I still like the Wall Street Journal.

While they often infuriate me with their new editorial policies and slanted news coverage, they still have some of the best reporters and best graphics people out there. I think it's because so many people over there really "get" economic reporting. Most newspapers have reporters who know the economy and then they have graphics people who know how to draw but the WSJ has graphics people who clearly understand the markets and it brings a lot of fine color to the articles – I can only hope Uncle Rupert realizes what he's got there and takes care of the rarely-recognized team. Here's the incredibly useful graphic today that prodded me to mention this:

Isn't that nice? Notice that we still have that WSJ/Top 1% slant on what's good for the economy, but it's a very useful springboard for discussion. I will never forget my meeting at Treasury when I said (and I was joking) to Geithner "So, does the US still have a strong dollar policy" and the Secretary of the Treasury laughed so hard he almost fell off his chair. We are not allowed to quote people directly so I'll just leave Tim's answer at the time (Aug 16th) as "no comment." The Rich (who control this country) do not want a strong dollar – only people who get paychecks in dollars want them to be strong but the people handing them out in exchange for labor are perfectly happy if Treasury Notes are as worthless as toilet paper because they generally run their businesses with debt financing anyway and at no time do they have significant cash assets.

It's very hard for workers to get their head around this concept. In grade school, we all laughed at the silly Indians who traded Manhattan Island for about $24 worth of beads and trinkets but, like US Dollars, they were plentiful and easy to get for the Dutch traders but very difficult to obtain for the Indians as the Bedazzler had still not been invented. Of course the Indians also had no concept of land ownership so the whole contract was a sham, but that's an essay for another day. Getting back to US workers – they exchange their valuable labor for essentially worthless bits of paper that are relatively easy for their employers to obtain – as long as we have a weak dollar, of course.

What else do the top 1% want? They want commodity prices to rise. That may seem counter-intuitive as they should be input costs but, in practice, consumers are charged on a "mark-up" pricing system and companies make a percentage of profits on sales so, if input costs go up, they simply raise prices and rising prices mean rising profits as long as they avoid margin compression – that's why "slightly" rising commodities are preferred as sharp rises can cause dislocations in pricing.

The top 1% don't want GDP to grow too fast (although at their outsourced factories in China, they seem to do quite well with 10% growth) and they don't want Unemployment to come down too quickly – otherwise the workers may get uppity and ask for higher wages! They want inflation but not too much and they want higher borrowing rates which again is based on the fact that they have easy access to money and they don't want the bottom 99% (which includes smaller businesses) playing on a level field. So that sums up very nicely what will make the markets happy in 2011 – the question is – how likely are these things to happen?

We have the November Factory Orders Report at 10 am and we'll see Auto Sales numbers for December throughout the day, which should be strong as TM just raised their forecasts. Tomorrow morning we will get the MBA Mortgage Report, ADP Jobs and ISM Services and Friday we get December's NonFarm Payroll numbers so we'll have some hints there but the real key to sustaining 8.5% unemployment (and thus low wages and benefits) while the economy recovers to 3.5% growth is going to be Productivity, and we don't see the Q4 numbers until Feb 3rd but it's a big one, with the entire "hotness" of the economic recovery riding on its back.

We have the November Factory Orders Report at 10 am and we'll see Auto Sales numbers for December throughout the day, which should be strong as TM just raised their forecasts. Tomorrow morning we will get the MBA Mortgage Report, ADP Jobs and ISM Services and Friday we get December's NonFarm Payroll numbers so we'll have some hints there but the real key to sustaining 8.5% unemployment (and thus low wages and benefits) while the economy recovers to 3.5% growth is going to be Productivity, and we don't see the Q4 numbers until Feb 3rd but it's a big one, with the entire "hotness" of the economic recovery riding on its back.

As you can see from the chart on the left – the trend was not looking like our friend in Q3 as Unit Labor Costs were coming back sharply while gains in productivity that were driving the recovery were trailing off. We don't have to worry about Unemployment falling too quickly as job growth has been anemic and, as I pointed out last week – American companies are hiring 40% more workers overseas than they are in this country and there's no danger to the top 1% that that is going to change soon as all fears of legislation that would encourage the growth of US jobs vanished in the last election.

So the biggest danger to the Goldilocks scenario for the investing class is that pesky dollar, which has been holding up surprisingly well, no matter how many of them Bernanke creates out of thin air. Printing money is supposed to raise commodity prices and that part is working as we've got TREMENDOUS rises in commodity inflation. Forget crude's little 14.1% run in 2010 or heating oil's 19% gains – it's the little things that meant a lot in 2010 like Cotton's 91.5% increase, a 75.4% rise in the price of coffee with corn, lumber, wheat and oats up in the 50% range as well. By comparison, copper and gold are fairly tame in their 30% runs.

So the biggest danger to the Goldilocks scenario for the investing class is that pesky dollar, which has been holding up surprisingly well, no matter how many of them Bernanke creates out of thin air. Printing money is supposed to raise commodity prices and that part is working as we've got TREMENDOUS rises in commodity inflation. Forget crude's little 14.1% run in 2010 or heating oil's 19% gains – it's the little things that meant a lot in 2010 like Cotton's 91.5% increase, a 75.4% rise in the price of coffee with corn, lumber, wheat and oats up in the 50% range as well. By comparison, copper and gold are fairly tame in their 30% runs.

All this, according to our government, translates into a 2.2% rise in consumer prices – the lowest on the planet according to the Ministry of Truth, which price-weights inflation as if you are buying a house and a car every day along with your groceries and gasoline so the $10,000 drop in the value of your home wipes out $833 a month of increases in other things you also might buy this year like food, fuel and clothing.

What is going to happen when home prices head higher (and what is the deal with lumber up 50% with no homes being built?) and we still have this insanity with food and fuel? Will the government then admit that inflation is in double digits or will they then decide to change the measurement to accommodate the new reality?

So – the Dollar. It's "too strong" and is stopping the market from going higher (when priced in dollars). I often point out that we get a very different chart picture on the markets when priced in other currencies and the action of the last 4 sessions really took the proverbial cake when priced in Yen as we dropped like a rock to the 200 50 dma and then bounced right back to the 20 dma in one mighty session yesterday – a very different picture than we got from looking at the dollar-priced charts:

What is reality? Is reality what 300M Americans see or what 3Bn Asians see when they look at the charts? Why is is a surprise that emerging markets are so popular when they look so much safer and stable than the US? Yesterday I went out on a limb in my first post of the year and called the action manipulated as we simply fail to see the fundamental underpinnings that should have led to a 2% reversal on the first day of the year (and see yesterday's post for chart of the same nonsense from last January).

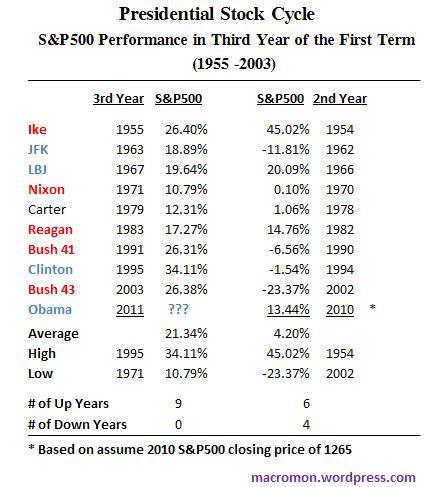

We might be wrong (especially with the very strong historical Presidential 3rd-year performance by the market) but, as we discussed in Member Chat over the weekend, the cost of NOT being cautious enough in a long-term investing virtual portfolio is 35 TIMES more than the cost of being too cautious. We will maintain a cautious short-term stance against our bullish long-term plays until we are satisfied that 2011 is on the right track. Europe needs to be "safe" for the Dollar to remain weak and, of course, our own Government needs to be able to pay its bills past March. Unemployment does need to come down below 9% (and certainly not go higher) and the combination of falling home prices and rising gas prices is not likely to end well either. Barry Ritholtz has his own concerns, saying:

We might be wrong (especially with the very strong historical Presidential 3rd-year performance by the market) but, as we discussed in Member Chat over the weekend, the cost of NOT being cautious enough in a long-term investing virtual portfolio is 35 TIMES more than the cost of being too cautious. We will maintain a cautious short-term stance against our bullish long-term plays until we are satisfied that 2011 is on the right track. Europe needs to be "safe" for the Dollar to remain weak and, of course, our own Government needs to be able to pay its bills past March. Unemployment does need to come down below 9% (and certainly not go higher) and the combination of falling home prices and rising gas prices is not likely to end well either. Barry Ritholtz has his own concerns, saying:

Broad consensus for strong gains always makes me nervous, and that is what we have at present. Sentiment is frothy. Government policies have been key drivers of gains, and everyone now knows that zero percent Fed fund rates are unsustainable. Organic growth is required for a self-sustaining recovery, and there is little of that to be found. Underemployment is a significant headwind, as is the sorry state residential real estate. Banks remain in mediocre financial condition, still under-capitalized and over-leveraged; the bailouts papered over the structural issues, and moral hazard all but guarantees a crisis in the next decade. States and cities are in a financially precarious position, and the GOP may very well force a shut down of government in Q2 when it comes time to raise the debt ceiling.

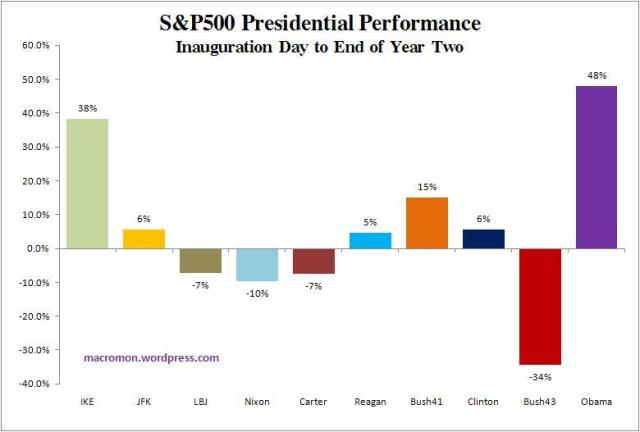

Meanwhile, kudos to the current President, who has pulled off the greatest first two-year market rally in modern history by a pretty wide margin. As Global Macro Monitor says: "If this is Socialism, call me Comrade!"

The dollar is down "just" 10% in the past two years and as long as the assets of the investor class are rising faster than the funny money we pay our workers with – all is well in the World of Capitalism, right? Gold was at $900 when Obama took office and is now $1,400, up 55% and far outpacing the declines in the dollar as well as beating the rise in the markets. Oil has also been a speculator's best friend as a barrel was $48.50 in January of 2009 but was trading at $92 yesterday, up 89% and almost double the pace of equities and, as we know from watching "Real Housewives of Bevery Hills" – if something is more expensive then it's got to be better!

Everything must be better in China because inflation is now in the 7-8% range led by the price of meat and vegetables, which are up over 50% from last year, which is a little uncomfortable for the typical Chinese shoppers, who make $5,000 a year per family and spend half their money on food. In some parts of China, the price of basic foods has doubled and shoppers in the southern city of Shenzhen have even taken to skipping across the border to Hong Kong to buy their daily groceries. On the Chinese internet, the Chinese character "Zhang", which means "inflate", has been picked as the word of the year.

Everything must be better in China because inflation is now in the 7-8% range led by the price of meat and vegetables, which are up over 50% from last year, which is a little uncomfortable for the typical Chinese shoppers, who make $5,000 a year per family and spend half their money on food. In some parts of China, the price of basic foods has doubled and shoppers in the southern city of Shenzhen have even taken to skipping across the border to Hong Kong to buy their daily groceries. On the Chinese internet, the Chinese character "Zhang", which means "inflate", has been picked as the word of the year.

Now, a freezing winter is threatening to further push up food prices and global commodities such as copper have already broken through record levels, a combination that spells further inflation. "If there is a recovery in the West, and global commodity prices continue to rise, that could feed problems in China," said Li Wei, an economist at Standard Chartered, based in Shanghai. "I would not be surprised to see inflation touching 7pc or 8pc in the first half of the year."

Two recent surveys, one by a government think tank and one by the People's Bank of China, have revealed that inflation is already causing deep resentment. According to the 2011 Social Blue Paper from the Chinese Academy of Social Sciences, residents in smaller cities and the countryside are especially dissatisfied with their lives, despite their per-capita income rising 9.7pc after inflation.

A questionnaire given to 20,000 banking customers in 50 cities also detected the same trend, with 74pc of respondents saying that prices in China are now "unbearably high".

So party on America and party on Europe – it's not like anything that happens in China matters, does it?