That didn’t take long did it?

That didn’t take long did it?

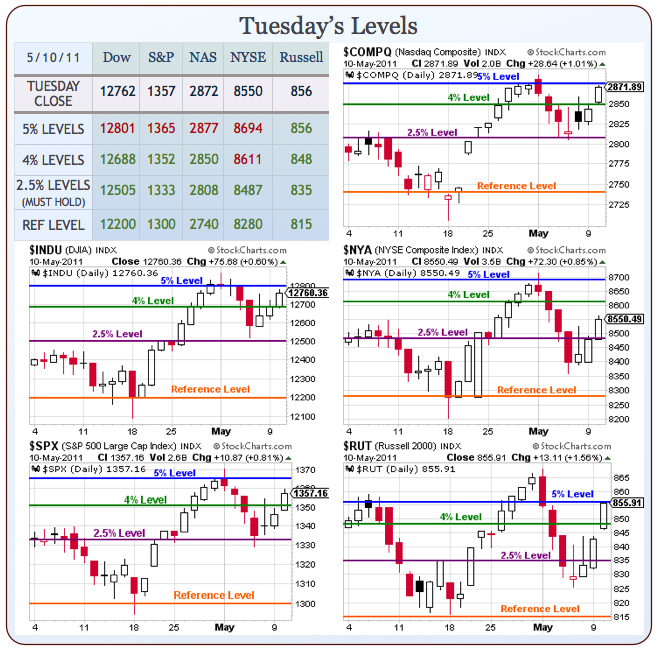

We’re right back to our 5% lines, which I predicted yesterday would be tested (and failed) so today we find out if I am half right or all right – hopefully it’s all right because we pushed our short plays to the lines and added a short on oil with USO May $41 puts, which we added yesterday afternoon for .95 at 2:30 and finished the day up a nickel. We are expecting the oil inventories to show some demand destruction at 10:30 – analysts are predicting a net 1Mb build, with a 1.6Mb increase in oil and a 300,000 barrel decrease in gasoline and distillates. A build in either gasoline or distillates will indicate pricing is hurting demand, despite whatever oil number comes up so that’s what we’ll be watching.

Yesterday, in the morning post (never miss one with a $1.90 per day Annual Report Membership!), I mentioned the TBT weekly $33 calls at $1.55 would make a good long and those finished the day at $1.87 (up 20%) but they looked good enough to keep into the close and we expect trouble in today’s 10-year auction so we’re being greedy and going for $2.15+, which will make a nice 40% gain in 2 days.

To make sure you don’t miss our next trade idea – today I will give you a trade idea that can knock 20% to 69% off the $695 Annual PSW Report Membership: You can buy 10 QQQ May $60 puts for $1 and sell 10 QQQ May $59 puts for .48 for net .52 ($520) on the $1 ($1,000) spread (it’s the net that matters, not the price of each leg). The maximum gain on this trade is $480 if the Qs finish below $59 next Friday and, if you stop your loss at net $400 (.40 per contract) that limits you to $120 lost and, if this trade loses money, let me know and I’ll give you 50% off an annual PSW Report Membership, which will save you $347.50 so net $127.50 (20%) saved on a Membership – even if the trade doesn’t work. If it does work – you are honor-bound to subscribe, of course!

What we are expecting, between now and Friday, is for the chart above to form a pattern that will look like the "M" in the McDonald’s arches, coming back to about our Retracement levels as the Dollar heads back over 75 (still 74.80). Of course we have many ways to make tremendous amounts of money playing that for our Members (we are already short the indexes from yesterday’s chat), but this will give you a quick idea of how you can use options trades to enhance your returns.

As you can see from our chart set, we rolled right up to kiss those 5% levels on the Dow, Nasdaq and Russell with the much larger (and harder to manipulate) S&P and NYSE bringing up the rear.

As you can see from our chart set, we rolled right up to kiss those 5% levels on the Dow, Nasdaq and Russell with the much larger (and harder to manipulate) S&P and NYSE bringing up the rear.

The NYSE should be the biggest concern to the bulls as they had no trouble at all getting to our 5% line at the end of April but we’re still close to 1% below the 4% line on our largest index. As I said the day before the last little dip – they’d better be careful or investors might get the impression all this bullish movement is actually bullshit….

David Fry points out that the volume is very light (which means the gains are meaningless), " which makes it easy for HFTs to pump prices." Dave believes it’s all about the POMO and, at 2pm we get the Fed’s new schedule for the next 30 days of handouts – any signs of the Fed cutting back could be a big negative for the market and we’ll be watching that number closely. Meanwhile, as Dave says:

So markets continued to rally due supposedly more M&A featuring MSFT’s buy of Skype and better growth data from China. Ignored was the steep 2.2% rise in import prices which will be passed on to consumers to mark the inflation supposedly we don’t have… Meanwhile, European investors are pretending some of their members’ problems will get papered over (literally) causing markets to rally.

I was pretty fed up yesterday as well, letting people know in the morning post that I was "mad as hell" but we did take it for another day as we got that 2:15 stick to move the markets higher after the 10am move up that was caused by comments made by Boehner that budget spending cuts must exceed any boost to the borrowing limit and that "raising taxes is off the table" because it would "have a devastating impact on our economy."

That sent the Dollar lower and sent the markets higher as we are, in theory, out of money on Monday and when the Speaker of the House of Representatives tells you he’s willing to play chicken with US Debt defaults and that he has no intention of attempting to balance the budget by raising taxes – well, it’s not surprising that people will lose a bit of faith in our joke of a currency. Keep in mind Boehner is talking about wanting $2 TRILLION dollars in spending cuts to match the necessary rise in the debt ceiling and it took Congress the first 4 months of this year to come up with $60Bn…

Since the market did just what we thought it would and for the reasons we thought it would (dollar weakness based on psychotic political rhetoric), we were comfortable following through in Member Chat on our plan to double up on our DIA $126 puts at our target of .60 from the morning Alert, giving us a 2x position at net .70 – those could be very exciting if the market rolls over and may still be available this morning. Another fun short we took yesterday was the NFLX June $220 puts at $5.40, which finished the day at $5.20 so you didn’t miss anything so far. We took a bearish backspread on AMZN, stayed bullish on FAS and TBT, added long-term, hedged longs on HRB (nice discount), SKX and YPF (who should get a nice pop today on a big discovery – thanks Kustomz!) but at the end of the day someone complained that we should make more picks – go figure… More picks don’t mean more money – the idea is to make the RIGHT picks!

Since the market did just what we thought it would and for the reasons we thought it would (dollar weakness based on psychotic political rhetoric), we were comfortable following through in Member Chat on our plan to double up on our DIA $126 puts at our target of .60 from the morning Alert, giving us a 2x position at net .70 – those could be very exciting if the market rolls over and may still be available this morning. Another fun short we took yesterday was the NFLX June $220 puts at $5.40, which finished the day at $5.20 so you didn’t miss anything so far. We took a bearish backspread on AMZN, stayed bullish on FAS and TBT, added long-term, hedged longs on HRB (nice discount), SKX and YPF (who should get a nice pop today on a big discovery – thanks Kustomz!) but at the end of the day someone complained that we should make more picks – go figure… More picks don’t mean more money – the idea is to make the RIGHT picks!

This morning, the Dollar is right back at our 74.80 line. Bond pimp Bill Gross doubled down on his Treasury shorts yesterday as his first shorting attempt ran right into the biggest rally in eight months and now his pal Jim Rogers says he’s jumping on the bandwagon and both of those guys speak Mandarin and may know a thing or two about what’s going to happen next. TLT had a nice run back to test $95 and we have a 10-year auction at 1pm and the June $91 puts at .56 are a fun way to play for a dip as they can easily double up on a 2-point drop in TLT and you can get out with a 50% loss (.28) if they break back over $95, which is what Jim and Bill are betting against.

Why do Gross and Rogers feel so strongly about our TBills falling? Well, for one thing, they speak Mandarin and that means they know that China’s April CPI came in at an alarming 5.3%, 33% over the 4% target. This is higher than was expected by Bloomberg’s 30 expert economists and just shy of a 3-year high after 6 months of China attempting to focus on controlling inflation and 5 months after Premier Wen Jiabao set a priority on keeping the monthly inflation rate under 4% for 2011. “The data looks bad,” said Dariusz Kowalczyk, senior economist at Credit Agricole CIB in Hong Kong. “The economy is slowing more sharply than expected but inflation is not.”

Even worse, despite a drastic slowdown in Output Growth, from 17.1% in March to 13.4% in April ("experts" had expected 17.6%), Producer Prices remained at 6.8%, indicating severe margin pressure as, not only can’t producers pass on price increases but Premier Wen wants them to charge LESS to curb inflation. Inflation is “the most pressing problem” facing China, Vice Premier Wang Qishan said at the Washington talks. Hey – they should all move over here – our Fed Chairman says we don’t have any inflation at all!

Even worse, despite a drastic slowdown in Output Growth, from 17.1% in March to 13.4% in April ("experts" had expected 17.6%), Producer Prices remained at 6.8%, indicating severe margin pressure as, not only can’t producers pass on price increases but Premier Wen wants them to charge LESS to curb inflation. Inflation is “the most pressing problem” facing China, Vice Premier Wang Qishan said at the Washington talks. Hey – they should all move over here – our Fed Chairman says we don’t have any inflation at all!

Also on Stagflaion Watch is the BOE, who have now increased the UK’s 2011 inflation forecast to 5% while lowering GDP growth expectations to 1.7%, which would be called a Recession by rational people who subtract the 1.7% from the 5% and find out that the economy is shrinking 3.3% in constant currency but – shhhhhhhhhhh – that’s not the story they want you to hear in the MSM, is it?

Over in Japan, TM’s profits were down 75% in Q1 and they are blaming it all on the March 15th earthquake so no one is selling them on this news, which I find astounding and I think selling the May $80 calls for $1.70 is a fun way to play for a shock of reality when people actually look at the numbers. This is part of a very disturbing trend of Japanese companies flat-out lying about their business prospects. TM sales were off 12% for the Quarter, 2 weeks out of 13 is 15% so we’d have to assume that, IMMEDIATELY after the earthquake, not a single Toyota car was sold anywhere in the World in order to blame the decline on the quake alone – yeah, that’s the ticket…

So lots of fun and games today. Oil inventories at 10:30, the 10-year note auction at 1pm and maybe the Fed will save us at 2pm with an aggressive POMO schedule. That’s the ticket.