I love the Berkshire Hathaway annual report!

I love the Berkshire Hathaway annual report!

Especially Warren Buffett’s letter to shareholders. The report gives us a great view of the overall economy from a man who has his finger in every pot and his letter to investors gives us a very good insight as to how things are going in the various sectors his operations cover. Most importantly, what I have learned in my own 40 years or reading Mr. Buffett’s reports (my Grandfather was a shareholder) is what should shape any long-term investing strategy: Patience and performance.

I often preach to members the joys of letting gains compound and our $25,000-$100,000 Virtual Portfolio, which is currently at $27,531 (up 10%) after 4 weeks, is an exercise in how to quickly compound small gains over the course of a year. Primarily, we try to follow Warren Buffett’s Number One Rule of Investing, which is: Don’t Lose Money. Buffett’s Rule #2 is: See Rule #1 and like us, it’s not that nothing Warren Buffett ever buys loses money – it’s just that he doesn’t ever buy things he isn’t willing to stick with UNTIL they make money. Sure we take a few losses along the road but, by being selective in our entries, we don’t discard stocks that we carefully selected just because the market temporarily disagrees with our valuations.

In our $25,000 Virtual Portfolio, it’s only been a month so we’ve only closed our winners so far and they were SPWRA with a 100% gain (these are option trades), INTC with a 40% gain, NFLX with a 42% gain, EDZ with a 75% gain, XLF with a 15% gain, VIX with a 50% gain, USO with a 53% gain and XLE with a 5% gain. In 19 trading day we have made 28 virtual portfolio moves (counting each leg) and, as I said, netted a 10% return to date. Interestingly, we’ve been playing it very cautious as we still have over $18,000 of virtual cash on the sidelines, hoping for a sign to get a little more aggressive next week.

In our $25,000 Virtual Portfolio, it’s only been a month so we’ve only closed our winners so far and they were SPWRA with a 100% gain (these are option trades), INTC with a 40% gain, NFLX with a 42% gain, EDZ with a 75% gain, XLF with a 15% gain, VIX with a 50% gain, USO with a 53% gain and XLE with a 5% gain. In 19 trading day we have made 28 virtual portfolio moves (counting each leg) and, as I said, netted a 10% return to date. Interestingly, we’ve been playing it very cautious as we still have over $18,000 of virtual cash on the sidelines, hoping for a sign to get a little more aggressive next week.

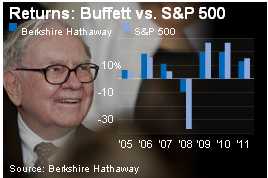

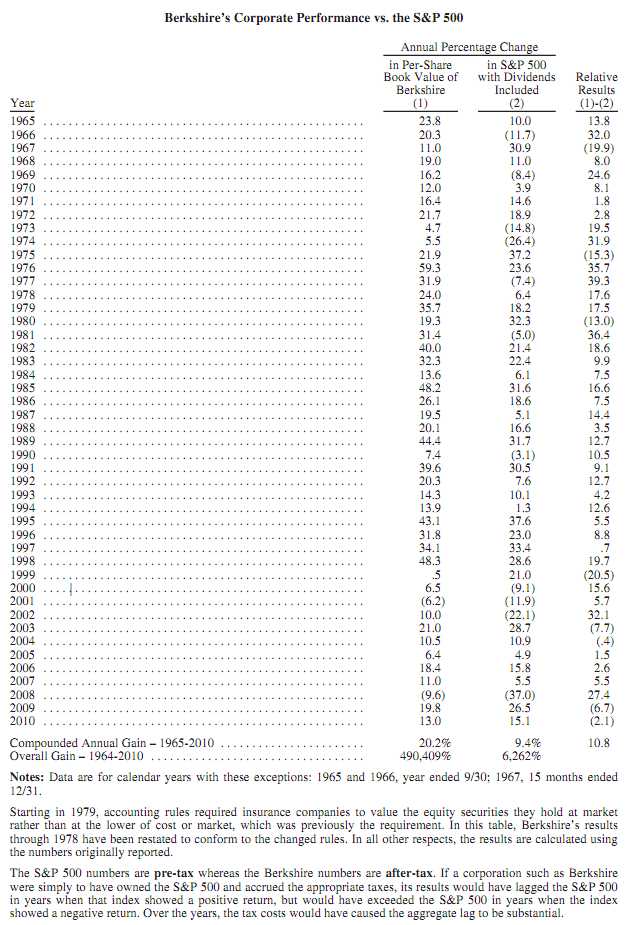

How, you may wonder, are we going to get to $100,000 by December with just $27,531 in February? THAT is the lesson Warren Buffett has to give us and that lesson is COMPOUNDING RETURNS! Since 1965, Berkshire Hathaway has returned an overall gain of 490,409% to it’s shareholders. $10,000 handed to Mr. Buffett in 1965 is worth $49M today – that’s enough to keep you ahead of inflation! Figure in 1965 a car was $1,500 and house was $20,000 so maybe $49M is worth an inflation-adjusted $4.5M. That’s still a very nice return on your investment, right?

Did Warren Buffett make this money swinging for the fences? Not at all. IN 45 years, Berkshire only returned more than 20% half the time (22). Like we do, Warren Buffet aims to make 20% a year – anything above that is just gravy. By not swinging for the fences, Buffett accomplishes something very few investors do – he does not strike out. In those same 45 years, Berkshire has only had 2 losses. One of those years was 2008 and the other was 2001 – both very tough years for the markets.

See what 20% a year can do for you? The hardest thing I try to do with new members is get them to let go of greed. Greed kills. Greed is not good – despite what you may have heard. Sure we have fun with big, quick gains but the bulk of a good virtual portfolio is based on well-hedged, long-term positions that make our (and Mr. Buffett’s) goal of a nice, steady, 20% annual return (see our Educational series on "Smart Virtual Portfolio Management". It’s very difficult, of course, because a person with $10,000 to invest, is not very happy with making $2,000 their first year and it’s very hard to see that that $2,000 is the first of 45 steps to $49,000,000.

Fortunately, last year, we were able to take advantage of the crazy market run and our $10,000 virtual portfolio hit a virtual $36,000 at the year’s end. We had, in fact, done so well that we stopped playing in the middle of the year with $25,000 as we made the money so fast it was no longer palatable to risk it but, by popular demand, we went for a double into the holidays but came up short at $36,000. Still, it was good enough to give us an excuse to go for the gold this year and thus, our $25,000-$100,000 Virtual Portfolio was born with the goal of doing each month what Berkshire manages to do each year and compound a 15% monthly average return into a 300% gain for the year (try it on the calculator – it’s fun AND educational).

Fortunately, last year, we were able to take advantage of the crazy market run and our $10,000 virtual portfolio hit a virtual $36,000 at the year’s end. We had, in fact, done so well that we stopped playing in the middle of the year with $25,000 as we made the money so fast it was no longer palatable to risk it but, by popular demand, we went for a double into the holidays but came up short at $36,000. Still, it was good enough to give us an excuse to go for the gold this year and thus, our $25,000-$100,000 Virtual Portfolio was born with the goal of doing each month what Berkshire manages to do each year and compound a 15% monthly average return into a 300% gain for the year (try it on the calculator – it’s fun AND educational).

I say again and again and again how important it is to take those 20% profits off the table. If you ALWAYS protect a 20% gain and you ALWAYS stop at a 20% loss then you need to be 50/50 in your picks to break even. If you balance you virtual portfolio bullish and bearish then the chance of that happening is strong. Now, if just one out of 100 trades you make gives you a double and 4 give you 60% gains and 8 give you 40% gains and then you have 37 20% winners and 50 20% losers but your 1 100% winner wipes out 5 losers and your 2 60% winners wipe out 6 losers and your 8 40% winners wipe out 16 losers leaving you with just 15 20% losers against those 37 20% winners.

If you allocated $1,000 to each position, that would be a profit of $4,400 in 100 trades. As you can see – that’s the strategy we’re pursuing with our $25,000 virtual portfolio – make a little bit of money as often as possible. As long as we make sure we keep our losses in line, our winners will take care of the rest! Warren Buffett always says his single biggest investing mistake was his first. He acquired Berkshire Hathaway as a struggling shirt-manufacturing company in 1965 thinking he could turn it around. The textile business was being outsourced at the time and there was no saving it. Rather than go down with the ship, Buffett completely remade the company into what it is today. There is a book about this called "The Buffett Way" that’s a very good read.

Meanwhile, according to Buffet’s 2010 report: "The per-share book value of both our Class A and Class B stock increased by 13% in 2010. Over the last 46 years (that is, since present management took over), book value has grown from $19 to $95,453, a rate of 20.2% compounded annually." The company spent $22Bn of it’s sidelined cash to acquire Burlington Northern Santa Fe and it’s already increasing Berkshire’s normal earning power by over 30% after-tax. This is why we hold a lot of sideline cash in an uncertain market – we wait for a REALLY good opportunity to present itself.

Meanwhile, according to Buffet’s 2010 report: "The per-share book value of both our Class A and Class B stock increased by 13% in 2010. Over the last 46 years (that is, since present management took over), book value has grown from $19 to $95,453, a rate of 20.2% compounded annually." The company spent $22Bn of it’s sidelined cash to acquire Burlington Northern Santa Fe and it’s already increasing Berkshire’s normal earning power by over 30% after-tax. This is why we hold a lot of sideline cash in an uncertain market – we wait for a REALLY good opportunity to present itself.

Buffett sees 2011 as a year free of a mega-catastrophe in his insurance segment and "a general business climate somewhat better than that of 2010 but weaker than that of 2005 or 2006." The company plans on spending 33% more on property and equipment this year ($8Bn total) and ALL of it in the United States – where Mr. Buffett still sees good value but, like us, takes a cautious approach, saying: "Money will always flow toward opportunity, and there is an abundance of that in America. Commentators today often talk of “great uncertainty.” But think back, for example, to December 6, 1941, October 18, 1987 and September 10, 2001. No matter how serene today may be, tomorrow is always uncertain." However, Buffet goes on to say:

Don’t let that reality spook you. Throughout my lifetime, politicians and pundits have constantly moaned about terrifying problems facing America. Yet our citizens now live an astonishing six times better than when I was born. The prophets of doom have overlooked the all-important factor that is certain: Human potential is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and effective. We are not natively smarter than we were when our country was founded nor do we work harder. But look around you and see a world beyond the dreams of any colonial citizen. Now, as in 1776, 1861, 1932 and 1941, America’s best days lie ahead.

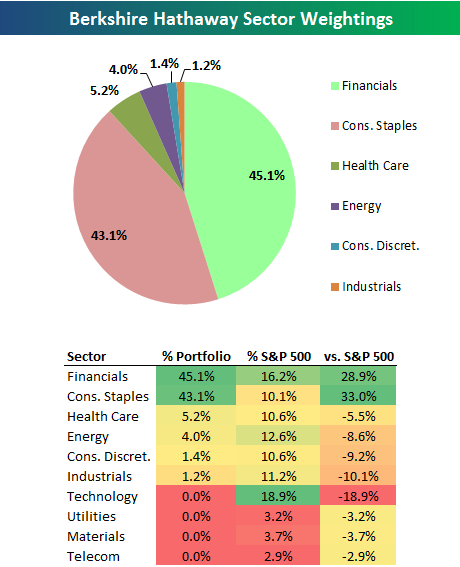

That’s the view of one of America’s wealthiest men, a man who built his fortune SLOWLY by acquiring stocks in good companies and holding them a long, long time! Berkshire currently has $158Bn of stocks, bonds and cash equivalents as well as $66Bn of "insurance float," which are not counted as an asset but are reserves they ultimately get to keep as long as the premiums the receive net out to equal insurance losses and expenses they pay out.

That’s the view of one of America’s wealthiest men, a man who built his fortune SLOWLY by acquiring stocks in good companies and holding them a long, long time! Berkshire currently has $158Bn of stocks, bonds and cash equivalents as well as $66Bn of "insurance float," which are not counted as an asset but are reserves they ultimately get to keep as long as the premiums the receive net out to equal insurance losses and expenses they pay out.

Also not counted is Buffett’s $5Bn derivative bet that the S&P will not close below 700 on 8 rolling years beginning in 2018 – a wager (a short put!) that will pay out approximately $35Bn if correct. It may be the gift that keeps on giving for Berkshire, even after Buffett is gone. There are also Billions of Goldman Sachs warrants – another bet Buffett was able to make by keeping his cash sidelined until there was a crisis where everything went on sale.

We like BRK.B (the optionable securities) at $84.87 a share. You can buy 100 shares for $8,487 and sell 1 2013 $80 call for $14 ($1,400) and 1 2013 $70 put for $5.40 ($540) and that is a net cost of $6,547 or $65.47 a share, which is a 22.55% discount off the current price. What’s the catch? Well if BRK.B finishes lower than $70 in Jan 2013, you will be forced to buy another 100 shares for $70, no matter what price the stock is. That would put you in 200 shares at an average cost of $67.74 or 20.1% below the current price.

Notice on this trade you make $14.53 (22.2%) on your $65.47 investment if BRK.B just holds $80 through Jan 2013. Of course we have strategies to roll and enhance the returns as the year rolls on but the key is to establish low entry points on long-term positions. While you may think making 11% a year is not sexy – don’t forget you make that 11% EVEN IF the stock falls 5% and you don’t lose a penny until the stock drops 20%. It’s only appropriate to buy Buffett’s own stock following Buffett’s own Rule #1: Don’t lose money!

Buying stocks at a 20% discount is the cornerstone to our long-term investing strategies which we refer to as a "buy/write" play and you can find the details in my article: "How to Buy a Stock for a 15-20% Discount." Selling index puts is another strategy Warren and I share in common – we used a short put on the S&P to offset the purchase of an aggressive SSO trade (ultra bullish on the S&P) in December 11th’s "Breakout Defense – 5,000% in 5 Trades or Less." In that trade, we were able to sell the SPX Jan 2011 $1,185 puts for $10 to fund the purchase of the SSO 2012 $30/42 bull call spread at $10.40 for a .40 cash entry on the $12 spread. The S&P was trading at 1,225 at the time and we did not think it was likely they would fall 40 points in 5 weeks. Obviously, the short puts expired worthless and left us with the spread at net .40 and no short margins! SSO has now run up to $52.95 and that spread went over $10 for a 2,500% gain and, of course, we moved on.

Buying stocks at a 20% discount is the cornerstone to our long-term investing strategies which we refer to as a "buy/write" play and you can find the details in my article: "How to Buy a Stock for a 15-20% Discount." Selling index puts is another strategy Warren and I share in common – we used a short put on the S&P to offset the purchase of an aggressive SSO trade (ultra bullish on the S&P) in December 11th’s "Breakout Defense – 5,000% in 5 Trades or Less." In that trade, we were able to sell the SPX Jan 2011 $1,185 puts for $10 to fund the purchase of the SSO 2012 $30/42 bull call spread at $10.40 for a .40 cash entry on the $12 spread. The S&P was trading at 1,225 at the time and we did not think it was likely they would fall 40 points in 5 weeks. Obviously, the short puts expired worthless and left us with the spread at net .40 and no short margins! SSO has now run up to $52.95 and that spread went over $10 for a 2,500% gain and, of course, we moved on.

A similar tactic can be used to get more aggressive with Berkshire’s stock by selling the Jan $80 puts for $5 to partially fund the purchase of the Jan $65/80 bull call spread at $11.60. That is net $6.60 on a $15 spread that is currently $14.87 in the money. At $85, the gain will be $8.40 or 127% in 10 months but this very much depends on your margin requirement, which should be about $17 (20% of the strike), which drops your return on cash margin ($23.60) to a still very nice 36% for the year. If you REALLY want to own BRK.B at $85.40, then the margin should not be an issue and, of course, the advantage is that your break-even is way down at $75.70 (10.8% off) and you make your 35% if Berkshire gains just 13 cents, rather than buying the stock at $84.87 and hoping it breaks $100.

This is a very Buffett way to invest. We have a conservative play that gets our foot in the door with a 20% discount and an 11% annual return and we have an aggressive play that pays us 36% in one year if the stock outperforms. Since the "penalty" for failing to hold $75.70 on the aggressive play is owning 100 shares at that price – we can combine 1 aggressive hedge with 2 of the long-term hedges and our very worst case would be owning 500 shares of BRK.B at an average of $69.33 each or 18.3% off the current price while a move up in Berkshire nets a bonus $840 (6.5%) against the $13,094 invested in the longer trade.

This is a very Buffett way to invest. We have a conservative play that gets our foot in the door with a 20% discount and an 11% annual return and we have an aggressive play that pays us 36% in one year if the stock outperforms. Since the "penalty" for failing to hold $75.70 on the aggressive play is owning 100 shares at that price – we can combine 1 aggressive hedge with 2 of the long-term hedges and our very worst case would be owning 500 shares of BRK.B at an average of $69.33 each or 18.3% off the current price while a move up in Berkshire nets a bonus $840 (6.5%) against the $13,094 invested in the longer trade.

In the Annual report, Buffett tells the story of how they acquired Geico, which began with his personal investment of $9,800 in 1951 but it wasn’t until the mid ’70’s when the stock ran into trouble and fell 95% that Berkshire jumped in, buying 1/3 of the troubled company when it’s price was the lowest it had been since his original investment 25 years earlier. Now that’s PATIENCE! Berkshire didn’t buy the other half of the company until 1996 making it, at 45 years, one of the slowest scaling into a full position moves I’ve ever seen…

That’s why I force my Members to watch "The Man Who Planted Trees." Patience is the hardest thing we have to teach investors and options investors are often the least patient of all yet the wealth effect you can generate by unlocking that leverage, CONSERVATIVELY, over time is probably the least understood aspect of investing – especially in a World where your "wealth managers" get paid based on the rate of your account churn. Of course "buy and hold is dead" – it doesn’t pay commissions and fees, does it?

Geico is another gem in the Berkshire virtual portfolio with an arguable Goodwill value of $14.3Bn (one year of customer premiums) that is valued at just $1.4Bn as it depreciates. Warren Buffett is not a guy that needs to shine up his books to impress investors (but he does take the time to mention their phone number and advise report readers to "check out their low rates"). Buffett is very pleased with his insurance sector and he should be – they have operated at an underwriting profit for 8 consecutive years while most insurance companies take a small loss (the goal is to increase your float – not to make money, per se). As Buffett so eloquently explains:

Geico is another gem in the Berkshire virtual portfolio with an arguable Goodwill value of $14.3Bn (one year of customer premiums) that is valued at just $1.4Bn as it depreciates. Warren Buffett is not a guy that needs to shine up his books to impress investors (but he does take the time to mention their phone number and advise report readers to "check out their low rates"). Buffett is very pleased with his insurance sector and he should be – they have operated at an underwriting profit for 8 consecutive years while most insurance companies take a small loss (the goal is to increase your float – not to make money, per se). As Buffett so eloquently explains:

I believe it likely that we will continue to underwrite profitably in most – though certainly not all – future years. If we accomplish that, our float will be better than cost-free. We will benefit just as we would if some party deposited $66 billion with us, paid us a fee for holding its money and then let us invest its funds for our own benefit.

I love the summary of the Manufacturing, Service and Retailing Operations:

This group of companies sells products ranging from lollipops to jet airplanes. Some of the businesses enjoy terrific economics, measured by earnings on unleveraged net tangible assets that run from 25% after-tax to more than 100%. Others produce good returns in the area of 12-20%. Unfortunately, a few have very poor returns, a result of some serious mistakes I have made in my job of capital allocation. These errors came about because I misjudged either the competitive strength of the business I was purchasing or the future economics of the industry in which it operated. I try to look out ten or twenty years when making an acquisition, but sometimes my eyesight has been poor.

Buffett is please with TTI – who distributes electronic components, Forest River – an RV and Boat manufacturer, CTB – a farm equipment maker, HH Brown – shoes and NetJets – which members were just discussing on Friday as getting hot again as our top 1% members are back to pricing out fractional ownerships to avoid those annoying airport lines – another sign that our part of the economy is certainly improving.

As we have noted in our readings of the Fed’s Beige Book and other reports and now confirmed by Buffett, the Home Construction Sector continues to be a disaster with Johns Manville, MiTek, Shaw and Acme Brick all falling on hard times, down over 2/3 from 2006 profit levels, even after 9,400 combined lay-offs. The Finance and Financial Products segment also has similar issues for the same reason. The Oracle of Omaha does see a probably housing recovery "within a year or so" and "certainly at some point." Man, I wish I could get paid for that kind of vagueness!

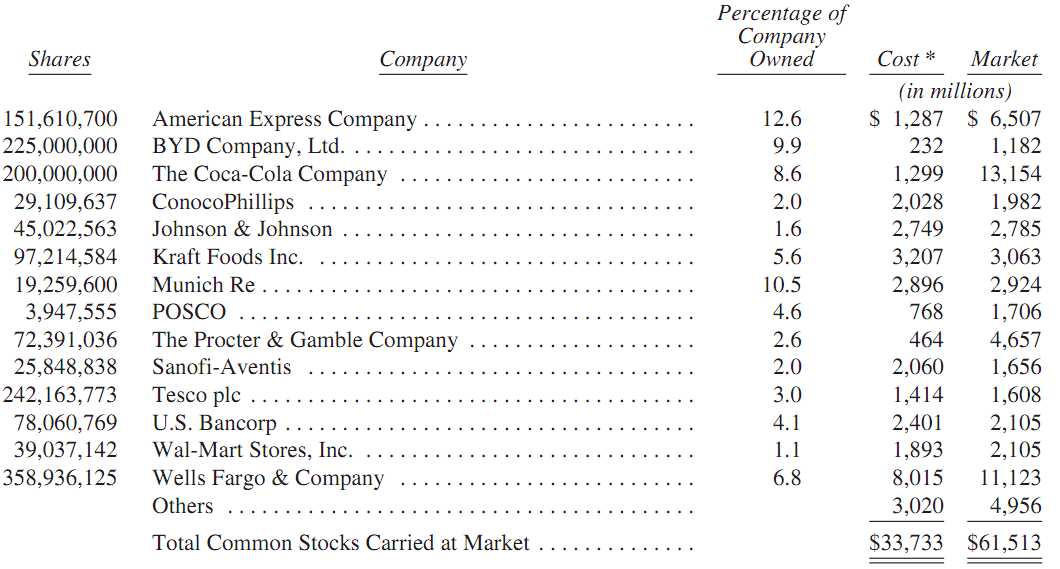

Berkshire is not as worried about the utility business as we are and discusses MidAmerican Energy in the same section as Burlington Northern and looks forward to growth from both. I was of the impression that a major reason Berkshire acquired BNSF was for the rail right of ways themselves, which will be crucial (and valuable) in laying the foundation for the Government’s eventual (we hope) investment into high-speed rail lines but there is no hint of it here. The stock investment virtual portfolio of Berkshire stands as follows:

Swiss Re redeemed Berkshire’s note early this year and Buffett expects both GE and GS to do the same – paying the company a total of $1.4Bn in premiums for the early exit. As Buffett says: "Goldman Sachs has the right to call our preferred on 30 days notice, but has been held back by the Federal Reserve (bless it!), which unfortunately will likely give Goldman the green light before long." Despite the BNI acquisition, the company is still sitting on $38Bn in cash with $10Bn coming back from GS and GE expected. They also expect WFC to reinstate dividends soon and perhaps we should all consider them for a long-term investment on that basis.

KO is mentioned as a favorite holding for pretty much the same reasons I pointed out when I interviewed CEO, Muhtar Kent in October. An increase in KO dividends will make Warren and I very happy indeed! Todd Combs beat me out to replace Lou Simpson as Berkshire’s investment manager and will get a salary plus a contingent payment based on his performance relative to the S&P (my favorite kind!).

KO is mentioned as a favorite holding for pretty much the same reasons I pointed out when I interviewed CEO, Muhtar Kent in October. An increase in KO dividends will make Warren and I very happy indeed! Todd Combs beat me out to replace Lou Simpson as Berkshire’s investment manager and will get a salary plus a contingent payment based on his performance relative to the S&P (my favorite kind!).

He’s "only" being given $1-3Bn of funds to start with but that’s the amount they expect him to deploy each year as they build towards the next decade’s $33Bn worth of investments. I didn’t care about the money, I just wanted to spend a couple of years sitting at a desk discussing investment ideas with Warren – you don’t have to pay me for that gig but, as Buffett said: "Our goal was to find a 2-year-old Secretariat, not a 10-year-old Seabiscuit."

I think one of my favorite parts of the current report is the semi-confessional section: "On Reporting and Misreporting: The Numbers That Count and Those That Don’t" in which the wizard himself pulls back the curtain on one of Wall Street’s dirtiest little secrets:

Let’s focus here on a number we omitted, but which many in the media feature above all others: net income. Important though that number may be at most companies, it is almost always meaningless at Berkshire. Regardless of how our businesses might be doing, Charlie and I could – quite legally – cause net income in any given period to be almost any number we would like.

We have that flexibility because realized gains or losses on investments go into the net income figure, whereas unrealized gains (and, in most cases, losses) are excluded. For example, imagine that Berkshire had a $10 billion increase in unrealized gains in a given year and concurrently had $1 billion of realized losses. Our net income – which would count only the loss – would be reported as less than our operating income. If we had meanwhile realized gains in the previous year, headlines might proclaim that our earnings were down X% when, in reality, our business might be much improved. If we really thought net income important, we could regularly feed realized gains into it simply because we have a huge amount of unrealized gains upon which to draw.

Another place Buffett and I agree is on the mis-use of Black-Scholes calculations to determine the value of long-dated options. As Buffet says (going back to our SPX example above): "We put our money where our mouth was by entering into our equity put contracts. By doing so, we implicitly asserted that the Black-Scholes calculations used by our counterparties or their customers were faulty. We continue, nevertheless, to use that formula in presenting our financial statements. Black-Scholes is the accepted standard for option valuation – almost all leading business schools teach it – and we would be accused of shoddy accounting if we deviated from it."

I closing, you don’t want to hear from me but from the guy I would work for for free. His additional advice to shareholders is:

Part of the appeal of Black-Scholes to auditors and regulators is that it produces a precise number. Charlie and I can’t supply one of those. We believe the true liability of our contracts to be far lower than that calculated by Black-Scholes, but we can’t come up with an exact figure – anymore than we can come up with a precise value for GEICO, BNSF, or for Berkshire Hathaway itself. Our inability to pinpoint a number doesn’t bother us: We would rather be approximately right than precisely wrong.

John Kenneth Galbraith once slyly observed that economists were most economical with ideas: They made the ones learned in graduate school last a lifetime. University finance departments often behave similarly. Witness the tenacity with which almost all clung to the theory of efficient markets throughout the 1970s and 1980s, dismissively calling powerful facts that refuted it “anomalies.” (I always love explanations of that kind: The Flat Earth Society probably views a ship’s circling of the globe as an annoying, but inconsequential, anomaly.)

Unquestionably, some people have become very rich through the use of borrowed money. However, that’s also been a way to get very poor. When leverage works, it magnifies your gains. Your spouse thinks you’re clever, and your neighbors get envious. But leverage is addictive. Once having profited from its wonders, very few people retreat to more conservative practices. And as we all learned in third grade – and some relearned in 2008 – any series of positive numbers, however impressive the numbers may be, evaporates when multiplied by a single zero. History tells us that leverage all too often produces zeroes, even when it is employed by very smart people.

At Berkshire, we have taken his $1,000 solution (his Uncle’s advice to always have ready cash) a bit further and have pledged that we will hold at least $10 billion of cash, excluding that held at our regulated utility and railroad businesses. Because of that commitment, we customarily keep at least $20 billion on hand so that we can both withstand unprecedented insurance losses (our largest to date having been about $3 billion from Katrina, the insurance industry’s most expensive catastrophe) and quickly seize acquisition or investment opportunities, even during times of financial turmoil.

The annual meeting will be held on Saturday, April 30th Carrie Kizer from our home office will be the . ringmaster, and her theme this year is Planes, Trains and Automobiles. This gives NetJets, BNSF and BYD a chance to show off.

If you’ve never been to a Berkshire meeting – spend $85, buy a share and GO! They call it Woodstock for Capitalists for a reason – it’s not just the meeting, it’s who you can meet in Omaha on a spring weekend while lining up at the various kiosks set up to show off Berkshire’s diversified holdings.