So, how are we doing?

I liked David Fry's tweet (is that the right word – I feel so old when I don't know this stuff!) yesterday which said: "SPY volume again pathetic at 55M shares. What's there to write about today? Seems many investors still stuck on planes that aren't moving." Dave was smart enough to take the day off – me, not so much. We did pick up another .20 with up the DIA Weekly $114 calls at 10:41 in Member Chat for $1.60and those were done at 1:05 for $1.80 as the market looked too risky to me. That was kind of silly as we do know that low volume is the bulls best friend but we're trying to get back to cash each day on quick trades – especially on calls that expire on Friday!

As you can see from the Euro chart (click to enlarge), I'm not ready to give up on my bearish premise, which is essentially that Europe may be in worse shape than the US and the Dollar and – IF the EU runs into crisis – then the Dollar looks RELATIVELY better and, despite all of Timmy and The Bernank's best efforts to destroy it – a strong dollar will pretty much undermine everybody's bullish premise since the only real bullish premise people have is that our worthless currency will drive people into equities and commodities since Treasury and the Fed will artificially keep bond rates so low as to make them unpalatable alternatives.

Even Glenview's Larry Robbins, who I thought would perhaps have an original thought in his Dow 20,000 premise, does not. The man entrusted with $4.8Bn of other people's money predicts that p/e multiples will expand by, get this, 45% by the end of 2013 – rocketing the Dow to 20,000 despite just 5% annual earnings growth. Larry Robbins thinks those investing in 10-year treasuries aren’t doing so for the paltry return. They’re in it to front run the Fed and make a quick buck at the expense of the taxpayers. Once this trade is over, Robbins says, they have nowhere to go except the high quality equities in the stock market.

Even Glenview's Larry Robbins, who I thought would perhaps have an original thought in his Dow 20,000 premise, does not. The man entrusted with $4.8Bn of other people's money predicts that p/e multiples will expand by, get this, 45% by the end of 2013 – rocketing the Dow to 20,000 despite just 5% annual earnings growth. Larry Robbins thinks those investing in 10-year treasuries aren’t doing so for the paltry return. They’re in it to front run the Fed and make a quick buck at the expense of the taxpayers. Once this trade is over, Robbins says, they have nowhere to go except the high quality equities in the stock market.

Read into any bull premise and you'll find inflation at the heart of it. The Global Economy is not really improving but the numbers are looking up because it costs more money to do everything. Now, I had an odd little thought that investors were not stupid enough to believe that just because numbers go higher, it does not mean that the economy is healthy but, silly me, I completely overestimated the intelligence of the investing public (not you, of course, only people who aren't reading this!).

How else do you explain the prevailing logic that the price of something as basic and necessary as gasoline can rise 50% in 4 months, back to our 2007 average yet GM gets an upgrade from Gang of 12 Members MS, JPM, BCS and CS – all on the same day (yesterday) that gasoline breaks the year's high. GM jumped 2% yesterday and now has a $58Bn market cap, which is almost 1/2 of the $138Bn they lost in Q4 of last year! Overvalued? Not according to the 4 IBanks who all felt compelled to release upgrades on the same low-volume day yesterday.

Heck, $10Bn in Receivables and $47Bn in Payables is no biggie, nor is $50Bn of "Other" and "Deferred Liabilities." GM offsets their liabilities (and we're not counting unfunded ones, of course) with $30Bn worth of "Goodwill" that is generated by those fine GM brands like Saturn and Pontiac – which they couldn't get a bid for an shut down at a total loss this year. GM, in March of 2009 was LOSING $20,000 for each car it produced. My advice to them back in March of that year was simply "Stop making cars!" That would have saved them from that $138Bn loss which, ultimately, the taxpayers footed the bill for. I have had no reason to change my mind so far in GM's new iteration.

Of course, GM is playing "the China card" and forecasting infinite growth selling to our Chinese masters. China is, of course, the other bull theme for 2011. According to analysts, over one Billion Chinese citizens (who earn an average of $2,000 a year per family) will be driving their SUVs to Chipolte on the way to the airport (booked by Priceline) dressed in Uggs and workout wear from LULU while watching NetFlix videos on car DVD players they bought from Amazon. At the airport they will buy gold from a vending machine, get more food from MCD or YUM and then fly to America where their tourist money will offset the Billions of surplus trade dollars we send them.

Of course, GM is playing "the China card" and forecasting infinite growth selling to our Chinese masters. China is, of course, the other bull theme for 2011. According to analysts, over one Billion Chinese citizens (who earn an average of $2,000 a year per family) will be driving their SUVs to Chipolte on the way to the airport (booked by Priceline) dressed in Uggs and workout wear from LULU while watching NetFlix videos on car DVD players they bought from Amazon. At the airport they will buy gold from a vending machine, get more food from MCD or YUM and then fly to America where their tourist money will offset the Billions of surplus trade dollars we send them.

Don't laugh, that pretty much describes half the families in California now so why wouldn't we expect our Chinese masters to emulate us in every way? After all, we've done such a fabulous job in this country creating a self-sustaining economy – wouldn't other countries want to emulate it so they too can borrow up to their eyeballs and plunge their population into centuries of debt, losing their position in the World to the point where their economy's only hope is selling knick-nacks to farmers and factory workers half a World away? Of course they would! It's what we call "The American Dream."

I worry about silly things like where the next Trillion is supposed to come from (and we had a very bad bond auction yesterday, as did Europe) and where the additional $50 a week for gas ($2,600/year) is going to come from for each global family along with another $50 for groceries and how the builders are supposed to afford $5 copper and why is NFLX "worth" $10,000,000,000 when they will barely make $120,000,000 this year and, also, how long will they keep being able to use 20% of the Internet bandwidth of the United States for free?

These are, however, all abstract concerns, like our $15Tn national debt (not counting the $111Tn of unfunded liabilities to be, theoretically at least, collected by Boomers over the next 20 years), our decaying infrastructure, our declining educational outcomes and, of course our near 20% real unemployment rate.

These are, however, all abstract concerns, like our $15Tn national debt (not counting the $111Tn of unfunded liabilities to be, theoretically at least, collected by Boomers over the next 20 years), our decaying infrastructure, our declining educational outcomes and, of course our near 20% real unemployment rate.

Intellectually, I know that the US no longer matters in the grand global scheme of things yet 70% of the US economy is still consumer spending and even if that drops off just 5% and even if the US is only 1/2 of the S&P 500's total sales – that's still a 1.75% hit to sales. Clearly though, with the VIX at 17.5% and S&P Short Interest at just 4.15% (the lowest level since 2007), happy days are here again and I'm only speaking to 4.15% of the population who are worried (and at least half of them are probably bulls with small hedges).

So, if we're going to get bullish in 2011, we need to switch off that thinking part of our brain and get ready to go with the market flow – much the way we had to in 1998 and 2007 – it doesn't matter how stupid an investment may seem, we're going to be betting on the madness of the crowd's and, looking at those SAT scores, it's a pretty obvious bet! Since we will be following form rather than substance, let's make sure we know what the market looks like from various perspectives – priced in Dollars, Euros and Yen, for example:

Obviously, we need to keep a close eye on those Yen levels as it does look like, from a Japanese perspective, we are failing to hold our 20 dma supports as the Yen comes off the mats at 118 and gains 3.3% in the past two weeks. I mentioned that Europe may look worse than the the US and thus the Dollar looks better than the Euro but what a joke that the "safest" looking currency is the one whose country is carrying a 200% Debt to GDP ratio. That's good news for the bulls actually as both the US and Europe is rapidly racing to catch up with Japan (assuming they stand still, which is doubtful) and THAT is how our markets are supposed to go up 45% in two years – what could possibly go wrong?

I played a fun game with my daughters the other day when my oldest asked me to explain how the Fed causes inflation and I said to here. Go ask your sister how much money she wants for a piece of gum. They both came back and reported that they had agreed 25 cents would be fair. I then took 20 strips of paper and wrote $100 on each one and gave them 10 each and said – "Congratulations, you are both rich."

I played a fun game with my daughters the other day when my oldest asked me to explain how the Fed causes inflation and I said to here. Go ask your sister how much money she wants for a piece of gum. They both came back and reported that they had agreed 25 cents would be fair. I then took 20 strips of paper and wrote $100 on each one and gave them 10 each and said – "Congratulations, you are both rich."

I then said to Madeline, now ask Jackie how much she wants for a piece of gum. Jackie initially asked for $100 because she (8 years old) could see Madeline had $1,000 and Madeline didn't have anything smaller than $100 and was about to give it to her, when I suggested she offer Jackie one real dollar.

Jackie accepted the offer and gave Maddie a stick of gum and then I said to Madeline, "What happened?" She told me she got a stick of gum for $1 and I said – "How much is a stick of gum worth?" We did the math and determined that, at 7-11, 5 pieces of Trident are $1 so a stick is "worth" .20 in "real" money. I said to Madeline "What made you go crazy and give your sister $1 for something that is only worth .20?" Her answer: "Inflation."

As traders, inflation will make our lives VERY easy. All we have to do is own something, hold it a while, and sell it to someone else. As long as the Fed and Treasury keep printing money and handing it out – we don't have to wait for it to "trickle down" as we're selling our stocks and commodities to the top 1% who, like my daughters, get money simply handed out to them hot off the printing presses. This works even better, of course, when we use options for leverage, as I illustrated with our "5 Trades to Make 5,000% on a Breakout" as well as other bullish set-ups we've been looking at to capitalize on an inflationary market.

Hedging against inflation is ridiculously easy using options. Just last Monday I put up a trade that returns 20,000% on cash if we "just" get to S&P 1,550 which was DB's high-water target until Larry Robbins trumped them today. That trade requires selling 2012 $85 SPY puts to pay for the long position (a bet that the S&P holds 850 for the year is the risk side) but that requires some margin, of course. An adjustment to that trade would be selling AAPL Jan 2013 $175 puts for $8, which pays for 2 SPY Jan 2012 $125/135 bull call spreads at $4.80 for net .80 on the 2 $10 spread so the return there, at S&P 1,350 in January of 2012 is $20 on the $1.60 cash commitment for a nice 1,150% gain.

Now, I would not suggest making this trade unless you REALLY want to own AAPL at $175 (now $326) as you are obligating yourself to do so should it fall but the margin on that trade, even in an ordinary margin account, is just net $1,755 (according to TOS) to collect $800 in cash. That $800 in free cash plus just $160 more out of pocket converts to $2,000 if the S&P hits it's relatively modest goal and you end up with a lovely 100%+ return on margin in just 12 months – even with an ordinary account.

THAT's the way we, in the top 1%, fight inflation! That's the way the government hands out money to those of us in the top 1% because we don't need $1,755 in margin to borrow $800, we can borrow $8,000 for $1,755 in margin so, as long as owning AAPL for $175 doesn't bother us – we can commit to owning 10,000 shares, collect $80,000 and take another $16,000 in cash to buy 200 of the spreads for a cash plus margin commitment of $33,550. If the Fed is successful and the S&P makes it to 1,350 (up 8%) over the next year – then we collect 20,000 x $10 or $200,000 (up 496%) for our troubles.

THAT's the way we, in the top 1%, fight inflation! That's the way the government hands out money to those of us in the top 1% because we don't need $1,755 in margin to borrow $800, we can borrow $8,000 for $1,755 in margin so, as long as owning AAPL for $175 doesn't bother us – we can commit to owning 10,000 shares, collect $80,000 and take another $16,000 in cash to buy 200 of the spreads for a cash plus margin commitment of $33,550. If the Fed is successful and the S&P makes it to 1,350 (up 8%) over the next year – then we collect 20,000 x $10 or $200,000 (up 496%) for our troubles.

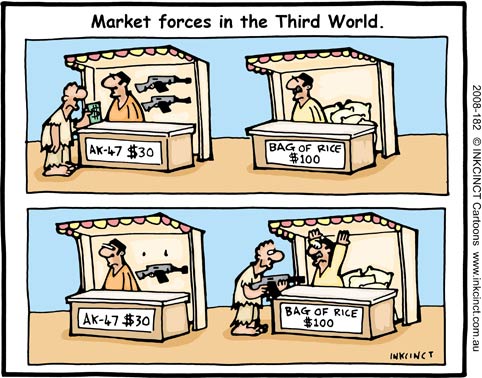

They will tell you it's a zero sum game but that's not so, that $200,000 doesn't come from nowhere – it comes from the inflated cost of every other stock you ordinary investors are forced to buy. It comes from the food you eat and the gas you put into your tank and the pills you buy at the drug store and it comes from your inflated tax dollars as well as from the Debt burden our government places on you and your family and it comes from the retirement fund you put away for 40 years that will barely pay the rent by the time you cash it in.

So thanks for the free money suckers! We're getting ours and I very much suggest you get yours or we'll be buying your gum for $1 too as we give you back .0005% of what we take while the government tells you how nice it is that we're trickling on you.