Hey, remember Fukushima?

Hey, remember Fukushima?

Arnie Gundersen is freaking me out! Gundersen is no tin-foil hat guy, he’s the chief engineer of energy consulting company Fairewinds Associates and a former nuclear power industry executive who served as an expert witness in the investigation of the Three Mile Island accident. Gundersen has said that the U.S. nuclear industry and regulators need to reexamine disaster planning and worst-case scenarios, especially in reactors such as Vermont Yankee, which have the same design as the crippled nuclear plant at the center of the 2011 Japanese Fukushima nuclear emergency. Vermont Yankee and similar plants are vulnerable to a similar cascade of events as in Japan.

The Nikkei had fallen down to 8,227 from 10,678 (23%) at the quake and has since recovered 10,017 on May 2nd but was back to 9,648 on Friday (3.6% off the bounce) and the 50 dma has now formed an aptly-named "death cross" below the 200 dma. Japan is already on the hook for $124Bn from the earthquake and will also have to cover TEPCO’s $31Bn (so far) liability as the alternative is let the country’s biggest energy supplier go bankrupt and that would be lights out on their economy.

Warning: Do not watch this video on a full stomach:

This is one of the things holding down the financials as there is no way to know right now, what the real damages are going to be from this ongoing disaster for the insurance companies (and the banks that lend them money). As Gundersen observed on Friday and as is not being reported officially, two other reactors are seriously damaged. A worker at the plant dropped dead on Saturday and Japanese banks and Insurance companies are all suffering with Daiici Life’s net profit down 66% from last year due to the accident.

Accident is a funny word isn’t it? With 435 active plant and 250 more under construction, even if they are 99.9% safe, that would still mean we get an accident like this every year. Hopefully they are 99.99% safe and we only have a major catastrophe every 10 years – wouldn’t that be nice but, so far, that’s not the case as we’ve had about 16 in 50 years with 9 of those considered "major." So accident applies to this situation in the same way that it’s an "accident" if the number you bet on in Roulette comes up on the wheel – it doesn’t USUALLY happen but, if you spin the wheel enough times – it’s GOING to happen and we spin the wheel on 435 power plants 365 days a year – giving them 158,775 opportunities for failure each year.

Residents of Kawamatamachi and Iitatemura, both in Fukushima Prefecture, began evacuating today. About 1,200 residents in Kawamatamachi will evacuate from their homes. In Iitatemura, about 4,500 residents will move from the village to accommodations in Fukushima city, such as housing for local government officials and hot spring hotels. Most of Iitatemura is located more than 30 kilometers from the Fukushima No. 1 power plant. However, the level of radiation detected in the village was as high as that in areas within a 20-kilometer radius of the power plant, which has been designated as a no-entry zone.

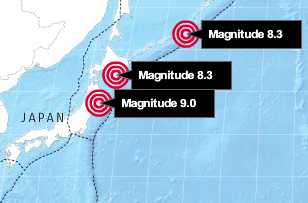

The WSJ has some nice interactive graphics to play with. On the one titled "Ring of Fire," notice that the entire Pacific plate has been very active this decade and then notice that not only is japan cut in half by an adjacent plate but that Tokyo sits right on the intersection of 3 plates. Keep that in mind before buying the dip in Japan or holding too many Yen, for that matter. Maybe not today, maybe not tomorrow but you keep rolling those dice over and over and over and – eventually – you WILL crap out!

The WSJ has some nice interactive graphics to play with. On the one titled "Ring of Fire," notice that the entire Pacific plate has been very active this decade and then notice that not only is japan cut in half by an adjacent plate but that Tokyo sits right on the intersection of 3 plates. Keep that in mind before buying the dip in Japan or holding too many Yen, for that matter. Maybe not today, maybe not tomorrow but you keep rolling those dice over and over and over and – eventually – you WILL crap out!

Now, initially, the earthquake sent the Dollar down to the lows of the year on nonsense that Japan was going to have to repatriate hundreds of Billions of Dollars to rebuild but, the fact is, Japan is borrowing more money and printing more money and offering more stimulus into a flagging economy – in other words, they are doing what Ben and Timmy have been doing for the past two years so why do people think when they do it, it will have the exact opposite effect?

The Skybridge Capital held their annual Salt Conference in Las Vegas this week and Thursday’s pre-lunch panel discussion was titled: "Investing for the End of the World: How to Profit from Economic Armageddon" – very apropos as George Bush gave the Keynote that morning. After all, who knows more about causing Economic Armageddon than our former President? Panelists took turns offering their dire assessments of the West, the culprits being the usual suspects: too much debt, fiscal irresponsibility, energy crises, etc.

The Skybridge Capital held their annual Salt Conference in Las Vegas this week and Thursday’s pre-lunch panel discussion was titled: "Investing for the End of the World: How to Profit from Economic Armageddon" – very apropos as George Bush gave the Keynote that morning. After all, who knows more about causing Economic Armageddon than our former President? Panelists took turns offering their dire assessments of the West, the culprits being the usual suspects: too much debt, fiscal irresponsibility, energy crises, etc.

John H. Burbank III, the chief investment officer of Passport Capital, a $4 billion hedge fund, started things off. “The West is bankrupt and failing, and it’s just a matter of when,” he told the crowd assembled in the hotel’s grand ballroom. Mr. Burbank also took a bit of a shot at asset managers, decrying crowding in the marketplace and how it distorts price. That means when bad things happen and investors move in tandem, there is an element of unpredictability. “Information and stability can change so quickly,” he said. Robert Sinnott, the chief executive of Kayne Anderson Capital Advisors, put it, when the markets seem like “a pond with black swans interbreeding and laughing at us.”

With the end of the World scheduled for Saturday and options expiration on Friday, we’re going to have a very busy week organizing our virtual portfolios. We have our disaster hedges in place so I’m feeling good about that and we expect follow-through selling down to our reference lines (see Stock World Weekly for updated charts – possibly our last issue if the pamphlet is right!), which are still a good 2.5% below where we finished on Friday. A combination of Dollar strength and Yen weakness (coupled with a Nikkei sell-off) should keep things heading down a bit longer although I’m sure there will be some attempt at a market rescue first.

![[DSK0515]](http://si.wsj.net/public/resources/images/OB-NX493_DSK051_E_20110515234747.jpg) The rescue of Greece is back in doubt as the head of the IMF, Dominique Kahn, was arrested on sexual assault charges (hard to tell whether this helps or hurts his bid to become France’s next President). The IMF doesn’t really have any provisions for this and that makes for uncertainty and uncertainty leads to panic and panic dropped the Euro all the way to $1.405 last night but they gained a point back since then. Greece was scheduled to meet with the ECB and IMF at 3pm TODAY in talks that were meant to resolve their issues and free up some much-needed cash.

The rescue of Greece is back in doubt as the head of the IMF, Dominique Kahn, was arrested on sexual assault charges (hard to tell whether this helps or hurts his bid to become France’s next President). The IMF doesn’t really have any provisions for this and that makes for uncertainty and uncertainty leads to panic and panic dropped the Euro all the way to $1.405 last night but they gained a point back since then. Greece was scheduled to meet with the ECB and IMF at 3pm TODAY in talks that were meant to resolve their issues and free up some much-needed cash.

Europe’s donor countries, led by Germany, are demanding deeper budget cuts in exchange for granting Greece extra aid or giving it more time to pay back official loans, and are weighing whether to make bondholders share the costs. Any extension of Greece’s bond maturities would need to prevent “the private sector steadily withdrawing from its positions” and shifting the burden to taxpayers," German Finance Minister Wolfgang Schaeuble told ARD television yesterday. “If there is an extension, then everyone has to be extended.” The euro hit its lowest since March today after Germany put up hurdles to an expanded aid package, with public discontent simmering in northern Europe over the costs of propping up high- deficit countries on the continent’s periphery.

“It’s pretty clear that this program is ultimately not going to work and Greece is going to have to be bailed out and there’s going to be a restructuring of their debt,” Eswar Prasad, a senior fellow at the Brookings Institution in Washington, said in a Bloomberg Television interview. “The presumption was that with Strauss-Kahn at the helm the IMF would not turn its back on Europe, that the IMF would continue to support Europe. Now, with Strauss-Kahn gone, that proposition becomes a little dubious.”

Greek bonds slipped today, sending the yield on 10-year Greek bonds up 15 basis points to 15.59 percent as of 8:45 a.m. in London. Two-year note yields gained four basis points to 24.93 percent. Eighty-five percent of international investors surveyed by Bloomberg last week said Greece will probably default on its debt, with majorities predicting the same fate for Ireland and Portugal.

Greek bonds slipped today, sending the yield on 10-year Greek bonds up 15 basis points to 15.59 percent as of 8:45 a.m. in London. Two-year note yields gained four basis points to 24.93 percent. Eighty-five percent of international investors surveyed by Bloomberg last week said Greece will probably default on its debt, with majorities predicting the same fate for Ireland and Portugal.

Strauss-Kahn, 62, denied the charges and will plead not guilty, his lawyer, Benjamin Brafman, said in an e-mailed statement. He’s scheduled to appear today at 11 a.m. for arraignment in Manhattan Criminal Court on charges that a maid came in to clean Kahn’s $3,000 a night suite and he came out of the shower and attacked her. I have no idea what the truth is but it does occur to me that shorting the Euro on Friday and paying a girl to say Kahn assaulted her could have net a clever investment banker an easy Billion Dollars.

Hell, for $100M, you might have been able to just pay Kahn to assault someone himself – that’s the problem when there are so many Billions of dollars riding on the actions of so few people. The timing of this could not possibly have been better for Euro shorts. Also on the agenda for the European finance ministers are approval of 78 billion euros in aid for Portugal and the nomination of Bank of Italy Governor Mario Draghi to be the next president of the European Central Bank.