Courtesy of Jesse’s Americain Cafe

Here is an interesting excerpt from the 2011 economic forecast from Piscataqua Research. Simple registration is required.

I am not sure I agree with their prescription to START with 4% short term rates and fiscal austerity, as I think it would shock the economy into a depression, even worse than the stagflation which seems to be unfolding already with today’s CPI print and slack retail sales. A healthy diet and rigorous exercise are good, but not for a patient in critical condition and on life support after twenty years of medical quackery and drug addiction. America needs a twelve step plan with changes starting from the top down.

And as for fear, well, with the resurgence of a US stock bubble, and incessant happy talk in the mainstream media and the nation’s thought leaders there does not appear to be any, unless you are poor, old, middle class, or recently unemployed. Personally I am beginning to fear that the US leadership has gone barking mad on power and greed and the fear of discovery, with the worst yet to come.

I most certainly agree with Piscataqua’s assessment of what they call ‘debt-onomics’ in both of its manifestations as unproductive stimulus spending and more tax cuts for the corporate trusts and the wealthiest few. Quantiative Easing without reform is creating further wealth disparity and another bubble in US financial assets. And this is made possible only by the extravagant privilege of the US holding the world’s reserve currency. This will not end well as history goes.

None of these simple approaches will work because the economy is broken, and badly distorted, with a greatly oversized financial sector and a global monetary regime that is highly imbalanced and unstable. And I suspect these changes will not occur because the monied interests are willing to ‘take it to the limit’ one more time, and then throw another bailout or worse on the table for the price of peace.

Until there is reform, significant changes, nothing will work and there will be no sustainable recovery. Trickle down ultimately leads to social dislocations that are highly unproductive. The obsessive tendency of greed and corruption to its own ultimate destruction has been this Cafe’s forecast since 2005, and so far nothing has fundamentally changed. The collapse of the US is starting to take on the inevitability of the demise of the former Soviet Union.

Piscataqua Research

Economic Projections Summary

January 3, 2011In our January 2010 summary, we said: “For the third year in a row, our 2010 guesses are easy to reach… what looks to Ivy League economists like a recovering economy looks to us like a pre-bankruptcy debt ramp.”

Our guesses for 2010 were: real consumption would decline without further direct government support; real residential investment should bounce along the bottom; an unusual inflation/deflation should push commodity prices higher and consumer product margins lower; government budget and pension problems and federal debts should continue to mount; and mortgage rates should set more new lows.

We also suggested gold and oil would average much higher prices in 2010 than in 2009 and national home prices would be stable or higher! We did very well in 2010! In July with oil at $75, we wrote: “We will not be surprised if oil prices exceed $100 (or $150!) per barrel by next spring!” We are getting closer!

Our guesses for 2011 are also easy to reach. The cash flow model shows a high probability of major U.S. economic difficulties starting in early 2011. Our guesses are:

• Residential investment could approach 1933 as a percent of GDP;

• Commodity price volatility should rise significantly;

• The trade deficit should rise and possibly reach a new high;

• Mortgage rates should reach a long-term bottom in 2011; and

• Government budgets will be more challenged in 12 months than they are now.

On the optimistic side: 2011 should not bring deflation; higher mortgage rates; or lower home prices. Why do the fearmongers get so much press? Low 4% mortgage rates gone forever? Housing prices down another 20%? A Federal debt limit slowdown “catastrophic”? A big bear market? Uncontrolled inflation?

We do not fear interest rate increases crashing the economy; a Federal debt slowdown; a crashing dollar; or market crashes. Since there are no “bond vigilantes”, it can happen if the Fed lets or makes it happen.

It was no surprise to see the Debt Commission support a higher 2011 deficit while “fixing” the 2050 deficit! Their recommendation is pure debt-onomics – raise the debt flow to keep asset prices higher!

The reality is simple: the Federal Reserve has messed up the economy with low interest rates. Since 2005, economic investment has closely followed the 1927 to 1933 path. 2011 is the year that 1933 arrives. The path after 2011 should show the underlying mathematical structure of debt-onomics.

There are two main problems with debt-onomics: 1) it is a choice to consume now and not save later; and 2) it causes booms and busts by accelerating economic investment. Deb-tonomics creates high profits and high unemployment and concentrates income and wealth. It looks like capitalism, but it is not.

Our model points to 2011 as the meeting point of many difficult monetary and economic problems. This intersection should bind governmental and personal budgets in a vice as QE2 and tax cut stimulated inflation drives costs head first into a stone wall of limited tax revenue and personal income.

We wrote in January, 2010: “America has reached the point where there are only two paths. The first path is Bernanke’s and Obama’s: more debt and higher deficits…” The tax bill added about $900B to the deficit and took the path of “Obama’s higher deficits.” The bill also took the path of “Bernanke’s more debt.” In 5 years as Chair, federal debt increased by about $6 trillion and will increase by almost $8 trillion after 6 years.

There is now ONLY ONE WAY to fix the economy. The STARTING point is 4% short interest rates and balanced budgets. We forgot to mention: “and getting past the fear.” Those first steps are hard, but they start the journey! Budget surpluses and higher rates would work even faster! The math is easy.

In our model, 2011 is a true mess! Could we be right about mortgage rates again?! We will see!

The responsibility for this mess is with the political leadership of both parties, the Federal Reserve, the mainstream media, and at the absolute heart of it all the FIRE sector and the Wall Street Banks which represent a corrosive and corrupting influence on all that they touch.

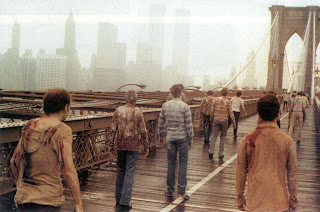

Welcome to Zombieland.