Flat futures this morning.

Isn't that special? The futures were off a bit very early this morning but the dollar fell below 77 and cheered them right up. Oil is looking like it will be around $98 this morning and gold is flat to Friday at $1,411 with silver at $33.50 and copper at $4.47 – just the normal noises in here, it seems. Tomorrow, of course, is March first and, as we all know, the first day of the month is THE BEST day to go long. 12 of the last 14 first day's of the month have been up days with the S&P gaining 17% on the first day of the month (Feb 1 not on this chart) and just 1.4% on all the rest of the day's combined!

So, miss the first day and miss out on the rally is a bit of an understatement, isn't it? In 2010 alone, the first trading day accounted for 123 of the 134 points the S&P gained. Essentially, the market traded flat the other 200-plus trading days. “Maybe it’s on that first day of the month that the Fed comes in and does its buying,” observed David Rosenberg, economist and strategist at Gluskin Sheff in Toronto. Whether it's more Fed manipulation or just 401K money pouring in on the adjustment periods – the first day of the month has been as reliable as buying the F'ing dips as an investing strategy and we stick with it until it doesn't work anymore, right?

February was a real classic with the S&P flying up from 1,276.34 on Jan 31st to 1,307.59 (2.44%) on Feb 1st and then went the next 23 days (through last Thursday) to get to 1,306.10. Friday, however, was a bit out of character with a huge bump back to 1,319.88 (up 1%) and this morning it looks like all stops are being pulled to give us a good February print with (according to Stock World Weekly – who knows all this stuff) another $7Bn of Federal Reserve funny money tee'd up for this morning's pump job. At 11:10 on Friday the Fed bought $7.24Bn of Treasuries from their pet IBanks, giving them back $65Bn in leverage which they used to bludgeon the bears into the close:

.jpg)

We did not take advantage of it as we were concerned about the Middle east going into the weekend and we were worried we might have already gotten too bullish with our dip buying spree into last week's sell-off. How silly of us, right? Of course the fact that Libya is getting worse or that China lowered their growth target or that the Saudi Stock market plunged 5% or that BAC, C and WFC are facing Billions in fines or that Roger Ailes is finally being indicted (allegedly!) or that the Governor of Wisconsin has been outed as nothing more than a lackey for the Koch Brothers or that Chinese Bank shares are collapsing under inflation pressures or that gasoline prices are up 17 cents (2%) in a week (but Bernanke will testify that there is no inflation to both Houses of Congress this week) or… Well, you get the idea – IT JUST DOESN'T MATTER!

Just look how healthy our economy is! (Chart above by Doug Short.) How can you deny the evidence of the greatest stock market recovery in history? Not by a little, ether – we are just blowing the doors off all previous market recoveries and, if anything, the gains are accelerating as all Americans share in our great recovery DEPSITE, mind you, the terrible, TERRIBLE handling of the economy by the Obama administration. That's right, you CAN have it both ways – I learned that watching Fox this weekend, where I also learned our government will shut down on Friday because Democrats secretly want it to happen.

Australia's Warwick McKibbin is the latest Central Banker to warn that global commodity prices are now in a bubble that "is shaping to be much bigger than 2004 to 2007." The RBA holds its monthly policy meeting tomorrow and is expected to keep the official cash rate on hold at 4.75 per cent, following the surge in oil prices after a week of political instability in North Africa and the Middle East. A bigger bubble you say? Cool – where can we invest? See – we are really getting the hang of this insane market now…

Australia's Warwick McKibbin is the latest Central Banker to warn that global commodity prices are now in a bubble that "is shaping to be much bigger than 2004 to 2007." The RBA holds its monthly policy meeting tomorrow and is expected to keep the official cash rate on hold at 4.75 per cent, following the surge in oil prices after a week of political instability in North Africa and the Middle East. A bigger bubble you say? Cool – where can we invest? See – we are really getting the hang of this insane market now…

Even Bernie Madoff is disgusted by the nonsense going on in the stock markets as he tells New York Magazine this weekend that the entire Government-run stock market is nothing more than a giant Ponzi scheme: "The whole new regulatory reform is a joke," Madoff said during a telephone interview with New York magazine in which he discussed his disdain for the financial industry and for its regulators. He also accused banks and hedge funds of being "complicit" in his Ponzi scheme to fleece people out of billions of dollars.

The front man in the Government shell game, Ben Bernanke, will address both houses of Congress this week in two days of testimony that used to be know as "Humphrey-Hawkins" but, since the 1978 act that requires the Chairman of the Federal Reserve to report to Congress was actually called the "Humphrey-Hawkins Full Employment Act" which "explicitly instructs the nation to strive toward four ultimate goals: full employment, growth in production, price stability, and balance of trade and budget" – the less attention drawn to it the better or some might get the impression that this entire charade is a total farce or something.

-

Explicitly states that the federal government will rely primarily on private enterprise to achieve the four goals.

Explicitly states that the federal government will rely primarily on private enterprise to achieve the four goals.

- Instructs the government to take reasonable means to balance the budget.

- Instructs the government to establish a balance of trade, i.e., to avoid trade surpluses or deficits.

- Mandates the Board of Governors of the Federal Reserve to establish a monetary policy that maintains long-run growth, minimizes inflation, and promotes price stability.

- Instructs the Board of Governors of the Federal Reserve to transmit an Monetary Policy Report to the Congress twice a year outlining its monetary policy.

- Requires the President to set numerical goals for the economy of the next fiscal year in the Economic Report of the Presidentand to suggest policies that will achieve these goals.

- Requires the Chairman of the Federal Reserve to connect the monetary policy with the Presidential economic policy.

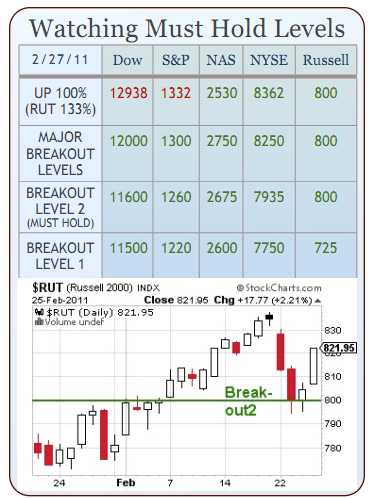

Not that it matters anyway. We're only focused on whether or not we hit our index goals this week – especially that S&P 1,332, which we've been over before so no sense in being shy about it now if the market is genuinely bullish. The same now goes for $100 oil, $4.65 copper, $34 silver and $1,430 gold. If this is a real 1999, 2007-style rally, why should we not be BUYBUYBUYing at the top? Why should we not commit more and more capital to buy less and less stocks and commodities in a mass-orgy of dollar destruction as we celebrate the Federal Reserve's total mandate failure along with our inept or corrupt (does it matter which?) Congress.

Not that it matters anyway. We're only focused on whether or not we hit our index goals this week – especially that S&P 1,332, which we've been over before so no sense in being shy about it now if the market is genuinely bullish. The same now goes for $100 oil, $4.65 copper, $34 silver and $1,430 gold. If this is a real 1999, 2007-style rally, why should we not be BUYBUYBUYing at the top? Why should we not commit more and more capital to buy less and less stocks and commodities in a mass-orgy of dollar destruction as we celebrate the Federal Reserve's total mandate failure along with our inept or corrupt (does it matter which?) Congress.