Can you believe it was just 100% ago that the market collapsed?

I talked about the blood in the streets and all the fun we had in Monday's post. The chart shows the S&P, DAX and Hang Seng all up almost exactly 100% (1,333 or bust is still our goal on the S&P) with the FTSE dragging along at 70%, the Nikkei up just 50% (although not bad for a country that is "mired in deflation") and the Shanghai isn't even trying with a 40% gain in 24 months. The star of our show is the Bombay Sensex, which is up 125% since March 9th of 2009 but it doesn't feel like it as they were up about 160% in November.

The Hang Seng has also pulled back about 20% since November but everyone else is catching up with even the Shangai bouncing while the Hang Seng consolidates. Our 100% lines on the US indexes are 12,938 on the Dow, 1,333 on the S&P, 2,530 on the Nasdaq, 8,362 on the NYSE and 684 on the Russell. The Russell is our leader, up 140% in two years (which is REALLY good for the RUT $390 Index calls we bought back on crash day for just $10!) and the Nasdaq is up 119% off their 1,265 low but we liked buying AMZN at $62.50 better than risking the basket of the index at the time and that too has worked out well with AMZN now $167 (up 167% coincidentally).

We were already in AAPL and GOOG etc – the usual suspects as we had gone bullish the week before the crash in March of 2009 – all the crash did was flash a big SALE sign at us while we were already at the mall with cash to spend. Most of my picks on that actual day were financials: SKF shorts, FAS longs, XLF long, RKH long, BAC long (at $3.14!) and then some staples like GE, DIS, TGT and HOV (at 0.65!) along with the Russell, which was our "index most likely to succeed" selection.

So you can't blame us for hoping we have another nice correction – especially with values currently so stretched. We don't want to be bearish but, when there's nothing to buy you either stay in cash or get a little short and, as much as we liked AMZN at $62.50, we have to question their true value at $167. It's not just the price – we still like HOV at $3.87 and that's up 495% from our entry, although now, of course, we hedge… Now we're in a market that requires a lot of hard work and due diligence to build a strong virtual portfolio – but you wouldn't know it the way others are buying stocks "hand over fist" as if it's March 9th, 2009 and the market just went on sale at 50% off, rather than March 9th, 2011 when up 100% in two years is considered a "laggard."

As I often say – I'm not bullish or bearish – just rangeish. One of the major ranges we have been watching (as is often discussed in Stock World Weekly) is the Dollar, as our Global Reserve Currency bangs up and down in it's channel, trying to retake the LOWS we achieved in 2007-2008, when our worthless currency (72 at the time) made us think our homes, stocks and commodities were much more valuable than they really were, which was an excellent fantasy until, of course, people actually tried to sell all the over-priced crap they had accumulated and then it all hit the fan very rapidly.

Thank goodness we all learn from our mistakes, right? I was being interviewed yesterday and was reminded that I was early with my May call that the World was hurtling into violent revolutions (see my musical photo essay) but it is kind of my job to be ahead of the curve and the fact of the matter is that I called this way back in December of 2009, when I wrote my "2010 Outlook – A Tale of Two Economies" in which I said:

Thank goodness we all learn from our mistakes, right? I was being interviewed yesterday and was reminded that I was early with my May call that the World was hurtling into violent revolutions (see my musical photo essay) but it is kind of my job to be ahead of the curve and the fact of the matter is that I called this way back in December of 2009, when I wrote my "2010 Outlook – A Tale of Two Economies" in which I said:

2010 is going to be an interesting year and it seems the majority of investors believe that we can keep living on this harshly divided planet and keep squeezing productivity gains out of the working masses even as we continue to hold wages down and drive the cost of their basic necessities higher. Even the slave owners had to provide food, clothing, shelter and medical care to their workers although I suppose we can feel good about the fact that slave owners outlawed education while we simply provide a very poor quality one – not enough for true upward mobility but certainly enough to hammer home the message that all they need is a dollar and that great American dream.

As long as we can keep the peasants from revolting we can keep partying like it’s 1999 but I do have reservations (obviously) and we will continue to exercise a degree of caution in our investing but history has taught us that the rich can indeed get richer and we have plenty of good places to focus our bullish attention as we begin this centrury’s second decade.

At the end of 2010 – nothing had changed and I told Members to just refer to the prior outlook. What we did instead was add our "Secret Santa's Inflation Hedges for 2011" and our "Breakout Defense Part Deux – 5 More Trades that Make 500% in a Rising Market," which was the sequel to early December's "Breakout Defense – 5,000% in 5 Trades or Less," which we had to close out as we hit goal early and didn't want to risk overexposing our upside. We have been patiently waiting to see if it's time to take another bullish round as I like to try to put up one Virtual Portfolio per month and the last set of Breakout Defense trades were from Feb 5th so tick, tick, tick but I also know not to force a decision – we need to let the market tell us which way it's going and then make our plays.

Right now, it's ALL about the dollar and how it performs at it's current inflection point. We are expecting that the situation in Europe will not stabilize and that the Mid-East will, which should drive money out of commodities, out of the Euro and into the dollar giving us the leg up that we're projecting in this long-range chart of the dollar. Keep in mind this is MONTHLY so we do expect a the rise to be short-term bearish for the markets but then we like the markets again as a strong dollar is effectively giving a raise to all the workers who get paid in dollars and it even lowers the cost of outsourced labor so even our Corporate Masters won't be too upset.

If the Dollar does not head higher at this point then doom I say — DOOM!!! We had a major data review in last night's Member Chat covering a very wide range of socio-economic issues but I think the most telling data is the state of income spending by men, women and families – all of which shows that ALL working Americans below the top 20% are net borrowers and have been squeezed to their absolute limits in this latest round of commodity inflation. As I pointed out earlier in the week – we have 42M people on food stamps, we have 23% of all homeowners upside-down on their mortgages – trapped in their homes, whether they can afford them or not and unless we do something for them (not with this Congress!) or unless a miracle occurs (the Administration's current plan) then every new inflationary dollar that is being charged to the consumers in one category will require an equal dollar sacrifice made in another category:

![[wheredidthemoneygo.jpg]](http://2.bp.blogspot.com/_otfwl2zc6Qc/SllZ0zknANI/AAAAAAAAKmk/3g1KjDP0yMY/s1600/wheredidthemoneygo.jpg)

Note on this chart that the "average" family is in the top 20% (as the top 1% drags the bottom 80% up that high!) with a $63,091 pre-tax income yet they spend $49,638 a year. Unless taxes are less than $13,493 (21.3%), this family is operating in the red! If you raise the price of gas (and this was 2009) from $2,400 a year to $3,600 a year – where does that $1,200 come from? Clearly no one is getting a raise, right? Dad is lucky to have a first job – not to many second jobs to fill in the gap so cuts must be made. Maybe you can cut that $1,200 but what about the extra $2,000 in food? The additional $600 in health care? The additional $1,200 in property taxes, the higher utility bills? The American consumer is dying the death of 1,000 cuts yet the only thing I see on CNBC is more and more speculators trying to figure out where they can stick the next knife. Beware the ides of March, Mr. Market – it's going to be rough next week!

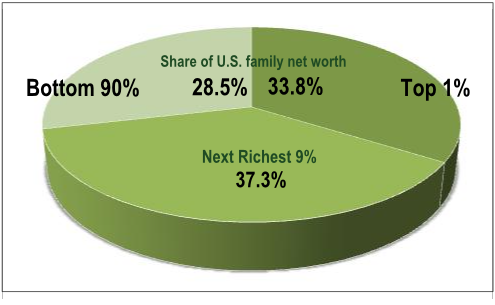

As I said to Members, it is very hard for us to keep things in perspective as most of us have had $500 dinners while the average American family has just $500 a month for food. At the risk of being considered a Commie Liberal whatever, I will point out that the chart on the left is very disturbing as it shows 400 Americans having as much accumulated wealth as 160M other Americans. That's a ratio of 400,000 to one where one day of effort by one of the Masters of America equals 1,000 years worth of labor from the bottom 50%.

As I said to Members, it is very hard for us to keep things in perspective as most of us have had $500 dinners while the average American family has just $500 a month for food. At the risk of being considered a Commie Liberal whatever, I will point out that the chart on the left is very disturbing as it shows 400 Americans having as much accumulated wealth as 160M other Americans. That's a ratio of 400,000 to one where one day of effort by one of the Masters of America equals 1,000 years worth of labor from the bottom 50%.

I'm not even going to bother discussing the merits of a system that can so grossly distorts the distribution of capital among the people because I know that it tends to fall on deaf (and then angry Conservative) ears but I will say that this is how revolutions begin – when those 160M people realize that to top 0.0001% are, in fact, only 400 people and, even if they aren't successful in storming the palace gates to redistribute the wealth by force – at least they will create the need for hundreds of thousands of guard jobs as we reach steady state of tension between the haves and the have nots.

After all, who are the have nots in America? It's the entire bottom 90%. Forget the fact that 400 people own more of the wealth than the bottom 50% – those guys are just lazy, losers who should have tried harder, right? They are probably some race you don't like, who believe things you don't like and vote for people you don't like and take up space in your otherwise very nice World – so screw those uneducated, immigrant bastards right. But what about the 40% above them. Are those "your kind of people"? Apparently not because the bottom 90% of the people only have 28.5% of the net worth of this Great Nation, which was founded on principals of equality or some such nonsense.

As you can see from this chart, the top 1% own 33.8% of the wealth and they have, so far, been generous enough to leave 37.3% to the next 9% (because you do still have to pay to get good help) but that only leaves 28.5% of the Nation's wealth to be distributed among the remaining 270M people which they will then use to buy food, shelter, fuel and clothing for their families. Only Egypt and China have a greater degree of Wealth Disparity in the developed World than the United States of America and it's time our leaders got serious and make a choice between repression of the masses now or violent revolution later – $105 oil may be the tipping point that puts those "average" families over the edge in 2011.

As you can see from this chart, the top 1% own 33.8% of the wealth and they have, so far, been generous enough to leave 37.3% to the next 9% (because you do still have to pay to get good help) but that only leaves 28.5% of the Nation's wealth to be distributed among the remaining 270M people which they will then use to buy food, shelter, fuel and clothing for their families. Only Egypt and China have a greater degree of Wealth Disparity in the developed World than the United States of America and it's time our leaders got serious and make a choice between repression of the masses now or violent revolution later – $105 oil may be the tipping point that puts those "average" families over the edge in 2011.

While we applaud Scott Walker in Wisconsin for showing us that repression can be effective in Middle America, we do worry about how it will play out on a larger scale with 40% of the US population now not working, up from 34% in 2001. Even some of the people who are working no longer have health insurance as the number of workers covered by private health insurance has fallen from 72M in 1979 to just 50M last year while state and local coverage has remained flat. So, even if the population didn't grow by 80M people in the past 30 years, that would still be 22M people dropping off the health rolls. I'm sure that's OK though – they can just "tough it out" for the good of the country that takes such good care of them. Here's a fun game – figure out what single women of various income groups should cut in order to afford this year's average 30% increase in health care costs:

It's kind of like jenga – pull out one item and try not to have the whole thing collapse on you! The markets are kind of like that right now – a very large house of cards that is built on the premise that these women, and these men and the families above, are going to keep driving to the gas station and paying $60 a tank and keep coming up with more and more money for food and clothing and pay the extra taxes or fees to offset the cuts in Government services and accept lower wages with less benefits and give up some of their retirement and, while they're at it, hopefully stop off at Best Buy to pick up that new IPod or flat-screen TV so we can get the message out to them to vote Republican in November.

Good luck with all that!