![[GERPOL]](http://si.wsj.net/public/resources/images/WO-AF006_GERPOL_NS_20110327191833.jpg) Oh, where to begin this morning?

Oh, where to begin this morning?

We already covered "Big Trouble in Little Tokyo" in our Weekend Reading post so we’ll just say things are still sucking in Japan. The Nikkei lost 0.6% in this morning’s trading but it was Angela Merkel who lost control of Germany this weekend as nuclear concerns gave a huge victory in a state election to the Green (environmental) party who, along with the Social Democrats (what it sounds like) now control 47.1% of Germany’s coalition-based Government vs just 44.3% held by Merkel’s Christian Democrats and her allies in the Free Democrat party.

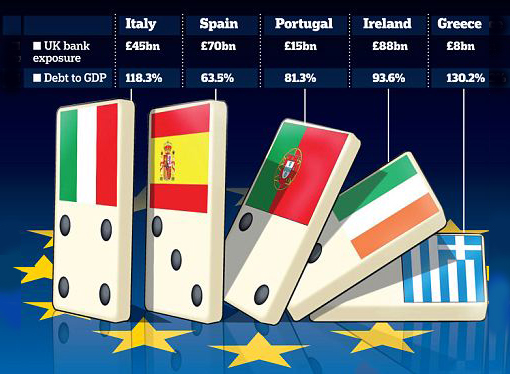

As a stand-alone, Germany’s GDP is about $3.5Tn, the World’s 4th largest economy, behind Japan’s $5.4Tn (maybe less at the moment) and China’s $5.8Tn and, of course, our $15Tn juggernaut of an economy. Together with the EU, however, Germany is part of a $16Tn economic union where it is followed by France ($2.5Tn and Sarkozy also took an electoral hit this weekend!), Italy ($2Tn), Spain ($1.4Tn) and then you drop down to The Netherlands at $770Bn. We know what kind of shape Italy and Spain are in so keep in mind that it’s Germany and France who run the EU – no matter who is "in charge."

Moody’s put another nail in Spain’s coffin this morning, downgrading 30 Spanish banks by one or more notches. Interestingly, they left STD and BBVA alone and I’m liking STD with their 9% dividend as money is likely to be drawn away from the smaller banks and moved to the relative safety of STD. STD is trading at $11.94 and they can be covered with Sept $11 calls at $1.60 for a net $10.34 entry or paired with the sale of the Sept $11 puts at $1.05 to drop the basis to $9.29. That gives you a net on the buy/write at $9.29/10.14, which is a 15% discount if put to you at $10.14 or called away with an 18% profit if called away at $11 in 9 months – PLUS the 9% annualized dividend!

Not surprisingly, Germany and the rest of the EU rushed through the final approval of their now $987Bn bailout fund as that was the number one issue that was crushing Merkel’s party and it’s not entirely sure Germany will have the will, going forward, to commit any more capital. The agreement requires 80Bn euros of cash provided by eurozone countries in five equal annual instalments in proportion to their GDP. There will be a further 620Bn euros in guarantees but keep in mind that word ANNUAL INSTALLMENTS – as we discussed over the weekend – this fund is nowhere near as large as it seems as it currently has NO CASH and just the guarantee to back up what seems to be an immediate $80Bn hole in Portugal’s finances and who knows how much in Spain. Not only that, but the fund doesn’t really exist until 2013!

There had been expectations that the two-day summit in Brussels would agree a resolution over rescuing Portugal’s stricken economy. But Portuguese ministers said they had no intention of following Greece and the Irish Republic in tapping the bail-out fund. Even so, analysts believe it is only a matter of time before other countries are forced to provide support to the ailing economy. Portugal says it does not need aid, but many analysts say Lisbon is in denial.

There had been expectations that the two-day summit in Brussels would agree a resolution over rescuing Portugal’s stricken economy. But Portuguese ministers said they had no intention of following Greece and the Irish Republic in tapping the bail-out fund. Even so, analysts believe it is only a matter of time before other countries are forced to provide support to the ailing economy. Portugal says it does not need aid, but many analysts say Lisbon is in denial.

UK Prime Minister David Cameron refused to respond to suggestions that Britain may have to pledge billions of pounds to any emergency funding. He said: "It’s not right to comment and speculate on another country’s finances, and I’m not going to do that." He has faced angry calls from his own Conservative MPs to refuse to contribute British money towards a bail-out. "Can I remind you that we have just had an austerity Budget?" said former frontbencher Bernard Jenkin in the Commons on Thursday. "Can you imagine how absolutely furious British voters would be if it turns out that the British taxpayer has to continue contributing to the bail-out of euro countries, even though we are not a member?"

The financial markets are also worried as Portugal must repay a large chunk of debt to lenders in April. On Friday, Standard & Poor’s downgraded Portugal’s credit ratings by two notches to BBB and warned it could cut it further. S&P followed a two-notch cut by Fitch on Thursday. A quick deal has also been put together to give Irish banks $80Bn to shore up their finances – also money that is being created out of nowhere but, on the whole, it’s keeping the EU markets stable this morning (so far!).

The financial markets are also worried as Portugal must repay a large chunk of debt to lenders in April. On Friday, Standard & Poor’s downgraded Portugal’s credit ratings by two notches to BBB and warned it could cut it further. S&P followed a two-notch cut by Fitch on Thursday. A quick deal has also been put together to give Irish banks $80Bn to shore up their finances – also money that is being created out of nowhere but, on the whole, it’s keeping the EU markets stable this morning (so far!).

There is increasing tension between the bankrollers and the bailed-out… three months of uncertainty lie ahead. – Gavin Hewitt, BBC Europe

Seeing the environmentalists gain control in the World’s 4th-largest economy has got to be bothering the oil speculators who, as we speculated, have pushed things too far with their ridiculous $105 per barrel price gouging in the middle of a recession (and it’s $115 in Europe!). This is exactly the kind of backlash we expected as well as the general debt issues in Europe that are very likely to strengthen the Dollar – just when the "smart money" was all lined up to bet against it.

Call us dumb money but we were short oil, short silver and long on the Dollar last week and I’m seeing ALL of those trades lining up perfectly with the newsflow this weekend. We’re still very concerned that we’re heading off a cliff (again) next week but we’ll worry about that on Wednesday – and we already have our disaster hedges in place despite last week’s "rally." We’ll see very soon if my call to cash out last week was a wise one but, on the whole, I’d rather miss a little more of a run-up than give up the excellent gains we captured playing the last mini-crash bullishly.

For now, the Quarter ends on Thursday and the beginning of the month generally benefits from ETFs putting 401K money to work but next week, we can expect to see those negative fund flows begin to catch up with the markets as hedge funds will be dealing with quarterly redemptions – which is why they are throwing everything but the kitchen sink into the market to paint those books for the end of Q1 – before the reality (and volume) of earnings season begins to "true up" some of our runaway valuations. This week, it’s all about Jobs and housing – generally two weak spots in our economy:

Our first data-point of the week is February Personal Income and Outlays and already the pom-poms are being waved on CNBC and in the WSJ as they spin a 0.7% increase in Personal Spending (up from 0.2% in January) as a market positive when, in truth, that extra 0.5% was spent entirely on food and energy! Personal Income fell further behind – up 0.3% vs. 0.4% expected by the blathering idiots who pose as economists in this country – DESPITE the reduction in SS contributions. The PCE core price index doubled to 0.2% from 0.1% in the last reading but the WSJ chooses to call that "in-line" as it’s only a 0.1% increase. Next months 0.1% increase should then be considered cause for celebration as it will "only" be a 50% bump from the prior month. Compared to last month, core prices rose 0.4%, a 4.8% annualized pace!

Disposable income, measured in constant dollars is down 0.1% since 2005 – which is a real shame as things you might want to buy with that lower income are much more expensive now. On the whole, this report is GOOD for the market as we are shearing the sheeple for more money without paying them another dime to produce the crap we sell – don’t you just LOVE being in the top 1%? Oh, and for those of you NOT in the top 1% – you’d better work harder (because that’s all it takes, right?) fast as the last first-class life-boat is about to leave the US Titanic and you know what happens to people who come in second…

Disposable income, measured in constant dollars is down 0.1% since 2005 – which is a real shame as things you might want to buy with that lower income are much more expensive now. On the whole, this report is GOOD for the market as we are shearing the sheeple for more money without paying them another dime to produce the crap we sell – don’t you just LOVE being in the top 1%? Oh, and for those of you NOT in the top 1% – you’d better work harder (because that’s all it takes, right?) fast as the last first-class life-boat is about to leave the US Titanic and you know what happens to people who come in second…

If not freezing to death in icy waters isn’t incentive enough to get you to join the top 1% – how about our bonus packages? Bonuses to senior executives are shooting up, Roger Lowenstein writes, offering a reminder of what Congress forgot when it was reforming the financial system: "Excessive pay isn’t just a problem at banks, it’s endemic to the culture of corporate America." It encourages CEOs to overreach and misallocate resources, and inequality is a major threat to U.S. democracy.

"Jobs now, deficits later" is the way to lift the economy, Paul Krugman writes, but it’s not what the "serious" people in D.C. pursue: "Self-styled deficit hawks want to punish the unemployed even as they oppose any action that would address our long-run budget problems. And here’s what we know from experience abroad: The confidence fairy won’t save us from the consequences of our folly."

"When you reduce the incomes of the people who service the debt but you don’t reduce the incomes of the bondholders, you won’t reduce the level of debt," says Barry Eichengreen, arguing austerity budgets with no bond haircuts are not just doomed to failure, but are patently unfair.

Speaking of unfair: The government’s finally sending people to jail for mortgage fraud, just not who you’d expect. Charlie Engle’s behind bars not for selling bad mortgages, but for borrowing – allegedly lying on a pair of liar loans. It took months of probing and a flirtatious undercover agent to put away a single borrower, Joe Nocera writes in a good read, while Countrywide’s Angelo Mozilo is still at large.

"I think it may be reasonable to send a signal to markets that we’re going to start withdrawing our stimulus," says St. Louis Fed President Bullard, calling for an early end to QEII. Bullard is the 3rd Fed member (Fisher, Plosser) in a few days to signal easy money needs to end soon. Unlike the others, Bullard is not a voter on the FOMC but all this hawkish talk is likely to boost the buck so we’ll be looking to re-take that 77 line and I’m liking FCX as a short play at $55. The April $57.50 puts at $3.60 have very little premium and make a nice way to play them short. I also like selling the May $57.50 calls for $2.05 but that’s riskier, of course.

Get ready for a wild week!

– Phil