Japan's quake on Friday was powerful enough to shift the whole island by 8 feet!

Despite the land movement, most of the damage was done by the 20-foot tsunami that hit the nation afterwards, much like the 2004 tsunami that killed over 200,000 people in Indonesia. The media is still banging the nuclear fear drum over and over again to keep people watching but the reality is that the chance of a catastrophe, at this point is very slim as the chain reaction was halted and enough time has passed for about 1/3 of the heat to dissipate and the containment units are holding (they outside shells blew out from venting blasts that did not damaged the main concrete containers.

That being said – you never really know what's going to happen but, if anything, people should be impressed with how EVEN a massive earthquake like this did not cause a major nuclear accident and that is based on a 40-year old design (by GE) so it's really no reason not to build new plants – preferably not so close to fault lines, though…

As I said to Members this morning in our special 1:41am Alert – there's going to be some real bargain-shopping opportunities here as Japan is probably looking at $50Bn in damages, which is already knocking down insurance companies like Swiss Re, Munich Re and Hanover Re – all down around the 5% rule, as we expected last week. Berkshire Hathaway got hit as well as is AFL, who are one of my favorite insurance companies – especially if we can get them in the mid-$40s again!

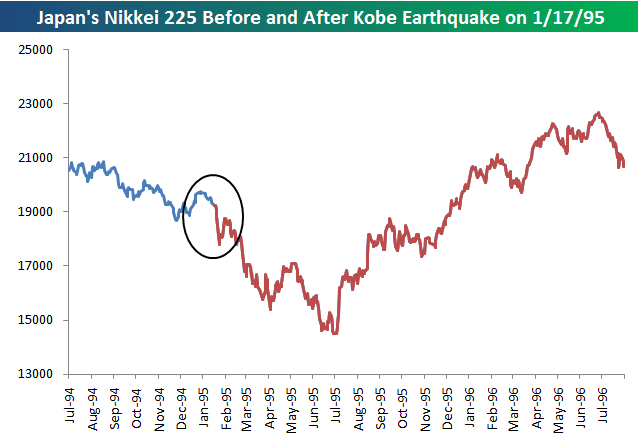

By the way, I don't want to come off goulish – we spent the weekend discussing the terrible tragedy and I'm heading to NYC tomorrow to help coordinate some relief efforts for the victims but this is our job – to figure out what the opportunities are – even in the face of a terrible tragedy like this. In no way do we want to belittle this tragedy but the damage toll will be much smaller than the Kobe quake of 1995, which caused $132Bn worth of damage (and that was in 1995 dollars!) as it struck one of Japan's major ports and industrial areas. Much like 9/11, what it really did was accelerate an already downtrending market and the Nikkei fell 25% in 6 months. Memories of that move is why we got such a violent reaction today in the Nikkei – despite the much smaller damage (especially in respect to the much larger GDP) done by the current quake:

And what did the US markets do while Japan took a plunge in 1995? Well, that was a very different story:

It was a very different World back then, of course so it's prudent for us to think about what the Japanese economy is like today and what major sectors are likely to be affected. For instance, Japan produces more than 40% of the world’s NAND flash memory chips — and 15% of its DRAM — the earthquake could seriously affect worldwide semiconductor supplies, according to analysts such as Jim Handy of research firm Objective Analysis.

Even a two-week shutdown of fabrication plants would remove from production a sizable share of wafer production, causing major price swings and short-term shortages. Not everyone agrees with the Objective Analysis view, however. Market research firm iSuppli does not believe that DRAM and NAND production will be affected by the quake. Micron (MU), Toshiba (ADR: TOSBF.PK) and Elpida Memory production facilities in the region were far enough away from the tsunamis to avoid damage. That said, many electronic manufacturer factories in region won’t be buying or shipping product until earthquake damage is repaired. This includes Sony (SNE), Murata (ADR: MRAAY.PK), Renaissance Electronics and Shin-Etsu Chemical ( ADR: SHECY.PK) factories.

China is scheduled to build 28 new reactors over the next decade, about 1/2 the World’s total planned. I doubt they will change their minds. Hopefully it will cause them to focus more effort on perfecting pebble bed reactors – which promise to be safer than current designs if they work out the bugs.

Toyota Motor Corp., the world’s top automaker, as well as Nissan Motor Co. and Honda suspended production at all their auto plants in Japan, starting Monday. When production will resume is uncertain. The area hit by the quake is a major center for car production, complete with a myriad of parts supliers and a network of roads and ports for efficient shipments. "There is no way to get our products out, even if we make them, with the roads and distribution system damaged," said Honda Motor Co. spokeswoman Natsuno Asanuma.

Toyota Motor Corp., the world’s top automaker, as well as Nissan Motor Co. and Honda suspended production at all their auto plants in Japan, starting Monday. When production will resume is uncertain. The area hit by the quake is a major center for car production, complete with a myriad of parts supliers and a network of roads and ports for efficient shipments. "There is no way to get our products out, even if we make them, with the roads and distribution system damaged," said Honda Motor Co. spokeswoman Natsuno Asanuma.

"For Japan, a nation that lives by the sea, food comes in by the sea, energy comes in by the sea, exports go out by the sea. Everything stops if a quarter of the coastline has been wiped out," said Weinberg who teaches at New York University.

We decided all this would be good for Ford, and there are 2 different ways to play option strategies on the $14.36 stock in the Morning Alert. I was liking them anyway as they pulled back down to the 200 dma and there's no reason not to take advantage of the situation by buying ourselves some of America's last remaining auto company.

The BOJ has already dropped the stimulus bomb, giving $184Bn to the Banksters (because they suffer most when tragedy strikes 150 miles from Tokyo). No word yet on any aid for the actual people who were effected but, as Larry Kudllow said on CNBC: "The human toll here looks to be much worse than the economic toll and we can be grateful for that."

Of course, that's to be expected of Larry, who began his career as a Staff Economist at the NY Fed and was an Associate Director of Reagan's OMB and was even an adviser to Freddie Mac and was "Mr. Goldilocks" on CNBC – telling investors not to worry in 2007 and 2008 as the market began to tank, which can best be summed up in his December, 2007 quote where he said "The recession debate is over. It's not gonna happen. Time to move on. At a bare minimum, we are looking at Goldilocks 2.0. (And that's a minimum). The Bush boom is alive and well. It's finishing up its sixth splendid year with many more years to come." as well as his May, 2008 statement that everything was going great and: "President George W. Bush may turn out to be the top economic forecaster in the country" in his "R" is for "Right!"

Of course, that's to be expected of Larry, who began his career as a Staff Economist at the NY Fed and was an Associate Director of Reagan's OMB and was even an adviser to Freddie Mac and was "Mr. Goldilocks" on CNBC – telling investors not to worry in 2007 and 2008 as the market began to tank, which can best be summed up in his December, 2007 quote where he said "The recession debate is over. It's not gonna happen. Time to move on. At a bare minimum, we are looking at Goldilocks 2.0. (And that's a minimum). The Bush boom is alive and well. It's finishing up its sixth splendid year with many more years to come." as well as his May, 2008 statement that everything was going great and: "President George W. Bush may turn out to be the top economic forecaster in the country" in his "R" is for "Right!"

Hey, I didn't plan on getting mad at Republicans over an earthquake in Japan – blame Larry! We can save our real outrage towards the Republicans when their short-sighted de-funding of things like the Pacific Tsunami Warning Center in Hawaii leads to future tragedies. The Center did issue a series of warnings prior to the quake as the National Weather Service and the National Oceanic and Atmospheric Administration (NOAA) get steadily better at modeling the planet we live on. Of course, the $1.2Bn defunding is based on the things the NOAA sees that SOME PEOPLE (who shall remain nameless Billionaire brothers) don't want you to see, like climate change studies and ocean pollution findings. As the Frankenstein Monster liked to say: "Science bad!"

"People could die. … It could be serious," said Barry Hirshorn, Pacific region chairman of the National Weather Service Employees Organization (oh no, a UNION – don't listen to him!), noting that Weather Service employees and employees of the Pacific Tsunami Warning Center could be hit with furloughs and closures. "It would impact our ability to issue warnings," he added. Democratic Rep. Colleen Hanabusa of Hawaii called the proposed cuts "Reckless – Drastically reducing the … ability to forecast weather and alert our communities about imminent, dangerous events is irresponsible," she said.

Sorry Colleen – we voted for irresponsible in November – no sense in whining about it now!

Fortunately, we were not impressed by Friday's stick-save close and kept ourselves well covered (slightly short) into the close, despite the enthusiastic gains the US markets were putting up. We will be getting bullish if we hold Friday's lows and buying the F'ing dip so be on the lookout for over-reactions on stocks like HMC and HIT (another one I really like on sale) and we'll see if we can grab some sale items in Member Chat today. We get a big snap down in the indexes because there are plenty of things people think they should be selling on the basis of the catastrophe (insurance companies, nuclear power companies, commodities, anyone who supplies Japan this quarter (very bad last two weeks)) but, in the grand scheme of things – as long as things don't get worse – they are bound to get better sooner or later (how profound!).

Speaking of things that get better – Qaddafi seems to have pushed back the rebels as his soldiers march on Brega where the rebel strongholds have been softened up by air-strikes as the UN twiddled their thumbs for another weekend. Other rebels who aren't doing so well this morning are the gang from Wiki-Leaks – who got a big "so what" from BAC this morning as they release their "smoking gun" EMails.

BAC should be good for some relief buying off the $14.25 line today.

We're certainly not going to be bullish until we see the Nas, NYSE and RUT retake their major breakout levels but we do expect the Breakout 2 levels to hold, other than the Russell, of course, which is already below 800 and, as we expected when we hedged, the fastest falling index. We will, of course be selling into the excitement – as soon as we get an indication that Friday's lows will hold.

The rest we'll have to play by ear and it's going to be a very exciting week.