We bought the dip.

We bought the dip.

That is to say we took the money and ran on our weekend shorts and we even picked up the DIA June $124.75 calls at $1.35 – just in case we get a little pop this morning. But, if that little pop is based on knocking down the dollar, AGAIN, then we’re certainly going to be shorting this morning because the Dollar simply needs to be higher at this point and it’s pretty clear that the Euro is not a "safe" alternative and to think that means the Yen (now embedded with cesium!) is the way to go is fairly ridiculous. Australia is not safe because it’s tied to Asia and Switzerland isn’t safe because it’s tied to Europe and too small anyway and the Canadian Loonie is still my favorite currency but we bailed at $1.05 when we flipped to the dollar after an excellent 10% run from our pick.

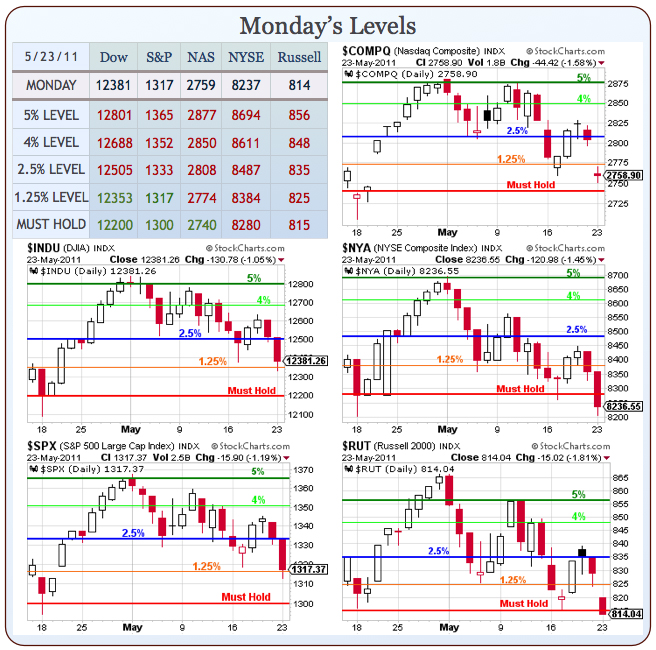

As I said yesterday, everything is proceeding as I have foreseen it and we are having a good old time playing this volatile market that is actually doing a fantastic job of obeying our 5% rule. We are simply following through on the pattern we saw forming up in late April and we went short into that last weekend and on Monday, May 2nd, I pointed out how TERRIBLE the indexes looked when priced in silver (which we were short at the time, now long again).

On May 2nd, we were down 50% over 12 months priced in silver. Now here is something my Members will completely understand and find funny – we have just completed a perfect 20% bounce on our indexes when priced in Silver:

It really shouldn’t be this easy to predict market moves, should it? At the same time, of course, we drew out the 5% lines on the top chart and made our bets expecting to test those red lines at the bottom. Yesterday, we got our test on the Nasdaq (close enough) the NYSE and the Russell, with the Dow and S&P holding their 4% lines. Today is not a day to make a call but if the NYSE can’t retake 8,280 today, then it is, once again, going to be the anchor that weighs down the other indices.

It continues to be all about the Dollar and the Dollar is all about the Euro and the Yen so the simple question to ask yourself is: Are Europe and Japan looking like better investments now than they were 3 months ago? 6 months ago? 12 months ago? No, no way. Is America a worse-looking investment than it was 3 months ago? 6 months ago? 12 months ago? Maybe a little but, generally, there is nothing new to be worried about – we’re the same freakin’ mess we were last year.

It continues to be all about the Dollar and the Dollar is all about the Euro and the Yen so the simple question to ask yourself is: Are Europe and Japan looking like better investments now than they were 3 months ago? 6 months ago? 12 months ago? No, no way. Is America a worse-looking investment than it was 3 months ago? 6 months ago? 12 months ago? Maybe a little but, generally, there is nothing new to be worried about – we’re the same freakin’ mess we were last year.

Why then, is the Dollar, 12% LOWER than it was last May? THAT is why we are short-term market bearish! Our equities (and commodities) are priced in Dollars and Dollar are themselves underpriced at 76. I pointed out to Members this weekend that it makes a lot of sense to sell our over-priced equities and commodities and invest in CASH for the short-term so we can beat the rush.

What happens when others begin to follow us? They will want to exchange their shiny bits of metal and bushels of corn and bails of cotton and barrels of oil and certificates that grant them ownership of 1/50,000,000th of NetFlix’s profits (about $3.50) in exchange for US Dollars. Do I want to give someone $250 of my US Dollars for a share of NetFlix that will make $3.50 this year? No freakin’ way!

That then, becomes a problem as the demand for Dollars begins to exceed the demand for shiny bits of metal and momentum stocks. Then the Dollars become more valuable and the PRICE of the MoMo stocks and speculative commodities begins to fall rapidly in relation to the rising Dollar and more people rush to exchange the stuff they never wanted in the fist place for Dollars and pretty soon no one has them – except us – because we cashed out while nobody wanted Dollars and were giving them away at 72.69.

See – not complicated!

If they can’t keep the Dollar below 76, then that possible bullish cross on the EMA turns into a Bullish Cross very soon and then we’re on our way to 78, where we are very likely to be rejected by the declining 200 dma and then we may consolidate between 78 and 76 for a while (unless Europe implodes and then we’re back to 81 in no time) and we can get back to ignoring the Dollar like we usually do in the markets. For now, though, the Dollar still rules and the big factors influencing it are going to be the EU Crisis and, of course, the Fed Crisis (as in – the people in charge are idiots but, fortunately, not idiots AND rapists, like their EU counterparts).

Moody’s just placed 14 out of 18 UK banks on review for downgrade this morning so there’s the Pound for you! CS says Chinese stocks, which fell 2.5% yesterday and flatlined today, are not at a bottom and GS says the "won’t rule out an additional 5-10% drop for Chinese stocks." We discussed this in yesterday’s post so I won’t get into it again but the great fallacy of China is like any investment that’s "out of town" – you only hear what the promoters want you to hear so the bad news, when it ultimately comes, always seems like a shock. I would have thought the Internet would have changed this for the better but I’m still one of the only analysts who actually source China Daily for my stories. It’s a real paper people – how can you invest (or, even worse, tell others to invest) in a country where you don’t even read the newspaper?

Moody’s just placed 14 out of 18 UK banks on review for downgrade this morning so there’s the Pound for you! CS says Chinese stocks, which fell 2.5% yesterday and flatlined today, are not at a bottom and GS says the "won’t rule out an additional 5-10% drop for Chinese stocks." We discussed this in yesterday’s post so I won’t get into it again but the great fallacy of China is like any investment that’s "out of town" – you only hear what the promoters want you to hear so the bad news, when it ultimately comes, always seems like a shock. I would have thought the Internet would have changed this for the better but I’m still one of the only analysts who actually source China Daily for my stories. It’s a real paper people – how can you invest (or, even worse, tell others to invest) in a country where you don’t even read the newspaper?

What are the headlines in the China Daily today? Severe drought in Hubei leaves 10M people without adequate water (so far). Interestingly, this prompts an IMMEDIATE response from the government who announce a plan to reinforce 7,000 reservoirs over the next 3 years. That’s right, make me dictator and I will give you central planning too! Northwest China has a plague of locust (not good for crops) but they are drill baby drilling in the China Sea and seriously concerned about inflation and whether the US will default on its debt. Also, Richard Koo’s little video is well worth watching. Koo warns of an impending balance sheet recession in China:

That last item is the most interesting because it comes from Simon Johnson, the former Chief Economist at the IMF and it plays into all the same fears of the debt ceiling and the out-of-control Congress that’s willing to destroy America to advance their own shallow political agenda etc. that we’ve all gotten tired of over here but it’s VERY effective in pushing the Dollar back to 76 as oil rockets back to our $100 line, where we will be thrilled to go short again. This is great for our Dow calls as well but we’ll likely be selling early and flipping bearish if the Dollar holds that 76 line and especially if our indexes can’t take back our "weak bounce" zones.

Speaking of oil and speaking of blatant market manipulation – this is a MUST READ: Nymex trader Dan Dicker becomes "one of us" and says oil prices have gone ‘just nuts‘ and he blames – drum-roll please — Goldman Sachs (GS)! His argument, brutally compacted, goes like this: Oil today is overpriced, driven ever higher by the new flow of money funneled through investment banks, energy hedge funds and exchange-traded and index funds. Feeding the frenzy are bets from the same kind of American investors who moan about paying almost $4 a gallon to fill up their SUVs. This new dynamic has led to wild fluctuations, Dicker says.

Remember how oil surged in 2008 to more than $145 a barrel in July, only to plunge to less than $34 by late December? “Nothing proved a speculative bubble more convincingly than the rapid price collapse we saw then,” he writes. Can this be fixed? Yes, says Dicker, though his solution would mean forbidding most individuals from trading oil (and handing some clout back to pros such as himself). If he had his way, commodity index investing would be banned, along with exchange-traded funds that engage in futures. Goldman raised their target on oil this morning, back to $130 a barrel (we’re shorting the bastards).

Meanwhile, back in the World’s 2nd largest consumer of oil: Tepco CONFIRMS THE MELTDOWN of 2 more reactors. Fuel rods in the No. 3 unit started melting on March 13 and those in the No. 2 reactor on March 14. The fuel dropped to the bottom of the pressure vessel after melting although the damage to the vessel is “limited,” he said. Tepco raised the possibility of more extensive damage than assumed at the reactors when it announced last week, more than two months after the disaster, that fuel rods in the No. 1 reactor had melted within 16 hours of the quake on March 11.

So how are those Yen investments looking? Meanwhile, there is a revolution going on in Spain and the MSM is flat out ignoring it – that I find FASCINATING. Dennis Gartman say forget Greece or Ireland quitting the EU – it’s Germany who will be cutting everyone else loose in order to save themselves, saying: "I think what ends up happening is that Germany says we’re out. We’ve had enough.” Gartman’s thesis is quite simple. He thinks Germany is tired of paying everybody’s bills.

Be careful out there – these may not be the dips you want to buy!