It's going to be another light trading week.

Europe is off 1.25% this morning (8am) as the Shanghai fell 2% and the Hang Seng dropped 0.3% on news that China was raising rates 0.25% for the second time in 2 months – weeks ahead of what most considered a fairly aggressive tightening schedule. Chinese Premier Wen Jiabao voiced confidence Sunday that his government can contain rising prices.

Speaking to listeners during a visit to state radio headquarters, Mr. Wen acknowledged that recent price increases have "made life more difficult" for middle and lower-income Chinese. But, pointing to measures the leadership has taken in recent months, he said: "As it looks now, we are completely able to control the overall level of prices." The remarks, in a session where Mr. Wen was asked repeatedly about prices, reflect the issue's political sensitivity for Beijing.

Our futures would certainly be taking a much bigger hit if the dollar wasn't down half a point since Friday, inflating the prices of stocks and commodities and giving us the illusion of stability in what can easily become a rough morning. Of course we felt that last week's zero-volume move higher was fake, Fake, FAKE but, when the acting is that good, there's nothing else you can do but sit back and enjoy the ride. One long we did take on Thursday was a long on the VIX as we expect volatility to perk up in January. We took a short position on FCX at 2pm ($119) as a proxy for shorting gold and copper and we have an obvious exit point if they hit $120.

On the other side of the tape, I put up 4 major inflation hedges for 2011 that will serve us all well in a runaway market this year (along with one strategy that can give you up to a 50% discount on an Annual PSW Membership). These are, of course, bets that Chairman Wen is wrong and prices cannot be contained. After all, what difference does it make how much China tightens if The Bernank has the spigots in the US running full blast and flooding the World with Dollars? The more dollars he prints, the more dollars are demanded to buy oil, gold, copper, cotton, silver, corn and whatever other dopey thing Goldman Sachs can buy low and sell high and those dollars go to producers like OPEC, who spend them new cars and donate them to Terrorists, who in turn put that money back in circulation to buy plastic explosives, detonators and airline tickets – isn't the global economy wonderful?

On the other side of the tape, I put up 4 major inflation hedges for 2011 that will serve us all well in a runaway market this year (along with one strategy that can give you up to a 50% discount on an Annual PSW Membership). These are, of course, bets that Chairman Wen is wrong and prices cannot be contained. After all, what difference does it make how much China tightens if The Bernank has the spigots in the US running full blast and flooding the World with Dollars? The more dollars he prints, the more dollars are demanded to buy oil, gold, copper, cotton, silver, corn and whatever other dopey thing Goldman Sachs can buy low and sell high and those dollars go to producers like OPEC, who spend them new cars and donate them to Terrorists, who in turn put that money back in circulation to buy plastic explosives, detonators and airline tickets – isn't the global economy wonderful?

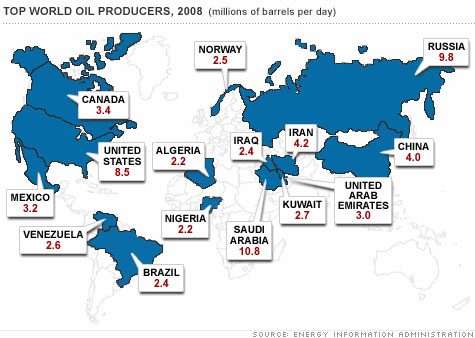

Let's not kid ourselves folks, oil is up $20 a barrel since September and that gives Ahmadinejad $84M PER DAY extra cash which he can use to help defeat the Great Satan. They are pumping the same oil as they were before – simply for a lot more money thanks (as usual) to Goldman Sachs, JP Morgan and the other patriotic speculators who are willing to bankrupt the people of their own countries in order to scrape a few extra dollars of commissions and profits off their energy trading. At $90 and 4.2M barrels a day, Iran gets 138Bn American Dollars a year to spend however they think is best and, if they thing that money is best spent buying roadside bombs for their militant friends in Iraq – well that's just good old fashioned Capitalism at work, right?

![[CHIRATES]](http://si.wsj.net/public/resources/images/WO-AD828_CHIRAT_NS_20101226181803.jpg) The entire GDP of Iran is $331Bn so almost half of that is oil money. If you ever wonder why Iraqi people are pissed off – their GDP is $65Bn and they pump 2.4M barrels a day, which at $90 times 365 days equals $78.8Bn so SOMEONE is getting ripped off in Iraq, don't you think? Even Nigeria gets a better deal than Iraq does with a GDP of $173Bn and 2.2Mbd of oil pumped out daily. We're still short oil – there is no shortage, just hype and speculation that will run its course. The question is, when?

The entire GDP of Iran is $331Bn so almost half of that is oil money. If you ever wonder why Iraqi people are pissed off – their GDP is $65Bn and they pump 2.4M barrels a day, which at $90 times 365 days equals $78.8Bn so SOMEONE is getting ripped off in Iraq, don't you think? Even Nigeria gets a better deal than Iraq does with a GDP of $173Bn and 2.2Mbd of oil pumped out daily. We're still short oil – there is no shortage, just hype and speculation that will run its course. The question is, when?

Wen, is the question everyone needs to be asking as China's last round of rate tightening, also spurred on by ridiculous rises in energy prices that the government was determined to put a lid on, was a trigger that collapsed the global economy in 2008. As you can see from the chart on the right, the last series of rate hikes took them from 6% to 7.5% in just over a year but, from their perspective, were not aggressive enough as oil soared to $140 a barrel in 2008 because Bush was giving away stimulus money as fast as China could remove it from the system.

Obama and the Bernanke have already teamed up for a $2Tn money drop in 2011 and that $20 that oil has risen since The Bernanke announce QE2 in September is $20 per barrel that China has to subsidize for their people, who pay a fixed rate. So take the $30Bn bonus that we're shipping over to Iran and multiply that by about 4 and that's what it costs the Chinese government to cover that extra $20 per barrel. Believe me, they DO NOT want to see $100, let alone $140 again, no matter how much CNBC, GS et al salivate over the possibility…

Somehow, the MSM seems to think American Consumers have an extra $400M a day to spend on oil and that, of course, is just 20M barrels times $20 extra or "just" $146Bn a year that will be spent on oil instead of ITunes. Of course, then you have refining mark-ups (great for our VLO, who are up 20% since Sept) and ancillary inflation in food, heat, electricity etc and you can easily double that to $300Bn. Figure each $10 rise in oil costs US Consumers $150Bn more to consume the same food and fuel that they did before and then contemplate that the bottom 90% of wage-earners in this country are making 5% LESS than they did in 2005 AND that 10% of them have no jobs at all.

That's why, in my very humble opinion, anyone who tells you that oil will be over $100 AND the economy will recover – is on crack! The Fed cannot create money fast enough and the Treasury cannot print money fast enough to wallpaper over rising food and fuel costs (which are, of course, not part of the "core" CPI) and give us a consumer-based recovery at the same time.

What we are seeing this holiday season is consumers RE-leveraging for the holidays. Now, I'm a little early with this, you won't hear about it until the data comes in later in the month – just like I told you about the Muni Debt months before it became a popular theme so let's just consider this something we'll need to watch out for in 2011.

As you can see from the chart on the left, we are in a contraction on CMI data, which takes into account broad consumer spending trends and clearly indicates we are in no way out of the woods yet. As Housing Time Bomb points out: "The CMI goes on to explain how the majority of our growth in 2010 was as a result of massive government stimulus combined with improved exports thanks to a falling currency." Or, as I said last week – we have fooled almost all of the people some of the time in 2010 – whether that will last into 2011 or not is the question we must ponder for the new year.

Meanwhile, baby it is cold outside in the Northeast and that, of course is bad news for retailers, who want consumers to come out and cash in those gift cards. It also stops air travel and keeps people at home and not driving – all bad for oil prices but we're not expecting them to fail $90 as long as we keep getting short-shipped over 10M barrels a week from our good friends at OPEC – a trick they've been using all of December to create artificial draws in US crude supplied. Last week, 8.7Mb of oil were imported per day and at least that was some improvement over the prior week's 7.7Mbd of imports, quite a bit below our 5-year average of 10Mbd.

This effectively shorts our inventories by 10-15Mb PER WEEK so it doesn't matter whether you try to conserve oil or not, they will just short-ship us and call the draw-down in energy "consumption" because that is the totally BS way they measure it. As I said, we are short oil and short the markets at the moment as we still aren't quite seeing how they can keep all these balls in the air – no matter what, it's going to be an interesting New Year – but let's try to get through the week first!

Be careful out there!