It's World Economic Forum time!

It's World Economic Forum time!

This is one of my favorite conferences as the Global Elite head over for their annual gathering and schmooze-fest where they end up wandering around and trying to get seats with the cool people at lunch and trying to find out where the good parties are and getting told there's no tables at the restaurant they want to go to – just like normal people! Nassim N. Taleb described it to Tom Keene of Bloomberg Television, the event is “chasing successful people who want to be seen with other successful people. That’s the game.”

The minimum price for admission to the conference is $50,000 for a membership to the World Economic Forum plus a $20,000 ticket to the conference so $70,000 before trying to get a hotel room at a place you won't be embarrassed to mention to the other guests. Getting to Davos is also a nightmare at the best of times but worth it for the skiing, if not the schmoozing. In short, it's group of people who have at least $80,000 to blow on a weekend sitting around discussing the problems ordinary folks like themselves face in the ever-changing global economy.

The event will be well-covered and we will get many, many sound-bytes during the week and, like any conference, there is sure to be some enlightening information if you are lucky enough to catch the right lecture but I'd probably enjoy it a lot more if someone sent Ricky Gervais to ask a lot of awkward questions and point out what BS this exercise is than having to spend another week watching the CNBC girls throw their panties at passing Billionaires.

Meanwhile, in the real World, the UK's GDP CONTRACTED by 0.5% in Q4. "Even allowing for a very substantial hit to economic activity from December's severe weather, contraction of 0.5% quarter-on-quarter … is extremely disappointing and worrying," said Howard Archer, chief European and U.K. economist at IHS Global Insight. An Office for National Statistics official said extreme weather at the end of the 2010—which resulted in the coldest December in over 100 years—was likely to have been the main cause of the contraction, with services and construction particularly hard hit. As usual, economists were clueless with the average prediction for a 0.4% expansion missing by over 200%. That sent the Pound ($1.358) and the Euro ($1.575) diving and boosted the Dollar back over 78.50 so we'll be back to watching that line today.

As the UK's Daily Mail pointed out Government spending in the UK already accounted for 50% of GDP last year. That means there simply is not that much more the government can give. We haven't even discussed the possibility of a UK default in Europe but 2010 Public Sector Net Debt was already clocking in at $1.3Tn, which is about 65% of the entire GDP with another $200Bn added this year. While that may sound shocking, it's actually nowhere near as bad as the US and we all laugh at Japan with their 200% debt load.

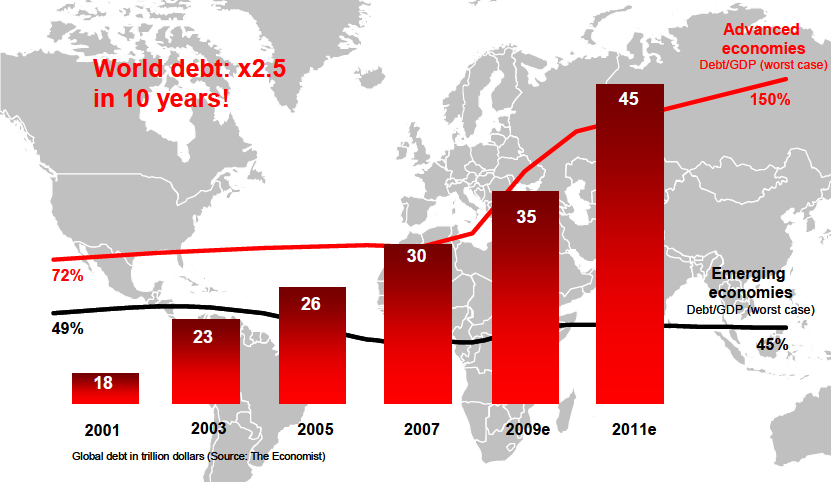

Global debt is the projected $80Tn gorilla in the room at Davos but, as I mentioned in yesterday's post, this conference likes to focus on the upbeat things and they circulate their "Global Risk Report" ahead of time so everyone can pretend they read it before they get on camera talk their book. Last year I reported on the conference and the IMF was predicting 3.9% global growth in 2010 and Roubini was saying we were all doomed. Greece was the big negative hanging in the air and the markets were already selling off sharply as Alpha 2 came crashing down in the last week of January.

Global debt is the projected $80Tn gorilla in the room at Davos but, as I mentioned in yesterday's post, this conference likes to focus on the upbeat things and they circulate their "Global Risk Report" ahead of time so everyone can pretend they read it before they get on camera talk their book. Last year I reported on the conference and the IMF was predicting 3.9% global growth in 2010 and Roubini was saying we were all doomed. Greece was the big negative hanging in the air and the markets were already selling off sharply as Alpha 2 came crashing down in the last week of January.

Not so this year, as we broke that pattern yesterday as the Dow went straight up 100 points on low volume and then did nothing on stronger volume the rest of the day but, as we know, all that matters is that headline print and we got 11,980 to close the day, a far cry from the 11,700 that we would have expected to hit if we stuck to the pattern of last January. Of course, we don't expect minute by minute timing but if we get our beloved Russell 800 back – we will have to tack on some more bullish bets and take this amazing move up in the Dow more seriously.

Just as the chart above ignores over $300Tn of "unfunded liabilities" like US Social Security, Medicare and Medicaid (Bush's prescription drug program alone is an unfunded $20Tn) but that's OK because there are over $600Tn worth of derivative bets for and against the eventual default of various sovereign nations so maybe someone who's a big winner on the derivatives side will help us out with a $50Tn donation to buy us another decade. Yeah, that's the plan…

We've held our bearish plays so far this week as we felt the Dollar would bounce off that 78 mark and, as you know, it's ALL about the Dollar. The Dollar has been driven down in anticipation of Obama promising to spend Trillions of them that he doesn't, as such, have in his State of the Union message tonight as well as tomorrow's Fed meeting, where The Bernank is sure to reiterate his loose money stance (has he ever had another kind?).

BUT (and it's a Big But. perhaps even a Big But, Davos Style), isn't this one of those "Buy on the rumor, sell on the news" situations because, after the State of the Union, comes the Republican rebuttal and, this year, it has teeth as Da Boyz have control of the House and nothing Obama wants to do gets approved unless a majority of those guys decide to back him…. Sorry, I was laughing so hard I fell off my chair. In fact, tonight we will get two rebuttals, one from Paul Ryan (R – Wisc) and one from the Tea Party's Michele Bachmann which I will predict right now will give Jon Stewart all the material he needs to win his next Emmy award.

Meanwhile, the price of a hot chocolate will be prohibitive for delegates at Davos as cocoa prices climb back to their all-time highs. The United Nations is warning of Global Food Riots (a little late as they are already in progress) as developing nations begin taking what often end up being disastrous steps to curb inflation, including price caps, export bans and rules to counter commodity speculation—to keep food costs from disrupting their economies as price spikes that some had hoped were temporary have stretched into the new year. Even ex-Superpower, Russia, is jumping on the price control bandwagon, announcing price caps on many basic food items. Even CNBC is finally catching on to the idea that rising food prices can hurt equities

Meanwhile, the price of a hot chocolate will be prohibitive for delegates at Davos as cocoa prices climb back to their all-time highs. The United Nations is warning of Global Food Riots (a little late as they are already in progress) as developing nations begin taking what often end up being disastrous steps to curb inflation, including price caps, export bans and rules to counter commodity speculation—to keep food costs from disrupting their economies as price spikes that some had hoped were temporary have stretched into the new year. Even ex-Superpower, Russia, is jumping on the price control bandwagon, announcing price caps on many basic food items. Even CNBC is finally catching on to the idea that rising food prices can hurt equities

Fortunately, in America, our food inflation is neatly offset by home price deflation. As the government figures it, if you spend $3,000 more at the grocery store this year, that can be balanced out by a $3,000 drop in the value of your home because, like groceries, you buy one of those every week, right? Well, on that logic you'll be happy to know that, according to Case-Shiller, home prices dropped another 1% in November and are now down 1.6% for 2010 – saving the average American with a $250,000 home almost $4,000.

Strangely, people are not taking that $4,000 they saved and going shopping. ICSC retail sales plunged 1.2% last week and Redbook expects a 0.7% drop in January. Come on people! You just "saved" $4,000 on your home so you'd better get out there and shop till you drop or you'll be saving another 10% in 2011!

Debt-O, debt-uh-oh

Interest come and we need another loan

Debt-O, debt-uh-oh

Interest come and we need another loanWork our lives just to lose our homes

Interest come and we need another loan

Stack default swaps till they come undone

Interest come and we need another loanCome on Economists, tell us some more BS

Interest come and we need another loan

Come on Economists, tell us some more BS

Interest come and we need another loan6%, 7% – it’s a credit crunch

Interest come and we need another loan

6%, 7% – it’s a credit crunch

Interest come and we need another loanDebt-O, debt-uh-oh

Interest come and we need another loan

Debt-O, debt-uh-oh

When interest comes we’ll need another loan

Ponzinomics pic credit: William Banzai7