Is it safe?

Is it safe?

I asked that question at the end of November in "Timid Tuesday – Is It Safe" and here we are, 60 days later and up 7.5% and, on the whole, feeling less safe than we did back then, when the Market Oracle and I seemed to be the only people concerned global inflation and sovereign default risks rising rapidly. Although we were playing the market bullishly, with our aggressive $10,000 Virtual Portfolio (and make sure you check out our brand new $25,000 Virtual Portfolio that begins today with a $100,000 goal by December 31st) we decided to try to take from $26,000 to $50,000 by Jan 21st (we only made $35,000), our Breakout Defense Plays (5,000% in 5 Trades or Less) and our Secret Santa’s Inflation Hedges – it was with one hand on the exit door at all times. As I said at the close of Timid Tuesday’s article: "This house of cards is teetering folks – please be careful out there!"

That was 60 days ago. We’re a lot older now and have learned a lot about the World since then. We learned that China, Japan and the IMF are all ready, willing and able to buy the bonds of various EU nations. We learned that the Dollar can still fall 5% (was 81.44 on November 30th) further down despite Europe’s very obvious problems and Japan’s MASSIVE 200% Debt to GDP ratio. We learned that Uncle Ben will never stop printing money (until forced) and we learned that commodities can rise much faster than even our aggressive "Secret Santa" plays anticipated, with every one of our hedges (XHB, XLE, DBA and XLF) already over our year-end targets, all on track for gains well over 100%.

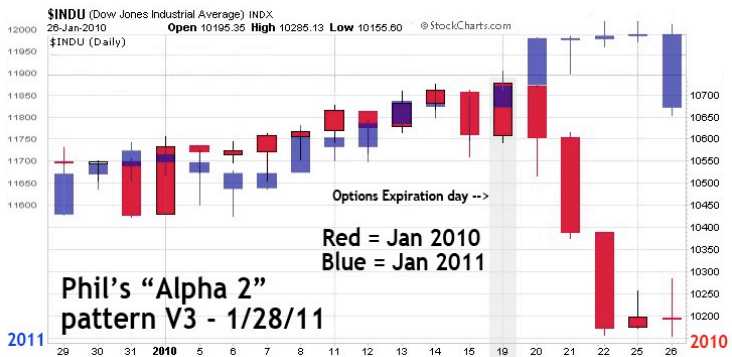

After watching our Alpha 2 pattern break (as I predicted it would on Monday morning) for the week, we went a lot more bearish on Thursday when I said in that morning post:

After watching our Alpha 2 pattern break (as I predicted it would on Monday morning) for the week, we went a lot more bearish on Thursday when I said in that morning post:

Keep in mind that gold and silver are our defensive plays. In Member Chat yesterday, Jromeha mentioned he’s 80% in cash and 85% short the market on the 20% in play and I said I thought that was an excellent way to play what I felt was a blow-off top after the Fed. We added 2 disaster hedges yesterday, a TZA spread that pays 500% if we get to $17 by April and a QID play looking for a quick 66% if they hit $11 by March. That’s in addition to our very short play on the Dow so we are SHORT in the short-run – DESPITE all the foolishness out of the Fed.

This is what hyperinflation looks like folks – you’re not supposed to pick 4 commodities and make over 100% in 60 days on what were not even particularly risky trade ideas. If everyone can make this kind of money, what good does it do you as it’s just funny money being spit out by a broken system that will, eventually, become meaningless once that money begins to circulate again and people begin to realize just how much of it there really is flowing around (and how relatively worthless that makes it).

In this week’s Stock World Weekly, Elliot and Ilene ask if The Bernank has cried "Havoc" and let slip the dogs of hyperinflation:

These are strong words, no question. But on January 5 the Food and Agriculture Organization of the United Nations released a report that shows the “FAO Food Price Index” going from 167 in July 2010 all the way to 215 as of December 2010, an increase of over 25% in just five months. If we accept the International Accounting Standards Board’s definition of hyperinflation as being 26% per annum over three years, then we are arguably seeing the beginnings of genuine hyperinflation, at least in the price of staples such as foodstuffs.

Many people around the world spend 40% or more of their income on food, so food price increases significantly affect their lives. Many are already struggling with the problems of unresponsive governments, rampant corruption and cronyism, and weak economies. Skyrocketing food prices may be the proverbial “straw that breaks the camel’s back.” In just three weeks, over one hundred people died in violent riots in Tunisia and over one hundred were reported dead in Egypt, as the regime struggled to maintain control of an unhappy populace.

Look at that chart! We are PAST the point where they broke the World last time! Also in Stock World Weekly (You don’t subscribe??? REALLY?), we have this lovely map, giving us a nice visual representation of the RESULTS of these rising food prices with riots, protests and Government troop actions spreading like wildfire across Asia and Africa and knocking right on Europe’s door, much as Genghis Kahn’s army did 800 years ago.

Look at that chart! We are PAST the point where they broke the World last time! Also in Stock World Weekly (You don’t subscribe??? REALLY?), we have this lovely map, giving us a nice visual representation of the RESULTS of these rising food prices with riots, protests and Government troop actions spreading like wildfire across Asia and Africa and knocking right on Europe’s door, much as Genghis Kahn’s army did 800 years ago.

At the time – I’m sure that the "modern" Europeans of the 13th Centrury never imagined that riotous looters in Asia and the Middle East would ever have an effect on their daily lifestyle but Giovanni de Plano Carpini, the Pope’s envoy to the Mongol Great Khan, traveled through Kiev in February 1246 and wrote:

"They [the Mongols] attacked Rus, where they made great havoc, destroying cities and fortresses and slaughtering men; and they laid siege to Kiev, the capital of Rus; after they had besieged the city for a long time, they took it and put the inhabitants to death. When we were journeying through that land we came across countless skulls and bones of dead men lying about on the ground. Kiev had been a very large and thickly populated town, but now it has been reduced almost to nothing, for there are at the present time scarce two hundred houses there and the inhabitants are kept in complete slavery."

Why then, are the first 3 trade ideas for the $25,000 Virtual Portfolio bullish ones? Well, as I said to Members in last night’s Alert, at the opening of the Asian markets (we have Members all over the World, of course): "It’s a busy data week (see Stock World Weekly) with tons of earnings. Not too much to be made of the early trading other than to say that it doesn’t look like anyone is panicking but we’re not hitting Egypt’s sphere of influence yet so it’s up to Europe to carry the ball in a few hours."

Well, here we are, a few hours later (8 actually) and Europe did just what we wished on Friday that the markets would do today – a sharp spike down at the open to test our 2.5% lines (FTSE and CAC) and bouncing back sharply. That was all it took for the Hang Seng to get a nice "stick save" into the close, jumping up 150 points right on the EU open (3am), almost as if there was some kind of program that triggered a buy on all the international markets simultaneously – AMAZING! At the same time (coincidence I’m sure) the dollar got mugged and fell from 78.3 all the way down to 77.8 – something we used to call an amazing move in the currency markets for a week but what we now call — Monday morning.

So, why do we make bullish bets when it looks like the New World Order is hanging by a thread? Because we’re not stupid! We know it’s a joke of a fixed market so we play the very funny fixed-market game and you can argue and say the markets aren’t fixed and this is all a great coincidence but our premise that the markets are fixed and our actions based on that premise seem to work out pretty darned well so we’ll stick with that theory thank you – until the evidence no longer fits our assumptions. Which could be a while the way things are looking…

So, why do we make bullish bets when it looks like the New World Order is hanging by a thread? Because we’re not stupid! We know it’s a joke of a fixed market so we play the very funny fixed-market game and you can argue and say the markets aren’t fixed and this is all a great coincidence but our premise that the markets are fixed and our actions based on that premise seem to work out pretty darned well so we’ll stick with that theory thank you – until the evidence no longer fits our assumptions. Which could be a while the way things are looking…

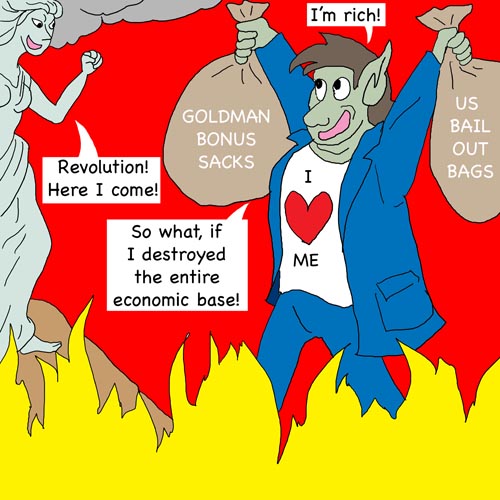

I was going over the news and data this weekend and wondering why "THEY" would want to be jacking up commodities this weekend with Egypt on fire and many other nations reaching the boiling point. We figure "THEY" are the Gang of 12 (GS, MS, JPM, DB, CS, etc – picture by Elaine at EMSNews.com) working hand in hand with their top 1% clients and their pet Governments so why would they want this level of instability to the point were they jacked oil back to $90 on Friday, up 5% in a single day?

Could they WANT violent revolution? Could they WANT political instability? Could they want war, starvation and death? Wow, you really do need a history lesson if you think they don’t! That’s where you make all the money people! Chaos, instability, panics, market distortions – it’s a party to the IBanks! While we reserve the right to morally condemn them for their actions – we certainly aren’t going to bet against them and, as I cautioned in Wednesday’s post, where I noted that the Government/Gang of 12 plan was to screw the bottom 99%:

In conclusion – you’d better be out there making an assload of money because you’ll need it to keep up with rising prices for things you buy and declining values of your US assets. We aren’t going to be able to afford to retire/run away to the Caymans if we have to count on US dollars to support us unless we have an obscene amount of them!

It’s only 3 trading days later – I haven’t changed my mind about that. It’s all going according to plan, even though the plan is HORRIFYING and it’s up to you to choose whether to play the hand that is being dealt, or watch from the sidelines while monkeys with a dartboard can rack up trades that make them 100% in 60 days while the dollars you keep "safe" in your bank or tied up in Dollar-denominated assets, drop another 5% in the next 60 days.

We remain nimble and ready to go either way. Friday we went, as planned, very short in the morning with QID and TZA plays in the Morning Alert to Members (also published for free on Seeking Alpha as we didn’t want our readers to get burned by the drop) that are obviously already doing well but we cashed out our short-term DIA puts, kept our long-term ones, took a long play on F (buying the F’ing dips!), a short one on NFLX (we’re with you Whitney!), a long on IWM (selling this weekly puts – very aggressive) and added/reiterated an EDZ hedge so we’re playing both sides and not ashamed of it!

It’s going to be a crazy week – be careful out there.