Ah, you guys fall for it every time, don't you?

Ah, you guys fall for it every time, don't you?

They take it up for BS reason, they take it down for BS reasons and, somehow, they get you to commit to some thing or another that goes the wrong way within a day or two. And you guys wonder why I like cash… You can't leave anything on the table in this market! Today's reason du jure for the markets pulling back is Europe again and, as we laid out for you weeks ago – it's now on to Portugal as the next "crisis" in the making.

It looks like almost all of Wednesday's gains will be wiped out by the time we open but let's keep in mind all this EU nonsense is nothing but hyena attacks as most of these countries are not in that bad shape overall – certainly no worse than we are (maybe we're next!). Anyone can be next. If you want to attack a country, you can attack any country where you can get traction on rumors that POTENTIAL bank losses exceed GDP – that's a banking failure.

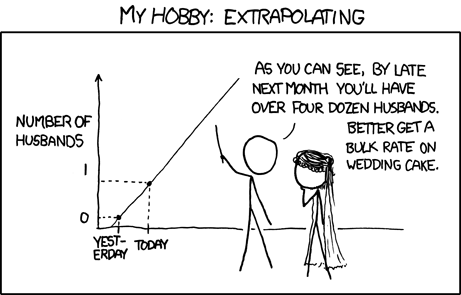

Once you get just a small amount of people to believe the banks may fail, then the rates start going up (and big investors can give them a little push artificially, of course, to get the ball rolling). Once the banks have to borrow at higher rates, then they need more capital reserves and then you can scream that they were lying about their capital requirements and call for "investigations" and that will convince more people they are hiding something and then the rates go higher and they need more capital and the bears can then parade on TV saying that they knew all along and that the banks are insolvent and they can EXTRAPOLATE that, at the rate things are going – the whole country will be bust in X amount of time…

Once you get just a small amount of people to believe the banks may fail, then the rates start going up (and big investors can give them a little push artificially, of course, to get the ball rolling). Once the banks have to borrow at higher rates, then they need more capital reserves and then you can scream that they were lying about their capital requirements and call for "investigations" and that will convince more people they are hiding something and then the rates go higher and they need more capital and the bears can then parade on TV saying that they knew all along and that the banks are insolvent and they can EXTRAPOLATE that, at the rate things are going – the whole country will be bust in X amount of time…

You can do this to anyone, anytime. Only if we stop the speculators from profiting from this game will it ever end. The reason that there are no runs on banks in China and Russia isn't because their banks are more solid – I'll bet there are Chinese banks who have nothing but a fortune cookie in their vault – but the difference is in Russia or China they will cut your head off if you try to run their banks. In America, when you cause a run on the banks, all they care about is how much you made so they can laud you as the next celebrity fund manager.

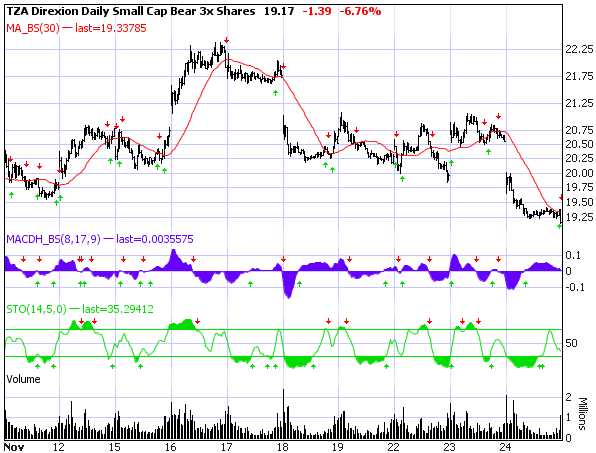

Nonetheless, our motto at PSW is "We don't care IF the game is rigged, as long as we can figure out HOW the game is rigged and place our bets accordingly." I may express my outrage at these various market scams in my posts but, once the market opens, we play to win! As I mentioned in Wednesday morning's post, our plan with our Members was to let the market move up and then we would short it. We grabbed an aggressive December TZA spread out of the box in the Morning Alert and then played the SPY Dec 3rd $119 puts at .90 (average) and we went back to naked on our DIA Mattress Play (fairly bearish) and added the USO $35 puts at .65 as oil spiked up. We also found 3 longer-term bullish plays but those are well hedged as we're just looking for a little balance – nothing like our aggressive short side.

With the Euro plunging to $1.32 early this morning and the Pound back at $1.56 – we finally have our Dollar pop over $80 and, of course, the commodity pushers don't like that one bit and even the expected Rent-A-Rebel attack on an oil tanker and more crazy talk from North Korea couldn't hold oil at the $84 mark against a rising dollar. As I said in yesterday's post, which I called "Thanksgiving Thursday – Stuffing the Futures," as we got more ridiculous pumping while the US markets were closed:

I’d feel better about ignoring the plight of this nation’s 20M unemployed and underemployed people if it wasn’t for the fact that consumable commodities have gotten so high. I don’t care how much money Donald Trump has but the World Record for corn eating is 46 ears in a sitting so, no matter how hard The Donald tries, he can’t consume enough corn to make up for the millions of people who have to cut back this holiday season. While 3D TVs and IPhones and Mercedes only need a few million customers to have a good year – it doesn’t make sense for broadly consumable commodities to assume the bottom 80% can continue to buy at these prices.

Of course, don't go getting too bearish now. We'll be taking our bearish money and running this morning as we have a $45Bn money drop scheduled by the Fed next week and, while I don't think it's going to be enough to turn the tide if the Dollar keeps rising, I don't think it's worth risking much to fight it.

As usual, we will get back to cool, liquid cash and simply ride the waves, looking for the next opportunity to dip our toes into. The EU needs to get their act together but if you take a look at this video of UK's Godfrey Bloom calling Germany's Martin Schultz "an undemocratic fascist" and getting ejected from the meeting – you'll see that they aren't all that close on coming to a general agreement on how to deal with their little PIIGies. Here's another "must see" video, an impassioned speech by UK's Nigel Farage condemning the entire proceeding!

Man I love European Politics! You might think that the EU spiraling out of control and a possible war in Korea would be great for gold but then you wouldn't be a PSW Member because we know it's ALL about the dollar and money flying out of the Euro doesn't go to gold, it goes to Dollars and Yen and a rising dollar is NOT good for gold and we'll get a nice move down there as the dollar moves back up. Our re-entry point on gold is $1,150 so we have about $200 to go, which is 14%, which is about Dollar 88 so that will be fun to watch if the Dollar gets a real squeeze but, at the moment, we are only counting on the Dollar hitting 82 as that's the 200 dma but woe unto the commodity pushers if it breaks over that mark so stabilizing the Euro will be critical this weekend for commodity bulls. Hopefully Bloom and Schultz will work out their differences by then (end extreme sarcasm font).

Spanish Prime Minister Zapatero must be a PSW Member as he is taking my advice this morning and going directly after bond speculators, "ABSOLUTELY" ruling out an EU rescue of Spain, saying: "I should warn those investors who are short-selling Spain that they are going to be wrong and will go against their own interests." Meanwhile, Portugal has denied a report that several EU countries as well as the ECB are pressuring the country to apply for a bailout. Separately, Portugal's finance minister says the EU cannot force his government to accept a bailout. The spread between Portuguese debt and German debt now stands at 444 basis points – that's 4.44% MORE for Portugal to borrow money than Germany.

The EU Commission is now (8am) suggesting doubling the size of its $588Bn bailout and that is boosting EU markets, who were down close to 2% going into lunch and are now recovering slightly on that news. That's how quickly things can change around here. Did I mention how much I like cash lately. Those dollars are getting more valuable every day!

So it will be take the money and run this morning, especially if our Dollar fails to hold 80.50, which would be disappointing on such bad news from Europe. We'll be watching copper between $3.70 and $3.75 to give us a directional signal as well as oil at the $82.50 line, which would be tragic if it fails. Natural gas has been our lagging commodity of choice and they are finally getting themselves together with a pop to $4.44 as LNG is once again being touted as driving future demand. It's all nonsense, of course – all LNG does is enable a two year supply of natural gas to be shoved into frozen storage but TBoone and his industry buddies have suckered enough governments and investors to buy into this nonsense that it has taken on a life of it's own and we are just going with the flow. CHK is the way to play Nat Gas long-term and they are quite a deal at $22.

Of course it's Black Friday and it's all about Retail Sales today and expectations are through the roof for a FANTASTIC holiday shopping season because all the people on TV (average salary $200,000) and all the analysts (average salary $250,000) and all the Retail CEOs (average salary $2.5M) and all the shopping mall owners (hanging on by a thread and will say anything it takes) say it's going to be a great holiday because everything is fine and all of their neighbors who haven't lost their homes yet are planning to buy something. Isn't that special?

Members, please take the time to participate in the 2010 PSW Holiday Shopping Survey. Last year we were able to accurately predict what turned out to be disappointing retail sales from our observations – we have a lot of very sharp people with a wealth of experience to draw on and I urge you to read last year's post and comments to get an idea of what we're looking for.

Have a great weekend,

– Phil