Courtesy of Mish

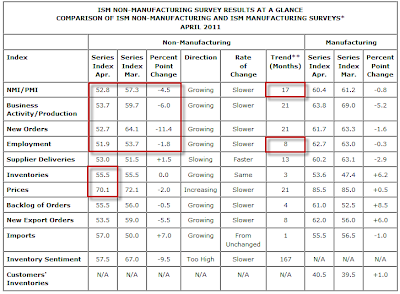

The April 2011 Non-Manufacturing ISM plunged 4.5 points to 52.8 from 57.3 The drop was below expected range of all 73 economists in a Bloomberg ISM Survey.

The range of economists’ forecasts in the Bloomberg survey was 54.5 to 59 with the median forecast up a tick to 57.4.

Tellingly, new orders collapsed by 11.4 points from 64.1 to 52.7. Employment, one of the weaker measures and up only 8 consecutive months fell to 51.9. One more reasonably bad month and services employment will contract.

Please consider the April 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 17th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

click on chart for sharper image

New Orders

The 12 industries reporting growth of new orders in April — listed in order — are: Management of Companies & Support Services; Arts, Entertainment & Recreation; Agriculture, Forestry, Fishing & Hunting; Mining; Real Estate, Rental & Leasing; Wholesale Trade; Information; Health Care & Social Assistance; Public Administration; Construction; Other Services; and Educational Services. The four industries reporting contraction of new orders in April are: Finance & Insurance; Retail Trade; Professional, Scientific & Technical Services; and Utilities.

Employment

Twelve industries reported increased employment, five industries reported decreased employment, and one industry reported unchanged employment compared to March.

The industries reporting an increase in employment in April — listed in order — are: Arts, Entertainment & Recreation; Mining; Agriculture, Forestry, Fishing & Hunting; Management of Companies & Support Services; Other Services; Information; Construction; Accommodation & Food Services; Finance & Insurance; Public Administration; Wholesale Trade; and Transportation & Warehousing. The industries reporting a reduction in employment in April are: Real Estate, Rental & Leasing; Educational Services; Health Care & Social Assistance; Professional, Scientific & Technical Services; and Utilities.

Prices

For the second consecutive month, all 18 non-manufacturing industries reported an increase in prices paid, in the following order: Agriculture, Forestry, Fishing & Hunting; Mining; Utilities; Arts, Entertainment & Recreation; Construction; Wholesale Trade; Accommodation & Food Services; Finance & Insurance; Transportation & Warehousing; Real Estate, Rental & Leasing; Management of Companies & Support Services; Educational Services; Professional, Scientific & Technical Services; Retail Trade; Public Administration; Information; Health Care & Social Assistance; and Other Services.

ISM Prices Firm, What About Profits?

This was a pretty grim ISM report, especially compared to expectations with the median prediction from economists was up not down.

Unless this report is an outlier, if prices paid remain firm, profits can’t. Employment is also suspect and close to contraction.

One month does not a trend make. However, if this is the start of a directional change, the report does not bode well for GDP, profits, or the unemployment rate.

Expect Keynesian clowns to howl for more stimulus.

Did Rosenberg Capitulate at the Top?

CNBC reports Rosenberg Goes Bullish: Is the End Nigh?

Published: Wednesday, 27 Apr 2011 | 12:52 PM ET

If the bull market will end when the last grizzled bear comes out of his den and comes to the table, then hold onto your portfolio, because it may well be dinnertime.

David Rosenberg, the curmudgeonly senior strategist and economist at Gluskin Sheff in Toronto, told clients Wednesday in his daily newsletter that he’s finally given up his long-held position that the market is heading for a thud, if not an all-out crash.

Even as the major averages have risen 90 percent off their March 2009 lows, Rosenberg hasn’t been convinced, arguing that the economy is still too weak and investor sentiment way too giddy to justify such a relentless rally.

No more.

“This is not about throwing in the towel,” he writes, “it is an acknowledgement of what the market internals are flashing at the current time from a purely tactical and technical standpoint.”

For more than two years now Rosenberg has been advising clients not to trust the rally, defending bonds against “inflationistas” and warning that deflation remains the far greater danger.

But he now marvels—somewhat incredulously, to be sure—at how investors are dispelling concerns over downward GDP revisions, soaring commodity prices, supply disruptions after the Japan disaster and looming European debt default risks.

“The (US dollar) is on a one-way ticket south and so far has been orderly—will that be sustained is anyone’s guess,” he writes. “For now it is being viewed as fodder for the global liquidity and risk-on trades.”

Rosenberg says he is still “nervous” about the US consumer, whose weakness in the wake of the credit collapse hasn’t bothered Wall Street investors much. He also makes an argument about Chinese inflation and equity weakness there.

But mostly, he sees the market trending toward an “important technical signpost” which he says is a “Holy Grail” that entails “new highs led by higher volume.”

Anyway, Rosenberg cites the “wall of worry” argument that the market will keep moving higher despite its many obstacles.

Wall of Worry? What Wall of Worry?

There has not been any worries for at least a year. What little worry there was a year ago vanished in a sea of liquidity, followed by a Fed-induced Quantitative Easing euphoria.

Yesterday, for the first time ever, I got a cold-call from a commodities broker telling me I should buy silver futures.

It is hard to find anyone who does not think buying this dip right now with both hands is a poor idea.

They could be right. Anything is possible. However, history suggests that buying the first dip following a parabolic spike is not a wise action.