Wheeeee – this is fun!

Wheeeee – this is fun!

I do so love it when a plan comes together and our plan in yesterday’s Morning Alert to Members at 9:55 was to pick up the DIA March $120.75 puts for .90 into the silly and very fake-looking "rally" and, as you can see, we had a very easy time getting in below our target and those puts took off like a rocket, giving us a huge win by lunch.

That gave us a very nice start to our trading week and we took trades on both sides of the aisle during the rest of the day including a short play on oil at $106 as I decided $105 was going to be tough to hold due to a combination of "fear exhaustion" and the fact that our crack team of overseas analysts have determined that Qaddafi can’t last and the only people who don’t know that are Qaddafi and the idiots pumping oil on CNBC.

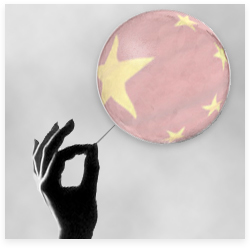

Still, for the most part, it was a watching and waiting kind of day although we did take the opportunity to adjust our $25,000 Virtual Portfolio, trying to lock down our $29,961 cash position by getting our unrealized gains and losses to cancel each other out. We did hold on to our EDZ hedges as they are for April and Fitch did just say that China faces a 60% risk of a bank crisis by 2013. "Fitch sees a risk of “holes in bank balance sheets” should a property bubble burst," according to Director Richard Fox. This same indicator used by Fitch correctly predicted both Iceland and Ireland’s crises well in advance (but nobody ever listens).

Bloomberg reports that events on the streets of Beijing offer a timely reality check. There, economists can find ample evidence that China may be approaching the limits of its ability to grow sustainably. Inflation is among the forces unnerving the masses, a phenomenon not unlike the one inspiring uprisings in the Middle East. The economy may be at a dangerous turning point, one where jumps in asset and consumer prices derail an impressive run. It doesn’t mean China is about to crash. It does mean that the time for taking its boom for granted is over.

Bloomberg reports that events on the streets of Beijing offer a timely reality check. There, economists can find ample evidence that China may be approaching the limits of its ability to grow sustainably. Inflation is among the forces unnerving the masses, a phenomenon not unlike the one inspiring uprisings in the Middle East. The economy may be at a dangerous turning point, one where jumps in asset and consumer prices derail an impressive run. It doesn’t mean China is about to crash. It does mean that the time for taking its boom for granted is over.

So China is clearly at the breaking point and our play is that either oil fails to hold $105 or China begins to fall apart – a fairly straightforward premise. Meanwhile, we had no trouble at all finding counterparties for our oil shorts as Large noncommercial speculators – firms that play the futures markets without taking delivery – added to their long position in West Texas Intermediate crude by 50,200 contracts last week, according to Commodity Futures Trading Commission data.

"It does not get any clearer which way Wall Street is trying to take oil," says Stephen Schork. The Schork Report notes that speculators now own nearly six times as many barrels of oil – 268,622 futures contracts representing nearly 269 million barrels – as can be stored at the WTI trading hub in Cushing, Okla. And since the CFTC numbers released Friday only go through last Tuesday, they likely underestimate the degree of speculative fervor building in the energy markets.

Olivier Jakob, who covers energy markets for Petromatrix in Zug, Switzerland, estimates that traders added 40,000 to 50,000 crude contracts (1,000 barrels per contract) to their long positions in the second half of last week. That would take them up to seven times the Cushing capacity, a level he calls "extraordinary." The speculative fervor is so remarkable that the big trading firms now have nearly twice as many long contracts open as they did in 2008, when oil spiked to $147 in the summer, a development that either foreshadowed or caused the global economic meltdown, depending on how you look at it.

Olivier Jakob, who covers energy markets for Petromatrix in Zug, Switzerland, estimates that traders added 40,000 to 50,000 crude contracts (1,000 barrels per contract) to their long positions in the second half of last week. That would take them up to seven times the Cushing capacity, a level he calls "extraordinary." The speculative fervor is so remarkable that the big trading firms now have nearly twice as many long contracts open as they did in 2008, when oil spiked to $147 in the summer, a development that either foreshadowed or caused the global economic meltdown, depending on how you look at it.

Another thing that helped to cause the 2008 credit crisis that we are celebrating this Crashiversary week was the unregulated swaps market. The CTFC has been trying to work with the SEC to tighten regulations but CTFC Commissioner Jill Sommers (who just happens to be a Republican) has, according to some, been sabotaging the efforts while, at the same time (and what a huge coincidence this is), Republicans in the house of Representatives (doing The People’s business, I am sure) voted to CUT funding to the CTFC by 1/3 and to strip another $25M from the SEC’s budget.

According to the Financial Times (who are not on the payola list for US energy interests so this may be just sour grapes):

Squeezing two of the most important regulators jeopardises the progress made in creating a safer financial system. Too much regulation did not cause the financial crisis. In the last decade, the SEC and CFTC have anyway been stretched. Over that time, the industry’s complexity and size have grown.

Technology has also changed the way markets operate, and regulators are as yet inadequately equipped with tools to monitor that change. Even if the remit of these two bodies had not expanded, therefore, to cut their budgets would be ill-advised. To do so when Dodd-Frank has added to their tasks, is irresponsible… The pressure to cut the SEC and CFTC budgets is part of the Republican war on the White House.

Speaking of lying, manipulative bastards who sell our country down the river to line their own pockets (no, not Scott Walker this time although here’s another great Jon Stewart bit on Wisconsin) – Goldman Sach’s David Greely is pushing for $200 oil by contending that OPEC’s spare capacity is lower than commonly estimated and the cartel will not be able to accommodate a prolonged supply disruption.

"As the lack of supply growth and price-insulated non-OECD demand suggest a future rebound in U.S. gross domestic product growth or a major oil supply disruption could lead to $150-$200 a barrel oil prices as growth in supply fails to keep pace with increased demand from developing nations," Goldman said. “The possibility of $150-$200 per barrel seems increasingly likely over the next six-24 months."

OOPS! I’m sorry, that report was from May 5th, 2008! Silly me – and silly you if you listened to GS then because oil was $120 at the time and did top out at $140 in June, boosted by Goldman’s predictions, of course, but fell to $35.13 6 months later – like I said: Oops! Notice that those analysts have been discredited so now GS has found a whole new sucker to put his credibility on the line in order to line the pockets of the energy traders. Of course, at the time, former GS alumni JIm Cramer’s TheStreet.com had to top that $200 call by 20%, calling for $240 oil that afternoon.

OOPS! I’m sorry, that report was from May 5th, 2008! Silly me – and silly you if you listened to GS then because oil was $120 at the time and did top out at $140 in June, boosted by Goldman’s predictions, of course, but fell to $35.13 6 months later – like I said: Oops! Notice that those analysts have been discredited so now GS has found a whole new sucker to put his credibility on the line in order to line the pockets of the energy traders. Of course, at the time, former GS alumni JIm Cramer’s TheStreet.com had to top that $200 call by 20%, calling for $240 oil that afternoon.

Of course, Cramer has a different 2 on his mind this year and that’s $2,000 gold! That’s right, fresh of his crushingly wrong call on oil, Jim Cramer is reloading and stampeding the beautiful sheeple into gold – again – saying: "With interest rates low and stocks starting to drop, gold is exactly what you should be in. I think you can see $1,550 (an ounce) very quickly and $2,000 within the next 18 months. I think between 10 and 20 percent of your virtual portfolio should be gold.”

As I said back on February 7th, when gold was "just" $1,350 an ounce – if you are going to be bullish on gold, "you need to know who our co-investors are so we can contemplate where they are likely to begin stampede for the exits." We already identified frightened Dictators as major co-investors in the gold game and now we can add Cramericans to the gold bugs and Glenn Beck faithful who are hoarding their shiny bits of metal in hopes of making a 30% profit if the World falls apart. We made more than that between breakfast and lunch yesterday so forgive us if we don’t find that to be a particularly impressive use of funds…

Most likely, they will be able to keep oil prices up through the weekend as we look forward to Saudi Arabia’s scheduled "Day of Rage" on Friday. BUT (and it’s a Big But) – the Saudi Tadawul Index is UP over 10% in the last 3 sessions so, it would seem, the people who actually live, work and trade in Saudi Arabia do not think we are heading into the potential catastrophe that is driving speculators into a frenzy this week.

Let them buy – we were hoping to go heavy on our oil shorts at $110, we only settled for $106 as we were worried they weren’t going to make it. Mostly we’ll be watching those 100% lines (see yesterday’s post) to see if they hold up. We lost the NYSE yesterday so that’s 3 under and 2 over and the Dow Transports failed 5,000 and the SOX failed 450 so those bulls need to show us the money this morning or our bets will be moving back on red!