Don’t Fight The Fed… For Now

Courtesy of Maulik Mody – Bondsquawk.com

Courtesy of Maulik Mody – Bondsquawk.com

So the Fed announced that it will purchase $600 billion worth of securities by the end of the second quarter next year to boost the faltering recovery. Including reinvestment of maturing securities, it comes to about $850 billion of securities. The Fed aims to increase asset prices and devalue the dollar in an attempt to spur economic growth. In a piece for the Washington Post, Bernanke wrote that the Fed is not satisfied with the current state of the US economy. To further stimulate the economy, it decided to buy securities with longer-term maturities since short-term rates are already close to zero.

Don’t Fight the Fed

Bernanke is certain that the policy will be successful. Past stands witness that when the Fed eases policy, bonds and stocks rally. Bernanke pointed to the rally in stock prices on the day following the announcement. Higher stock prices will boost consumer wealth and instill confidence, and thereby spur consumer spending. Increased spending will result in higher incomes and profits, which will cause business expansion and increase investments and hiring by companies.

Bernanke chalked out his intentions clearly but seems a little implausible to me. Investors have been hurt badly by recent slumps in the stock markets, so they know better than to trust this “stimulated” rally. Weakening its currency to increase asset prices and exports was a primary intention, but this intention is shared by the Euro zone and Japan too. A weaker dollar would mean lower exports for other countries as demand for their goods slump. This would result in a re-emergence of debt servicing concerns, which, as we have seen in case of the Euro zone, cannot be reduced by merely changing its perception. Growing debt and deficits can only be “serviced” by persistent growth in the economy over time.

Let’s assume for now that the latest round of stimulus is successful in growing the economy. Rates have been dropping since the time the Fed hinted its intentions of adding more stimulus, and analysts expect that this announcement will cause a further drop, if at all, of not more than 25 basis points drop in the mid to long end of the curve. Economists estimate that this will convert to an additional 0.2% to 0.3% growth in 2011 GDP. The popular Okun’s rule of thumb, which states that the relation between GDP growth and unemployment is roughly 2 to 1 (inverse), tells me that this meager growth in GDP will barely cause a fall in unemployment, if any.

As expected, the markets won’t fight the Fed and as a result stocks will rally. But this rally will be a result of increased asset prices caused by more money pumped in the economy. It might not create the wealth effect that will increase consumer spending and directly aid economic growth. Although responsible primarily for monetary policy control, the Fed will have to take measures that stimulate productivity and address the structural issues of the economy. Lowering interest rates and further quantitative easing will not necessarily create an environment for businesses to grow and expand. And until that happens, the only good that the rally can do is make stock investors some money. As for those relying on interest or fixed payments as their prime source of income, higher prices are going to sting.

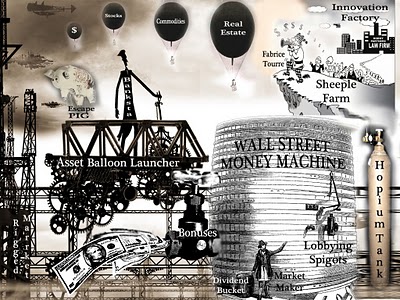

Pic credit: William Banzai7