Good job Congress!

Way to bend of and take it from your new Republican Masters! Not since Jack sold his cow for some magic beans has a deal like this been made by our "leadership" where families earning between $35,000 and $64,000 go $7,800 further into debt to get a $613 tax break while families earning between $5M and $10M get $38,590 and families earning $50M to $100M get $380,590 and families (or Corporations, of course) earning $500M to $1Bn get $3,859,000 or about 12,590 times more than the average middle class family but, then again, they deserve it because – they are that much better than you are!

Face it, unless you are in an income category where your tax benefit has 5 digits, you are what George Orwell (who worked in England’s Ministry of Propaganda) called a "Prole." In "1984" the Proles (proletariat) were the vast majority of the populace, the working class of Oceana. Though the proles are the majority, they are unimportant. The Party explicitly teaches that the Proles are "natural inferiors who must be kept in subjection, like animals". As one of the Party Leaders observes: "the relative freedom of working-class people is merely a symptom of the contempt in which they are held".

It is not only the Party which regards the Proles as unimportant: the arch-enemy, Goldstein, dismisses them too, referring to the divisions of High, Middle and Low people, in which the Low are essentially destined to remain powerless. This attitude has much in common with the one Huxley shows in Brave New World—the lower castes are mindless enough to be satisfied with little, and can be relied on not to be troublesome.

You’re not going to be any trouble are you? Enjoy your $613, little people. That’s what, about a month’s worth of gasoline and cable TV? Congratulations on your voting acumen – you certainly have gotten the Government that you deserve! I apologize because I had mischaracterized the tax cuts as being fairer to the Middle Class last week, when I said it was only an outrage. I thought that families earning $50,000 would be getting $900, not $613, but it turns out that 12,590 times $287 is another $3,613,330 that could be given to a Billionaire and they NEED that money to buy stuff that might create a job while you would only go waste it on food or clothing. Thank goodness we have elected people who see this clearly!

You’re not going to be any trouble are you? Enjoy your $613, little people. That’s what, about a month’s worth of gasoline and cable TV? Congratulations on your voting acumen – you certainly have gotten the Government that you deserve! I apologize because I had mischaracterized the tax cuts as being fairer to the Middle Class last week, when I said it was only an outrage. I thought that families earning $50,000 would be getting $900, not $613, but it turns out that 12,590 times $287 is another $3,613,330 that could be given to a Billionaire and they NEED that money to buy stuff that might create a job while you would only go waste it on food or clothing. Thank goodness we have elected people who see this clearly!

Congressman Ryan Paul is one of those people and he points out: "Whose money is this after all?" It’s not your money that your family is going $7,800 further into debt to protect – it’s THEIR money. THEY earned it and THEY are darned well going to keep it. "Hey," you might say, "I work for THEM – didn’t I make that money and isn’t this OUR country that’s in debt and needs responsible fiscal policy?" Well, that’s just Commie talk and you’d better watch yourself – we’ve already sent your name of to HomeSec so consider yourself on notice…

The Proles in this country are dumb enough but what amazes me is the people who support the tax cuts thinking you are "one of THEM" when "they" look at you the same way you step over a homeless man in the streets. $858Bn is the NATIONAL Debt that we are taking on to fund these cuts. The cuts work out to about 0.75% of your income and your family share of the additional debt burden is $7,800 so, unless you are making AT LEAST $1M PER YEAR as a corporation or individual, this tax cut is a net loss for you. Once you clear that $1M hurdle, it’s all gravy flowing uphill to your plate! Even better if you are a "Corporate Citizen" – you have no real debt obligation to this nation because, like Haliburton and many, many others – you can simply move whenever you want – to avoid taxation AND prosecution!

As Bloomberg proclaims today "It’s a Great Time to Be Rich" saying: "Savvy wealthy Americans would be able to capitalize on an environment in which their tax rates on income and investments remain at historic lows. Also, new rules would make it possible to pass on fortunes to heirs with less fuss and lower taxes than all but a brief period of the past 80 years." "The climate we’ll have after this legislation is extremely favorable for wealthy families," says Jeffrey Cooper, a professor at Quinnipiac University School of Law and a former estate planner who has studied the history of U.S. tax law.

As Bloomberg proclaims today "It’s a Great Time to Be Rich" saying: "Savvy wealthy Americans would be able to capitalize on an environment in which their tax rates on income and investments remain at historic lows. Also, new rules would make it possible to pass on fortunes to heirs with less fuss and lower taxes than all but a brief period of the past 80 years." "The climate we’ll have after this legislation is extremely favorable for wealthy families," says Jeffrey Cooper, a professor at Quinnipiac University School of Law and a former estate planner who has studied the history of U.S. tax law.

The tax compromise extends a 15 percent top tax rate on long-term capital gains and dividends enacted in 2003, which is the lowest rate since 1933. The top capital-gains rate was 77 percent in 1918 and, since 1921, its highest point was 39.9 percent in 1976 and 1977—though certain gains could be excluded from taxation. Estate planning experts say their wealthy clients could be entering an unprecedented period when tax rules—along with low interest rates and previously existing loopholes—make it easier than ever to transfer large sums to children and grandchildren. Obama and other Democrats had sought to limit the use of GRATs, but failed. "That’s a wonderful technique for parents looking to pass assets on to children at nearly zero [tax rates]," says Jennifer Immel, senior wealth planner at PNC Wealth Management.

As Robert Reich points out: "The only practical effect of adding $858 billion to the deficit will be to put more pressure on Democrats to reduce non-defense spending of all sorts, including Social Security and Medicare, as well as education and infrastructure. It is nothing short of Ronald Reagan’s (and David Stockman’s) notorious "starve the beast" strategy." As Bob reminds us, the richest 1 percent of Americans is now taking home a larger percentage of the nation’s income than at any time since 1928. And we recall what happened in 1929. He warns: "Unless the vast majority of Americans has enough purchasing power to keep the economy going without going ever more deeply into debt, the economy will eventually go over a cliff." Yeah, I know, just another Liberal worried about the stupid Proles…

As Robert Reich points out: "The only practical effect of adding $858 billion to the deficit will be to put more pressure on Democrats to reduce non-defense spending of all sorts, including Social Security and Medicare, as well as education and infrastructure. It is nothing short of Ronald Reagan’s (and David Stockman’s) notorious "starve the beast" strategy." As Bob reminds us, the richest 1 percent of Americans is now taking home a larger percentage of the nation’s income than at any time since 1928. And we recall what happened in 1929. He warns: "Unless the vast majority of Americans has enough purchasing power to keep the economy going without going ever more deeply into debt, the economy will eventually go over a cliff." Yeah, I know, just another Liberal worried about the stupid Proles…

So let’s forget feeling sorry for the losers at the bottom of the economic pyramid and start studying them to come up with an investment premise. After all, last year, in my 2010 outlook, I predicted this year would be "A Tale of Two Economies" as the rich would continue to do very, very well while the poor would fall further behind. What I didn’t expect was that the poor would vote for more of the same in the elections but, as PT Barnum once said "Never underestimate the stupidity of the American public." As I said, they now have exactly the Government they deserve so screw those guys and let’s make some money!

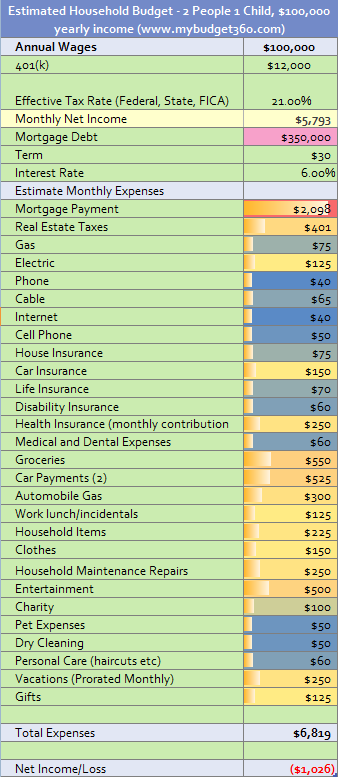

We need to examine the family budget and find the places where money can actually be made selling to people who have none. Back in last December’s article, I had said: "Let’s not kid ourselves that anything in this country is being done for the benefit of the 90% who serve us. We provide the basics and there are even many fine companies who can make money selling those basics like KO, MCD, JNJ, WMT… that we can invest in." MCD has flown up 25% this year with KO up 15% with WMT up just 5% and JNJ actually down about 3%.

Medical equipment (IHI) has been a mixed bag with Health Care legislation still in question but GE has been a great performer (up 20%) and both UHS and THC were the right way to go only THC only started working recently. Big Pharma and Biotech still have room to run. TBT has NOT had a good year but it’s finally starting to improve as our country sinks further and further into debt – we just didn’t account for QE1 or QE2, for that matter back in December.

IHG was a good pick and CAL got bought out but what was I thinking liking OWW better than PCLN – never bet against Shatner! Solars like SPWRA and STP have dropped 50% this year while WFR (our favorite) is getting cheap again and GLW is my bargain pick of the tech group along with CSCO (who wasn’t on last year’s list).

All in all, not much has changed but I will be doing my 2011 outlook over the holidays so let’s keep that household budget in mind but as this family with the $100K income now has another $750 to spend, maybe more if they refinanced their home – I’ll try to do an updated budget, taking into account higher fuel prices (as we’ve noted, it’s a great way to FORCE middle class people to spend money) and higher food prices. Remember, as Mr. Davies said:

Gas bills, rent bills, tax bills, phone bills

I’m such a wreck but I’m staying aliveI’d really like to change the world

And save it from the mess it’s in

I’m too weak, I’m so thin

I’d like to fly but I can’t even swimGotta be a Superman just to survive

We’re still skeptical and bearish until the Dow actually holds 11,500 for a day, so far, we haven’t even closed there – missing it yesterday by just 0.75! Oil fell all the way to 87.75 pre market, giving us yet another (yawn) victory off the $89 line in the futures. This trade will keep working until we’re over $90 and we can expect another test into the open on tax cut fever but it’s copper we’ll be watching today as well as the Dollar at the 80.50 mark to give us a clue as to intra-day direction. While we may look irresponsible in our spending – that’s only because you are not sitting us next to Europe, who are still spiraling out of control (Ireland just got a FIVE (5!) notch downgrade from Moody’s. Generally you have to be hit with a nuclear missile for that to happen) – even as they pass bigger and bigger bailout deals.