Yawn!

Yawn!

Yes, YAWN I say to a 1% bounce! I mean REALLY people, have we taught you nothing following our 5% Rule? This is a very basic part of it, you get a 20% reversal off of 5% moves and that is called a WEAK BOUNCE. Don’t blame me, I don’t make the rules… Oh wait, actually I did make this one. Anyway, don’t blame me, this is just a rule based on how the system works so let’s not get too excited about what basically amounts to physics.

It could have been Ireland (which we were expecting) or it could have been JPM bashing the dollar (they did) or it could have been Buffett saying "All is well" in the NYTimes (gotta get the liberal into the market too!) – it could have been anything but SOMETHING was going to give us a dead cat bounce.

Note the Nov 2nd levels on the chart. Here, if it helps I’ll do an impression of a TV analyst: "It is truly amazing to see how resilient our markets are making such a strong recovery and we project…" Oh, excuse me, I made myself sick… Come on people, we’re back to our Nov 2nd highs (if that) and, if we pull back to the "year to date" view, the song "I’m Always Chasing Rainbows" springs to mind (the Alice Cooper version):

.jpg)

So pretty, isn’t it? Maybe this time it will be different. I’m not saying we CAN’T go up – with the Fed pumping in cash at an annualized rate of $1.8Bn it would be pathetic if we DON’T go up but I am very skeptical until we do break over those April highs and hold them as a firm floor. I was skeptical about Monday’s bounce (from 11,200 on the Dow to 11,275 and from 1,200 on the S&P to 1,207) and that served us quite well so give me the benefit of the doubt on this one before you all go off chasing this rally. We have a weekend coming up (lots of things could go wrong) and then a short week into a holiday which just so happens to be the holiday after which we expected the market to fall off a cliff if it continues to follow April’s Beta 3 pattern (see Monday’s post).

Yesterday was choppy and I told members in the Morning Alert that we would use the 11,000 line on the Dow and the 1,177 line on the S&P as the on-off switch for the DIA Dec $113 calls at .88. We finished the day right at Dow 11,007 and S&P 1,178 – close enough for a finish off my 10:03 call.

Yesterday was choppy and I told members in the Morning Alert that we would use the 11,000 line on the Dow and the 1,177 line on the S&P as the on-off switch for the DIA Dec $113 calls at .88. We finished the day right at Dow 11,007 and S&P 1,178 – close enough for a finish off my 10:03 call.

That did not stop us from picking up some day-trade shorts like the USO $36 puts at .92, which finished at $1.30 (up 41%) and QID $13 calls at .22 which were disappointing as they topped out at .32 but again, a 45% move in a day is nothing to cry over. Our other long play yesterday was a bullish play on JPM and they should get a nice pop this morning on their own negative call on the dollar, which is down 1% from yesterday’s highs.

As I said to Members in Chat at 1:26: "Meanwhile – there is still hope for the longs as the Dollar is once again rejected right at 79.25, which is turning into quite the contested area." Last night, I met with a group of investors and came away with a less than positive outlook for the US economy after discussing how their various businesses were performing. Not, this is anecdotal, of course, for the Northeast – but that’s what the Fed’s Beige Book is and don’t you dare tell me I’m less qualified to have a firm grip on the real economy than those bozos! As to what is going on in Ireland, my comment to Members was:

Look what’s happening in Ireland. They don’t want to borrow more money, they don’t have any unmet debt obligations but the bondholders are nervous and now that Bill Gross has picked up his 2:1 ratio of foreign debt, he is pulling on EU strings to make sure they guarantee his debt, which makes the high-interest bonds that he picked up during the uncertainty (that he caused) far more valuable. So he gets to control the events and first lend the Irish people money at usurious rates and then force the Irish people to borrow from others to remove the risk factor from the bonds he bought. It’s a great scam, you get to economically enslave a nation without firing a shot…

Speaking of manipulation: Of course if you are looking to spark a US rally you don’t wait for the US to open. That’s why it’s so great to be a multinational manipulator like JP Morgan, whose Tohru Sasaki in Japan got the ball rolling last night by proclaiming: "The dollar may fall below 75 yen next year as it becomes the world’s weakest currency due to the Federal Reserve’s monetary-easing program." U.S. policy makers may take additional easing steps following the $600 billion bond-purchase program announced this month depending on inflation and the labor market, he said. “The U.S. has the world’s largest current-account deficit but keeps interest rates at virtually zero,” Sasaki said at a forum in Tokyo. “The dollar can’t avoid the status as the weakest currency.”

Isn’t this the greatest scam? Hold a meeting of high net worth investors and drop a bombshell like that as if you have some inside information on US policy which, of course, Japanese investors believe JP Morgan does have. Follow it up with absolutist statements that would make even the strongest dollar bulls take pause and you have yourself a little dollar dust-off as the dollar fell from 79 to 78.50 between 3:30 and 4 am (a huge move for a currency). I’m more interested in the fact that it held 78.50 than the fact that it fell and a dire negative statement made by the head of FOREX Research as the 2nd largest bank in America. Really JPM? Is that all you’ve got?

Cash is still king and that’s why we’re doing lots of little short-term trades and running back to cash as quickly as possible. The Fed is relentlessly pumping cash into the market and it may not have worked yesterday or the day before but we are seeing some progress being made and that’s why we went long on JPM (not a day-trade) as well as the play on the banks I discussed earlier in the week. If POMO is going to work, it’s damned well going to work for the banks and we don’t let our disgust at their tactics stop us from betting on the winners (kind of like pro wrestling).

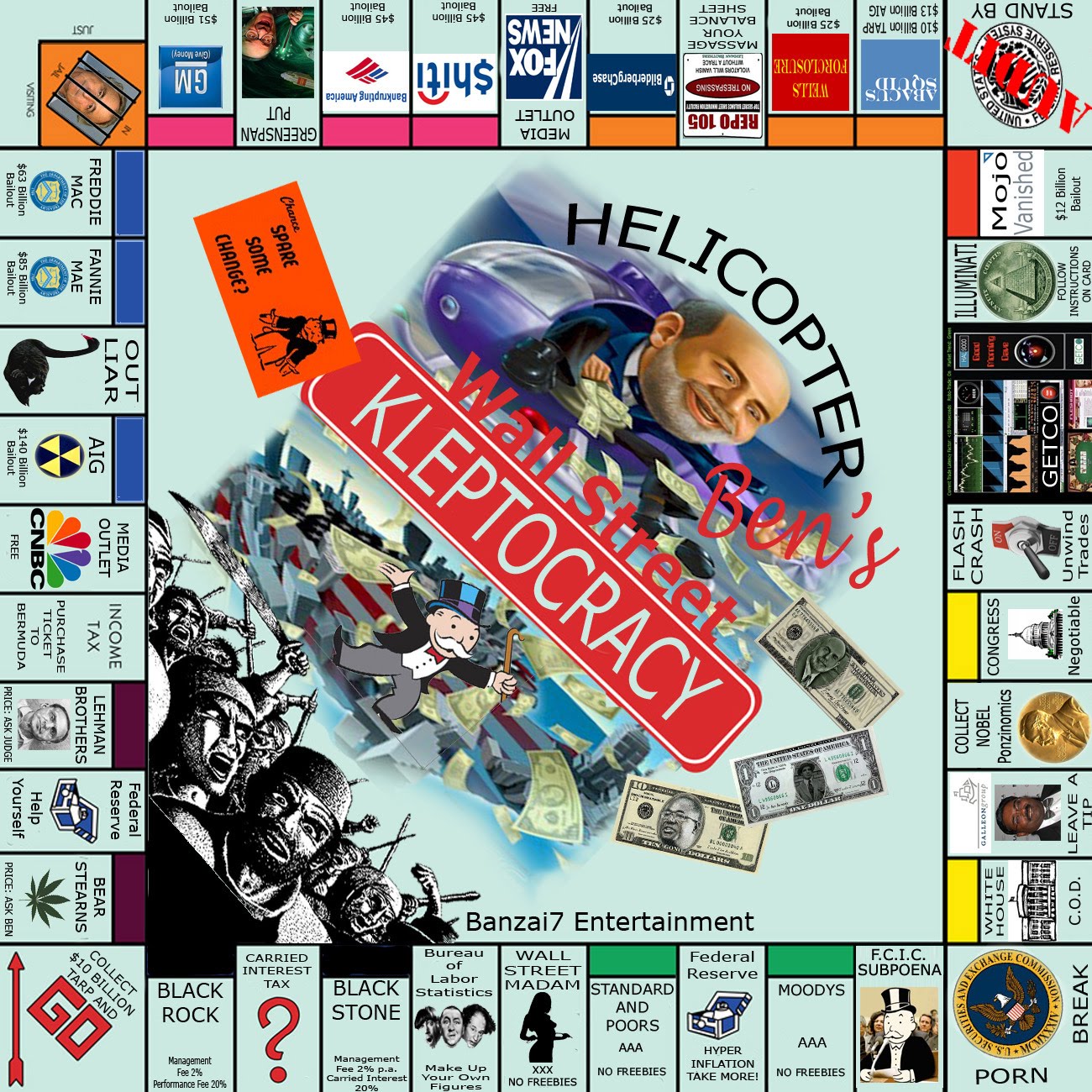

Here’s a great post from Pragmatic Capitalist and great board game by William Banzai7. Pragcap sees QE2 as nothing but a stealth bailout for the banks. I question the "stealth" issue but I guess the way the general public is totally blind to what’s happening and the way the MSM pretends it’s not happening at all – I guess blatantly taking hundreds of Billions of Dollars of the American people’s money and funneling through the banks and letting them scrape fees and profits as they funnel the money into guaranteed bets can be considered stealthy when done in front of a public that is too naive to know when they are getting screwed (unlike China’s President Hu Jintao, who really gets it!):

You just cannot take this stuff too seriously, it would drive you nuts… Speaking of market manipulation again, we have Fed speak "up the wazoo" today with data from the Philly Fed at 10 (NY Fed SUCKED!) and that will be spun by Governors Warsh at 1pm and Kocherlakota at 1:30. At the end of the day, the tag is made and the teammates from Treasury step into the ring with Wolin talking about Financial Reform at 3:30 and Warren talking about Banking and Finance at 4:15 and then they tag out for the Fed’s Plosser, who speaks at 4:30 about "Asset Bubbles and Monetary Policy" as if they are two different things. This is all in hopes of distracting us, or at least overwhelming the news flow as we also get the shameful Money Supply at 4:30 along with the even more shameful Fed Balance Sheet.

This is a standard PR move, when you get caught committing a crime, step out in front of it. That’s exactly what Treasury and the Fed are doing as they stole another 1% of your net worth this morning…