Russell 8-0-0, Russell 8-0-0! Wherefore art thou Russell8-0-0? Deny thy dollar and refuse to fall, or, if thou spike not, be but consolidating at resistance and I’ll happily Capitulate….

If it's good enough for fair Juliet, it's going to have to be good enough for us as the Russell finally makes it over our 800 target – the last barrier that was keeping us on the bearish side. Above these lines – it's time to stop worrying and love the rally as we romanticize the deadly combination of QE2 the Obama tax cuts as: "A pair of star-crossed lovers take their life, whose misadventured piteous overthrows doth with their death bury their parents’ strife."

Of course Willie Shakespeare has nothing on Jimmy Cramer, who's pearls of wisdom are also sure to be repeated centuries from now. Last night the Bard of Wall Street sang a veritable sonnet in praise of the stock market and foretold a tale of woe for anyone dumb enough to take profits into this rally:

We got the correction this morning, Dow fell 35 points… Today's action was proof positive that you need to stop worrying and learn to love corrections… What scares me, and what should scare you, is that if you sell your stocks here, you won't be able to get back in. You should be worried about stocks getting away from you, because I think we can be on the verge of something big – something very positive. FORGET the fact that stocks have run up a lot in the last 6 months. For more than 10 years, this market has done nothing, THAT is the most important frame of reference…

What's changed? We are finally starting to see big breakouts from a slew of breakouts from several large cap companies including: CAT, UTX, FCX, SWK, CBE, ETN, CSX, UNP and so many other big industrials. Ladies and gentlemen, we have waited over a decade for this move and what do people want to do now that it has arrived? They want to sell! That's right, they want to sell. That's right. They want to dump the stocks (sell button sound effect) because they are up way too much short-term or because they think the moves are illusory or driven by short squeezes that will come to and end as soon as we run out of battered short sellers (machine gun sound effects).

In fact, to me it seems like the conventional wisdom among the "punditocracy" (note that anything with "ocracy" attached to it is now evil) is that, other than a few exceptions like maybe QCOM or NFLX, AAPL, AMZN, you shouldn't even bother with most stocks because they can't go up from here until they decline first and "consolidate" (sound effect "the house of pain").

Note the old-time revival feeling as Cramer preaches to the retail investors. You almost want to jump out of your seat and yell "Hellelujah – I see the light and it is carried on fiber-optic cables from GLW with CSCO routers!" But Cramer isn't telling you to buy sensible companies like GLW ($18.98, forward p/e 10, way more cash than debt) or CSCO ($20.77, forward p/e 11, another great balance sheet) that we like to focus on, even in a runaway market. Cramer is selling the snake oil, he is selling the hair tonic and he is selling the religion of "Buy High and Sell Higher," which makes him one of the most dangerous men in America.

Cramer does make the bull case well and yes, we also believe global growth will heal all wounds but we have also learned that market values, like Shakespeare's fairies, are ethereal things that can be there one moment and disappear the next. Cramer chides our caution about "whatever the negative story de jour happens to be" and tells us (and I am not making this up it's at 4:20) "maybe we can't see the positive forest through the data trees." Whuck? Never since Dorothy was told to "pay no attention to that man behind the curtain" has more BS advice been given to rural America.

Cramer does make the bull case well and yes, we also believe global growth will heal all wounds but we have also learned that market values, like Shakespeare's fairies, are ethereal things that can be there one moment and disappear the next. Cramer chides our caution about "whatever the negative story de jour happens to be" and tells us (and I am not making this up it's at 4:20) "maybe we can't see the positive forest through the data trees." Whuck? Never since Dorothy was told to "pay no attention to that man behind the curtain" has more BS advice been given to rural America.

Wait, I'm sorry, I forgot the other time such bad advice was given to the American people. It was, in fact, just 2 years ago when CNBC in general and Jim Cramer in very particular used the same line of BS reasoning to stampede the poor, innocent sheeple in for the slaughter, right at the top of the market. As Jon Stewart famously pointed out: "If I had only followed CNBC's advice I would have a Million Dollars today — providing I had started with $100 Million Dollars."

Really, take 10 minutes and watch the above two videos – it's the same nonsense we're hearing today: "Ignore the naysayers, don't ignore the momentum, be afraid to miss out, ignore pockets of bad news, things are great in China…." CNBC, like much of the Mainstream Media is there to get you to BUY things. They want you to spend money and buy stocks from their advertisers – what do you expect them to say? Jon Stewart gave Jim Cramer an entire show to make his case so I will let them retort and you can decide but this is the reason I often say – Be careful out there.

This is not about being bearish, this is about being careful. We were not careful enough in the crash, listening to the advice of Cramer and his fellow cartoon characters, who tell us to "Just Buy the F'ing Dips You F'ing Idiot" – because the key to pushing a sucker into a con is through greed and fear and that's a tune Cramer plays like a maestro, telling you there is a shining city on the hill while at the same time telling you that the last bus to get there is leaving the station and you'd better pay up to get on it.

This is not about being bearish, this is about being careful. We were not careful enough in the crash, listening to the advice of Cramer and his fellow cartoon characters, who tell us to "Just Buy the F'ing Dips You F'ing Idiot" – because the key to pushing a sucker into a con is through greed and fear and that's a tune Cramer plays like a maestro, telling you there is a shining city on the hill while at the same time telling you that the last bus to get there is leaving the station and you'd better pay up to get on it.

This kind of advice doesn't even make sense. If we're having the kind of rally where NFLX ($179.73, p/e 46, net tangible assets of $199M, market cap $10Bn) or AMZN ($187.42, p/e 53, NTA $4Bn, market cap $84Bn) are "cheap" then we are not missing any kind of bus by cashing in our profits here. Yesterday I warned Members to do just that on plays from ourOctober 23rd Dividend plays and our Dec 11th Breakout Defense plays (but not our longer-term Dec 25th Secret Santa's Inflation Hedges) that are up ahead of schedule if we now fail ANY of our Breakout II levels (see Stock World Weekly for summary of levels).

I know this makes me seem like a big stick in the mud but I am forced to be the voice of reason when the markets become unreasonable – even though voicing concerns during a rally costs me "ratings." I have said this before, people love the cheerleaders, they want affirmation of their buying decisions, they want to feel good about their investments so they gravitate towards those who tell them what they want to hear. It's human nature – and CNBC et al play off it to get ratings. They don't care if the advice is good or bad – it makes the sponsors happy and it makes the viewers happy and, as 2008-9 has proven – there is no downside – no one except me seems to remember what a tragedy their last round of pom-pom waving caused.

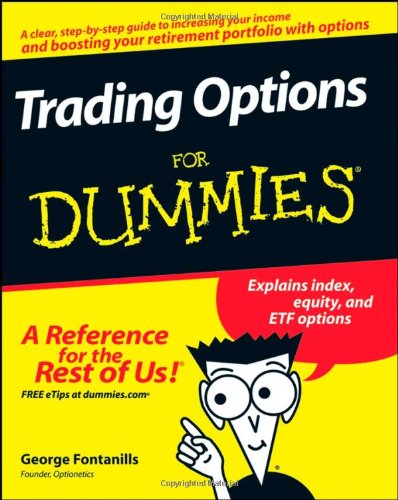

Above 11,500 on the Dow and 1,220 on the S&P we had our Breakout Defense plays and even on the Friday before (Dec 3rd) that, I had put up a couple of high-leverage upside plays to make sure no one would miss out on the Santa Claus Rally. The first one was an FAS Apr $20/25 bull call spread at $2.70, selling the April $21 puts for $2.55 for net .15 on the $5 spread. XLF is, of course, my play of the year(see Secret Santa post) and FAS is a derivative of that one and has since shot up to $30, putting the Apr $20/25 spread at $3.90 and dropping the $21 puts to .85 for net $3.05, up 2,033% on net cash committed in a month.

Above 11,500 on the Dow and 1,220 on the S&P we had our Breakout Defense plays and even on the Friday before (Dec 3rd) that, I had put up a couple of high-leverage upside plays to make sure no one would miss out on the Santa Claus Rally. The first one was an FAS Apr $20/25 bull call spread at $2.70, selling the April $21 puts for $2.55 for net .15 on the $5 spread. XLF is, of course, my play of the year(see Secret Santa post) and FAS is a derivative of that one and has since shot up to $30, putting the Apr $20/25 spread at $3.90 and dropping the $21 puts to .85 for net $3.05, up 2,033% on net cash committed in a month.

Perhaps you can see why we don't fear a bull market – as long as we PRESERVE our cash – a monkey with a dartboard, even Cramer, can pick winners in an inflation-driven upside market. Our other play was bullish on oil and commodities (I'll bet you can already guess how that went!) using DBC with a longer play. There were two plays there. One was very simply buying the Apr $27 calls for $1. No margin is required and we were quite sure that inflation was taking commodities higher so we liked the rare (for us) naked position. Those calls are already $1.55, up a nice 55% in their first month but that's the kind of play we kill if they fall back to 45%, despite Cramer's "advice" to HOLDHOLDHOLD.

The other trade idea for DBC was the Jan 2012 $26/30 bull call spread at $1.40, selling the 2012 Jan $22 puts for $1.10 for net .30 on the $4 spread. The $26/30 spread is just $1.60 but the $22 puts have fallen to .75 so a not so bad net gain on cash of 283% out of a potential 1,233% max gain so a bit ahead of schedule in our first month. This is an example of a play we're more likely to let ride as we can ride out a correction buy why on earth would we let the 2,033% gain get away from us or the 55% gain on the straight call that has no hedges?

We're not afraid of a rally – we simply aren't convinced enough that the forces that are driving stocks higher have the fundamental underpinnings to be sustained and we are almost POSITIVE that the market will in no way be able to stand up to any serious bad news (sovereign default, municipal default, bank default, terrorism) – none of which even Cramer can pretend are really off the table. So we will continue to take our money and run and, frankly, this week we've been "Selling the F'ing Pops" as the Cramericans throw their cash into overpriced stocks that we think have an excellent chance of giving us big money on downside moves where we also will be taking the money and running.

We're not bullish or bearish – we're rangeish and, until proven otherwise (Russell 800 would be a start), we will continue to play this as the top of our range.