Reminder: Pharmboy is available to chat with Members, comments are found below each post.

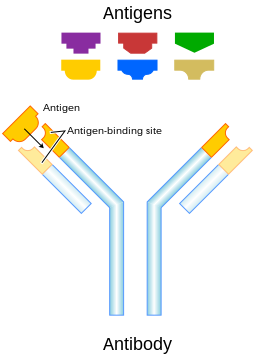

Antibodies (also known as immunoglobulins) are large Y-shaped protein secreted by a white blood cell known as a plasma cell to identify and neutralize foreign objects (i.e., bacteria, viruses and cancer). The antibody recognizes a unique part of the foreign target, termed an antigen (Figure 1). Each antibody's "Y" end contains a paratope (lock) that is specific for one particular antigen epitope (key), allowing these structures to bind. This binding mechanism allows the antibody to 'tag' a microbe, an infected cell, or foreign cell (cancer) for attack by other parts of the immune system, or can neutralize its target directly (for example, by blocking a part of a microbe that is essential for its invasion and survival). The production of antibodies is the main function of the humoral immune system.

Figure 1. Plasma cell and an antibody binding to an antigen.

Antibodies can occur in two physical forms, a soluble form that is secreted from the cell, and a membrane-bound form that is attached to the surface of a B cell and is referred to as the B cell receptor (BCR). The BCR is only found on the surface of B cells and facilitates the activation of these cells and their subsequent differentiation into either antibody factories called plasma cells, or memory B cells that will survive in the body and remember that same antigen so the B cells can respond faster upon future exposure (this is how immunity works, i.e., small pox). In most cases, interaction of the B cell with a T helper cell is necessary to produce full activation of the B cell and, therefore, antibody generation following antigen binding. Soluble antibodies are released into the blood and tissue fluids, as well as many secretions to continue to survey for invading microorganisms.

Scientists figured out long ago that B cells could make specific antibodies, and thus the modern monoclonal antibody (mAb) production was born and the cancer fighting field exploded with optimism. About 10 years ago, Rituxan was approved and it marked the birth of a multi-billion dollar market. Since then, 8 additional antibodies have joined Rituxan. The market is currently dominated by a specific flavor of antibodies termed “naked” antibodies, which represent a fraction of the different antibody types. Other antibodies that have yet to reach maturity include:

- Trastuzumab emtansine (IMGN) and Brentuximab vedotin (SGEN) are Antibody-drug conjugates (ADCs). The antibody serves as a guiding system by guiding the drug to tumors, and releases the drug inside cancer cells. Some refer to the technology as a targeted antibody payload (TAP; IMGN).

- Bexxar (GSK) is an antibody-radioactive molecule where the antibody is more 'potent' in killing the cancer cells of target.

- Other technologies are coming along, but one is starting to move to the forefront and is making a big splash in this arena, Micromet's bispecific T-cell engagers (BiTE antibodies). These antibodies have the ability to bind to more than one antigen (more below).

is a biopharmaceutical company, engages in the discovery, development, and commercialization of antibodies for the treatment of cancer, inflammation, and autoimmune diseases. Its product development pipeline includes novel antibodies generated with its proprietary BiTE antibody platform, as well as conventional monoclonal antibodies. The company's lead product MT103 is in Phase II clinical trial for the treatment of acute lymphoblastic leukemia, as well as in Phase I trial for non-Hodgkin?s lymphoma. Its Phase II trial product also includes MT201 for solid tumors; and Phase I trial products comprise MT110 and MT293 for solid tumors, and MT203 for the treatment of inflammatory diseases. The company's products in preclinical stage include MT111 to treat solid tumors; BiTE antibody for acute myelogenic lymphoma and solid tumors; MT228 for melanoma; and MT204 for the treatment of inflammatory diseases, including rheumatoid arthritis, asthma, acute transplant rejection, uveitis, psoriasis, and multiple sclerosis. It has license agreements and collaborations with Biovation Limited; Enzon Pharmaceuticals, Inc.; MedImmune LLC; Bayer Schering Pharma AG; TRACON Pharmaceuticals, Inc.; Nycomed A/S; Morphotek, Inc.; Sanofi-Aventis; and Boehringer Ingelheim. The company is headquartered in Bethesda, Maryland.

About 20 yrs ago, academic and industrial laboratories started pursuing bispecific antibodies, but the technology was not as advanced and progress was hampered by quantity and purity. Micromet solved the problem vexing developers of bispecific antibodies and developed a platform technology termed BiTE (bispecific T-cell engagers), potent single-chain antibodies with bispecific capabilities. Specifics will be skipped on the exact process of how they work, but if one is so inclined, here is a background on them.

Micromet has several BiTE mAbs in clinical trials (both wholly owned and in collaboration with Pharma). The company's most advanced candidate is blinatumomab, designed to redirect T-cells toward CD19 positive B-cells. Blinatumomab is in pivotal trials for minimal residual disease (MRD) positive lymphoblastic leukemia; MRD results when front-line chemotherapy fails to clear all the leukemia cells from a patients bone marrow. The drug is also being tested in non-Hodgkin’s lymphoma (NHL) patients.

Data for blinatumomab were quite impressive when presented at ASH in December 2010.. Of 20 evaluable patients for MRD Acute Lymphoblstic Leukemia (ALL), 80% achieved MRD negativity, and 60% registered hematologic disease free at 27.5 months of follow-up. The pivotal blinatumomab trial is a single armed, open label trial set to accrue 130 MRD positive patients with ALL. The primary endpoint is MRD response rate at 6 weeks. Secondary outcome measures include hematological relapse-free survival, overall survival, and overall adverse effects. It was initiated in Q3 2010.

Early NHL results were also quite good. At 60 microgram/square meter, 18 of 22 (82%) patients with relapsed non-Hodgkin’s lymphoma achieved an objective response. There was one concerning issue of CNS events, but they appear to be reversible; it appeared to be linked to B-cell to T-cell ratio, patients with a higher B:T ratio had a low incidence of discontinuation due to CNS events. The company believes the effect can be detected early and managed with steroids.

Bispecific mAb are a very hot area now, and Micromet is closest to market in the US. One bispecific mAb named catumaxomab, by Trion, is already approved in the EU. The drug is 1/2 mouse anti-CD3 antibody tethered with 1/2 a rat anti-EpCAM antibody. Catumaxomabis is a tri-functional antibodybecause it binds to CD3 positive T-cells, EpCAM positive tumor cells, as well as other immune cells via its Fc chain.

Other contenders include Macrogenics and the start-up f-star. Macrogenics has its Dual-Affinity Re-Targeting (DART) technology, and many consider the DART technology to be more potent than BiTE mAbs. Unfortunately, Macrogenics molecules are still in pre-clinical development. f-star pproducts are at a very early stage and its key differentiator is a Modular Antibody Technology format from which it can engineer single chain antibodies, diabodies, as well as full antibodies. The attraction of their technology is its ease of production.

Micromet is leadin the charge in mAb BiTEs, and other companies will follow with different mechanisms to deliver potent therapies for cancer. With the interim positive data, buying a small amount of stock here and selling the November $7.50 Calls and $5 Puts for $1 or better. This is not as good as the entry last week, but still within our striking range.

Disclosure: I currently sold the Aug $5 Ps.