Here’s the latest edition of Stock World Weekly: Irresistible Forces Meet Immovable Objects. – Ilene

Excerpt:

On Saturday, February 27, the Security Council of the United Nations (UN) voted unanimously to institute sanctions on Libya, including travel bans and freezing the assets of Muammar al-Gaddafi and others associated with his regime. Protests have dragged into their twelfth day, and protestors refuse to yield in the face of utterly horrific retaliation by Gaddafi’s loyal forces. U.S. ambassador to the UN, Susan Rice said, “When atrocities are committed against innocents, the international community must act with one voice – and tonight it has.”

The Telegraph reported over the weekend that Gaddafi apparently made good on his threats to trigger a civil war, using irregular forces largely composed of hired mercenaries to launch a counterattack against protesters. “Anywhere we go there is danger,” said one woman, a 28-year-old mother of four who asked not to be named. “All we want is food and fresh water for our children but it is impossible to find. Security is the only concern of the authorities.”

An accurate report of the death toll is impossible to obtain at this time, but on Wednesday, Italy’s Foreign Minister, Franco Frattini said, “We believe that the estimates of about 1,000 are credible.” The situation in Libya has deteriorated since then. Multiple stories coming in from all over the country have cited dozens to hundreds of casualties in each city. It appears that Libya has slipped into the abyss of complete social breakdown and civil war.

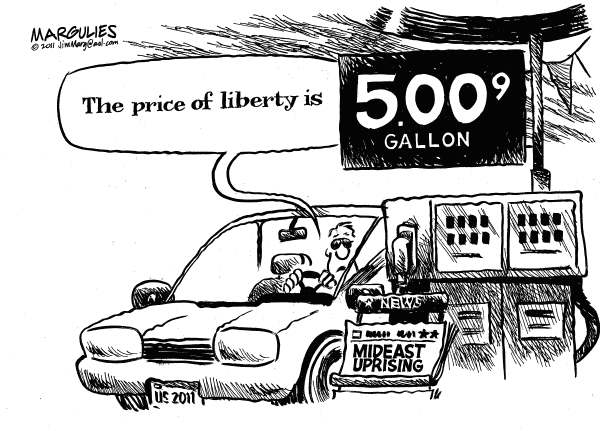

This is just one example of the tide of popular unrest that has been unleashed in the wake of the Federal Reserve’s and other central banks’ inflationary policies. The chart below shows the U.S. Adjusted Monetary Base increasing from $1.75Tn in 2009, to $2.0Tn in 2010, and now nearing $2.3Tn, an increase of $300Bn in just two months! This represents an increase of 35% in less than 18 months. (The U.S. Monetary Base is the total amount of currency that is circulating in the hands of the public or in the commercial bank deposits held in reserves of member banks of the Federal Reserve System.)

Another revolt of a more peaceful nature took place in Ireland. The long-dominant Fianna Fail party was brutally rejected by Irish voters, taking just 15.1% of the vote and losing 58 seats in Parliament. Opposition party Fine Gael won 36% of the vote, and is expected to form a coalition government with Labour, their traditional partner and winner of 20.5% of the vote. Leaders of both Fine Gael and Labour have both promised that they will renegotiate the EU-IMF austerity program and force financial investors to shoulder some of the bank debts that are currently being paid by taxpayers.

Meanwhile, in the United States, conflict between public labor and Republican leaders is now spreading in the wake of a standoff between Wisconsin public Union members and Republican Governor Scott Walker. Protestors in other states are demonstrating in sympathy. Thousands of people marched in support of Wisconsin’s Union protestors in Indiana and Ohio. In Ohio, so many Union activists arrived at the Statehouse that police locked the doors.

In these stories and more, there is a common theme being expressed. All over the world, in countries as far apart and diverse as Egypt and Vietnam, Ireland and Libya, Bahrain and the United States, people are standing up and saying “No more concessions, no more cutbacks, no more bailouts, no more austerity, no more!”

Read the Stock World Weekly Newsletter to find out what biotech Pharmboy likes as a long position, and what stock Scott at Sabrient thinks is still a good short.