Courtesy of Mish

Inflation is officially running in China at 5%. Unofficially, estimates are 10% or more. Is it just a matter of time before these costs get passed through?

Inflation is officially running in China at 5%. Unofficially, estimates are 10% or more. Is it just a matter of time before these costs get passed through?

The New York Times article Rising Chinese Inflation to Show Up in U.S. Imports suggests just that.

When garment buyers from New York show up next month at China’s annual trade shows to bargain over next autumn’s fashions, many will face sticker shock.

“They’re going to go home with 35 percent less product than for the same dollars as last year,” particularly for fur coats and cotton sportswear, said Bennett Model, chief executive of Cassin, a Manhattan-based line of designer clothing. “The consumer will definitely see the price rise.”

While American importers of Chinese goods will feel the squeeze, the effect on American consumers may be more subtle and the overall impact on United States inflation may be minimal.

There are simply too many other markups along the way — from transportation to salesclerks’ wages — that affect the American retail prices of Chinese-made products. Excluding those markups, imports from China are equal to little more than 2 percent of the overall American economy.

The bigger consumer impact is in China itself. As China’s booming economy enables more of its own citizens to buy the goods pouring out of its factories, Chinese consumers are feeling inflation directly. And Beijing is increasingly worried about the social unrest that could result.

In China, consumer prices were 5.1 percent higher in November than a year earlier, according to official government data. And many economists say the official figures actually understate the rate of inflation, which might in reality be twice as high.

Hu Xingdou, an economist at the Beijing Institute of Technology, said that a more accurate gauge of inflation would show consumer prices rising 10 percent a year. The National Bureau of Statistics has said it is actively studying ways to improve the consumer price index.

Inflation in China is not just the result of China’s currency market intervention, although Mr. Hu and other economists describe it as the biggest single cause. Another cause is aggressive lending by Chinese banks, despite repeated demands by regulators to slow things down.

And globally, strong demand from consumers in China and other emerging economies is pushing up not only gasoline prices, but also the prices of cashmere, rabbit fur, cotton, copper and many other commodities.

After showing little change for nearly two years, import prices for goods arriving from China at American docks rose from September to November at a rate equivalent to an annual rise of 3.6 percent.

In another indicator that the Chinese central bank released Tuesday, China’s foreign reserves leaped by $199 billion in the fourth quarter. The increase was much larger than economists had expected, and they suggested that China had roughly doubled its intervention in currency markets to around $2 billion a day.

Where’s The Pass Through?

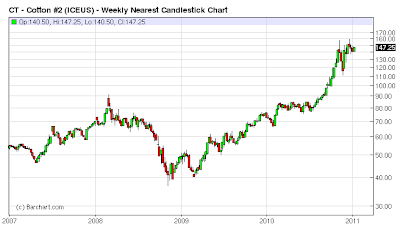

A couple months ago I had a cotton buyer tell me that prices of garments in the US would soar in 2011 because cotton prices are up 35 percent. Actually, cotton futures are up 100% in a year as the following chart shows.

Cotton Weekly Chart

This year, futures (raw cotton) prices are up 100%, and the buyer’s price of cotton is up 35%.

From September to November, the price of goods from China in general rose at an annual rate of at a rate of 3.6 percent. How much of that price will made it to the stores? More importantly, how much of the commodity price pressures will make it to the stores in 2011?

Clearly it’s a guess, but let’s take a look at soaring food prices, something less elastic than apparel prices.

Soybean Weekly Chart

Soybeans did not exceed the 2008 high but are up substantially since early 2010. The same holds true for corn.

Corn Weekly Chart

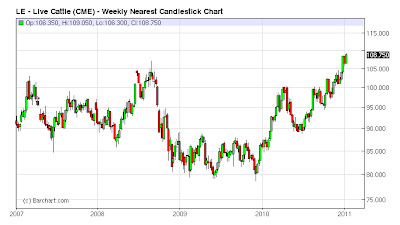

Live Cattle Weekly Chart

Live cattle prices have taken out the 2008 high and lean hog futures matched the the 2008 highs. Both futures are up substantially on the year. Yet I have seen virtually no passthrough on meat prices at the stores.

In fact, I have not seen any hike in meat prices for at least 5 years and I do 90% of our grocery shopping.

Bear in mind I only buy what is on sale so I am comparing typical sales prices to typical sales prices. For example, I do not buy pork chops when they are $4.59 lb. Instead I buy center cut chops when they are $2.29 lb or less. Sometimes they drop as low as $17.9 lb.

Food Is A Bargain

I worked at a grocery store in high school and college. The best price of whole chickens on sale was 21 cents a pound. Farmers were buying them. One farmer came in and bought the limit telling me he could not raise chickens for 21 cents a pound. That was 1970.

41 years later you can routinely get chickens on sale for 59 cents a pound and sometimes even 49 cents a pound. Let’s use the former. That’s about 2.55% annualized. Had I started with the typical sales price of 25 cents a pound instead of the lowest price I remember, the annualized rate of inflation would be 2.12%. Someone holding out for 49 cents a pound would see an annualized rate of inflation at 1.65%.

Meanwhile, college tuition rose from $240 a semester when I started school at the the University of Illinois to about $9,000 semester today, roughly 10.91% a year.

Gasoline prices are up about 7.5% per year in the same timeframe.

What do people complain about? Food and gasoline because they see food and gasoline prices everyday. From my perspective, food is a bargain and gasoline simply reflects peak oil and rising demand from emerging markets.

College costs are absolutely insane.

Margin Squeeze at ConAgra

The Wall Street Journal reports ConAgra Profit Falls 16%, Pressured by Rising Costs

ConAgra Foods Inc. is raising prices in response to higher commodity costs and adjusting merchandising strategies to accommodate consumers who no longer stock up during grocery trips.

ConAgra, which Tuesday reported a 16% decline in fiscal second-quarter earnings, hopes the strategies can help boost profit in the back half of its fiscal year. ConAgra, which makes Healthy Choice meals, Slim Jim meat snacks and Reddi-wip, has recently raised prices on cooking oils and snacks, and plans to do the same on other products. It’s part of an industrywide trend, as food makers like Kellogg Co. and General Mills Inc. are all raising prices to offset higher costs for wheat, proteins and other ingredients.

ConAgra’s plan to raise prices echoes that of Kellogg and General Mills. The manufacturers hope that pressure from higher commodity costs will spell an end to aggressive promotions across the industry and force companies to raise retail prices.

The challenge will be whether consumers, who have grown accustomed to getting deals at supermarkets, will take to the higher prices.

At ConAgra’s consumer-foods unit, its largest, volume rose 1%, but consumer response to promotions was weaker-than-expected and earnings declined 14% in the segment.

At its commercial-foods segment—which includes frozen-potato products, flour and seasonings—revenue improved 3% but profit fell 16% on higher costs of processing and selling last year’s more expensive potato crop.

ConAgra’s revenue was up 3% but profit down 16%. Clearly ConAgra has not been unable to pass on costs. It attempts to do so now, but will buyers of "Healthy Choice" balk?

I bet they do. I scoff at price-hike tactics when according to ConAgra the "consumer response to promotions was weaker-than-expected". Will Healthy Choice and Slim Jim look better at higher prices or will consumers decide to eat healthy and cook dinner themselves?

Cereal Wars

In a slightly more dated article from November, MarketWatch reports Kellogg profit hurt by cereal-price war

Kellogg Co., hammered by price wars in the cereal aisles of U.S. food retailers, reported Tuesday a third-quarter profit that fell 6%.

U.S. cereal makers have been locked in a price war since summer, and the battle has hurt Kellogg (K) more than rival General Mills Inc. (GIS), which makes Cheerios and Wheaties. For the three months ended Oct. 2, Kellogg said retail cereal sales in North America skidded 6% — on top of a 13% drop in the quarter ended July 3.

A&P Goes Under

A&P, America’s first national supermarket chain had 16,000 stores in 1930. It has 395 stores today. It may not have any in a few years. It simply could not keep up with price pressures from Kroger and Walmart.

Please consider A&P in Bankruptcy Filing.

A&P, the troubled grocer, filed for Chapter 11 bankruptcy protection Sunday, weighed down by a crushing debt load and competition from low-price rivals.

A person familiar with the situation said A&P’s inability to negotiate concessions from its main supplier, C&S Wholesale Grocers Inc., contributed to the chain’s decision to seek bankruptcy protection.

Supermarket magnate Ron Burkle infused A&P with $115 million last year in exchange for a 27.6% ownership stake and two board seats in addition to one he already had.

But that wasn’t enough to save the grocer, which has been squeezed by rivals chains like Stop & Shop and Shoprite as well as Wal-Mart Stores Inc. as consumers looked for deals amid the recession.

Grocers that solidified reputations as low-priced alternatives have seen sales grow recently, while those like A&P that have kept prices higher suffered declines.

Supply vs. Demand Economics

For years I have had people telling me that commodity prices will cause consumer prices to skyrocket. Yet, the only place where I have seen consumer prices rise significantly is at the pump.

A&P raised prices and went bankrupt in the process.

Apparel sales were extremely brisk at Christmas. Will they be as brisk 35% higher? 10% higher?

While apparel prices may rise a few percent, margins will likely suffer far more if consumers balk as I expect them to do, or if stores think they have more pricing power than they do and hike prices too fast.

Regardless of what happens to raw commodity prices, prices of finished goods and services will only rise if there is consumer demand at those prices. Inflationists never seem to remember this simple economic fact of life.

China Overheats

Meanwhile China is clearly overheating and that was theme number five of Ten Economic and Investment Themes for 2011

5. China Overheats, Multiple Rate Hikes Coming

China, everyone’s favorite promised land, has a hard landing. China will grow at perhaps 5-6% but that is nowhere near as much as China wants, or the world expects. Tightening in China will crack its property bubble and more importantly pressure commodities. The longer China holds off in tightening, the harder the landing.

China’s Foreign Exchange Reserves Jump by Record $199 Billion

The Financial Times reports China’s forex reserves show record leap

China’s foreign exchange reserves jumped by a record $199bn in the last quarter of 2010, taking the total to $2,850bn and underlining the continuing imbalances in the global economy.

Already the largest in the world, China’s reserves increased by 18.7 per cent over the course of 2010, including an increase of $194bn in the third quarter.

Although China’s monthly trade surplus dropped in December, the continued strong increases in its foreign exchange reserves will bolster the case of critics who are calling for a more rapid appreciation of the renminbi.

The continued increase in reserves is also complicating the management of monetary policy at a time when strong bank lending and a rising money supply are already adding to inflationary pressures in the economy.

Total new Rmb-denominated bank lending in 2010 hit Rmb7,950bn, overshooting the Rmb7,500bn target Beijing set at the start of the year, according to central bank figures released on Tuesday.

The central bank intervenes in the market by buying foreign exchange with Rmb in order to hold down the value of its currency and the foreign exchange that it buys ends up in its reserves.

It then has to sterilise much of the newly-issued Rmb by selling special bills to banks and requiring banks to hold more of their deposits on reserve with the central bank in order to manage liquidity in the Chinese economy.

Chinese Lending Greater Than Reported

Credit expansion in China is massive, yet under-reported as noted in the Financial Times article China’s monetary tightening will be felt around the globe

In December, Fitch came out with a report that suggested credit flows in China are as high this year as last — they are just less visible. “Lending has not moderated, it has merely found other channels,” the Fitch report states. Fitch said banks were evading stricter lending quotas by securitising loans, selling them to trust companies and then going out and booking more loans.

As I have been saying for years, those looking for inflation (credit expansion) or price inflation (a typical symptom) can find it in China.

For more on China please see

- Hunting Elephants With Pea Shooters; China Allows Yuan Denominated Accounts in US Banks

- China Hikes Rates, Ponders Capital Controls to Halt Currency Inflows; Eight Reasons China Faces Hard Landing

Strangely, nearly everyone insists inflation is roaring in the US instead of where it is roaring, China and India. The alleged proof of US inflation is a series of widely circulated charts of various commodity prices even though there has been little-to-no passthrough on any consumer prices except gasoline, and home prices are once again falling like a rock.