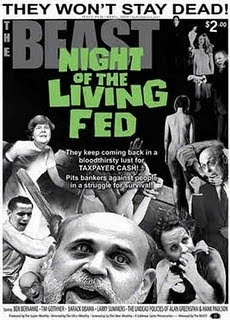

“THE MOST IGNORANT REMARKS EVER MADE BY A CENTRAL BANKER”

Courtesy of The Pragmatic Capitalist

Courtesy of The Pragmatic Capitalist

As usual, the latest Hussman letter is an honest and realistic perspective on what is going on today. This week’s letter is a scathing criticism of Federal Reserve policies and their blatant manipulation and counterproductive policy responses. The primary target of this week’s letter is quantitative easing. In discussing Mr. Bernanke’s Washington Post op-ed Mr. Hussman refers to the Chairman’s comments as “the most ignorant remarks ever made by a central banker”. I entirely agree and believe that these same comments will forever haunt Mr. Bernanke. Naturally, I think Mr. Hussman is right and it’s clear in my opinion that the Federal Reserve is becoming part of the problem and not the solution.

The most interesting part of the criticism is Hussman’s debunking of the “wealth effect”:

“Historically, a 1% increase in the S&P 500 has been associated with a corresponding change in

GDP of 0.042% in the same year, 0.035% the next year, and has negative correlations with GDP growth thereafter (sufficient to eliminate any effect on the long-run level of GDP). Now, even if one assumes – counter to reasonable analysis – that the GDP changes are caused by the stock market changes (rather than stocks responding to the economy), the potential benefit to the economy of even a 10% market advance would be to increment GDP growth by less than half of one percent for a two year period.Now, as of last week, the total capitalization of the U.S. stock

market was at about the same as the level as nominal GDP ($14.7 trillion). So a market advance of say, 10% – again, even assuming that stock prices cause GDP – would result in $1.47 trillion of market value, and a cumulative but temporary increment to GDP that works out to $11.3 billion dollars divided over two years. Moreover, even if profits as a share of GDP were to hold at a record high of 8%, and these profits were entirely deliverable to shareholders, the resulting one-time benefit to corporate shareholders would amount to a lump sum of $904 million dollars. In effect, Ben Bernanke is arguing that investors should value a one-time payout of $904 million dollars at $1.47 trillion. Virtuous circle indeed.

So what have investors done to themselves? They’ve added an excess risk to their portfolios purely based on Fed speak and manipulation:

As a result of Bernanke’s actions, investors now own higher priced securities that can be expected to deliver commensurately lower long-term returns, leaving their lifetime “wealth” unaffected, but exposing them to enormous risk of price declines over the intermediate (2-5 year) horizon. This is not a basis on which consumers are likely to shift their spending patterns. What Bernanke doesn’t seem to absorb is that stocks are nothing but a claim on a long-term stream of cash flows that investors expect to be delivered over time. Propping up the price of stocks changes the distribution of long-term investment returns, but it doesn’t materially affect the cash flows. This reckless policy has done nothing but to promote further overvaluation of already overvalued assets. The current Shiller P/E above 22 has historically been associated with subsequent total returns in the S&P 500 of less than 5% annually, on average, over every investment horizon shorter than a decade.

Read the full letter here.

Pic credit: Jr. Deputy Accountant