Scaramouche, Scaramouche, will you do the Fandango?

Scaramouche, Scaramouche, will you do the Fandango?

Nothing really matters, anyone can see, nothing really matters to me – any way the wind blows. That's right, I am now resorting to random gibberish in the hopes of getting a better understanding of the markets. Random gibberish is exactly what we got in the Minutes of the Federal Reserve's Jan 26th meeting, that were released yesterday at 2pm. My extensive commentary to Members is available over at Seeking Alpha, but it loses a bit without the color-coding, which they do not support (sorry).

It was really the same old song and dance: "The pace of the recovery was insufficient to bring about a significant improvement in labor market conditions, and measures of underlying inflation had trended downward… the Committee reiterated its expectation that economic conditions were likely to warrant exceptionally low levels for the federal funds rate for an extended period…"

Nothing to move the markets over which means, of course, we keep going up since up is the natural direction of the markets these days as we ride the ever-increasing tide of easy money right to the stratosphere. To summarize the Fed's statement, it was something like: "Hast Du etwas Zeit für mich, dann singe ich ein Lied fuer Dich," which roughly translates to:

You and I in a little toy shop

Buy a bag of balloons with the money we've got.

Set them free at the break of dawn

'Til one by one, they were gone.

Back at base, bugs in the software

Flash the message, Something's out there.

Floating in the summer sky.

99 red balloons go by.Panic bells, it's red alert.

There's something here from somewhere else.

OK, so what have we learned from all this gibberish? Well, for one thing, we've learned that Nena is HOT (and still is)! I saw her at a club in Amsterdam around the time of that video and I was totally in love with her – had no idea what she was saying but I loved the way she said it. Who knew the lyrics were deep as well?

As for B-B-B-Bennie and the Fed? We (and he) have learned nothing at all. The overriding theme of the minutes were along the lines of "Inflation, what inflation? I don't know nothing about no inflation. Hey Dudly – Do you see any inflation?" "No, I don't see no inflation boss." "Yellen, do you see any inflation?" "No, sir Ben, no inflation here." "See, there's no inflation – youse guys must be mistaking us for some other country – now here's a Trillion Dollars, go buy yourself something nice and tell 'em Uncle Ben sent you."

Yes, according to the Fed, everything will be just fine if they just keep buying TBills at the current pace (about $120Bn a month) to supplement our $140Bn a month deficit habit. This works just about as well as making sure and addict has enough money for more heroin every day but – what the Hell? No one wants to have the Fed act responsibly and the Fed certainly doesn't want anyone to think anything is actually wrong.

Yes, according to the Fed, everything will be just fine if they just keep buying TBills at the current pace (about $120Bn a month) to supplement our $140Bn a month deficit habit. This works just about as well as making sure and addict has enough money for more heroin every day but – what the Hell? No one wants to have the Fed act responsibly and the Fed certainly doesn't want anyone to think anything is actually wrong.

This is probably why, despite mentioning the word "inflation" 7 times in their 4 paragraph official statement on January 26th and despite 42 mentions during the meeting, the Fed's official stance is "there is no inflation and the inflation that you think there is isn't our fault." You know, there is no fountain of youth either but, somehow, when I sit down and have a two day meeting that generates a dozen pages of minutes, the term "fountain of youth" doesn't come up 42 times and, when I issue an official statement, I don't mention it 7 times. Do you know why? Because it ACTUALLY doesn't exist.

We tend not to have 2 day meetings discussing things that don't exist. We do have two day meetings PRETENDING we have problems under control. Companies do this all the time. Ben would not know this because he has never run a company and neither have the majority of Federal Reserve Members. What they run, at the moment, is a printing press where they can redistribute the nation's wealth with the stroke of a pen to whoever they choose and, not surprisingly given their origin, they choose to distribute our wealth to their own Member Banks who use it like JP Morgan, to play the stock market and ring up $19Bn worth of trading profits in 2010 as they run the price of – well, everything, up 50 to 100% – destroying millions of lives and toppling governments in the process.

I will let Karl Denninger have the last word with "Bernanke's Outrages Exposed" and leave it at that as I could go on all day. If you have a few minutes though, I would suggest watching this entertaining video that follows up on the topic of Newspeak we talked about on Monday as so much of the language we are now hearing from our politicians, policy makers, corporations and their media mouthpieces is now couched in so many layers of BS that you do need a degree in semantics just to figure out what they MIGHT be saying (also see "Superfreakonomics"):

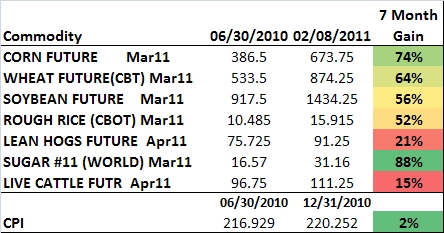

Also being featured today at Philstockworld is "How to Fake an Economic Recovery" and Russ Winter's observations on the sudden and sharp decline of Chinese exports that JUST MIGHT indicate a small leak in the Global ship of state. Also, a new favorite of Members is David's "All about Trends" section, where he posts a mid-day update with charts to watch on the market. I don't usually mention what's on in our own site because I can't mention everyone but, while I'm on the subject: Tyler has a great post analyzing the credibility of Steve Jobs' latest cancer scare (hitting AAPL this morning), Mike Snyder sums up what is wrong with the US economy in 10 charts and, most germane to this morning's conversation, Surly Trader has a post simply called "The Commodity Bubble," which features this chart:

This is a perfect spot to move on to discuss the CPI, which came in this morning at "just" 0.4%, which is 33% more than expected (and how many times have we heard that this week) by those same expert analysts the Fed likes to consult with. Actually 33% is the closest they've come all week to predicting anything. Not so lucky on the core CPI, which was 100% over the 0.1% predicted at 0.2%. Food prices are "only up 0.7% in January, which is quite a break after those 50% gains we can see on the chart (if we are going to believe the BS government measurments, of course, as they are still just 1/3 of the Billion Price Index we discussed on Monday).

This is a perfect spot to move on to discuss the CPI, which came in this morning at "just" 0.4%, which is 33% more than expected (and how many times have we heard that this week) by those same expert analysts the Fed likes to consult with. Actually 33% is the closest they've come all week to predicting anything. Not so lucky on the core CPI, which was 100% over the 0.1% predicted at 0.2%. Food prices are "only up 0.7% in January, which is quite a break after those 50% gains we can see on the chart (if we are going to believe the BS government measurments, of course, as they are still just 1/3 of the Billion Price Index we discussed on Monday).

But investors need not worry because inflation is a no-show in the one place it would bother us – or the Fed. The beautiful sheeple got paid – get this, you will love it – 0.1% LESS in January than they did in December! Isn't that great? Labor costs are higher than most commodity costs for most corporations so this is a win-win where we pay people less AND they come to work hungry and alert and extra productive for fear of losing their jobs and starving like 10% of their neighbors. Oh it's good to be the boss!

Even better, jobless claims are UP again, back over 400,000 to 410,000 with continuing claims rising slightly but still "just" 3.9M as we no longer consider the other 10M people who lost their jobs to be "in the workforce." I mean, come on already – it's been over 2 years since the crash – get a job! The peasants are indeed revolting in Libya, Bahrain and Yemin today with riots and tear gas everywhere. This is good news for TASR (got 'em), who just got a nice, fat, international order yesterday for their "crowd control" devices.

This is all great news for investors as Global chaos and high unemployment at home means: MORE FREE MONEY – and that's what it's all about, right? The Fed is telling their banks to be ready for renewed recession and 11% unemployment on the same day they are releasing their minutes telling the American people how great things are and those banks are once again pouring Billions of Dollars into the same toxic securities that tanked the economy back in the olden days that no one seems to remember (so last decade now) and Fitch is preparing to downgrade states like Illinois, Nevada, Massachusetts and Minnesota, who are unlikely to clear their new hurdles for A paper. .

This is all great news for investors as Global chaos and high unemployment at home means: MORE FREE MONEY – and that's what it's all about, right? The Fed is telling their banks to be ready for renewed recession and 11% unemployment on the same day they are releasing their minutes telling the American people how great things are and those banks are once again pouring Billions of Dollars into the same toxic securities that tanked the economy back in the olden days that no one seems to remember (so last decade now) and Fitch is preparing to downgrade states like Illinois, Nevada, Massachusetts and Minnesota, who are unlikely to clear their new hurdles for A paper. .

Cotton broke $2 and is looking to go hyperbolic, 1,000 companies are having their employment records audited in a hunt for illegal immigrants, BOE's Andrew Sentance breaks with Mervyn King and says the "outlook for inflation is too optimistic" and later we will hear more BS from the Fed's Lockhart and Evens, who will both be speaking about the economy at luncheons, which will come after the 10am Philly Fed Report and before the release of the Fed's Balance Sheet at 4pm.

Lots of fun stuff we can ignore today!

Crazy Bennie pic courtesy of William Banzai7