Bank of America agreed to settle part of its claim with Fannie and Freddie for $2.8 billion. It appears to have gotten off cheap but Market Watch reports For B. of A., mortgage ‘put backs’ aren’t over

Bank of America Corp. unveiled a $2.8 billion deal with Freddie Mac and Fannie Mae on Monday that settles legal spats over losses on hundreds of billions of dollars in home loans that the lender sold to the government-owned mortgage giants.

However, the agreement only deals with part of Bank of America’s exposure to mortgage repurchase, or “put back,” requests, according to analysts.

The bank said it paid Freddie Mac $1.28 billion in cash on Dec. 31 to extinguish “all outstanding and potential mortgage repurchase and make-whole claims” from alleged breaches of representations and warranties on home loans sold by Countrywide Financial to Freddie through 2008. This covers 787,000 loans with a total unpaid principal balance of $127 billion, the bank noted.

Bank of America also said Monday that it agreed to pay Fannie Mae $1.52 billion in cash. But this payment only deals with 12,045 Countrywide loans with about $2.7 billion of unpaid principal balance. It also resolves specific outstanding repurchase or make-whole claims, or extends the cure period for missing documentation-related claims, on another 5,760 Countrywide loans with roughly $1.3 billion of unpaid principal balance, the company noted.

“We have largely addressed the remaining GSE repurchase exposure for legacy Countrywide and the other Bank of America entities,” Bank of America Chief Financial Officer Charles Noski said during a conference call with analysts on Monday.

However, the payments announced Monday don’t eliminate future liability on loans with an unpaid principal balance of $394 billion that Bank of America entities sold to Fannie Mae, according to Chris Gamaitoni and other analysts at Compass Point Research & Trading LLC.

“I’m perplexed by the reaction,” Gamaitoni said in an interview.

Bank of America’s payment to Fannie Mae only resolved claims currently outstanding, he noted.

“To believe this is dealt with, you have to assume that Fannie will suffer no losses on its remaining exposure” to home loans with an unpaid principal balance of $394 billion, Gamaitoni added.

A bigger concern is potential losses from put back requests from private mortgage investors and insurers, according to Gamaitoni and other analysts.

In August, Compass Point estimated that Bank of America may lose $35 billion from put backs by insurers and private investors in mortgage-backed securities.

Deutsche Bank analyst Matt O’Connor reckons Bank of America could take another $15 billion hit from repurchase requests on so-called private label mortgage-backed securities.

Still, losses from private label mortgage put backs aren’t a systemic risk for big banks, according to Bose George, analyst at Keefe, Bruyette & Woods in New York.

With private label securities, the originator must have knowledge of the fraud for the investor suit to have merit. In contrast, sales to Fannie and Freddie have a more absolute standard.

Also, private label securities investors must show that the fraud contributed to their losses — something that’s difficult to do as time passes, George noted.

Raise your hand if you think Fannie will suffer no losses on $394 billion in loans and that Bank of America is not at huge risk from other lawsuits.

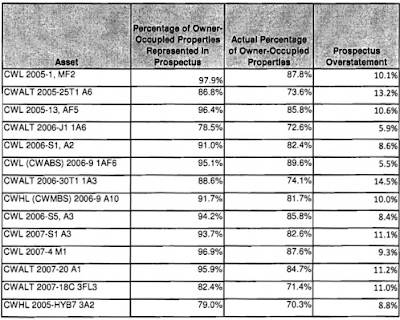

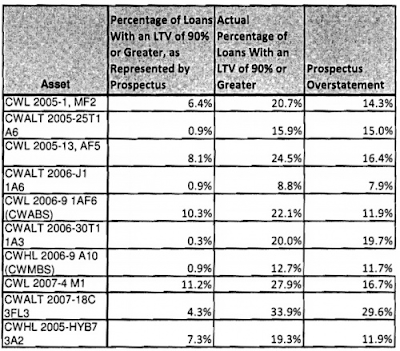

Courtesy of Zero Hedge here is a sampling of what Countrywide alleged in a prospectus and what was actually delivered.

Owner Occupied Fraud

Loan-To-Value Fraud

For more examples and a very good writeup, please see How Allstate Used Sampling To Confirm BofA/Countrywide Lied About Virtually Everything When Selling Mortgages

Clearly, Bank of America (Countrywide Financial) committed fraud, so the idea that investor lawsuits have no merit is preposterous. Moreover, it is a simple matter of common sense that when Bank of America exaggerated various numbers in its pools, that it "contributed to losses".

Nonetheless, private investor cases will not be decided on the merits of easily visible fraud, or on the basis of common sense, but rather on how much BofA can get tossed out of court on various legal technicalities.

Thus, it is difficult to assess the odds as to what extent Bank of America gets away with its fraudulent endeavors.