No man born with a living soul

Can be working for the clampdown

Kick over the wall 'cause government's to fall

How can you refuse it?

Let fury have the hour, anger can be power

D'you know that you can use it?The voices in your head are calling

Stop wasting your time, there's nothing coming

Only a fool would think someone could save youIn these days of evil presidentes

Working for the clampdown

But lately one or two has fully paid their due

For working for the clampdown – The Clash

Portugal is having a national strike today and labor unions in Ireland are planning “mass mobilization” in protest of planned spending cuts, with a march in Dublin on Nov. 27.

Portugal said in September it would cut the wage bill by 5 percent for public workers earning more than 1,500 euros ($2005) a month, freeze hiring and raise value-added taxes by 2 percentage points to 23 percent to help reduce a deficit that amounted to 9.3 percent of gross domestic product last year. The measures are included in the government’s 2011 spending plan, which faces a final vote in parliament on Nov. 26. “The strike arises in a context of a set of measures that are quite significant and have social impact,” said Carlos Firme, a director at Lisbon-based Banif Banco de Investimento SA. “It’s natural that there are demonstrations of discontent.”

I'm sure King George's Bankster buddies told him the same thing when the American colonists expressed their "discontent" – Don't worry my King, there's sure to be some grumbling from the peasants but your stimulus package is working wonderfully – now come outside and check out the golden horseshoes I put on my carriage team!

I'm sure King George's Bankster buddies told him the same thing when the American colonists expressed their "discontent" – Don't worry my King, there's sure to be some grumbling from the peasants but your stimulus package is working wonderfully – now come outside and check out the golden horseshoes I put on my carriage team!

We were able to add a little bling to our own rides as those QQQQ $53 puts I told you about in yesterday's morning post, which we picked up in Member chat on Monday at .45, opened at .75 and flew on up to $1.25 (up another 110% from Monday's entry) and pulled back to finish the day at .98. We were, of course, very happy to take a daily double off the table because that's all you need to stay ahead of the game. Even if you are just playing with $450 (10 contracts) – a single double-up like that once a week will drop $23,400 into your virtual portfolio over the course of a year – adding almost 10% to a $250,000 virtual portfolio taking relatively small (0.18%) risks.

See, it's not as complicated as it seems. We're just playing the trading range, which on Monday was .45 at the bottom so my call was to pick up the options if they hit .45 again into the close because we still thought the bottom of the range would hold. Of course that part is based on the fundamentals and our volume tracks and our knowledge of the Bots that are playing games with the markets but the actual act of using what we know about these very, very fixed markets to make money is really not that complicated. It's perfectly OK to stay in cash when you can take small plays like this and make the occasional double – better than trying to grind out 4% on 25 positions at risk, isn't it?

I made a call to kill the shorts at 11:33 in yesterday's Member Chat but we weren't jumping in on the long side, just getting back to cash and waiting to see what happens next my exact comment to members was:

.jpg)

Oh no, Dollar popped to 79.71 – it’s out of control!!! Pound ($1.582) and Euro ($1.338) selling off hard into the close and dollar is gaining so fast even the Yen went down but this is the end of their trading and we’re heading into 11:30 with 60M on the Dow, which is only a normal amount of trading for a Bot day so very stickable once the EU people are done panicking. I have to say I favor killing the short directionals and going long into the Fed (2pm) once we hold a bottom (probably a reject of the dollar around 80 or even 79.75).

Have I told you it's ALL about the Dollar? I'm pretty sure I have. We had a little Yentervention last night that drove up the dollar into Japan's close and that rescued the Nikkei from a down 250-point open, allowing them to close down "just" 85 points. The Hang Seng went the other way, with a big gap up at the open of 225 points and they "only" lost 100 points into the close to finish the day up 127 points but still about 700 points off Friday's high and down 1,977 points from the Nov 8th high at 25,000. The Shanghai managed to take a nice 1% bounce off their own 10% drop line this morning and it's a real tough call into the long weekend but I think we'll be picking a short – just in case things turn south while we're carving up the birds.

Other than a slightly bearish spread on OPEN, we didn't take any new plays after my cash call yesterday as it's going to be a wait and see day. We didn't hold the lines I put up in the morning post of Dow 11,120, S&P 1,185, Nas 2,500, NYSE 7,550 and Russell 715 with the actual finish at Dow 11,036, S&P 1,180, Nas 2,494, NYSE 7,470 and Russell 719 so that's 4 of 5 missing the mark and, as usual, it's the Russell that holds up the best. In our Multi-Currency Charts, you'll notice that, as far as Europe can tell – we're still rallying!

So now our charts are unclear and that makes us love our cash even more. As long as the dollar is getting stronger (up 5% since my bottom call) then our cash is gaining just fine – we only get worried when equity gains begin to out-pace our currency holdings but there sure are plenty of bargains to be had now compared to where we cashed out!

We had an increase in Mortgage Applications this week of 2.1% despite the 30-year fixed rate rising back to 4.5% so maybe a good sign there and Jobless Claims fell 34,000 to 407,000 this week while Personal Income rose 0.5% vs -0.1% last month and Personal Spending was up 0.4% vs 0.2% last month. One thing people are NOT spending money on is Durable Goods, as orders fell 3.3% in October from up 3.5% in September. Ex-Transport we were still down 2.7%, snowballing from down 0.8% prior but we kind of knew this would happen from the retail earnings reports we saw.

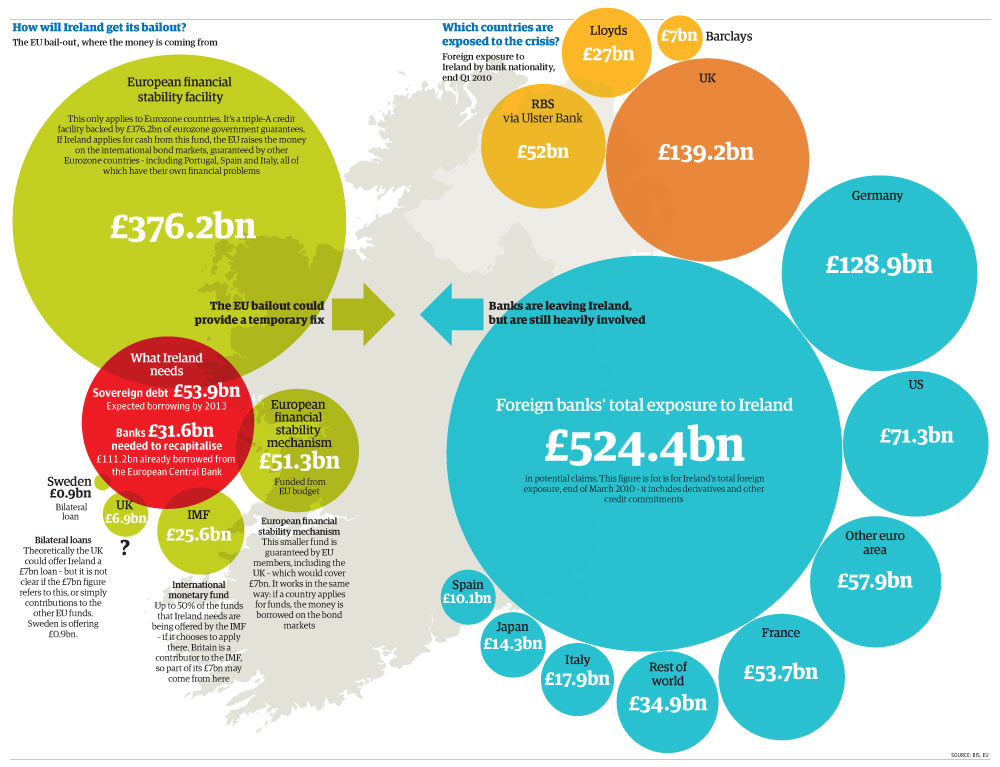

We're at goal (80) on the dollar so it's very hard to say what's going to happen next. A break over 80 could lead to a lot of dollar short-covering that can easily bring us up to 82 and that's enough to shove the markets down another 2.5% so we'll be watching that very closely but, for now, I think the dollar pulls back and that lets the markets recover, which sets us up for a short play into the close. As you can see from Barry's Guardian Chart, Ireland isn't out of intensive care and the sharks have already swum downstream to begin circling Portugal, Italy and Spain. Another $100Bn here and $100Bn there and we may actually have a crisis one day:

Those are Pounds, of course, and Pounds are $1.58 at the moment as the mother country continues to kick our rebel assets, even 234 years later… Ireland is another band of rebels that won't bend to British rule and S&P is punishing them with a dreaded two-step ratings downgrade AND a negative outlook because they have been very, very bad boys. “The Irish government looks set to borrow over and above our previous projections to fund further bank capital injections into Ireland’s troubled banking system,” S&P said in a statement. Putting the rating on “CreditWatch with negative implications” reflects risk of a further downgrade if talks on a European Union-led rescue fail to stanch capital flight, it said.

This is playing games with the entire EU's credit at this point and the Markit iTraxx Financial Index of credit-default swaps on senior debt rose 12.5 basis points, or 0.125 percentage point, to 163.5 basis points, the biggest increase since June. Contracts on Portugal’s Banco Espirito Santo SA are at a record, and Spain’s Banco Santander SA are at the highest level in five months. “Senior bondholders will most likely find themselves as potential burden-sharers, which is in stark contrast with the rules of engagement of the market,” said Roberto Henriques, a fixed-income analyst at JPMorgan Chase & Co. in London. “Even at the worst point of the current crisis, it was generally a given that senior debt was sacrosanct.”

This is playing games with the entire EU's credit at this point and the Markit iTraxx Financial Index of credit-default swaps on senior debt rose 12.5 basis points, or 0.125 percentage point, to 163.5 basis points, the biggest increase since June. Contracts on Portugal’s Banco Espirito Santo SA are at a record, and Spain’s Banco Santander SA are at the highest level in five months. “Senior bondholders will most likely find themselves as potential burden-sharers, which is in stark contrast with the rules of engagement of the market,” said Roberto Henriques, a fixed-income analyst at JPMorgan Chase & Co. in London. “Even at the worst point of the current crisis, it was generally a given that senior debt was sacrosanct.”

Credit-default swaps on the senior debt of Ireland’s biggest lenders approached records highs. Contracts on Allied Irish Banks Plc climbed 103 to 954.5 while Bank of Ireland Plc jumped 89.9 to 735.7, according to CMA. The cost of insuring Ireland’s government debt climbed 13 to 588, while Portugal surged 13.5 to a record 5888 and Spain was up 9 to an all-time high of 310, CMA prices show.

Credit-default swaps typically rise as investor confidence deteriorates and fall as it improves, paying the buyer face value if a borrower fails to meet its obligations, less the value of the defaulted debt. A basis point equals $1,000 annually on a contract protecting $10 million of debt.

According to Bloomberg: The 750-billion-euro European Financial Stability Facility, created in May to support the region’s most indebted governments, won’t be big enough to rescue Spain, Citigroup’s Buiter said. A rise in Spanish bank risk could be the “tipping point” for the financial credit swaps gauge, according to JPMorgan. Credit-default swaps on Lisbon-based Banco Espirito Santo have climbed almost 300 basis points (75%) this month to 699, according to CMA. Contracts on Banco Santander are up about 80 (50%) to 232.

This is NOT what we call a healthy investing climate people! Of course North Korea is still doing it's crazy thing and half of Wall Street is under investigation by the FBI all of which makes it so you hardly even notice that China and Russia have agreed to stop using US dollars to settle bilateral trade since it's no longer a reliable exchange currency. This will reduce the need for two major superpowers to hold dollars, paving the way for The Bernank's dream of $10 a gallon gasoline to "fix" the economy.

That should goose TBT back over $36 today but will it be enough to get the dollar back under 79.5, which we need to claw back to our market targets (above). Probably not because all the Rubles and Yuan in the World are only enough for Lloyd to light his cigars with compared to how many Dollars and Euros are circulation and with the Euro now looking like the World's scariest currency and Japan actively working to keep the Yen down – where else can people go but the Dollar?

And don't say gold because that's just silly…

We're investing in Turkeys this weekend. I hope you have a Happy Thanksgiving and let's all be thankful that things are not much worse — yet.

All the best,

– Phil

Top pic credit: William Banzai7