Courtesy of CULLEN ROCHE of The Pragmatic Capitalist

Another earnings season is right around the bend and it’s shaping up to be very similar to the last 6 that we’ve seen. In short, cost cuts have created very lean balance sheets and corporations are leveraging up these lean balance sheets to generate respectable and “better than expected” bottom line growth. The result is an environment that continues to be unappreciated by the majority of investors.

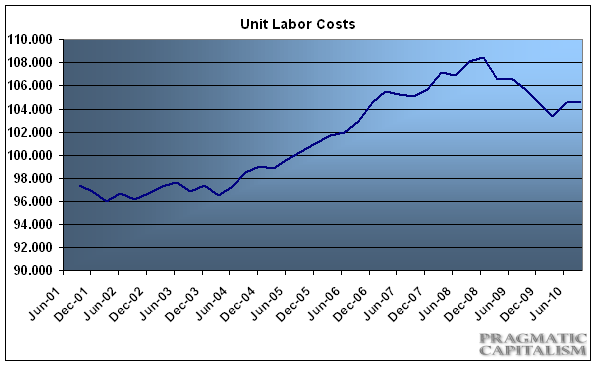

The largest single cost input for most corporations is labor. During this recession we’ve experienced a near unprecedented decline in unit labor costs. As I mentioned yesterday, this massive cost cut is causing extraordinary pain on Main Street, but is actually helping to generate healthy margins for Wall Street. Although the cost cutting appears to have troughed in the last few quarters labor costs remain very low by historical standards. Rising input costs have started to put pressure on balance sheets, however, on the whole we should see fairly stable margins as long as unit labor costs remain low.

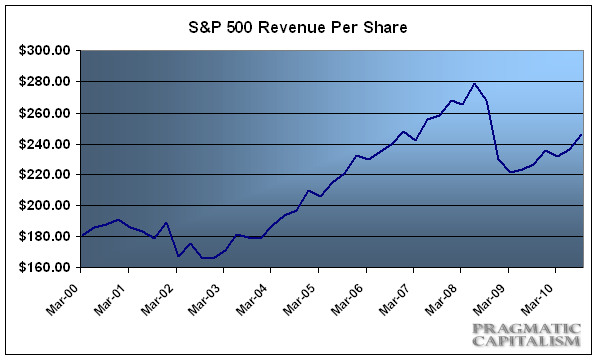

Revenues have been unspectacular in recent quarters, but low single digit domestic growth combined with double digit growth from Asia is helping to drive S&P 500 revenues per share in the right direction. So, we’re seeing continued cost cuts and relatively good revenue growth.

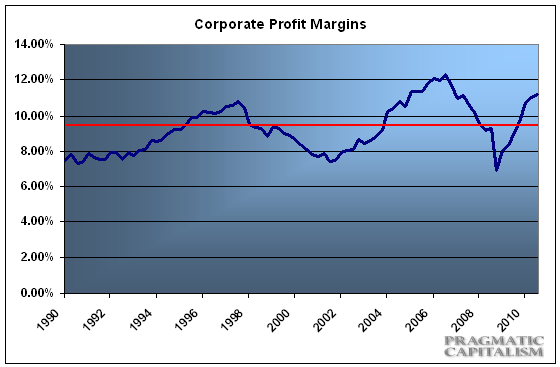

What does that mean? It means nice fat margin expansion. Although margins are still off their all-time highs they are fast approaching those levels. I would expect to see some stagnation in margins in the coming quarters as revenues continue to tick higher and costs continue to move north, however, with margins at record highs we can expect to see continued profit expansion.

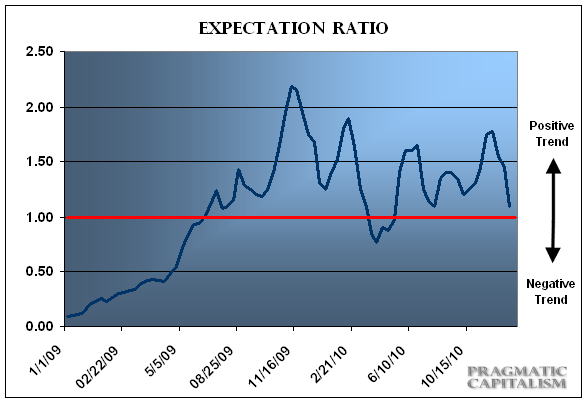

What does it all add up to? It likely means we’re in for another quarter of “better than expected” earnings. The deeply negative sentiment and solid bottom line growth has created an investment environment that is ripe for outperformance. This is best reflected in my Expectation Ratio which has now forecast very strong earnings trends since Q2 2009. Based on the recent reading of 1.45 we can be quite confident that the state of corporate America remains quite strong.