And once again the futures are up!

And once again the futures are up!

As Dave Fry notes in his chart on the right, we had a lovely boost yesterday as the Fed pumped $7.24Bn into the IBanks covering a solid 34% of the $20.98Bn of junk that was offered up to them – in this case bonds that were maturing 2018-2021 at toxically low rates. The idiot taxpayers in this country will never know what hit them in this scam until rates begin to fly up and these bonds that the Fed is putting us on the hook for begin to be discounted towards zero.

When you wonder what kind if idiots would be buying 10-year notes at 3% when a gallon of gas was $1.40 ten years ago and now $4 – that idiot is you. Originally, that idiot was a bank but banks aren’t allowed to lose money in America – that’s what taxpayers are for! What the Fed does, on your behalf, is to buy all those notes from the Banksters at face value – because if they tried to sell them on the open market they’d never get it.

In exchange, the IBanks go out and buy more Government debt to make it look like there’s actual interest and the little game of hot potato keeps going until the music stops and the Fed’s $2.6Tn Balance sheet is transferred back to the taxpayers and added to our national debt.

Isn’t economics fun?

We held onto our bullish stance from the weekend but covered with a couple of index puts that will be beat up this morning as the Dollar is slapped back down to 74.80 but that’s OK because 74.80 is the line we expected to be tested in yesterday’s Member Chat, where I used it as an example of how I could know that’s the support line we’d hit on the Dollar through math, and not because I am just psychic, as some Members have been saying.

We held onto our bullish stance from the weekend but covered with a couple of index puts that will be beat up this morning as the Dollar is slapped back down to 74.80 but that’s OK because 74.80 is the line we expected to be tested in yesterday’s Member Chat, where I used it as an example of how I could know that’s the support line we’d hit on the Dollar through math, and not because I am just psychic, as some Members have been saying.

While it’s very useful to know what channel the Dollar is trading in, not too many of us play currencies but, fortunately – the Dollar affects everything else so we can make lots of plays based on knowing what the dollar is going to do but, of course, first it needs to hold 74.80!

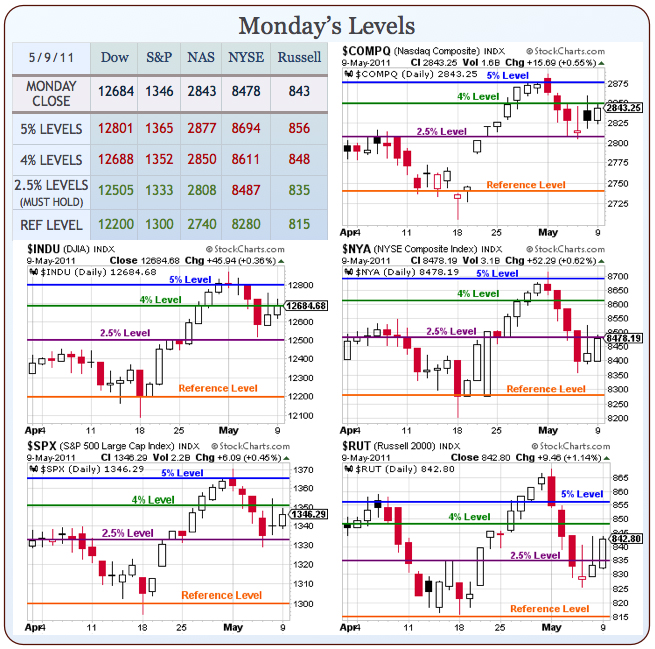

Our cool new chart shows you our anticipated range and those 5% levels should be tested (and failed) today and then we can get on board for the ride down as we face the uncertainty of the end of the POMO schedule until the new one comes out Wednesday at 2pm at the same time as our Government is trying to hawk off another $72Bn in debt, starting today with $32Bn in 3-year notes at 1pm.

Probably a good day to go long on TBT, now trading at $34.50 and you can pick up the weekly $33 call for $1.55, which is only a nickel of premium with some really good upside potential and yesterday’s low was $34.30 so figure a stop at $34.25 is risking .25 to make $1 or more if things go well.

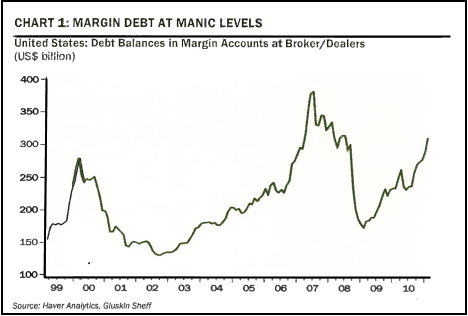

As I said to Members in yesterday’s chat, we are right back to the speculative bubble we were shorting a week ago – I know investors have short memories but gee…. Cullen Roche points our that, despite the tightening of margin requirements on silver this month, margin debt is exploding back to the same record level ($350Bn) that we hit just before the market began to fall apart in 2007. In February alone, margin spending jumped $20.7Bn, and Cullen notes:

As I said to Members in yesterday’s chat, we are right back to the speculative bubble we were shorting a week ago – I know investors have short memories but gee…. Cullen Roche points our that, despite the tightening of margin requirements on silver this month, margin debt is exploding back to the same record level ($350Bn) that we hit just before the market began to fall apart in 2007. In February alone, margin spending jumped $20.7Bn, and Cullen notes:

To put that $20.7 billion incremental leverage in on month into proper perspective, it represents a 7.2% jump, or an increase of no less than 129% at an annual rate. And, it’s not just February – the rising use of credit to buy stocks has zoomed ahead at a 64% annual rate in the past three months. If and when the markets breaks, the problem in trying to contain the downside momentum is that there are no short left to cover, which actually helps as a shock absorber. The Fed has successfully cleaned out the short community, and the extent to which we see margins being called away may very well accentuate and downside pressure…if it should come."

A CIO from an unnamed investment firm sums it all up nicely:

A CIO from an unnamed investment firm sums it all up nicely:

If this financing pyramid is near correct, then prices are simply a reflection of leverage rather than an inflation of money. If there is only speculative non-bank horizontal money, then whatever commodity (non-monetary) inflation exists must be transitory, because it relies on a permanent Ponzi condition (leveraged commodities holdings that depend on prices being higher to satisfy liabilities).

So it seems that the central banks distortions of the last several years are creating some imbalances that are unintended and unwanted, which is to increase speculative volatility in things like oil, which goes from $40 to $150 to $50 to $130 over and over. Paper profits change accounts but the real economy is not theoretically affected, except that it is held hostage to this casino game of rapidly changing prices for basic materials and necessities that businesses and consumers use to make decisions. So the economy is in actuality disrupted by the casino, the casino creates no net wealth, and everyone is worse off as this charade continues.

As I said before – isn’t economics fun? It sure is if you are a Bankster, especially if you are JP Morgan (the IBank, not the dead guy, although he had tons of fun while he was alive), who had their 3rd CONSECUTIVE quarter without losing money trading on a single day – averaging $112M a day in profits in Q1. The odds of going 180 days without a loss is over a Quintillion to one in an un-rigged market – EVEN IF you assume JPM has a 66% chance of winning because they are so smart! This is why JPM is our favorite Bankster for long-term investing – it’s like picking the Globetrotters to beat the Washington Generals – the only hard part is finding some fool to bet against you.

Goldman Sachs, embarrassingly enough, took a loss on one of their trading days and I’m sure heads are going to roll over that one. Of course, poor GS was shuttling back and forth as they were under investigation for numerous (alleged) crimes but that’s all behind them now and it’s Sheila Baird who’s losing her job – not anyone at GS. As I said to Members yesterday – that should be good for our FAS play today. Keep in mind Q1 included the Earthquake so JPM (and BAC) had PERFECT records, indicating they even played for a Sunday night disaster perfectly on Friday – AMAZING! BAC is, of course, driven by those gamblin’ fools from Merril Lynch – who do very well except when they don’t and bankrupt the firm.

Goldman Sachs, embarrassingly enough, took a loss on one of their trading days and I’m sure heads are going to roll over that one. Of course, poor GS was shuttling back and forth as they were under investigation for numerous (alleged) crimes but that’s all behind them now and it’s Sheila Baird who’s losing her job – not anyone at GS. As I said to Members yesterday – that should be good for our FAS play today. Keep in mind Q1 included the Earthquake so JPM (and BAC) had PERFECT records, indicating they even played for a Sunday night disaster perfectly on Friday – AMAZING! BAC is, of course, driven by those gamblin’ fools from Merril Lynch – who do very well except when they don’t and bankrupt the firm.

Things are not "all better" just because financial thugs are doing well. That’s like saying it must be a good neighborhood because the Crips clearly have control of the entire block. It’s great if you happen to be a Crip but not so good if you are a Blood or an ordinary citizen caught in the crossfire.

Speaking of Bloods – China had an $11.4Bn trade surplus in April on record exports of $156Bn and up 10x from March’s $140M and over 200% larger than the $3.2Bn "expert" economists had predicted. This despite near-record prices paid on 5M barrels of imported oil. Consumer prices in China rose 5.4% in March, the most in 32 months and we get April’s total tomorrow, which I would say should be even higher although the "experts" disagree with me and are projecting 5.2%. Crude oil imports were down 0.6% in April as consumers cut back a bit but it was offset by the 10% price increase and iron ore volume dropped 11% with rubber and copper imports down 14% in April – all signs of a slowing economy but you won’t hear that from our MSM as the fable of infinite China growth is one of the key market drivers.

Speaking of Bloods – China had an $11.4Bn trade surplus in April on record exports of $156Bn and up 10x from March’s $140M and over 200% larger than the $3.2Bn "expert" economists had predicted. This despite near-record prices paid on 5M barrels of imported oil. Consumer prices in China rose 5.4% in March, the most in 32 months and we get April’s total tomorrow, which I would say should be even higher although the "experts" disagree with me and are projecting 5.2%. Crude oil imports were down 0.6% in April as consumers cut back a bit but it was offset by the 10% price increase and iron ore volume dropped 11% with rubber and copper imports down 14% in April – all signs of a slowing economy but you won’t hear that from our MSM as the fable of infinite China growth is one of the key market drivers.

Greece is on, off – who cares? As I mentioned yesterday, Greece, Ireland and Portugal combined’s total debt is less than Japan is spending to clean up their current disaster, which will only add 4% to their own current $11Tn debt load against a $5Tn economy. If we’re going to get all upset about Greece’s $120Bn debt, we may as well throw in the global towel on Japan and don’t even THINK about the US debt, which is 25% of the entire planet’s GDP. I think the real danger of the Greek crisis IS solving it – because that will then free up the Cassandra crowd to focus on REAL problems like Spanish and Italian debt or US Municipal Debt (much of it hitting the fan in June) or whatever else will distract them from the real issues of Japan and America and even the UK’s $3.666Tn debt (there’s that decimal again!), which is 149% of their GDP.

So sorry folks, I’m not going to tell you things are OK – instead I will leave you with my all-time favorite film quote from Network and we’ll pick up tomorrow as we roll our short plays to stronger positions this morning and play for that rejection off the 5% lines in this morning’s ridiculous pre-market pump job (watch that 74.80 line on the buck):

I don’t have to tell you things are bad. Everybody knows things are bad. It’s a depression. Everybody’s out of work or scared of losing their job. The dollar buys a nickel’s worth; banks are going bust; shopkeepers keep a gun under the counter; punks are running wild in the street, and there’s nobody anywhere who seems to know what to do, and there’s no end to it.

We know the air is unfit to breathe and our food is unfit to eat. And we sit watching our TVs while some local newscaster tells us that today we had fifteen homicides and sixty-three violent crimes, as if that’s the way it’s supposed to be!

We all know things are bad — worse than bad — they’re crazy.

It’s like everything everywhere is going crazy, so we don’t go out any more. We sit in the house, and slowly the world we’re living in is getting smaller, and all we say is, "Please, at least leave us alone in our living rooms. Let me have my toaster and my TV and my steel-belted radials, and I won’t say anything. Just leave us alone."

Well, I’m not going to leave you alone.

I want you to get mad!

I don’t want you to protest. I don’t want you to riot. I don’t want you to write to your Congressman, because I wouldn’t know what to tell you to write. I don’t know what to do about the depression and the inflation and the Russians and the crime in the street.

All I know is that first, you’ve got to get mad.

You’ve gotta say, "I’m a human being, goddammit! My life has value!"

So, I want you to get up now. I want all of you to get up out of your chairs. I want you to get up right now and go to the window, open it, and stick your head out and yell,

"I’m as mad as hell,

and I’m not going to take this anymore!!"