Thank you Republicans!

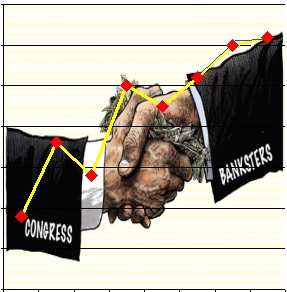

The party of fiscal responsibility has strong-armed the President and what little is left on the Democrats in Congress to extend the Bush Tax cuts for another two years at a cost of "just" $830Bn to the little people who still have to pay taxes. They accomplished this by allowing the Democrats to extend $56Bn of additional unemployment relief to the 2M families who were cut off on Friday and were about to go their first week without checks with just 17 shopping days left until Christmas. Of course, the Democrats don't just bend, they BREAK and the Republicans also got a 30% reduction in the estate taxes that are projected to cost an additional $66Bn to the people who don't have $5M estates. Merry Christmas, rich folks – Lloyd bless us, everyone!

"But Phil," you may ask "who actually does pay taxes?" When your deficit is about as high as your net collections – the answer is: No one really – or no anyone who matters, anyway. As I've often told you, our Corporate Overlords actually pay just 2.4% of our GDP in taxes, just $138Bn last year which was less than the $6Tn in bailouts they collected by a factor of 43 – no wonder they are doing so well! As you can see from the chart, Estate and Excise taxes are barely a point on the graph and Individual income taxes are barely 6% while Employment Taxes have jumped from 1.5% of GDP in 1950 to 7.5% today – that's a 400% increase but don't worry, it only affects your first $106,800 in income – after that, ZERO! That way, if you earn $1M, the jump in payroll taxes from $1,250 to $6,250 is just 0.5% of your income vs the 5% increase borne by a person earning $100,000 or less.

Imagine if all 140M US workers were given an even $6,000 break ($840Bn divided by 140M) on their take-home pay by just eliminating those SS deductions (it's not like they'll ever get that money back anyway)? Why everyone would immediately be taking home $500 more per month. Of course we know that the poor people would only "waste" it on food, shelter and clothing so our wise government has guided the bailout to the places it will do the most good, with $670Bn going to the top 5% and $160Bn trickling down to the rest of the tired, poor, huddled masses yearning to be able to pay their bills.

Imagine if all 140M US workers were given an even $6,000 break ($840Bn divided by 140M) on their take-home pay by just eliminating those SS deductions (it's not like they'll ever get that money back anyway)? Why everyone would immediately be taking home $500 more per month. Of course we know that the poor people would only "waste" it on food, shelter and clothing so our wise government has guided the bailout to the places it will do the most good, with $670Bn going to the top 5% and $160Bn trickling down to the rest of the tired, poor, huddled masses yearning to be able to pay their bills.

Sorry poor people, sorry middle class, sorry anyone who doesn't make over $106,800 a year. As Dr. Seuss said: "They're finding out now that no Christmas is coming! They're just waking up, I know just what they'll do. Their mouths will hang open a minute or two, then the Whos down in Whoville will all cry, "Boo Hoo."

And for the top 5%? Well, to quote the film: "The avarice never ends! "I want golf clubs. I want diamonds. I want a pony so I can ride it twice, get bored and sell it to make glue." Welcome to America, 2010 – land of the free ride for the wealthy and home of the downtrodden masses who will be paying $3 a gallon for gas to drive to the mall this weekend where they can look at $1,430 an ounce gold jewelry that they can't afford so they will pay $30 an ounce for the silver that was only $19 in September before Uncle Ben set sail on the QE2.

Well, there's nothing we can do to save the poor – they are just screwed so let's just get ours while we can! Obviously we can expect Friday's FAS and DBC plays to do very well as they were plays assuming there would be MORE FREE MONEY and we sure have that today! All we need if for FAS to hit $25 to put us 100% in the money on a 3,233% play and DBC was "just" a 1,200% net upside with a $27 target but nothing gets those commodities going like free money, does it? Those are perfect insurance against our bearish bets and our $10K to $25K Virtual Portfolio was up a very nice $1,825 in our first week back but we'll likely be giving up half of our gains as we gambled bearish into today on the expectations that either the EU, Congress or Ireland's Government would finally put their foot down and say no to debasing their currencies and plunging the working class people into a lifetime of debt. Silly me – what the hell was I thinking?

We'll be looking for upside trade ideas on lagging financials if we're going finally to break through the top of our range (Dow 11,500 is the big one) and C ($4.56) is one we're already in but would like more of. BAC is still cheap at $11.79 and should be thrilled that the British have arrested WikiLeaks founder Julian Assange. Secrets are once again safe and bloggers like me have been served notice that it's OK to mess around with the US Government (well Democratic ones) as Big Business likes them to look weak and ineffective but mess around with the Financial sector and you'll find yourself bound and shackled toot suite!

We'll be looking for upside trade ideas on lagging financials if we're going finally to break through the top of our range (Dow 11,500 is the big one) and C ($4.56) is one we're already in but would like more of. BAC is still cheap at $11.79 and should be thrilled that the British have arrested WikiLeaks founder Julian Assange. Secrets are once again safe and bloggers like me have been served notice that it's OK to mess around with the US Government (well Democratic ones) as Big Business likes them to look weak and ineffective but mess around with the Financial sector and you'll find yourself bound and shackled toot suite!

While I still think this will all end in tears, we've been patiently waiting for our range tops to be broken at Dow 11,500, S&P 1,220, Nasdaq 2,600, NYSE 7,750 and Russell 725. We should open this morning with all but the Dow over the line and, as we did in early November, we will sit PATIENTLY waiting for the Dow to confirm the move up, at which point we can safely go with the flow, using those numbers as our new breakdown watch levels.

That's not too much to ask for is it? Certainly not after the government drops another $1Tn on us just a month after The Bernank announce his $1Tn gift basked for bankers – that's $2Tn in two months – as much money as our Government collects in taxes in an entire year… What could possibly go wrong? So we're very excited to see what $2Tn buys us these days as it helps us plan our own holiday shopping. The Fed spent $2.5Tn in 2009 and bought us a run from about 850 on the S&P to 1,150 so just about $100Bn per point is the going rate. When the stimulus ran down, we dropped from 1,220 back to 1,110 in 90 days so we know what it costs NOT to pump up the markets, don't we? Now we're basing off 1,050 and the Fed and Congress have decided to buy 200 more S&P points for $2,000,000,000,000 but we already anticipated all this and we're already up 175 points so we'd better watch that 1,250 line closely as I'm not sure we paid the price of admission to 1,300 yet (QE3 anyone?).

Chris Kimble over at our Chart School points to our key Fibonacci levels on the major indexes and we'll be watching those very closely as we wait for Dow 11,500 (was kind of like waiting for Godot last time – he never came!). Once we break 11,500 on the Dow, fundamentals are out the window (not that they've mattered much in the past month) and it's all about the technicals once we move above these lines:

CLICK ON CHART TO ENLARGE

Nobody wants to miss out on the big rally as all the rubes are being herded under the big top to pay for the freak show that is the Global Marketplace. Ironically, Germany's refusal to fund additional bailouts in the EU led to a strengthening of the Euro against the Dollar last night and the Euro tapped $1.34 this morning, up 5% from last week's lows while the Dollar fell back to 79.65, a 0.5% drop from the open, which is usually good for a 1% boost to the markets. What we're going to want to see as a proper show of strength in the markets is for the markets to begin ignoring the dollar and moving up on their own – something that hasn't happened in over a month.

This whole house of cards could still come tumbling down if Ireland votes no today. According to Rupert’s Journal, Ireland is expected to pass and the markets are reacting accordingly. The Irish are not raising corporate taxes off their EU-low 12.5% level and are instead taxing people who make up to $25,000 20%, where before they were exempt. It’s a brave, new World… Ireland’s unemployment is (officially) 13.5% and the government is cutting back services severely too. We’ll see if this thing blows up down the road regardless:

Ireland’s main political parties agree on the urgent need to fix the country’s fiscal and banking problems. Yet even after Tuesday’s budget vote, it is unclear whether some of Mr. Cowen’s austerity measures will reach fruition given his feeble hold on power.

Facing calls to resign and a revolt from his own political allies, Mr. Cowen recently agreed to hold new elections next year after the government’s budget effort finishes. His ruling center-right Fianna Fail party is widely expected to suffer in next year’s elections, thanks to popularity ratings that are lower even than those of Sinn Fein, a party with only four seats in Ireland’s 166-seat Parliament.

If Ireland’s two main opposition parties, Fine Gael and Labour, take the reins as expected, they could push for changes in the country’s austerity drive. Fine Gael has vowed to overturn the government’s move to lower the minimum wage, while Labour politicians have sought higher taxes for the wealthy.

One last stab at making some bearish profits for us (see Morning Alert) but, Overall, it looks like we’re going to have another up move in the markets unless Ireland surprises people with a rejection so let’s crank up the tunes and PARTY like it’s 1999!