Wheeee, what a day already!

Wheeee, what a day already!

After a perfect week of market timing last week we hit another one last night as we shorted oil futures in Weekend Member Chat (yes, we never sleep!) below the $98.50 line and we caught a ride down all the way to $97.70, which is a nice bonus on a Sunday. Now we are back to our primary index watch, looking for the completion of the golden arches pattern I had predicted last week – as illustrated in this week's issue of Stock World Weekly, which also has our 3 long ways to play CSCO and a dozen more pages of very useful information.

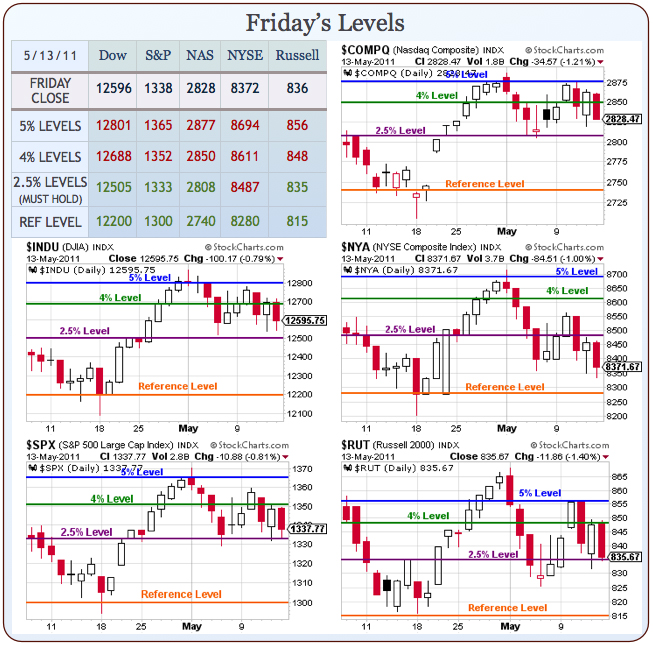

Speaking of useful information – I already went over the status of Fukushima and how we are playing Japan, the Skybridge Capital Conference and their panel discussion "Investing for the End of the World: How to Profit from Economic Armageddon" as well as the arrest of IMF President Dominique Kahn on sexual assault charges in New York yesterday – an issue that is destabilizing the entire EU. That is a very juicy and very well-timed scandal but you can read all about that in "The Good, the Bad and Fukushima" – we'll move on here to cover new ground as we keep an eye on those 2.5% lines this morning:

We have the normal pattern of the Dollar being knocked back down pre-markets, now 75.85 at 8am and that 76 line on the Dollar will give us a great bearish signal for stocks and commodities if we can get back over it. Keep in mind that EU/IMF meeting BEGINS at 3pm, which is about 10am and is bound to take a while so the rumor mill will be running rampant this morning and we could get some wild swings. EU markets themselves are down about 1% this morning, off their lows of the day's but below their own technicals with the FTSE at 5,876, DAX 7,317 and CAC 3,968 – obviously it's the CAC that's most likely to test 4,000 so we'll keep an eye on them and then FTSE 6,000 would have to confirm a recovery while failing 7,250 on the Dax would be a sign of very rough waters ahead.

On the other hand, if you think the EU is a mess, try America! Today is the day we both hit our debt limit and illustrate what a meaningless joke it is by having nothing actually happen as a result. Well, not NOTHING – the Treasury Department plans to announce it will stop issuing and reinvesting government securities in certain government pension plans, part of a series of steps designed to delay a default until Aug. 2.

On the other hand, if you think the EU is a mess, try America! Today is the day we both hit our debt limit and illustrate what a meaningless joke it is by having nothing actually happen as a result. Well, not NOTHING – the Treasury Department plans to announce it will stop issuing and reinvesting government securities in certain government pension plans, part of a series of steps designed to delay a default until Aug. 2.

Republican leaders say tax increases can't be part of any deficit plan, but White House officials have said any plan must include revenue increases. A group of House Republicans has questioned the validity of the August deadline, suggesting the Treasury could sell assets, such as gold reserves, to keep paying creditors. Treasury officials have rejected the idea, but could be forced to rethink if talks stall.

We're still liking those TBT May $33 calls, based on the simple concept of "how much interest would you want for letting these jokers hold your money?" Only The Bernank is fool enough to lend money to US at these rates but, then again, he's only lending us our own money so it's not like he himself is taking on any risk at all. Notice that the $300Bn of steps to expand the debt ceiling focus on screwing pension plans and retirement benefits for Government employees – this is just where the Republicans want to strike so the situation is not likely to be resolved until it threatens Bank bailouts or Military funding. There is also a vested interest in tanking the markets now so the Banksters can engineer an excuse for QE3 – because the only way that will pass muster is if, once again, "our economy is in great peril."

Of course, it's not a conspiracy, just a huge set of coincidences lining up in such a way that it works out exactly the way we predicted it would if there were a conspiracy. Life is funny that way, I guess…

Goldman Sachs (who would never attempt to manipulate the markets) sent the Asian markets sharply lower this morning by lowering their ratings on Japanese and Korean equities. Perhaps they just read my weekend post on Japan and figured they'd better catch up to our Members. The Nikkei and the BSE were off 1% this morning and the Hang Seng fell 1.34% with the Shanghai down 0.76% but that's dangerously back to the now declining 200 dma at 359, down 7.5% from the April 18th high.

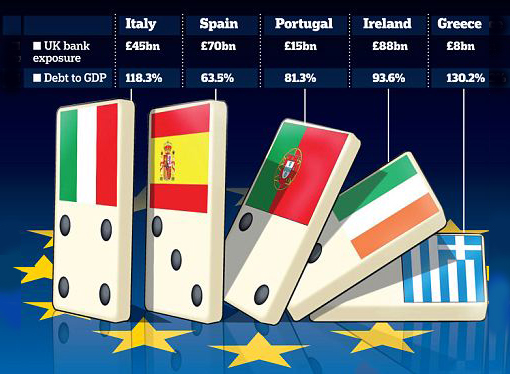

Turning back to Europe – it's time to get real people: Analysts are cutting European earnings forecasts by the most in almost two years just as equities in the region trail U.S. shares by the widest margin since the bull market began. Estimates for Stoxx Europe 600 Index profit growth dropped by as much as 4 percentage points this year, including the biggest three-month reduction since September 2009, according to data compiled by Bloomberg. Should analysts’ lowest projections for 2011 prove correct, companies would earn about 24 billion euros ($34 billion) less than expected at the start of the year, the data show. Projections for earnings in the Standard & Poor’s 500 Index have risen 4 points in 2011.

I wish I had time to look this up but it's deja vu all over again as I used to tell people in 2008, when we had THE SAME SITUATION, that the reason the EU looks worse than us is only because EU CEOs are more honest than US CEOs – not because they operate in a different global business environment! Electrolux AB, for example, lost 14 percent this year as the average estimate for its 2011 earnings fell by the same amount.

I wish I had time to look this up but it's deja vu all over again as I used to tell people in 2008, when we had THE SAME SITUATION, that the reason the EU looks worse than us is only because EU CEOs are more honest than US CEOs – not because they operate in a different global business environment! Electrolux AB, for example, lost 14 percent this year as the average estimate for its 2011 earnings fell by the same amount.

UBS AG cut its prediction for earnings before interest, taxes, depreciation and amortization at Lafarge for the next five years by an average of 5 percent on May 9, citing the euro’s gains. The world’s biggest cement maker reported a drop in operating earnings on May 5 as rising energy costs and violence in Egypt offset growth in demand elsewhere.

Andrew Gardiner and Youssef Essaegh, analysts at Barclays Plc in London, reduced their 2011 estimates on May 3 for Geneva- based STMicroelectronics NV by more than 5 percent, saying Europe’s largest chipmaker will be hurt by a weakening dollar and a decline at its wireless-chip joint venture. STMicroelectronics has pared this year’s advance to 1.8 percent from as much as 23 percent in March.

Speculation sovereign defaults will spur bank losses and the rising euro will cut exports has held the rally in the Stoxx 600 over the last 26 months to 20 percentage points below the gain in the S&P 500. While the benchmark gauge for U.S. equities rose to a three-year high of 1,363.61 on April 29, the Stoxx 600 has failed to climb above its peak of 291.16 on Feb. 17. “You have a strong euro, an aggressive central bank, slow growth and of course the government bond crisis,” said Joost van Leenders, who helps oversee $787 billion as strategist at BNP Paribas Investment Partners in Amsterdam. “We are negative on Europe.”

Other quick items ahead of the bell:

- The PBOC has apparently put the screws to a scheme where firms purchased copper to use as collateral for below-market financing. This may explain the downturn in demand (and price) for copper. Michael Pettis says companies are already busy figuring the next way to "innovate" around credit growth tightening measures.

- XOM's CEO says oil should be $60-70 a barrel and the rest is sepculation that is "engineered by the high-frequency trading of quantitative hedge funds."

- The percentage of Germans whose trust in the single European currency is "very low" or "quite low" has increased by 4 percent since December to 58%.

- Egg prices have risen 24% in China from a year earlier, citing its own monitoring system. Prices are up 5.2% since April 18, according to the report, which was posted on the central government's website.

- Pork prices in China on May 14 had increased 44% from a year earlier due to tight supplies. Pork prices on that day had increased more than 50% from a year earlier in the provinces of Liaoning, Jilin, Anhui, Hunan and Sichuan

- The EU imposes its first ever anti-subsidy tariffs on Chinese imports, finding the government is significantly subsidizing the coated fine paper industry. The EU also imposes anti-dumping duties, accusing China's fine paper producers of selling their products at dumped prices.

We had the Empire State Manufacturing Survey this morning and it was a disaster, coming in at 11.9 vs 20 expected by "experts" who are paid to follow it closely and down from 21.7 in April. New Orders fell to 17.2 from 22.2 (down 22.5%) but prices rose to 69.9, the highest level since mid-2008 – just before the economy collapsed. Prices received went up just on point, from 27 to 28 indicating severe margin pressure BUT the optimism index is STRONGER! This is what I was saying above – US CEOs are lying or delusional – doesn't really matter which, does it?

Be very careful out there – it's going to be a wild week!