(Solar information firm iSuppli’s forecast for growth in 2011 above…looks solid!)

CSUN was opened yesterday at 4.76 for a Play of the Week. The stock got good news from LDK (up 8% in pre-market) and from JA Solar (up 5%). Solarfun was somewhat disappointing, but if the stock had not jumped 15% into earnings, it would be up as well with its earnings. Overall, Q3 is strong for solar and Q4 looks bright moving forward. We are looking to exit this position from 4.89 and up. Dryships (DRYS) was one of our pickups as well yesterday from the $5 List. We entered at 4.84, and we are looking to only make a small gain with target exit range at 4.92 – 4.97. The stock looks like it will open in the range. Finally, we still have our short sale in Green Mountain Coffee Roasters (GMCR). I will look to close that position today.

Let’s get into some plays for today…

Buy Pick of the Day: First Solar Inc. (FSLR)

Buy Pick of the Day: First Solar Inc. (FSLR)

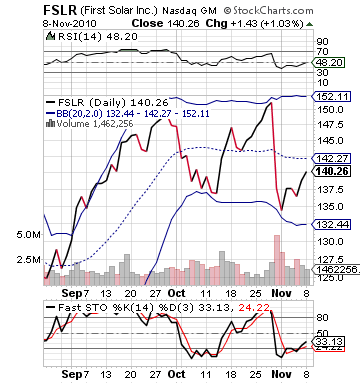

Analysis: The story in solar for Q3 has been pretty solid thus far with every reporting company thus far beating expectations, raising forecasts, and looking rosy moving forward. First Solar, since its earnings though, has not had a major run up. The stock is one of only the solar stocks to show undervaluation on RSI. With today’s earnings looking to prop up the sector, First Solar has a ton of upside and looks poised for some nice quick gains.

JA Solar is now up over 8% in pre-market, LDK is up almost 10%, and SOLF has dropped more. Yet, other companies that did not report are in the green not red. First Solar should benefit from its peers doing so well and its current undervaluation. On RSI, the stock is at 45.82 with 9% upside and 5% downside on bollinger bands. The stock has moved up slowly 4% in the big bull run that solar has had. Yet, FSLR just has not moved like the rest of the market.

Despite being a leader, First Solar should be a follower. The stock has not traded much in pre-market, but it has made some trades in the red, further making this play attractive. Futures are in the green slightly, however, I am not sure the market can hold onto its gains. Still First Solar should be much higher. Long term we have a FV estimate on it at up in the 180s. The stock is still in a Buy range longterm here, and it just should not be this low given its earnings.

Get in today, this one is moving up…finally!

Entry: We are looking to get involved at 139.90 – 140.40.

Exit: We are looking to exit for a 2-3% gain.

Stop Loss: 3% on bottom.

Short Sale of the Day: Direxion Daily Energy Bull ETF (ERX)

Analysis: This one is pretty simple. I don’t think this ETF can go any higher, and I don’t think oil/market will hang onto early gains they are posting in pre-market. There is not really much news except a.png) Chevron buy of Atlas Energy out there to give a bull run. We were in a bear run starting yesterday on very high valuations and runups in oil, stocks, gold etc. A pullback even further is still in order, and oil should be giving up any gains it has currently and even more.

Chevron buy of Atlas Energy out there to give a bull run. We were in a bear run starting yesterday on very high valuations and runups in oil, stocks, gold etc. A pullback even further is still in order, and oil should be giving up any gains it has currently and even more.

Direxion’s Daily Energy Bull ETF (ERX) has been a #1 beneficiary of the large bull market we had last week and oil’s run. The ETF has moved up 30% in the last month without much downward movement whatsoever. The ETF is now jumped outside of its upper bollinger band, is completely overbought, and has an RSI near the 70 red alert level. Oil is just too overvalued, and it should make some movement downwards.

Get in early as this ETF will be dropping and we want to short or buy some puts!

Entry: We are looking to short at 45.60 – 45.80.

Exit: We are looking to cover at 2-3% drop.

Stop Buy: 3% on top.

Good Investing,

David Ristau