We’re watching our 100% lines.

We’re watching our 100% lines.

While we did follow our plan and bought the F’ing dips yesterday – we did so cautiously as 3 of our 5 100% lines fell during the worst one-day drop since August 11th of last year. Not shown on this chart, the NYSE fell 2.1% to 8,325 and the Russell landed down 1.9% at 812. That means, other than the Nas – all of our indices bounced off and held their 2.5% lines and we can forgive the Nas because it was dragged down by AAPL, who was a BUYBUYBUY for us on the $340 line.

The 100% (off the March 9 lows) levels were discussed, along with the chart for the S&P showing our critical ranges, in this weekend’s "Fibonacci Rules – Sometimes, the Old Ways Are the Best!" so I’m not going to waste any time going over that but, for a quick reference, our 100% levels are: Dow 12,938, S&P 1,332, Nasdaq 2,530, NYSE 8,362 and Russell 800 (100% was 685). With the RUT so far over their 100% line, we used them as a key index hedge and the TZA’s banged right up to our target $13.50 into yesterday’s close and we took that money and ran ahead of the reverse split in our favorite Ultra-ETF this evening.

Clearly from the above chart, you can see how our logic pays off. Also, we chose the Dow for our long index for the same reason as they were lagging the others by a wide margin so we played the pair of Dow up and Russell down to cover some of our trades. Another place we took the money and ran was XLE, which was a $25,000 Virtual Portfolio trade in yesterday’s morning Alert to Members. We added 10 of the XLE March $75 puts at .85 and that could not have gone better as they ran straight up to $1.30, where we got out of dodge (you can see our volume enter and exit below) as it was enough to get us out of a previous XLE position that had hurt us all even, leaving our virtual $25,000 Virtual Portfolio nicely balanced at $27,511, up just over 10% in 15 trading days and on track for our goal of $100,000 by the year’s end. We just need to make more trades like this and we’ll be all set:

I mentioned EDZ was our primary hedge in the Morning Post and, even if you weren’t in the leveraged option play from Friday’s $21.40, they still "only" opened at $22.40 and topped out at $23.70, up 5.8% on the day. Who says I don’t pick stocks? I also mentioned our XRT short on the $50 line and, wouldn’t you know it, they had the nerve to run it back to $50 in the morning before falling to $49 by the day’s end, just 2.5% for you boring old stock players and I don’t even want to tell you how great that is when you are playing options! What else did I give away yesterday? How about the Dow Futures short at 12,350 – we got out as planned at 12,250 but, wouldn’t you know it – they ran back to 12,340 again at 10:20 on that silly spike and that was ANOTHER good entry opportunity for the ride down to 12,157. That’s good money at $5 per point per contract!

It’s OK to be bullish but you have to know how to slap on the defenses, like the above plays, when it all hits the fan. Don’t stand there like a deer in the headlights when the market moves against you. This reminds me of two oldie but goody articles written by Option Sage and I back in the Summer of 2007, when the markets were rocky and Sage wrote: "Don’t Just Stand There, Do Something" to which my counterpoint the next day was "Don’t Just Do Something, Stand There." Members will recognize both techniques can and are used simultaneously as we navigate these very choppy market waters and, if you haven’t read them before – now is a perfect time to get a feel for one of our core philosophies.

It’s OK to be bullish but you have to know how to slap on the defenses, like the above plays, when it all hits the fan. Don’t stand there like a deer in the headlights when the market moves against you. This reminds me of two oldie but goody articles written by Option Sage and I back in the Summer of 2007, when the markets were rocky and Sage wrote: "Don’t Just Stand There, Do Something" to which my counterpoint the next day was "Don’t Just Do Something, Stand There." Members will recognize both techniques can and are used simultaneously as we navigate these very choppy market waters and, if you haven’t read them before – now is a perfect time to get a feel for one of our core philosophies.

So, yesterday was fun and we only had a weak bounce per our 5% rule, which looks for us to get back at least 0.5% after a 2.5% drop. If it wasn’t for the dollar dropping 0.5% this morning, we wouldn’t even have that action in the futures so we need to be prepared for anything but we will want to play the Dollar to hold the 77.50 line and that may not be good for stocks and commodities in this morning’s trading.

Gold is right on the $1,400 line with silver at $33.25 and copper at $4.31 so this is about storing wealth (probably the wealth of Middle Eastern leaders) and not so much about some actual demand for metals. As pointed out by Penson Futures’ Sharon Johnson in this weekend’s edition of Stock World Weekly "I cannot say this clearly enough… This is not mill buying, mills CANNOT buy at these prices. If mills are not driving the price demand, this leaves only speculators as a source." How sick is that? They have pushed cotton prices to the point where the mills can’t afford to use it – yet the speculators STILL think they can make money on it. Can they be that dumb?

Of course they can! Oil speculators think we can afford $100 oil for a sustained period of time even though, just two years ago, it was a proximate cause for the collapse of the entire global economy. Cotton got real this week, falling from $210 to $170 (19%) since Friday – limit down two days in a row and they haven’t even come CLOSE to filling the volume of suckers that bought in since the middle of January. Once again we see my "Roach Motel Theory" of commodity trading proving out as speculators check in – but they can’t check out!

Of course they can! Oil speculators think we can afford $100 oil for a sustained period of time even though, just two years ago, it was a proximate cause for the collapse of the entire global economy. Cotton got real this week, falling from $210 to $170 (19%) since Friday – limit down two days in a row and they haven’t even come CLOSE to filling the volume of suckers that bought in since the middle of January. Once again we see my "Roach Motel Theory" of commodity trading proving out as speculators check in – but they can’t check out!

Speaking of roaches: Qaddafi (there are so many ways to spell it!) has vowed to fight a growing rebellion until his “last drop of blood,” as parts of the capital of Tripoli resembled a war zone and some of his followers and troops defected to the opposition. In Tripoli, bodies were left in the streets after an attack on protesters by pro-Qaddafi gunmen, the opposition National Front for the Salvation of Libya said. In the eastern city of Benghazi, where the protests began, the flag of the constitutional monarchy overthrown by Qaddafi in 1969 flew on streets and over several buildings and there were no security forces in evidence except traffic police, witnesses said. “In my opinion, the regime is over,” former Interior Minister Abdel Fattah Younes, one of those who defected, said on Al Arabiya television. “Most of the towns and tribes have said they back the revolution,” he said, while urging the Libyan army to join the rebellion.

This is why we got out of our short position on XLE – too scary with all this stuff going on but it will be a great trade again when it’s over, as will OIH shorts, as they got silly at $165 as well. Not yet though – China’s got their own "Jasmine" Revolution in progress but, shhhhhh – it doesn’t fit in with CNBC’s BUYBUYBUY oil premise so you won’t hear anything about it there. Also being played down is the American Revolution as labor finally finds a spine and begins to fight back. I don’t think many Conservatives have any idea that the Wisconsin unions gave in to EVERY single demand made by the Governor (to fund his $67M Corporate Tax Cut no less!) EXCEPT his demand to break up the union and THAT is what this is all about – Union Busting – pure and simple, good old-fashioned Union Busting as we spiral towards Third World America:

Steve Colbert was also very funny (and you have to laugh because it’s so sad), interviewing one of the runaway Democrats on his show. Just like the rampant spread of Democracy in the Middle East that we support, the rampant spread of workers rights in American must be crushed immediately. Now protests are breaking our in Indiana and Ohio as well. They are, of course, no Libya – with just 19M people between them. And, of course, they have no oil – so we can pretty much ignore the whiny US lower-class workers, who need to just shut up and consume, right? If these people would just stop marching around and get their law degrees, they could be making $1,250 an hour in no time!

$1,250 means a lawyer working just 40 hours can make $50,000 or 66% more than the average Wisconsin protester makes in a year ($30,000). Why don’t these people JUST GET BETTER JOBS? Stop teaching and putting out fires and go earn some real money people. I’m sure there are plenty of spare people at McDonald’s or KFC who can stop by between shifts and teach your kids for $576 a week.

$1,250 means a lawyer working just 40 hours can make $50,000 or 66% more than the average Wisconsin protester makes in a year ($30,000). Why don’t these people JUST GET BETTER JOBS? Stop teaching and putting out fires and go earn some real money people. I’m sure there are plenty of spare people at McDonald’s or KFC who can stop by between shifts and teach your kids for $576 a week.

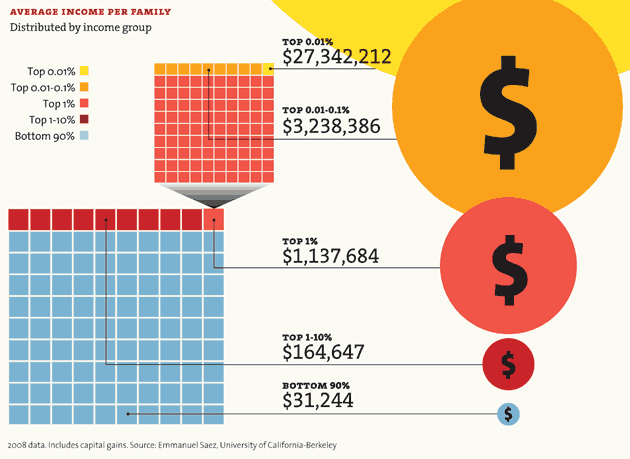

The chart on the right is from a great article called "How Rich are the Super-Rich?" and (spoiler alert) it seems like they are pretty freakin’ rich. To put it into perspective, our lawyer friend, even making $1,250 an hour won’t even crack to the top 0.1% (one in 1,000 Americans) unless he puts in a lot of overtime with his paltry $2.6M annual salary. Hell, the top 0.01% pay that much in fees at the club! No, it’s not exclusive – they’ll let anyone in who can pay the dues. This is, after all, a Democracy…

Speaking of Democracy – you’ll be glad to know that the median net worth of a US Congressman is $912,000, about 10 times the median net worth of the average American family. That is the House of Congress that is supposed to be representing the people! The top 10 Senators have a combined net worth of $2.8Bn and ALL of them voted to extend the Bush tax cuts. Perhaps this explains how THIS happened to America since the Reagan Revolution planted all these rich jackasses in power:

As you know, my pet peeve isn’t that the rich get richer (we just got richer yesterday!) but that the Corporations don’t pay their fair share of taxes – causing our entire deficit. Of course, that’s not how the brain-washed public that is taught by $30,000 teachers sees it because those same Corporations wash, rinse and repeat on our brains at a rate that commands, by the age of 30, 1,000% more of the average citizen’s time and attention than their entire academic careers. George Orwell never imagined that a society would develop that would WILLINGLY make television the dominant feature of their homes and would WILLINGLY leave it on virtually all day long to feed them an endless stream of Corporate Propaganda to the point where even this doesn’t make them get out of their chairs and riot:

Think about it.

Please…