What a wild month this has been.

What a wild month this has been.

As of Friday's close, all of our US indices were off at least 2.5% from the end of April with a week to go in May. We got the pattern we anticipated for the month but we're only as good as our last call so now what?

Well, to a large extent that will depend on how we handle those 2.5% lines but that is just going to be a measure of how well (if at all) we are staving off a major correction. There is plenty of POMO power left in the Fed's gun with Stock World Weekly reporting $28Bn in the first 4 days of the week to be showered on our Bankster buddies.

Also on the schedule for next week are New Home Sales on Tuesday, Durable Goods and Home Prices on Wednesday, GDP (2nd Estimate) along with the usual Jobless Claims on Thursday and Friday, in case anyone hasn't left early for the long weekend – it's Personal Income and Spending along with PCE Prices AND Pending Home Sales.

So Friday could be a REALLY depressing day on the data front, where we see Incomes dropping, prices inflating and home sales dropping off a cliff – all ahead of a holiday weekend that will make or break the retail season with gas still around $4 a gallon (35% more than last year).

None of that matters though, as long as the Dollar behaves itself and refrains from showing any signs of life. We tested 76 in early futures trading this evening (I am writing this post early as I won't be around in the morning) but NO ONE wants to see the Dollar that strong – especially the guys who are in charge of it in America so it was quickly and firmly slapped back (so far). It's really all about Europe but first, let's take a closer look at the big picture on the S&P:

Note how we are forming a similar pattern coming into a similar holiday weekend to the one we had for Martin Luther King weekend, 2010. At the time, on January 19th, with the S&P at 1,150 – I asked the question "Have the Markets Become Comfortably Numb" where I summed up the apparent indifference to bad news by saying: "I have a theory that the markets (and the American people in general) aren’t irrational, they are simply shell-shocked after suffering a very traumatic group financial experience…" At the time, we had taken a bearish stance, pretty much since New Years, when the S&P had crossed over 1,120, which was 40% over our base at 800 (see "5% Rules! How Can We Be So Right?").

At the time, we had drawn a line expecting a pullback to 1,014 and you can see that's right about where we ended up in late June but – in between – it was a wild ride. So while we do expect a major correction (20%) at some point, we won't be surprised at all to hold our 10% lines first and then move even higher – maybe on QE3 or whatever else it takes to try to make things look pretty into the elections. We also won't be surprised if we completely blow out now though – and I'm sorry we can't be more definitive (other than to be short-term bearish) but so much is currently riding on a very unstable situation in Europe.

Back on my bearish weekend update of January 16th, 2010, I gave my "bullish" premise on the market, outlining the plan that was indeed implemented by The Bernank (through QE1 & QE2) and by his Bankster Masters through the largest run-up in speculative positions every achieved (so far). My comment was:

That is how we are "fixing" the economy. It turns out you may not be able to get blood from a stone but we sure can bleed US and global consumers dry through commodity speculation that completely ignores the fundamentals of supply and demand in order to dig into consumers’ pockets and pull out that last dollar. This is a mainstay of the "Dooh Nibor Economy" and is, of course, great for us top 10% club members as we already know the bottom 90% are tapped out.

By getting that extra $20 for gas each week from 165M drivers, WE make sure that $3.3Bn goes to people who will actually spend it on stuff – further boosting the GDP. Add another $5Bn in mandatory grocery spending (becaues EVERYONE needs to eat – muhaha) and we’re getting $431Bn from those poor cheapskates, who would only save it or pay off some debt if left to their own devices (and we don’t need them to pay off their loans – that’s the government’s job!).

How much was gas in January 2010? $2.10 wholesale. In January of 2011, we hit $2.50 ($8 more per 20-gallon tank) and recently we hit $3.40 ($26 more per 20-gallon tank) but pulled back to that dollar increase we expect before the pain at the pump becomes too much for the consumer to bear and the rest of the market begins to buckle under the weight of a consumer pullback. This little pullback came a bit prematurely but that is due, in large part, to a premature run in greed that hit us this February, as gas prices shot up from $2.50 to $3 in about 2 weeks in celebration of the Jasmine Revolution in the Middle East.

How much was gas in January 2010? $2.10 wholesale. In January of 2011, we hit $2.50 ($8 more per 20-gallon tank) and recently we hit $3.40 ($26 more per 20-gallon tank) but pulled back to that dollar increase we expect before the pain at the pump becomes too much for the consumer to bear and the rest of the market begins to buckle under the weight of a consumer pullback. This little pullback came a bit prematurely but that is due, in large part, to a premature run in greed that hit us this February, as gas prices shot up from $2.50 to $3 in about 2 weeks in celebration of the Jasmine Revolution in the Middle East.

As I mentioned on Thursday – there was certainly no shortage of gasoline and no interruption in supply and certainly no increase in demand as Americans are using 7% LESS oil products than last year but don't let FACTS get in the way of a good, speculative story, right? And this is where the greed got out of control because, while Americans live lives of overconsumption and waste and can be squeezed to pay more and more for necessities by manipulative speculators who form cartels to control the markets – the rest of the World is on a tighter budget and other nations are falling like dominoes – one by one – into cycles of inflation, debt, poverty, rebellion and chaos.

Let's keep an eye on those red lines on the International Charts – those are our 200 dmas and whenever you see the blue 50 dma drop below that, it's called a "death cross" and it's a sign of a seriously weakening trend. The rest of the World gave us a very clear signal that a correction was coming in 2008 but most Americans (including the punditocracy) were simply too arrogant to see it. Sure China is the most important country on Earth when you are forecasting the infinite growth you need to justify insane multiples for public companies but then, when China begins to stumble and run into it's own economic troubles – suddenly it's not a big deal?

When I hear idiocy like that coming out of someone in the MSM's mouth, I tend to cross them off my list of people to listen to. Needless to say, at this point in my career, I have a very short list left. If that weak looking Shanghai chart hits that rapidly descending 50 dma and pops down from there, below 360, which is below their 100% gain off the 2008 lows – will they take it seriously or will they ignore it like we did the first time they failed this level – in June of 2008?

Will they get on TV and tell you to BUYBUYBUY China on "the dip" as the Shanghai Composite falls to 340, 320, 300, 280 (support), 240 etc and then will they change their tune and tell you to SELLSELLSELL at exactly the point at which you SHOULD begin buying – between 240 and 200? Only time will tell if they can be that foolish again but it's probably a good time to review our post-crash review and remember what it was like back then and just how wrong the idiots on the idiot box can be.

If you watch the video of that last link, it reminds us how the MSM "reassures" us as the markets, and the entire economy, are falling apart. They don't work for you – you are one of millions of viewers and you contribute pennies to their bottom line through the value of your eyeballs. Who does pay them? The Financials, the oil companies, the gold companies, the brokers – what do you expect them to say? NBC/CNBC/MSNBC was owned by GE, for goodness sakes – did you really think they were going to tell you the truth?

Cash is not our enemy right now – cash is your friend. That's why we have deployed very little of it in our conservative virtual portfolios. I have been saying for quite some time that the Dollar below 73 was a buy and that in itself is an investing premise as there is no shame in cashing our our bullish winners and "investing" in US dollars to mark our assets through a period of market uncertainty, such as this one. While we do need one desperately, the revolution in America is probably a long-time coming – unless the Fall TV schedule is really awful – in which case this country won't make it to Christmas. But, probably it will be business as usual and the World will burn while America fiddles and that's what keeps other nations flying to the Dollar for safety – no matter how many of those suckers Uncle Ben and Timmy print up.

So how screwed up is the rest of the World? Remember, they are competing with the US, who have set the bar at "very screwed up," which we thought would guarantee us a spot in the finals but already we have been leap-frogged by Ireland, Spain (pictured left), Greece AND Portugal in Europe as well as Egypt, Tunesia, Libya, etc and, if you think things are great in China, you are just not paying attention.

So how screwed up is the rest of the World? Remember, they are competing with the US, who have set the bar at "very screwed up," which we thought would guarantee us a spot in the finals but already we have been leap-frogged by Ireland, Spain (pictured left), Greece AND Portugal in Europe as well as Egypt, Tunesia, Libya, etc and, if you think things are great in China, you are just not paying attention.

The best quote of the year came out of Spain (thank SWW!) and is already spreading far and wide with people protesting against a regime of banks,

business and politicians they perceive as corrupt.

“Maribel,” a 21-year old who declined to give a

last name, said the demonstrations are not about

politics: “It’s (about) change. We are fed up with

the L’Oreals, McDonald’s, Coca-Cola. We are not

anti-system, the system is anti-us, and you don’t

know how to stop us.”

"The system is anti-us" – well that pretty much sums it up for the bottom 99% and what despicable arrogance on the part of our elitist "leaders" that they felt they could just ignore the vast bulk of humanity while they fattened themselves at the trough (see my "2010 Outlook – A Tale of Two Economies") along with the fat-cats who fund their puppet careers. "Those who make peaceful revolution impossible, make violent revolution inevitable" said John F. Kennedy and it was Jefferson who said "EVERY generation needs a new revolution" but, of course, he was a rabble-rouser, wasn't he?

"The system is anti-us" – well that pretty much sums it up for the bottom 99% and what despicable arrogance on the part of our elitist "leaders" that they felt they could just ignore the vast bulk of humanity while they fattened themselves at the trough (see my "2010 Outlook – A Tale of Two Economies") along with the fat-cats who fund their puppet careers. "Those who make peaceful revolution impossible, make violent revolution inevitable" said John F. Kennedy and it was Jefferson who said "EVERY generation needs a new revolution" but, of course, he was a rabble-rouser, wasn't he?

"And you don't know how to stop us" UNDERSTANDS the 21 year-old Spanish girl… With each success by one group of revolutionaries the next group is emboldened to take to the streets and protest – how long before they tire of that and take up arms? It's already happening in Libya, which has a full-blown civil war and Iraqis are rebelling against yet another repressive regime (oh wait, that's us!) and even India, China and Russia have their share of unrest at this stage. Heck, we've even had protests in this country but, fortunately, the press can label anyone who protests as being "pro-union" or, even worse, "liberal" and that allows them to be brushed off from serious consideration because we all know that unions are evil, right? I mean, come on – THAT's THE SYSTEM!

And that system is anti-us if by we mean the United States of America and what it used to stand for. Like "All men are created equal" unless of course they happen to be created in a poor school district, in which case their chance of getting into college is less than 1/3 of that of someone born to an upper-income household. Good luck with that whole "life, liberty and pursuit of happiness" thing if you haven't got money as well.

That was all fine when the majority of people in this country had enough money to consider themselves "middle class" but that middle class line has drifted up to almost $70,000 of family income and, even for those lucky enough to be at that level there has been a terrible erosion of disposable income that actually leaves a modern dual-income family taking home $67,800 a year WORSE OFF than a 1970s single-income family making $38,700 a year (middle class at that time).

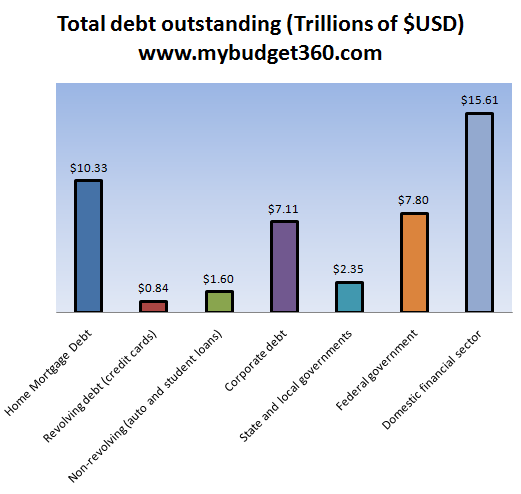

We borrowed our assets off on an extend and pretend spree that's gone on since Al Gore's "lock box" was broken into to fund upper class tax cuts at the turn of the century. Here we are 11 years later and the average family is $113,000 in debt – and that's real, actual Household Debt, not counting the $163,000 share of the national debt that we will, in theory, have to pay off at some point as well.

We borrowed our assets off on an extend and pretend spree that's gone on since Al Gore's "lock box" was broken into to fund upper class tax cuts at the turn of the century. Here we are 11 years later and the average family is $113,000 in debt – and that's real, actual Household Debt, not counting the $163,000 share of the national debt that we will, in theory, have to pay off at some point as well.

Of course keep in mind that half the people in the country see these numbers and laugh because there's no chance they will EVER pay that off and 1% of the country sees those numbers and laughs because it represents less than 1% of their wealth and, ultimately, if the country gets real and decides to pay off the debts – we can't tax the bottom 50% more but the top 1% know that they can argue that it would be "UnAmerican" for them to pay a bigger share so, ultimately, the top 50% will all equally be assessed, perhaps $300,000 and the top 1% will complain about the unfairness of having to give up 2% of their net worth while the middle 50-99%, who average $30,000 of disposable income – will work 10 years to pay it off or simply suffer the oppressive austerity measure that are even now being forced on Ireland, Greece and Portugal by their lenders.

Your Government will have to say: We can't afford medical care (and the rich don't care, more for them), we can't afford affordable housing (and the rich don't care, more for them), we can't afford to educate our children (and the rich don't care, your kids can't compete), we can't afford to feed our children (and the rich don't care, more for their kids), we can't afford to fix the roads (New York's last fiscal crisis caused me to buy a Range Rover so I could laugh over potholes), we can't afford parks or museums or zoos (rich people take their kids on trips to those kind of places), we can't afford libraries (rich kids have kindles), we can't afford police protection (rich people live in gated communities), etc…

How long will Generations X and Y put up with that? On Friday I discussed the Boomers, who are heading into retirement this year and forming the beginning of a 20-year bubble that is already too much for our over-stressed, under-funded system to handle. What will happen over the next 10 years as 50M more people retire and the 10 after that as the first 50M people move into assisted-care facilities while another 50M people retire?

It won't be quite that bad as not everyone lives that long but, unless we start hunting them down – old people simply are not dying fast enough to stop the chart on the left from happening and we are only halfway to peak population of people over 65 from where we were for most of the last 40 years and this chart doesn't even assume we get better at curing things and increase overall longevity – which could be an even bigger disaster if it happens before 2070, when we are past "peak age."

I'll be 100 by then anyway so I'm not too worried about it as I enter that 85 and up line right about on schedule in 2050. Already I have no illusions that will be able to rely on the US Government to take care of me as I move up the lines on this chart but, unfortunately, 90% of the people in this country have less than $40,000 to retire on. This isn't a result of poor planning – they have no access to disposable income in the first place – not to mention that 12.25% of their income has been put aside for Social Security their whole lives and the Government, like Otter in Animal House, now has only has this to say to American Workers:

Will the American people take it lying down? As Dean Wormer said in the same movie: "Fat, drunk and stupid is no way to go through life." Unfortunately, our sponsors at MCD, BUD and the American Education system would have to disagree with that statement and any attempt to "regulate" them or improve our health or educational standards… well THAT is met with protests! Our current math scores rank us right along side Italy, Greece, Spain, Portugal and Turkey (perhaps there is a connection between a population that sucks at math and a nation that is drowning in debts?) but our national reading scores are still in-line with what you would expect from a developed nation as we are within 8% of catching up to South Korea in reading (12% behind in Math) – so we have that goal to shoot for (but don't ever look at where we rank compared to Asia – that's just sad)!

Also sad are the markets in Asia, down almost 2% into their lunch breaks. The Dollar is up to 76.17 at 12:30 and I'll check in again in the morning to see how we look pre-market but, so far – everything is proceeding as I have foreseen it.

6 am update – Well it's an economic Apocalypse, if nothing else this morning! Bulls are going to wish their positions were called to heaven over the weekend because the ones they are stuck with are certainly going to look like Hell. The dollar ran up to 76.50 and that's all the wrath this market needed to plunge about 1% in the futures, and it looks like we'll be testing last week's lows but, in the futures, we take the money and run on oil at $97.50 (trailing stop), as planned and that will go with our USO puts at that line as well, we can always play for a further slide if they fail $96 but, unless we break below the 2.5% lines on our indices.

Asia took a bath with the Nikkei down 1.5%, the BSE down 1.88%, the Hang Seng down 2.11% and the Shanghai down 2.93% – all finishing at their worst levels of the day. Europe, where all the worry is, is down about 2% across the board coming into their lunch and if they can't hold their lows (see chart above) then our own lows (chart above that) are likely to fail as well.

Still, odds favor playing for a bounce and the key will be whether we have a weak bounce (back one line of resistance on our chart) or a strong one. Cash will be king until we avoid a black Tuesday but it is worth improving (rolling) some of our longer-term bullish positions – in the very least to put us in a good position to sell front-month calls against them later. The $1.40 line is a "must hold" on the Euro and I think it will based on the news so far but if sentiment turns more negative on news and data – then we could have BIG TROUBLE.

So be careful out there and watch those lines!