Osama Bin Laden is dead.

Osama Bin Laden is dead.

As I pointed out to Members this morning, he seems to have died at 4pm (in Pakistan, 40 miles from the capital in a city of 1M people – not in the mountains at all!) and the metals markets gapped down at the open (6pm EST) and oil began selling off out of the gate despite the usual push down of the Dollar – all the way to 72.985 when Obama made the official announcement. After the announcement, the dollar rise back to 73.50 but the markets went up, with the Dow jumping well over 100 points on the news but that is not the "smart money" – the smart money knew Bin Laden was dead at the open of overnight trading and it was commodities down, markets flat.

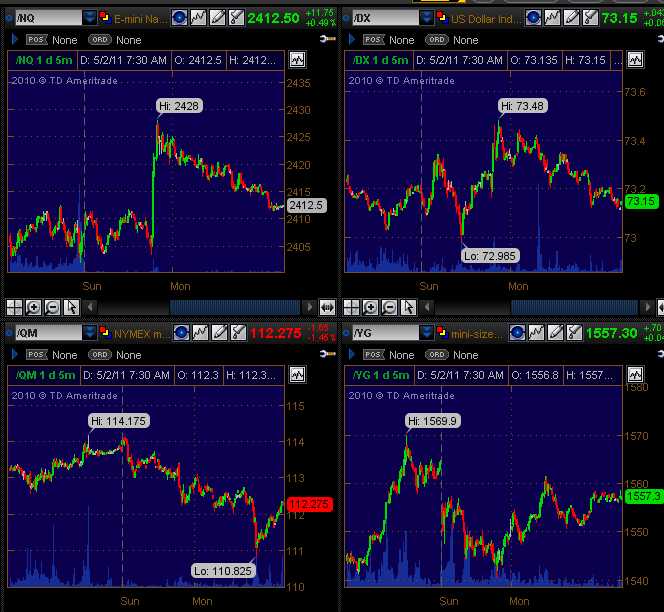

Now we are going to have a gap up open, or whatever is left of the morning excitement (7:30 futures charts pictured here with NQ = Nasdaq, DX = Dollar, QM = Oil and YG = Gold), which is fading fast and could do more than that if commodities begin an earnest sell-off but CNBC already has a parade of spin-masters jumping on the air saying that Bin Laden's death is no reason to sell oil.

Frankly, Bin Laden's death elevates CNBC's brand of Financial Terrorism to a level that should now merit Homeland Security's attention as they do more to destabilize this country than any terrorist has ever managed with their constant fear-mongering and self-serving manipulation of news to promote their objectives – objectives which causes direct harm to every man woman and child in this country (or at least 99% of them, anyway).

Terrorists may have destroyed the World Trade Center and caused $20Bn worth of damage to New York City but CNBC's constant promotion of commodity speculation has driven the price of living in New York City up 14% since last year alone! With a $1.3Tn economy in New York, that's $182Bn in damages that CNBC and the speculation crowd are costing New York City alone, IN A SINGLE YEAR, with their constant spreading of misinformation and fear in the market-place – all aimed to drive prices ever-higher to promote their cause at the expense of others.

And don't think it's a victimless crime, either. Thousands of children die from disease and malnutrition in this country while, Globally – it's millions. Commodity speculation isn't about who gets to drive a Hummer – it's about who gets to eat. Globally, 16,000 children a day die from hunger-related causes – think about that the next time they are telling you how we should burn an acre of corn to make a gallon of ethanol.

"Don't fear inflation, profit from it" – says Jim Cramer! I'm guilty of the same thing as just this weekend we were looking at some "May Flowering Inflation Hedges" (sorry, Members Only) as a follow up to our open to the public "Secret Santa Inflation Hedges," which really saved our assets so far this year. Perhaps it's a thin line but I feel that there is a World of difference between simply choosing to protect ourselves from the tidal wave of inflation and those who actively promote activities and create a market impression that causes inflationary price increases by encouraging frenzied speculation that may be good for ratings, but it's also bad for America and the rest of the World as well.

Piling on CNBC's misery trade in April are Global Hedge Funds, who added $3Bn in Dollar short positions last week alone! $15.5Bn worth of long bets were placed on the Euro and the Pound last week as well – these are record bets in a week in which Bernanke gave his first press conference and Tim Geithner said the US has a "Strong Dollar Policy." Douglas Borthwick, managing director of Faros Trading, a foreign exchange trader, said dumping dollars was a "one-way bet with very little pullback".

The London Telegraph ran a headline this weekend saying "America's Reckless Money-Printing Could Put the World Back into Crisis," pointing out that, despite Bernanke's rosy assessment of the US economy: "In the real world, US growth is slowing sharply. Annualised GDP rose just 1.8pc during the first three months of 2011, down from 3.1pc the quarter before. America remains mired in sovereign, commercial and household debt."

The Telegraph sums up the situation quite nicely, without the layers of BS we are used to from the US MSM, saying: "So the Fed will keep on "printing" virtual money – at least for now. By the end of June, it will have purchased $600bn (£363bn) of longer-term Treasuries, with the US government effectively buying its own debt from funds created ex nihilo. That's on top of the original $1,750bn (£1,048bn) QE scheme, launched in late 2008." I live that they call it a "scheme" – that really cuts to the fact, doesn't it? The whole article is a must read – THIS is how the World sees us:

America's base money supply – the bedrock of the world's reserve currency – has doubled in little more than two years. Despite consternation among many US voters, and dismay – rapidly turning to anger – across the world, most of America's political elite refuse even to debate QE. Such is the state of democracy in the "land of the free and the home of the brave". And America is not alone.

Bernanke's utterances caused gold to jump another 2pc. Silver – known as "poor man's gold", another "inflation hedge" – spiked 6.5pc. But the real story was the plunging dollar. Against a basket of five major global currencies, the US currency fell sharply and is now at its weakest since July 2008. The Fed's "real broad dollar index", a 26-currency composite and adjusted for inflation, is testing levels not seen since 1979.

Yet still Tim Geithner puffed-out his chest and reaffirmed America's "strong dollar" commitment. "Our policy has been, and will always be, as long as I'm in this job, that a strong dollar is in America's interest," the US treasury secretary said.

That's total nonsense, of course – seeing as a weaker currency boosts US exports and lowers the value of America's external debt. Geithner's words are not only disingenuous, but insulting to America's creditors and trading partners. In fact, Washington's constant berating of Beijing for "currency manipulation" is looking more and more like a diversion tactic.

Diversion tactics are common in the Financial reporting game. This morning they have an excuse I suppose but the big headline this weekend was Rio Tinto's CEO, Jan du Plessis, saying: "Soaring commodity prices are unsustainable and Rio Tinto will maintain a very strong balance sheet to insulate it from any future volatility in global markets." Interestingly, he said this on Thursday, at the Annual Meeting but the WSJ didn't publish it until today, when they could tuck it out of the way unnoticed. I'm not saying it's a conspiracy – just a whole lot of coincidences – how about that?

What does make the headlines is an article in Bloomberg titled "Commodities Beat Financial Assets for Fifth Month in Best Streak Since '97." It seems all commodities in the S&P GSCI Total Return Index jumped 4.4% in April while Uncle Ben waves his hand ans says "This is not the inflation you have been looking for." As noted in Stock World Weekly, the Dollar fell 3.9% for the week so it was all the poor commodities could do just to keep up. Stock indexes fell behind, gaining "just" 2-2.5% for the week.

What does make the headlines is an article in Bloomberg titled "Commodities Beat Financial Assets for Fifth Month in Best Streak Since '97." It seems all commodities in the S&P GSCI Total Return Index jumped 4.4% in April while Uncle Ben waves his hand ans says "This is not the inflation you have been looking for." As noted in Stock World Weekly, the Dollar fell 3.9% for the week so it was all the poor commodities could do just to keep up. Stock indexes fell behind, gaining "just" 2-2.5% for the week.

Like the dollars the Fed is printing, stock values are also rising "ex nihilo" as $25Tn of market cap has been added to the US indexes on less than $2Tn of cash inflows in the past two years. And that, let's not forget, is $2Tn of inflated cash! Where does the other $23Tn come from? It doesn't? It's a leap of faith based on you hoping that the $60Tn worth of stock and commodity shareholders continue to enjoy their paper wealth and don't do anything as foolish as trying to exchange their paper shares for actual cash – especially if that cash is in a foreign currency or in the form of a commodity like silver.

Last week – I warned you that the markets was not strong at all when priced in Euros and neither was our GDP, which is actually trending down sharply but LOOKS healthy when priced in Dollars that are worth 10% less than they were last year. For this week's reality check, let's look at our major indexes priced in silver:

Not a pretty picture, is it? There are lots of things we can price the markets in, of course and silver is the worst but this is reality – down about 50% this year priced against the metal. Notice how we are down in lock-step with the Dollar. People who tell you a weak dollar is good for the markets are not just lying to you but treating you like you are an idiot. A weak dollar affects the PRICE of a stock (in Dollars), not it's value – but the Financial Terrorists on CNBC and other media outlets count on the fact that you can't tell the difference. Is silver ridiculously underpriced or should the markets be much, much higher? Unfortunately, it seems to me that silver is ridiculously priced, not that the average stock should be priced 100% higher – even against our pathetic dollar but that's why we have our inflation hedges – just in case.

Meanwhile, we went into the weekend short and today's morning pop gives us a chance to improve our short positions while we wait to see what holds up. The CME has pushed margins on silver higher to try to reign in the madness – we'll see if it helps but, so far, silver is hanging onto $45 after opening last night at $42.20.

Be careful out there!