I already sent out an Alert to Members this morning.

I already sent out an Alert to Members this morning.

Obviously, with the Steve Jobs situation, everyone is wondering how to play things. At the time (7:03) I thought the fact that AAPL was only down 3.7%, at $335, seemed fake and ridiculous – but what else is new in this market? Our position was to short pretty much everything as the Nas futures were all the way back to 2,310, which was not even down half a point from Friday’s close and some simple math tells us that AAPL is over 20% of the Nasdaq so a 5% drop in AAPL will take the Nasdaq down 1% while a 20% drop in AAPL will take the Nasdaq down 4% – right back to the 50 DMA at 2,640 and that seems like a reasonable pullback – especially when you consider that 2% of the current 2,755 was a result of Friday’s ridiculous rally.

Surely at least we would expect the loss of Steve Jobs to AT LEAST put the Nasdaq back to Friday’s open at 2,730 (2,300 in the futures) but I’ll be very surprised if we don’t at least test that 50 DMA so that will be our watch line for the week. Oddly enough, we had been discussing Steve Jobs’ health as one of the key unpriced market risks last Thursday, when I said to Members (in response to why I preferred a very defensive AAPL spread to holding the stock):

AAPL/Iflan – As I said to Maya, I like my above AAPL trade better than cash but I do not like AAPL stock better than cash because you can only sell 10% worth of protection and that caps your gains at 10% (and we can do better with cash) and it also doesn’t cover the risk of Steve Jobs catching a cold or just coughing on stage, which could cost you 20% very quickly.

In fact, concerns of AAPL and Jobs’ health were the premise for pressing our QID bets in February (see our $10,000 Virtual Portfolio Review), where I said at the time: "QID/Drum – Well since we were saved from doom on USO I got brave and went for a DD on the QID Feb $10s (now .82) and I think that’s worth the risk into expiration and the following weekend. Same goes for waiting on the puts as $12 isn’t all that far away if AAPL falls." No, we did not have any insider knowledge of what was going on at AAPL – we simply paid attention and Jobs has been scarce at Apple events and we had earnings and a product announcement coming up and that’s when (January) Apple tanked in 2009 on our last Steve Jobs health scare.

In fact, concerns of AAPL and Jobs’ health were the premise for pressing our QID bets in February (see our $10,000 Virtual Portfolio Review), where I said at the time: "QID/Drum – Well since we were saved from doom on USO I got brave and went for a DD on the QID Feb $10s (now .82) and I think that’s worth the risk into expiration and the following weekend. Same goes for waiting on the puts as $12 isn’t all that far away if AAPL falls." No, we did not have any insider knowledge of what was going on at AAPL – we simply paid attention and Jobs has been scarce at Apple events and we had earnings and a product announcement coming up and that’s when (January) Apple tanked in 2009 on our last Steve Jobs health scare.

At the time, I was pounding the BUY button with AAPL at $78.20 ($85 was our buy point) but that’s because it was DOWN from $192.24 in Q2 of the prior year and we didn’t see any way that earnings were going to fall off that hard. NOW IS NOT THE SAME, with AAPL UP at $348, UP 75% for the year already on (as I pointed out to Members on Sunday) "just" 46% more earnings per share. The full text of that comment is appropriate here as it was my general commentary on why I was cautious about both Apple and the Nasdaq into earnings (we were discussing using SQQQ as a way to benefit from a Nasdaq crash and how AAPL’s earnings may play into it):

SQQQ/Trad – It’s not about AAPL missing but about "can they exceed expectations?" They are up 10% more this month on top of a 12.5% run since last Q (from $280) on expectations that they hit $5.38 in EPS for the Quarter, which is up from $3.67 last year (46%) when the stock was at $200. So the stock is already up 74% on a 46% gain in EPS (and they sold off after earnings last Jan), which means they are running a bit ahead of themselves so ANY disappointment is not likely to be taken too well, whether it’s soft IPod sales, lowered guidance due to memory supply constraints or any sort of decrease in margin. I wouldn’t bet on those things happening because AAPL is the greatest company on the planet Earth but – even with all that going for them, at the moment 2011 is projected to hit $20 EPS, up from $15 last year (33%) and 2012 is pegged at $23.15, up a mere 15% – that is slowing growth and, as we often point out re. extrapolating – AAPL is NOT priced for slowing growth and, also as I have pointed out – unless they come out with cars or TVs they can sell to the top 10% over the next 5 years – they soon become a company that will go back to refreshing the same old things, fighting for market share with everyone else.

So the short story is AAPL $350 bothered us for a whole host of reasons, with Steve Jobs’ health being just one of them. Now that his health is back in play I was amazed to hear a rumor that Jim Cramer sent out an Email to subscribers last night saying AAPL would be a BUYING opportunity this morning. Talk about herding sheep in for the slaughter! I don’t subscribe to Cramer so I don’t know if it’s true or not but I certainly hope not as it is simply beyond irresponsible to jump into what is, at the moment, a very minor pullback on an already overpriced stock right before earnings AFTER they just got devastating news about their CEO/President. I mean – THIS is a buying premise, Jim? REALLY?

So the short story is AAPL $350 bothered us for a whole host of reasons, with Steve Jobs’ health being just one of them. Now that his health is back in play I was amazed to hear a rumor that Jim Cramer sent out an Email to subscribers last night saying AAPL would be a BUYING opportunity this morning. Talk about herding sheep in for the slaughter! I don’t subscribe to Cramer so I don’t know if it’s true or not but I certainly hope not as it is simply beyond irresponsible to jump into what is, at the moment, a very minor pullback on an already overpriced stock right before earnings AFTER they just got devastating news about their CEO/President. I mean – THIS is a buying premise, Jim? REALLY?

In addition to reviewing our $10,000 to $50,000 Virtual Portfolio over the weekend (just under a virtual net $30,000 with a week to go) our weekend edition of Stock World Weekly took a close look at the situation in Europe as well as the coming storm in the municipal bond market. It was also noted that the first week of January booked huge outflows from Domestic equity funds with almost net $5Bn running away from the markets in a holiday-shortened week vs. $500M of inflows during Christmas week’s light trading that was considered "rally fuel" as it was the first positive inflow in months. So if $500M coming in is "rally fuel" – what is $5Bn going back out a week later?

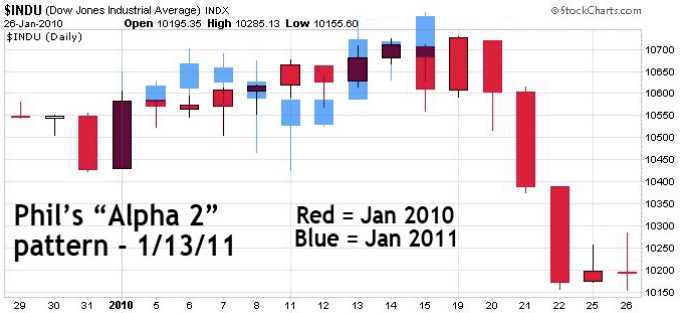

Also very nicely done by Elliot and the team at SWW was the tracking chart of Goldman’s Alpha 2 TradeBot program we’ve been watching for the month of January. This is a great visual presentation of last year vs. this year but do keep in mind that we expected the flatline to stretch out to this Friday’s expiration day and THEN we feel it would be a good time for a 5% dip in the Dow:

If you pull those blue lines back a week, you’ll see we’re actually well on track for our 11,850 target (as long as AAPL doesn’t derail us), which we expected to hit this Thursday. Of course we are now running into the harsh reality of earnings season and I would urge you to review my macro outlook from "Monday Morning Musings" to get right up to speed on the Big Picture as we get ready for China’s Hu Jintao’s visit to America, which hopefully will go better than the last time those crazy kids got together.

I love that video (original is even better) – It sums up our situation so nicely! As I pointed out in this morning’s Alert, there are Strange goings on in China as well as the Shanghai opened down almost 2% but closed flat with the huge stick save coming into lunch, beginning at 11am. The Hang Seng, on the other hand, fell 250 points after lunch and closed flat at the day’s low. The Nikkei went up 50 points at the open to flat and stayed flat all day while the Bombay bounced off 18,888 – a number that the Chinese consider very lucky (by coincidence, of course).

It remains to be seen if the bulls can support the market through expiration day (Friday) or if things do, in fact, begin to fall apart on the 21st, as they did last year. C, DAL and MMR had misses this morning and the Empire State Manufacturing Survey was in-line at 11.9, up from 10.57 last month so not all bad news this morning.

My biggest concern of the weekend was Jeff Nielson’s very negative review of the holiday shopping season, in which he points out:

My biggest concern of the weekend was Jeff Nielson’s very negative review of the holiday shopping season, in which he points out:

The most important number we need to begin this calculation is the real rate of inflation. As regular readers know, there is only one destination for those who want realistic statistical information on the U.S. economy: Shadowstats.com. Visit that site, and John Williams (the respected economist who runs the site) will tell you that as of his most recent reading, U.S. inflation was still running at about an 8.5% annual rate of increase.

Now the raw data from the U.S. retail sector. Comparing December 2010 to December 2009, we see that total retail sales rose 7.9%. Subtracting 8.5% from that number, we see that the sales of goods in the U.S. fell in December 2010 – to below the level of the two worst (previous) shopping seasons on record. If we look at the full-year numbers, the picture is even worse. Total U.S. retail sales in 2010 were up 6.6%, nearly a full 2% lower than the rate of inflation.

How long can we keep going pretending that the headline numbers are real while ignoring the facts that really are not all that deeply buried before the surface? Will Steve Jobs prove to be the scratch in the surface that exposes the weakness that lies beneath or will it be just another injury we ignore while we continue to party like it’s 1999 – or the summer of 2008.