I love it when a plan comes together!

I love it when a plan comes together!

We promised you M’s and it’s M’s we have but let’s take a closer look at what’s going on. EVERYONE blew their 2.5% lines yesterday and we had a bit of a recovery but only because the Dollar went from 76 at the open down to 75.35 at the close. That’s a 0.85% drop and what did our markets do? Other than the Nasdaq they all finished in the red. If an almost -1% pullback in the Dollar can’t move the price of equities up even half a point – the VALUE of those equities must seriously be questioned.

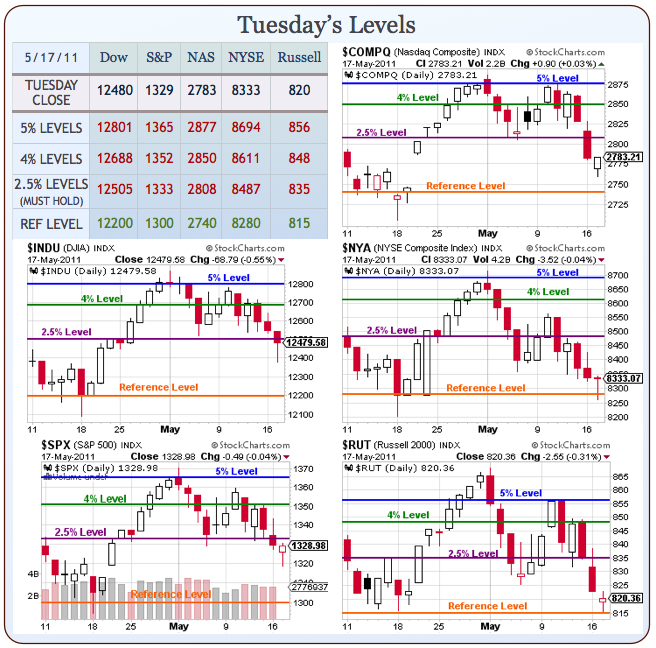

I set the following retrace lines for Members at 2:18 in Member Chat – these are what we call "weak bounce" levels off our 5% Rule – anything less than this and we remain bearish:

- Dow 12,505 (the 2.5% line) – needs 26

- S&P 1,333 (the 2.5% line) – needs 5

- Nas 2,767 (the 4% line) – over by 13

- NYSE 8,362 (the 4% line) – needs 29

- RUT 823 (the 4% line) – needs 5

The Nasdaq close was SUPER FAKE yesterday as was the take-down of the Dollar but fake is effective in this joke of a market and David Fry made a good comment on the action:

The Nasdaq close was SUPER FAKE yesterday as was the take-down of the Dollar but fake is effective in this joke of a market and David Fry made a good comment on the action:

With markets now at least short-term oversold bulls took a stab at perceived value and/or defended open long positions late in the day. But sometimes this type of buying is wasted buying power against a poor economic backdrop and with earnings season done. This leaves only QE to get them buying.

Note on Dave’s Dollar chart, that we were soundly rejected at the 76 line, which is to be expected on a first attempt but not all the way back to 75.35 – that’s overdone by any stretch so we woke up early this morning and shorted oil (the new July contracts) at $99 on expectations the Dollar will come back today.

It’s very easy to shove the markets around after hours and in pre-market but it’s very expensive to do so once the bell rings and the Fed is stingy today and tomorrow with the POMO, with just $2.5Bn scheduled to be handed out to the Banksters each day – barely enough for Lloyd to tank up the limo! Friday they make up for it with $8Bn and then next week it’s 8+7+6+7 = $28Bn into the holiday and another $18.5Bn even on the short week following.

THAT’S when we want to be a bit more bullish, not today. Hopefully we get another shove down and we can do a little bottom fishing but, if we do pop 3 of 5 of our bounce levels – we’ll have to take some short-term bullish positions there, using the 3 of 5 rule to stop back out if it doesn’t stick. It’s been a bad week for the markets but, in the grand scheme of things – it’s just a 20% pullback off the 30% POMO run since September – still bullish if we hold those reference levels:

Notice that declining green line on the chart is our Dollar – the thing you get when you cash in those "amazingly performing" stocks. Pretty much, as fast as your equities move up in price, Benny and Timmy will print more Dollars and they’ll keep it going for as long as they can because, when they stop – where are the Dollars going to come from when you want to cash in your "valuable" shares and commodities? Certainly the bottom consumers don’t have any and the top 1% are busy giving $60Bn worth of funny money to Glencore – a commodity IPO that marks the height of insanity if ever there was one.

It’s brilliant really, the IBanks ramp up commodity prices, triple the "value" of Glencore and then take them public so they can remove $60Bn perfectly good dollars from circulation (and take a $6Bn fee plus warrants) that are now invested in the hopes that commodity prices go even higher and make that $60Bn near worthless – very much like all the builders and REITs the retail schmucks were being herded into at the top of the last rally. Oh yeah – and Ethanol! – case closed….

It’s brilliant really, the IBanks ramp up commodity prices, triple the "value" of Glencore and then take them public so they can remove $60Bn perfectly good dollars from circulation (and take a $6Bn fee plus warrants) that are now invested in the hopes that commodity prices go even higher and make that $60Bn near worthless – very much like all the builders and REITs the retail schmucks were being herded into at the top of the last rally. Oh yeah – and Ethanol! – case closed….

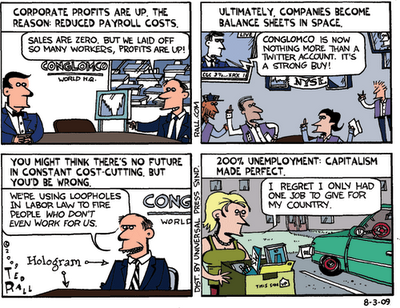

Here’s a quick summary of investing in companies like Glencore in a bad market:

You are one of 100 people on an island and you all make a decent living and you are in the top 10%. Glencore comes along and corners the fish market and begins charging double for fish. After a while 50 people go bankrupt but you are in the top 10% and earn 3 times more than the the bottom 90% so you don’t really mind paying double for your fish because Glencore sells it under the label "Whole Fish" and tells you it’s better for you than the other fish used to be and, of course, not being a fool – you only buy the best stuff.

Now there are only 50 working people left on the island and Glencore is making $2 per fish but selling less fish so they buy up the coconut and pineapple farms as well and now all food comes from Glencore and, to fund the acquisitions, they start charging $3 per fish but they tell you that’s because there’s a shortage and you believe them because you are rich and too lazy to check whether there is a shortage or whether Glencore is lying to you to rip you off. Still $3 per fish is fine and you are making even more money now because 50 bankrupt people have driven wages down for all of the new bottom 10%. Incidentally, since 50 people are effectively out of the economy, the bottom 90% is now 45 and 5 of the former top 10%’ers have also died but that’s great for you as you get to charge what you want for goods and pay what you want for labor. In fact, things are going so well, you invest in Glencore.

That’s about where we are now and if you think the next stage of this farce isn’t going to affect you, then you must truly believe you are "one of them" and will never be concerned about looking for a job or inflation or health insurance or in any way, shape or form taking responsibility for your nation’s debts (because, when there’s only 25 working people on the island, the Debt will still be there and goes up every day if the Government tries to keep the other 75 people alive).

That’s why the current strategy in Congress is focused on NOT paying for those 75 unemployed people – this IS the direction this country is heading so the quicker the top 10% walk away from supporting the bottom 90% the better because we already stopped hiring them or giving them raises or paying for their health care, helping them get housing or lending them money so now we need to stop buying them food and and stop educating their children (ours can go to private school – why can’t they?) and stop providing them with emergency medicine and NO FRIGGIN’ WAY are we going to pay them not to work or, even worse, RETIRE!

That’s why the current strategy in Congress is focused on NOT paying for those 75 unemployed people – this IS the direction this country is heading so the quicker the top 10% walk away from supporting the bottom 90% the better because we already stopped hiring them or giving them raises or paying for their health care, helping them get housing or lending them money so now we need to stop buying them food and and stop educating their children (ours can go to private school – why can’t they?) and stop providing them with emergency medicine and NO FRIGGIN’ WAY are we going to pay them not to work or, even worse, RETIRE!

So God bless Paul Ryan and all those other hard-working Congresspeople for looking our for our interests – otherwise we may end up suffering for profiting off the system that impoverished everyone else.

It’s not just Congress, of course, never let it be said that our Senators don’t give us our money’s worth as well. Just last night the Senate only voted 52-48 (60 votes were needed) to block the evil Democrats proposal to end tax benefits for the 5 leading oil companies, who made $35Bn in Q1 alone. Mark Begich of Alaska, Mary Landrieu of Louisiana and Ben Nelson of Nebraska were the only Democrats to vote no while Sue Collins of Maine was the only Republican to vote yes.

“We have to stand up and say, ‘Enough is enough,’ ” said Senator Al Franken, Democrat of Minnesota. “While oil prices are gouging the pocketbooks of American families, these companies are on a pace for a record profit this year.” Under the proposal, Democrats would have eliminated five different tax breaks enjoyed by the multinational oil companies, producing an estimated $21 billion over 10 years. That’s 10 years in which the 5 oil companies are projected to make $1.5 Trillion in profits. More than $12 billion would have come from eliminating a domestic manufacturing tax deduction for the big oil companies, and $6 billion would have been generated by ending their deductions for taxes paid to foreign governments.

“We have to stand up and say, ‘Enough is enough,’ ” said Senator Al Franken, Democrat of Minnesota. “While oil prices are gouging the pocketbooks of American families, these companies are on a pace for a record profit this year.” Under the proposal, Democrats would have eliminated five different tax breaks enjoyed by the multinational oil companies, producing an estimated $21 billion over 10 years. That’s 10 years in which the 5 oil companies are projected to make $1.5 Trillion in profits. More than $12 billion would have come from eliminating a domestic manufacturing tax deduction for the big oil companies, and $6 billion would have been generated by ending their deductions for taxes paid to foreign governments.

Critics suggest that the companies have been able to disguise what should be foreign royalty payments as taxes to reduce their tax liability. It has also been pointed out that those 5 companies spent $137M on lobbyists last year – a total of $274,000 per elected official – and that’s not including campaign contributions but still, it’s a return on investment of 14 times their lobbying investment in the first year alone! And let’s not forget they already took another $60Bn in tax cuts off the table just to get this bill to a vote. Now that, my friends, is how you buy yourself some good Government!

When you are done being mad at oil companies, try reading Matt Taibbi’s new article on how Goldman Sachs flat out lied to their clients and lied to Congress or, better yet, you can just check out this short video that explains it well:

Shenanigans everywhere, including a convenient (for oil bulls) fire up in Calgary, Canada that is probably going to shut in 100,000 barrels a day of production. I told Members last night to expect some Rent-A-Rebel action to support the contract rollover at the NYMEX but arson is a new one in their bag of tricks. Sure, you might think 100,000 barrels a day would matter little in a World that uses 88 Million barrels a day, especially to a country that has 1.4Billion barrels in storage like America but that won’t stop CNBC from making it seem like the Apocalypse today – mark my words…

We have oil inventories at 10:30 this morning and there was already a "mix-up" on Rand Squawk, where they reported a draw-down of 1.479Mb of crude when, in fact, the API report showed a 2.7M barrel BUILD. Hey, what’s a 4.2 Million barrel swing between friends. Still, that and the fire are doing wonders to hold prices up at the NYMEX open, despite the Dollar testing the critical 75.75 line.

Perhaps we should all go buy some XOM today….

We may as well join ’em because we sure can’t beat them, right? Fed minutes will be out at 2pm and, if nothing else, that should be able to kill the Dollar so bottom-fishing it shall be as we celebrate inflation and the destruction of our American Dollar.

Enjoy.