Courtesy of williambanzai7

Today we learn that Squidco is pulling the FaceShnook "private placement" from US Investors and instead will direct the offering to it’s "off-shore" or foreign clients.

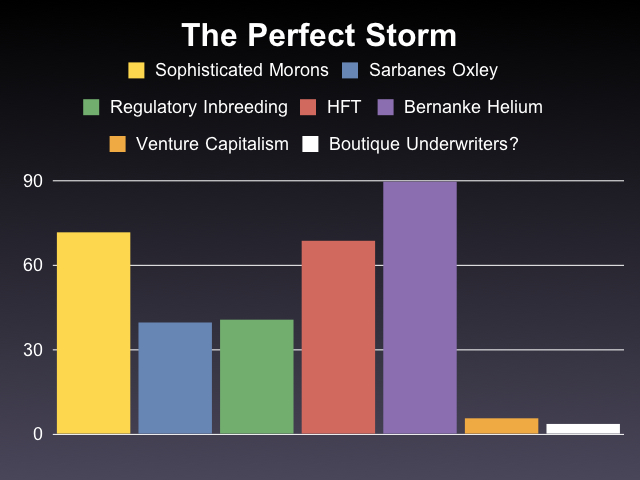

Unfortunately, this is not a moment to be savoring delicious fried squid. This is a time to reflect on what this latest two week squid fiasco really signifies. I submit that it signifies in bright Chinese made neon, that the capital formation process in the United States is truly broken. It is a perfect storm. Here’s why…

Once upon a time the American system for raising capital consisted of relatively small venture capital funds looking to make lots of relatively small bets that every so often delivered a whopping exit return, now extinct small and middle bracket boutique underwriting firms that specialized in initial public offerings for young promising but risky enterprises like for example a FaceShnook or Groupon and bulge bracket investment banks that underwrote securities offerings by established businesses and the rare situation where a very large start-up IPO was justified by fundamentals (say for example, a model with a solid revenue stream). Today, the American IPO juggernaut is firmly dominated by…yes, the Too Big To Fail banks hungry to generate fat fees from gigantic transactions with bubbling price multiples.

The American system of "capital formation" was once the envy of the rest of the free world. It was the first thing the financial pundits pointed to in explaining why the American economy could appear to be down but could never be out. America was known as the undisputed destination to go and finance many new and exciting businesses that would drive the American dream. This is how we turned it around when Japan Inc. had us on our knees in the early 90s.

I won’t bore you with all the details of how the demise of this system began with the lunacy of the dot.com era and was accelerated by the greed and klepto-capitalist mentality that pervaded Wall Street under Greenspan’s and Benron’s reign of foolishness. Instead I would like to summarize why today’s news is an important reminder of the dysfunctional state of a mechanism that in normal circumstances would be a critical driver for an economic recovery.

Why is FaceShnook a symptom? It’s simple, FaceShnook has already been through a nascent period of venture capital like financing. Anyone who says FaceShnook cannot afford to be a public company today because the cost (a la Sarbanes Oxley) is prohibitive, is a canard. The reason FaceBook is delaying its inevitable IPO is timing. The longer it can hold out by accessing "private capital", the easier it will be for it to try and "Reggie proof" a business case justifying an irrationally exuberant IPO valuation. Those lucky few who can get on the FaceBus today, are looking forward to a magic IPO joy ride financed with oodles and oodles of Bernanke QE-bucks just waiting to be flushed anywhere.

But it is not all that simple. In the good old days, venture capitalists were not greed driven to target absolutely outrageous returns. They controlled the IPO timing decision and were willing to take a fair share of their chips off the table at an earlier stage. This generally meant a more down to earth IPO valuation.

The problem is in response to the Enron and Global Crossing debacle, Congress passed the so called Sarbanes Oxley law, which created a great deal of additional regulatory cost to operating as a nascent public company. Many say this cost is actually prohibitive for start-up enterprises. The exodus of many foreign issuers from the US markets and the dearth of small and medium IPOs (is there such a thing anymore besides pink sheet scams?) seems to validate this thinking.

So it actually is more costly to IPO earlier in the life cycle of a business. This means that if an enterprise with an unusually high capital burn rate wants to seek financing, it has two choices (a) IPO earlier despite the additional cost (undesirable), (b) seek capital from a larger pool of IRR driven venture capitalists (more costly from a negotiating perspective) or (c) go and ask your friendly neighborhood squid to raise the money from a pool of sophisticated morons.

Who are these "sophisticated investor" morons we keep hearing about? The ones who can invest $2 million by signing on the back of a used KFC napkin. You know, they are "high net worth individuals" like the ones who invested with Bernie Madoff, and well financed institutions that are more than capable of fending for themselves. Or squid food like ABN AMRO, German bankers from Dusseldorf and oh yah, don’t forget the nimrods at…A.I.G.

As long as you don’t sell to more than 500 of these unSPV’d suckas, you are a home free "private company" right? Wrong. Just because it is legal to line up a hungry roster of sophisticated fools, it is not OK to engage in any kind of "general solicitation" campaign. By doing so you breach the rules governing what qualifies as a "private placement" as opposed to a public offering requiring a full battery of SEC disclosure for eventual sale to the even greater fools.

Sorry folks, in this hyper tweeted/wired/wireless day and age, it is impossible for a firm like FaceShnook to do anything without anticipating that it will be all over the media/blogosphere in the next 2 hour business news cycle.

The squids probably should have anticipated this and adjusted their marketing strategy accordingly. It is surprising that they put them selves in a position of having to back pedal given the hyper-publicity surrounding everything FaceShnook does. They have succeeded in further enhancing their squidly reputation, without reaping any benefit.

Getting back to our dysfunctional capital formation process, Squidco will now have to limit the FaceShnook placement to "off-shore" clients in far flung places like the Cayman Islands, Moscow, Shanghai, Singapore and Hong Kong.

What does this mean? It means that if there is an opportunity to get fabulously rich on a FaceShnook IPO financed with QE Helium freebased with HFT crack, it is a trade that American investors will not be allowed to play, at least not at the pre-IPO stage.

So here we are, we have a situation where everyone and their grandmother is hungry for a piece of an irrationally exuberant Fed financed FaceShnook IPO, but given FaceShnook’s desire to hold out for more, the opportunity to get richer relatively quicker will be limited to guys with names like Cayman, Boris and Li.

And what of all those other small but genuinely interesting job creating enterprises chomping at the bit to manufacture things like solar paneling in places like Massachusetts? How will they raise money in this capital formation clusterfuck?

Easy, they will have to relocate to China and India (here please google solar paneling and Massachusetts).

Do you think we can have a genuine economic recovery with a capital market like this?

"I have a broken dream…"

WB7