It's starting!

The last of the bears are now capitulating. We're hearing it in Member Chat and we're reading it in analyst reports and we're seeing the fund managers on TV – it is very out vogue to be a bear.

Just a few weeks ago, I pointed out to Members how few bears remained by saying "Look to your left, look to your right, look in front of you and look behind you – you would be the only bear." That was way back when "only" 20% of investors were bearish – as of yesterday, we lost 1/3 of those poor creatures and now only 13% of the market is bearish. Now you can look diagonally as well and you'll STILL be the only bear!

Certainly the market seems to be proving the primary axiom of "You can't fight the Fed." Pretty much no matter what happens, the market goes up. Bryan Leighton from Traddr! Makes a good point saying: "It's a neutral to positive market and the only thing that can change that is some sort of surprise event out of Europe or out of Asia or something major out of the US that the Fed is not ready for or prepared for. If they are prepared for it – it will not happen – it will not have a major effect on the markets."

That's the reality we're dealing with out there. As long as the Fed and their pet IBanks are running the markets and as long as volume is at 3-year lows, allowing the TradeBots to control each move – then it is wrong to be a bear. But, is it 87% wrong? 87% bullish sentiment isn't just "very" bullish – it's a new, historic high. It's like going to a fight where the entire crowd only cheers for one guy which, like professional wrestling, would be an automatic indication that the game must be fake, Fake, FAKE!

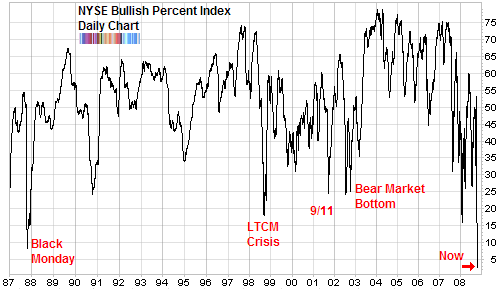

As you can see from this longer-term chart, we are as extremely bullish now as we were extremely bearish in the two worst market events of the past quarter-century. Much the way that Black Monday of 1987 and the Crashes of 2008/9 were unique buying opportunities at 15% bullish, this may be a unique shorting opportunity at 15% bearish that you are not likely to see again for decades.

As you can see from this longer-term chart, we are as extremely bullish now as we were extremely bearish in the two worst market events of the past quarter-century. Much the way that Black Monday of 1987 and the Crashes of 2008/9 were unique buying opportunities at 15% bullish, this may be a unique shorting opportunity at 15% bearish that you are not likely to see again for decades.

As an optimist, it was easy for me to say buy when I was one of the 15% still bullish in March of 2009 – don't expect the same conviction from me about selling in January of 2011. We are generally bullish. We are long-term bullish. BUT – and it's a Big But (not to mention blasphemy) – I don't think The Bernank is either all powerful or infallible and I do believe that "some sort of surprise event out of Europe or out of Asia or something major out of the US" could happen at any moment so, as I said yesterday – we remain short-term cautious between now and April, even as the rest of the market marches towards 99% bullish around us.

This does not stop us from making some bullish plays – in fact Scott of Sabrient just reviewed the 4 Dark Horse Trader's Hedge plays we've been tracking in a virtual portfolio since the fall and the only problem we've been having is they are TOO successful as the stocks have been outpacing our expectations and we have to let go of both VECO (with a 36% profit in 5 months) and WRLD (with a 25% profit in 3 months) because the stocks performed so well that they're not worth adjusting our hedges anymore. That's why we like our bullish to neutral Buy/Write Strategy, we can't be harmed to the upside, only forced to take our profits off the table and find anther partner to dance with – which isn't a bad forced discipline on stocks that are running ahead of 100% annual gains.

Could we make more money by just "going for it" and being 100% bullish? Sure we could and once inflation takes hold and begins to snowball the markets higher, that is exactly what we're going to do but, as I have pointed out before – missing the first 100% move up in the Zimbabwe Stock Exchange wasn't a big deal as it was followed by moves of 1,000%, 1,000,000%, 1,000,000,000% and 1,000,000,000,000% before the markets finally calmed down. On the other hand, people who participated in Brazil's 100% run in 8 months that began in October of 2007, found themselves right back where they started just 4 months later.

Could we make more money by just "going for it" and being 100% bullish? Sure we could and once inflation takes hold and begins to snowball the markets higher, that is exactly what we're going to do but, as I have pointed out before – missing the first 100% move up in the Zimbabwe Stock Exchange wasn't a big deal as it was followed by moves of 1,000%, 1,000,000%, 1,000,000,000% and 1,000,000,000,000% before the markets finally calmed down. On the other hand, people who participated in Brazil's 100% run in 8 months that began in October of 2007, found themselves right back where they started just 4 months later.

We participated 100% bullishly since our June 26th Buy List, which was followed by July 7th's "9 Fabulous Dow Plays Plus a Chip Shot," July 26ths "Turning $10K to $50K by Jan 21st" (halfway there), August 29th's "Defending Your Virtual Portfolio With Dividends" and September 3rd's "September's Dozen." That's how we played the rally from S&P 1,030 to 1,160 (10%).

On October 3rd, I put up "October's Overbought Eight" and they were AMZN, BIDU, CMG, FSLR, MOS, NFLX, PCLN and TLT. Needless to say, we got stopped out of most of those pretty quickly and that led to a Q4 version of "Defending Your Virtual Portfolio With Dividends" on October 23rd (S&P 1,180) and we rode those out through December 11th, when we got tired of waiting for a correction and (at S&P 1,240) went with "Breakout Defense – 5,000% in 5 Trades or Less" and those were followed with December 25th's (S&P 1,256) "Secret Santa's Inflation Hedges for 2011" also with a few trades aimed at making around 500% should the rally continue.

So why is it, with only one bearish Member Virtual Portfolio in 7 months, that I feel like I might be too bearish? Well, for one thing – I'm getting lonely. I work on the Web and my colleagues in the MSM and the Bogosphere have pretty much all found religion and developed an almost unshakable faith in The Bernanke, in China, in Corporate America, in Commodities – you name it – they think it can't go wrong. So much so that the VIX, which measures the market's expectation of stock market volatility over the next 30 day period, has dropped all the way to 16.

So why is it, with only one bearish Member Virtual Portfolio in 7 months, that I feel like I might be too bearish? Well, for one thing – I'm getting lonely. I work on the Web and my colleagues in the MSM and the Bogosphere have pretty much all found religion and developed an almost unshakable faith in The Bernanke, in China, in Corporate America, in Commodities – you name it – they think it can't go wrong. So much so that the VIX, which measures the market's expectation of stock market volatility over the next 30 day period, has dropped all the way to 16.

Now 16 isn't "low" for the VIX, it's actually about the historic average. It is, however a far cry from 89 in 2008 and 48 as recently as May and if you tell me I now have less to worry about today than I did in 2007 when we were still in the middle of a major rally and 60% of investors were bullish and the VIX was in the mid-20s, I have to ask you why? 10% more people are unemployed than in 2007, the World is $18Tn more in debt than it was then, Inflation has tripled (although you can argue that playing inflation IS the bullish premise), Global GDP projections are 1/2 of what they were, Banks are unstable, States are unstable and Nations are unstable yet I am supposed to by NFLX (we are short) with a p/e multiple of 71.50 or AMZN with a p/e of 74.50 (we want to be short) based primarily on my faith that the Great Bernanke in the sky would not let anything bad happen to my investments?

Well sorry, call me an atheist, call it blaspheme, but I do not have 100% faith in the Great Bernanke in the sky. I may have had 60% faith and I may have even had 70% faith but I DO NOT have 87% faith that Bernanke will overcome all those MASSIVE, SCARY, DANGEROUS Global obstacles that are still littering the investing landscape and take us to the promised land of S&P 1,500. Does that make me bearish or sensibly cautious? When 87% of the market is bullish, then sensibly cautious looks a lot like bearish, doesn't it?

Perhaps that's why people like the right Reverend Jim Cramer and his Cult of the MoMo Stocks irritate me lately. That man has FAITH! Well, either faith or he's being paid off by fund managers to pimp theirs stocks so they can dump them on Jimmy's fanatical followers while they pick up whatever he's chasing people out of on the cheap – it's hard to tell….

I was the lone bullish preacher in the wilderness in March of 2009 so I have seen the promised land of recovery and, unlike Dr. King, who said "I may not get there with you" and was, unfortunately right, I fully intend to to get there and I want us all to get there with our virtual portfolios intact so we will continue to hedge the market following the sound policy advocated by Ronald Reagan when dealing with the Russians, which was: "Trust — but verify."

I pointed out on the first trading day of 2011 that we expected January to be heavily manipulated right up to expiration. Assuming Lloyd and Co. were lazy and using the same Alpha 2 Bot program they ran last January, we were looking for a 300 point run that tops out at 11,850 on the Dow and 1,285 on the S&P and we hit goal on the S&P yesterday, to the penny of where I said we'd be on Jan 3rd – trusted and verified. Now we will see how the next 7 market sessions play out into expiration day. If we pop higher – we're off the pattern and we'll have to consider leaving the 13%, shouting hallelujah and joining the crowd but, if we flatline or fail to hold – then you can expect the first Member Virtual Portfolio of 2011 to be a bearish one!