Courtesy of Mish

Hedge funds, pension plans, and small speculators have all been plowing into commodities with abandon. The result is easy to spot, particularly in the energy markets.

Hedge funds, pension plans, and small speculators have all been plowing into commodities with abandon. The result is easy to spot, particularly in the energy markets.

Bloomberg reports Hedge Funds Raise Crude Bets to Four-Year High

Hedge funds raised bullish bets on crude oil to the highest level in more than four years on speculation that futures will climb as the U.S. recovers from the deepest recession since the 1930s.

The funds and other large speculators increased net-long positions, or wagers on rising prices, by 4.6 percent in the seven days ended Dec. 28, according to the Commodity Futures Trading Commission’s weekly Commitments of Traders report. It was the biggest total in records going back to June 2006.

Oil prices will average $93 a barrel this year and are “very likely” to climb above $100, Jason Schenker, president of Prestige Economics in Austin, Texas, said yesterday in an interview with Deirdre Bolton on Bloomberg Television’s “InsideTrack.”

Futures advanced as high as $92.58 yesterday after the Institute for Supply Management’s U.S. factory index climbed to 57 in December, the fastest pace in seven months. Fuel demand increased to the highest since May 2008 in the week ended Dec. 24, Energy Department figures showed last week.

“Crude oil prices are up, and people expect them to keep going up,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. “It speaks to the frame of mind that people are in more than it speaks to the underlying reality. We have no physical tightness here.”

CFTC’s position limit plan gains needed support

Please consider CFTC’s position limit plan gains needed support

A top official at the U.S. futures regulator said on Tuesday he was now in favor of a stalled position limit plan, a key turnaround that would allow the controversial rules to advance to the public comment stage.

The Commodity Futures Trading Commission introduced on December 16 its long-awaited plan to curb speculation in the metals, agriculture and energy markets but at the meeting, Chairman Gary Gensler abruptly postponed a vote on the proposal.

Commissioner Bart Chilton, the most vocal proponent of cracking down on speculators, was key to the postponement as he told Reuters he would have voted against the plan. It would have included a two-step approach to allow more time for the agency to gather information on the opaque swaps market.

“While I will now support publishing a position limit proposal for public comment, I will continue to make the case that we need to address excessive speculation in these markets immediately,” Chilton said in a statement on Tuesday.

A coalition of businesses dependent on buying commodities which has pushed for the limits said it supports Chilton’s plan as an interim measure.

“In light of the existence of large speculative positions in today’s energy and agricultural markets, it is imperative that the Commission to do something now, and without delay, in order to address these large positions and send a message of confidence and certainty to market participants,” said Jim Collura, spokesman for the Commodity Market Oversight Coalition.

U.S. Commodity Regulator to Review Speculation Limits

Let’s flash back to December 16 and a recap of U.S. Commodity Regulator to Review Speculation Limits

The top U.S. commodities regulator will consider today steps to curb speculation in raw materials including oil, gold and wheat as part of the most sweeping rewrite of Wall Street rules since the 1930s.

Four of five members of the Commodity Futures Trading Commission said they will vote in favor of publishing a two-part proposal to restrict the number of contracts one firm can hold. The plan, if approved after a 60-day public comment period, would limit traders to 25 percent of deliverable supply in the contract nearest to expiration, followed by an all-month ceiling of 10 percent of open interest up to the first 25,000 contracts and 2.5 percent thereafter.

“At the core of our obligation is to protect market integrity,” Gensler said at the hearing today. The rule will shield the markets from excessive speculation by ensuring positions aren’t too concentrated, he said.

Gensler, along with Commissioners Bart Chilton, Scott O’Malia and Michael Dunn said they will vote today in favor of publishing the rule for comment. Dunn and O’Malia said they may not ultimately support imposing position limits. Commissioner Jill Sommers said she would vote against the rule.

“It’s bad policy to promulgate regulations that are not enforceable,” Sommers said, adding that the commission lacks the data needed to enforce effective caps.

“Without specific swaps data, we have no ability to claim we are applying enforceable limits without understanding the full size of the market,” O’Malia said in a statement.

The plan exempts so-called bona fide hedgers who use contracts to offset commercial risk. Swaps dealers, who sell derivatives, are free from limits as long as the transaction is made on behalf of an end-user, while facing caps for trades made to mitigate bets dealt to speculators.

The proposal covers 28 commodities, including crude, natural gas, gasoline, heating oil, gold, silver, copper, platinum, palladium, corn, oats, rice, soybeans, soybean meal, soybean oil, wheat, feeder cattle, live cattle, lean hogs, milk, cocoa, coffee, orange juice, sugar and cotton.

The commission estimated that the spot-month rules would affect 70 traders in agricultural contracts, six in base metals, eight in precious metals and 40 in energy. The combined caps may affect 80 agriculture traders, 25 in base metals, 20 in precious metals and 10 in energy.

Nearly Everyone Is Happy (For Now)

"Super Silver Bulls" want limits thinking it will force prices up and crush JPMorgan. Meanwhile, buyers of energy and agricultural goods think limits will reduce prices. For a while, this means bulls, bears, and buyers are all happy.

The only ones not happy with limits are the few commissioners who think limits will not work. I side with those who think limits will not work. I have both short and long-term reasons.

Short-term, position limits will likely reduce liquidity and further distort the markets.

The most likely long-term impact is that trading will move to less regulated foreign exchanges. If so, US commodity exchanges will lose their global importance.

Long-term, commodity prices are going to go where they are going to go anyway. Attempts to curb speculation brought on by loose policies of the Fed cannot work in the long run.

The Impact on JPMorgan

Short-term prices might depend on exactly what the limits are, who is affected, and how the CFTC implements the rules changes.

Here is one key paragraph: "The plan exempts so-called bona fide hedgers who use contracts to offset commercial risk. Swaps dealers, who sell derivatives, are free from limits as long as the transaction is made on behalf of an end-user, while facing caps for trades made to mitigate bets dealt to speculators."

I fail to see how that will necessarily curb JPMorgan’s massive short position. (I am assuming JPMorgan is hedged). However, let’s assume JPMorgan is not hedged.

How will the CFTC phase in the rules? If they do so by limiting the buying of silver futures until position limits are reached (the method used to end the Hunt cornering attempt) , then silver will likely get hammered short-term.

Thus, I do not agree with zero-hedge who writes "And if indeed this news was the catalyst for today’s precious metal and other commodities sell off, it is woefully misinterpreted, as the only major institutional parties impacted will be those who hold outsized short positions in the precious metals space."

It’s not that Zero-Hedge is necessarily wrong; it’s just that he is not necessarily right.

However, if I had to bet one way or another, I would bet that whatever method the CFTC comes up with will not adversely impact JPMorgan in any significant way.

Thus, if anyone is impacted in the short-term, I suspect it will be silver longs, even though long-term the price of silver will get to wherever it is headed.

My friend "HB" agrees. He just pinged me with this comment. "The GATA crowd should be livid when it realizes that position limits may – gasp – depress the silver price."

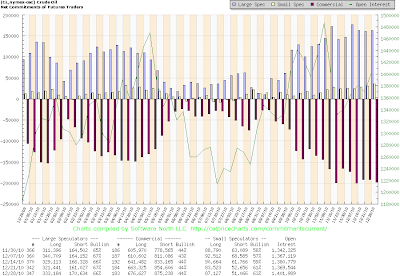

Crude COTs

click on any chart below for sharper image

Crude Weekly Chart

Commodity charts and open interest are not always as correlated as show above.

By the way, much of that crude open interest is hedging various crack spreads (crude vs. gasoline, heating oil, diesel, etc).

Crack spread is a term used in the oil industry and futures trading for the differential between the price of crude oil and petroleum products extracted from it – that is, the profit margin that an oil refinery can expect to make by "cracking" crude oil (breaking its long-chain hydrocarbons into useful shorter-chain petroleum products).

In the futures markets, the "crack spread" is a specific spread trade involving simultaneously buying and selling contracts in crude oil and one or more derivative products, typically gasoline and heating oil. Oil refineries may trade a crack spread to hedge the price risk of their operations, while speculators attempt to profit from a change in the oil/gasoline price differential.

Is the CFTC ready to sort this all out?

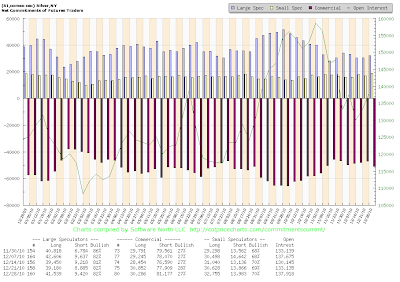

Silver COTs

It is had to predict anything at all regarding the price of silver from the following COT chart.

Silver Weekly Chart

Finally, it is worth pointing out that commodities in general simply might be ready for a strong pullback. Sentiment is extreme. It happens, attributing precious metal declines to a smackdown by gold and silver shorts is beyond silly.