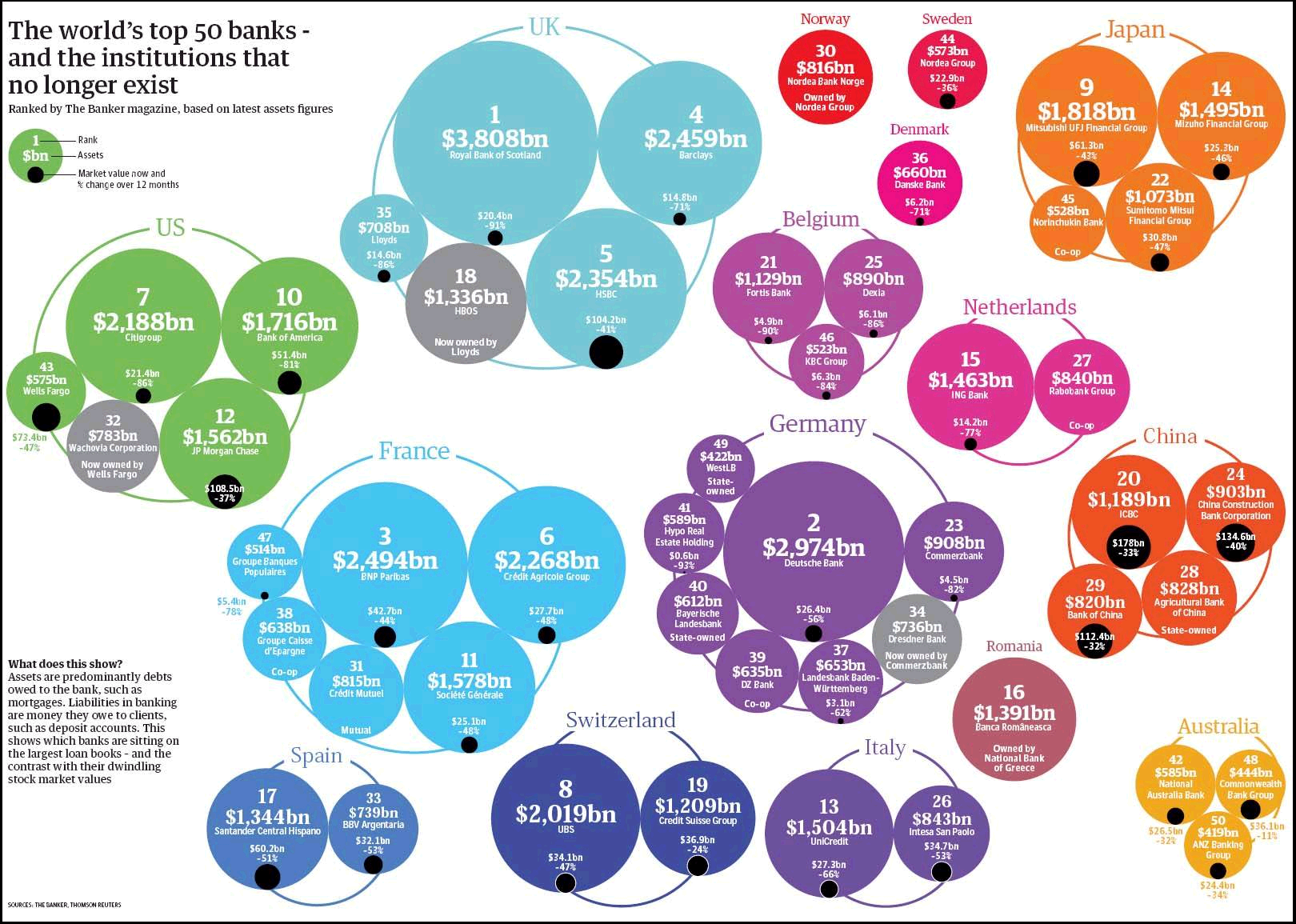

We have the MBA Mortgage Report this morning along with ADP Employment (+43,000 jobs – all service), Inventories and ISM manufacturing but nothing really matters other than the Fed, which has to ignore all the improvements in the underlying data and risk hyperinflation by jamming another Trillion dollars into the dead pool of the US Money Supply. We like XLF, UYG (see Member chat for our plays on them) as well as FAS to play the QE2 game because, eventually, all this money will flow through them at some point. Globally, the banking sector is just a shadow if it's former self, as illustrated in this chart (click to enlarge):

It's also interesting to note that just 4 of the World's top 50 banks are US banks – this probably does not fit into the average voters delusion of US economic superiority but we love our delusional voters because they are also delusional investors who pay us premiums, aren't they? Barry points out that the election means "Less Limits and Oversight of Banks." If we can't beat them, we may as well join them as we gear up for round 2 of "Grand Theft America."

It's all about the Fed today and then it will be all about Jobs on Friday. Despite intervention on the Yen this morning that took the dollar back to 81 this morning, the overall dollars has stayed below the 77 line since yesterday morning. My comment to Members near yesterday's close was that the market move was very unimpressive on the heels of a 0.7% drop in the dollar as they market should AT LEAST gain enough to offset the currency it's priced in and then you have the magnification as the commodity pushers move up on the weak dollar as well.

Not seeing good action makes us wonder, how low does the dollar have to go to get us back to April's highs, when the dollar was 7% stronger? All else being equal, we should be 7% ABOVE April's highs, not 7% below it and, if we can make 1,300% on a flatline – imagine what we can do with a 14% pop!

Here's looking forward to a very exciting final two months…